|

市场调查报告书

商品编码

1404326

企业路由器 -市场占有率分析、产业趋势与统计、2024-2029 年成长预测Enterprise Routers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

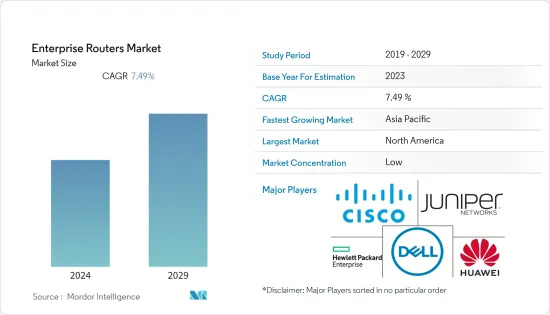

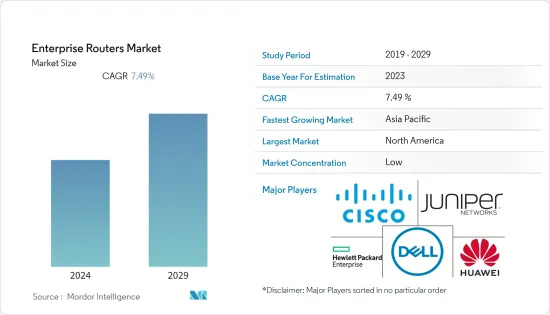

本财年企业路由器市值为157.6亿美元,预计到预测期结束时将达到240.3亿美元,预测期内复合年增长率为7.49%。

企业路由器是经常使用企业和组织的必备产品。透过将电脑连接到互联网,它为企业做出了巨大贡献。路由器可以执行许多功能,包括企业路由,使企业能够拥有更多的 CPU 容量来管理部署任务。此外,您还可以增加无线和有线网路介面的频宽,以及使用 NetflowsFlow、MPLS、QoS 和其他安全功能。它具有整合深层封包检测和广域网路加速的能力。企业路由器可以帮助最大限度地提高办公室效率,但其安装需要工程技能和经验。企业路由器可以帮助最大限度地提高办公室效率,但其安装需要工程技能和经验。

主要亮点

- 华为全球产业愿景预计,2025年,85%的企业应用将迁移到云端,企业广域网路出口流量将大幅成长。这种市场开拓预计将为研究地区的市场成长提供令人兴奋的机会。

- 此外,根据思科的说法,物联网 (IoT) 是一个普及的系统,其中人、资料、流程和事物连接到互联网并相互连接。在全球范围内,M2M 连线数预计将从 2018 年的 61 亿成长到 2023 年的 147 亿,成长 2.4 倍。到 2023年终,全球每人将拥有 1.8 个 M2M 连线。 M2M 连接的增加可能会推动企业路由器的普及。

- 企业网路系统可提高职场的生产力,但安装需要工程专业知识和培训。专用链路可以以每秒几兆位元的速度通讯,但由于网路容易拥塞,因此无法保证服务品质。 AddFind 软体广域网路是完美的解决方案,因为它透过应用程式提供灵活且高效的网路管理。

- 此外,服务供应商正在快速更新其网络,以满足企业对提高效能和改善用户体验的需求。然而,由于虚拟和SDN功能的采用,这些服务供应商仍然受到检查方法的阻碍,需要重新审视这些方法。企业向云端运算迁移以及对服务供应商软体应用程式的依赖增加等领域也出现了新的挑战。

- 公司正在推出新产品和解决方案,以满足消费者的复杂需求。例如,2023年6月,IP-COM宣布推出新款企业路由器M80和M50。 M80是一款Gigabit企业级路由器,专为饭店、企业、社群等频宽营运需求较高的使用者而设计。路由器配备1.4GHz双核心网路处理器和4GB高速DDR3 RAM。采用IP-COM企业系统韧体,内建智慧型AP管理系统,可自动分配与维护自动AP配置。还可满足各种场景的存取认证需求,如WEB帐号密码认证、PPPoE伺服器存取认证方式、WEB金钥认证等。

- 此外,由于可支配收入的增加、智慧型手机和网路的普及、消费行为的改变和生活方式的改变,零售业正在经历强劲增长。例如,根据IBEF预测,2019年至2030年,印度零售业将成长9%,从2019年的约7790亿美元成长到2026年的约14,070亿美元,到2030年预计将超过1.8兆美元。零售业的成长可能会推动企业路由器的普及。

企业路由器市场趋势

无线连线预计将占据很大份额

- 典型的无线路由器可以支援大约 10 到 20 个使用者。相较之下,企业无线接入路由器点可以由50个或更多、甚至数百个用户访问,并且可以发送和接收讯号。

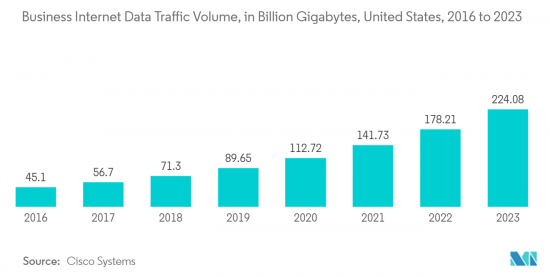

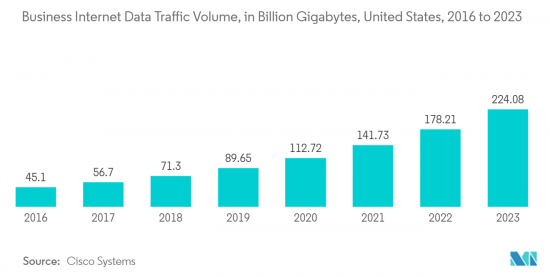

- 据Cisco称,美国商业互联网资料流量预计将从2022年的1782.1亿GB增长到2023年的2240.8亿GB。 IP 流量的稳定成长预计将显着推动所研究市场的成长。

- 由于网路流量和设备的成长,平均固定通讯速度和网路用户预计在预测期内也会增加。多个市场参与企业正在开发和推出尖端产品,以满足不断增长的消费者需求。例如,2022 年 11 月,全球消费和商业网路产品领导者 TPLink 宣布推出一款名为 WiFi 7 的突破性产品,为该网路提供解决方案。 TP-Link针对ISP市场推出了最新的WiFi 7路由器、Omada EAP、Deco产品和Aginet产品,涵盖所有使用情境。 TP-Link 的新 HomeShield 3.0 声称提供更可靠、更智慧的网路解决方案。

- 2022年10月,以物联网平台和云端运算解决方案闻名的晶片製造商联发科宣布达成策略合作,部署5G和Wi-Fi路由器解决方案。此次合作将促进印度广泛解决方案的开发和重要的製造能力。全新的Silboa产品线完善了英维迪的商业和工业通讯解决方案组合,支援跨行业各类业务的WiFI,包括Multi-WAN 4/5、VPN/6、NMWAN 5/6等。由标准4G/ 5G组成SDW 无线电。

- 而且无线路由器的讯号传输范围只有几十公尺。无线接取路由器的覆盖距离可达100300m,让使用者在网路上自由操作。而且无线路由器的网路模型非常简单,不太弹性。相较之下,无线网路基地台有不同的操作模式,例如简单AP、无线用户端和无线桥接多点。具有协调性的集中管理系统也是可能的。

- 此外,M2M Connectivity 还提供广泛的产品,包括 4G/3G 无线路由器、卫星和短距离 RFWLAN 蓝牙型号。这些乙太网路切换器允许使用者存取远端控制单元、资料记录器和微控制器等设备和资产并与之通讯。随着越来越多的用户使用这些解决方案,该领域的市场正在扩大。

北美预计将占据很大份额

- 企业路由器设备市场估计在北美占据很大份额。网路路由器供应商在该地区拥有强大的立足点。推动该市场成长的公司包括:思科系统公司、瞻博网路公司和惠普企业公司。

- 在美国,对超大规模资料中心的需求不断增长正在推动网路硬体产业的成长。 Jones Lang LaSalle IP, Inc.表示,在过去的十年中,一些公司寻求透过云端来加速其数位转型,但由于业务转型不可避免的障碍而受到阻碍。这次疫情给许多公司敲响了警钟,要求他们加快步伐,将IT基础设施提升到前所未有的高度,并成为全面转型的企业。

- 根据仲量联行的数据,美国比世界其他地区表现出更强的投资意愿,约占 2018 年至 2022 年所有资料中心交易的 52%。此外,美国六大主要市场预计将在 2022 年吸收 1,633 兆瓦:达拉斯-沃斯堡、芝加哥、新泽西、北维吉尼亚、北加州和凤凰城。此外,这些市场还有 1,939 兆瓦正在建设中。

- 随着数位IT基础设施需求的增加,超标量和边缘预计将成为资料中心产业成长最快的部分。北美地区正在对资料中心进行大量投资。例如,2022年4月,Google斥资95亿美元新建Google资料中心和办公室,并宣布在内布拉斯加州新建7.5亿美元资料中心。随着对Google云端服务和基础设施的需求不断增长,欧马哈的Google新园区将由四栋建筑组成,总合140 万平方英尺。这可能会导致高速 IP 流量的增加和企业路由器需求的激增。

- 此外,近年来,特别是在 COVID-19 大流行之后,美国政府开始致力于透过「美国製造」等倡议来促进本地製造业,这正在推动所研究市场的成长。例如,2022 年 3 月,美国政府宣布 60% 的零件价值必须在国内製造,才能使产品符合联邦采购的「美国製造」资格。计划到2024年提高到65%,2029年提高到75%。这些倡议为智慧製造在该地区的渗透提供了进一步的机会,从而促进了研究市场的成长。

企业路由器产业概况

随着全球参与企业投资多种小型企业产品最新创新的研发,企业路由器市场变得支离破碎。主要参与企业包括思科系统公司、瞻博网路公司和惠普企业。市场上的企业不断开发新的解决方案,帮助服务供应商实现基础设施整体转型,并赢得新的策略订单,我们正在努力投资。

- 2022年5月,华为消费者业务印度推出最新支援Wi-Fi 6标准的华为Wi-Fi AX3双核心路由器。该路由器声称使用专有的 Gigahome WiFi 晶片组,将网路技术与该公司专有的晶片协作技术融为一体。 Wi-Fi AX3路由器具备金融级华为HomeSec安全防护,随时为使用者提供直觉、快速、稳定、安全的Wi-Fi 6连线。作为华为1+8+N全场景智慧生活战略的连结枢纽

- 2022 年 5 月 - 诺基亚今天宣布向 team.blue 丹麦公司推出 7750 服务路由器 (SR),该公司是 team.blue 集团的成员,为欧洲各地的中小企业提供託管和云端服务。此次部署将使 team.blue 能够轻鬆扩展其网路基础设施,以支援其为丹麦 25 万名客户快速成长的服务。

- 2022 年 3 月 - 网路硬体供应商 Perle Systems 的 IRG 7440 5G 路由器和网关获得国际认证。 IP数位电子看板、视讯监控系统、物联网资料处理和智慧储物柜等 IoT/M2M网路存取应用是 IRG7440 边缘路由器连接工业机械、远端资料记录器和感测设备的绝佳选择。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 和宏观经济趋势对产业的影响

- 新进入者的威胁

第五章市场动态

- 市场驱动因素

- 网路虚拟的增加

- IP流量公司快速成长

- 市场抑制因素

- 安全和隐私问题

第 6 章 技术概览

第七章市场区隔

- 连接类型

- 有线

- 无线的

- 连接埠类型

- 固定连接埠

- 模组化的

- 类型

- 核心路由器

- 多服务边际

- 存取路由器

- 其他类型

- 按最终用户产业

- BFSI

- 资讯科技与电信

- 医疗保健

- 零售

- 製造业

- 其他最终用户(按行业)

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东 非洲

第八章竞争形势

- 公司简介

- Cisco Systems, Inc.

- Juniper Networks, Inc.

- Hewlett Packard Enterprise Co.

- Dell Inc.

- Nokia Networks Corporation

- Huawei Technologies Co., Ltd.

- Avaya, Inc.

- ZTE Corporation

- Alcatel-Lucent SA

- Riverbed Technology, Inc.

第九章投资分析

第十章市场机会与未来趋势

The Enterprise Routers Market was valued at USD 15.76 billion in the current year and is anticipated to reach USD 24.03 billion by the end of the forecast period, registering a CAGR of 7.49% during the forecast period. Enterprise routers are essential products for any enterprise or organisation that uses them on a regular basis. By connecting computers and the Internet, they contribute to enterprises in a major way. Routers are capable of performing many functions, including enterprise routing which allows businesses to have greater CPU capacity for the management of placement tasks. Furthermore, it will enable enterprises to increase their network interface bandwidth for both wireless and wired circuits as well as use NetflowsFlow, MPLS, Quality of Service or any additional security features. It is equipped with features to integrate deep packet inspection and Wide Area Network acceleration. Enterprise routers are helping maximise productivity in the office, requiring an engineer's skill and experience to install them. An Enterprise Router can assist in maximising efficiency at your office, while an engineer's skills and experience are required to install the enterprise router.

Key Highlights

- Huawei's Global Industry Vision predicts that by 2025, 85% of enterprise applications would be moved to the cloud, resulting in significant traffic growth at the part of egress of enterprise WANs. This development will be an exciting opportunity for market growth in the study area.

- Further, according to Cisco, the Internet of Things (IoT) has become a prevalent system in which people, data, processes, and things connect to the Internet and each other. Globally, M2M connections are estimated to grow 2.4-fold, from where 6.1 billion in 2018 to 14.7 billion by 2023. There would be 1.8 M2M connections for each member of the global population by the end of 2023. The increasing number of M2M connections are likely to boost the penetration of enterprise routers.

- Enterprise networking systems improve productivity at the workplace, but they require an engineering professional's expertise and training to install them. Private links are capable of several Mbit per second but they tend to be congested in the network, so service quality cannot be guaranteed. Adefined software wide area networks, which make use of flexible and efficient network management with applications, are the best solution.

- Moreover, in order to meet enterprises' growing demand for enhanced performance and better user experiences, the service providers are rapidly updating their networks. However, these services providers are still being hampered by inspection methods that need to be reviewed because of the adoption of virtualisation and SDN capabilities. New challenges have arisen in the area of migration to cloud computing for enterprises and an increased reliance on software applications from service providers, This has driven service providers to adopt NFV, SDN, and cloud-native computing technologies.

- To cater to the complex requirements of consumers, several companies are striving to launch new products and solutions. For instance, in June 2023, IP-COM announced the launch of its new enterprise routers M80 & M50. The M80 is a Gigabit enterprise router developed for high-requirement users, including hotels, enterprises, and community bandwidth operations. The router is furnished with a dual-core special 1.4GHz dual-core network processor with 4GB of high-speed DDR3 RAM. It embraces IP-COM enterprise system firmware utilizing a built-in intelligent AP management system, which can automatically distribute and maintain automatic AP configuration. It helps WEB account password authentication, PPPoE Server access authentication mode, WEB key authentication, and a few other securities which can satisfy the access authentication requirements under different scenarios.

- Moreover, due to the increasing disposable income, increasing penetration of smartphones and internet, shift in consumer behavior and changing lifestyles, the retail sector is witnessing robust growth. For instance, According to IBEF, India's retail industry is projected to grow by 9% from 2019-2030, from approximately USD 779 billion in 2019 to about USD 1,407 billion by 2026 and more than USD 1.8 trillion by 2030. The growth in the retail industry would aid the penetration of enterprise routers.

Enterprise Routers Market Trends

Wireless Connectivity is Expected to Hold Major Share

- There are only about 10 to 20 users that can be supported by an ordinary wireless router. In contrast, the enterprise wireless access router point allows over 50 or even hundreds of users' access, with the potential to send and receive signals.

- According to Cisco Systems, the business internet data traffic volume in the United States is estimated to increase from 178.21 billion gigabytes in 2022 to 224.08 billion gigabytes in 2023. Such robust increase in IP traffic is anticipated to significantly drive the growth of the studied market.

- As a result of increased internet traffic and devices, the forecast period is also expected to see an increase in average fixed broadband speeds and internet users. To respond to the growing consumer demand, several market participants are developing and introducing cutting edge products. For instance, in November 2022, TPLink, the world leader in consumer and business networking products, launched an epochal product launch of WiFi 7 to communicate its solution for this network. TP-Link launched its latest WiFi 7 routers, Omada EAPs, Deco products, and Aginet products for ISP markets to cover all usage scenarios. TP-Link's new HomeShield 3.0 is claim to provide more reliable and smarter network solutions.

- In October 2022, chip maker MediaTek, a prominent player in IoT platforms and cloud computing solutions, announced a strategic collaboration to roll out 5G and Wi-Fi router solutions. The collaboration will make it easier for a broad range of solutions and significant manufacturing capabilities in India to be developed. The new Silboa product line improves the INvendis business and industry communication solution portfolio to consist of 4G/5G SDW radios with WiFI standards that support multiWAN 4/5, VPN/6, NMWAN 5/6, etc. from a variety of different types of businesses across various industries.

- In addition, there are only a few dozen meters in the range of signal transmission on an Wireless Router. Further distances of up to 100300m, enabling users to operate freely on the network, shall be covered by a wireless access router. In addition, the wireless router's networking model is quite easy and does not allow for much flexibility. In contrast, a wireless access point is equipped with different modes of operation including simplex AP, Wireless Client, Wireless Bridge Multipoint and so forth. A centralised management system, involving cooperation, is possible.

- Moreover, The M2M connectivity provides a broad range of 4G/3G Wireless Routers, Satellite and Shortrange RFWLAN Bluetooth Models. These Ethernet switches allow users to access and communicate with devices and assets, such as Remote Control Units, Data Loggers or Microcontrollers. The market in this sector has been growing as more and more users are using these solutions.

North America is Expected to Hold Major Share

- The market for enterprise router equipment is estimated to have a significant share in North America. The region has a strong foothold among vendors of network routers. Some of the companies that help to drive growth on this market are: Cisco Systems, Inc., Dell EMC Corporation and Juniper Networks, Inc.

- In the US, the growth of the network hardware industry is driven by the growing demand for hyperscale data centers. According to Jones Lang LaSalle IP, Inc., over the last decade, several companies have been scrutinizing the cloud to accelerate the digital shift but were held back by inescapable change barriers that come with business transformation. The pandemic served as a wake-up call for numerous organizations to take their IT infrastructure to unexplored heights and accelerate their timelines to become completely transformed enterprises.

- As per JLL, the United States is seeing a strong appetite than regions and accounts for approximately 52% of all data center transactions from 2018 to 2022. Additionally, the United States had 1,633 megawatts of absorption in 2022 for the six United States primary markets - Dallas-Fort Worth, Chicago, New Jersey, Northern Virginia, Northern California, and Phoenix. In addition, there are 1,939 megawatts being built in these markets.

- As the demand for digital IT infrastructure persists to increase, hyperscalers and edge are anticipated to be the fastest-growing segments of the data center industry. The North American region is witnessing significant investments in data centers. For instance, in April 2022, Google spent USD 9.5 billion on new Google data centers and offices and unveiled a new USD 750 million data center in Nebraska. The massive new Google campus in Omaha, would consist of four buildings totaling over 1.4 million square feet as the demand for Google Cloud services and infrastructure is soaring. This would create increased high-speed IP traffic, which would spike the demand for enterprise routers.

- Further, in recent years, especially after the COVID-19 pandemic, the US government has started focusing on boosting its local manufacturing industries with initiatives like "Make in America," which is expected to drive the growth of the market studied. For instance, in March 2022, the US government announced that for the products to qualify as Made in America for federal procurement, 60% of the value of their parts should be manufactured in the country, which earlier accounted for 55%. The government plans to enhance it further to 65% in 2024 and 75% in 2029. Such initiatives would offer more opportunities for the penetration of smart manufacturing practices in the region, thereby driving the growth for the studied market.

Enterprise Routers Industry Overview

The enterprise router market is fragmented as the global players invest in R&D for the latest innovations in the product for several small to medium-sized companies. Key players are Cisco Systems, Inc., Juniper Networks, Inc., Hewlett Packard Enterprise, etc. The companies operating in the market continuously strive to launch new solutions to help service providers achieve a holistic approach to infrastructure transformation and gain new orders in that course for strategic aim.

- May 2022 - Huawei Consumer Business Group India launched the latest Huawei Wi-Fi AX3 dual-core router with support for the Wi-Fi 6 standards. The router is claiming, using its own patented Gigahome WiFi chipsets, that it has combined networking technology with the company's proprietary chip collaboration technologies., the Wi-Fi AX3 router features financial-level Huawei HomeSec security safeguards, supplying users with an intuitive, fast, stable, and secure Wi-Fi 6 connection at all times as As the connecting hub for Huawei's 1+8+N all-scenario smart life strategy

- May 2022 - Nokia today announced the deployment of its 7750 Service Routers (SR) for team.blue Denmark, part of team.blue Group, a prominent provider of hosting and cloud services to small and medium enterprises across Europe. The deployment would facilitate team.blue to scale its network infrastructure to aid rapidly growing services for its 250,000 customers in Denmark.

- March 2022 - International approval has been granted for the IRG 7440 5G Router and Gateways by Perle Systems, a provider of networking hardware. IoT/M2M network access applications like IP digital signag, video surveillance systems, processing IoT data or smart lockers, The excellent candidates for IRG7440 routers are at the edge, by connecting industrial machines, remote data loggers or sensing devices.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 and Macro Economic Trends on the Industry

- 4.4.1 Threat of New Entrants

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Network Virtualization

- 5.1.2 Rapid Growth in IP Traffic Enterprise

- 5.2 Market Restraints

- 5.2.1 Security and Privacy Concerns

6 TECHNOLOGY SNAPSHOT

7 MARKET SEGMENTATION

- 7.1 Type of Connectivity

- 7.1.1 Wired

- 7.1.2 Wireless

- 7.2 Type of Port

- 7.2.1 Fixed Port

- 7.2.2 Modular

- 7.3 Type

- 7.3.1 Core Routers

- 7.3.2 Multi-Services Edge

- 7.3.3 Access Router

- 7.3.4 Other Types

- 7.4 End-user Vertical

- 7.4.1 BFSI

- 7.4.2 IT & Telecom

- 7.4.3 Healthcare

- 7.4.4 Retail

- 7.4.5 Manufacturing

- 7.4.6 Other End-user Verticals

- 7.5 Geography

- 7.5.1 North America

- 7.5.2 Europe

- 7.5.3 Asia Pacific

- 7.5.4 Latin America

- 7.5.5 Middle East & Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Cisco Systems, Inc.

- 8.1.2 Juniper Networks, Inc.

- 8.1.3 Hewlett Packard Enterprise Co.

- 8.1.4 Dell Inc.

- 8.1.5 Nokia Networks Corporation

- 8.1.6 Huawei Technologies Co., Ltd.

- 8.1.7 Avaya, Inc.

- 8.1.8 ZTE Corporation

- 8.1.9 Alcatel-Lucent S.A.

- 8.1.10 Riverbed Technology, Inc.