|

市场调查报告书

商品编码

1404327

主动地理围篱:市场占有率分析、产业趋势与统计资料、2024 年至 2029 年的成长预测Active Geofencing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

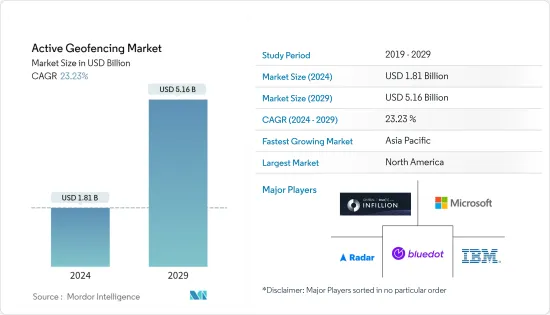

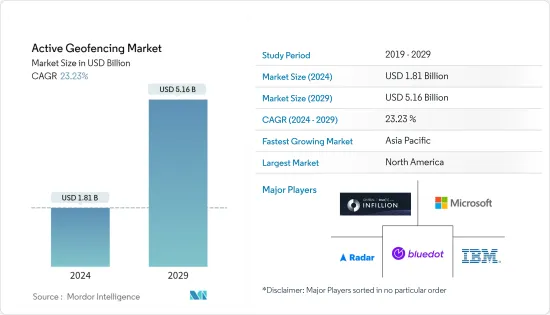

预计主动地理围篱市场规模到 2024 年将达到 18.1 亿美元,预计到 2029 年将达到 51.6 亿美元,在预测期内(2024-2029 年)复合年增长率为 23.23%。

由于空间资料的更有效利用、即时资讯技术的改进以及全球消费者越来越多地采用基于位置的应用程序,主动地理围栏正在不断发展。

主要亮点

- 地理围栏是一种应用程式或应用程序,当设备离开称为地理围栏的地理区域的虚拟边界时,利用 GPS、PFID、WiFI 和移动资料等技术触发预编程操作。它是软体,是一种定位是基于每个最终用户使用的服务。

- 空间资料和即时资讯技术的使用不断增加,正在改变人们和企业与世界互动的方式,并节省数百万人的开支。各种设备和系统都连接到互联网,包括电话、智慧建筑、汽车导航系统、工业和自动驾驶汽车。需要提供即时位置资讯的技术来维持系统的日常正常运作。

- 由于技术弹性和功能,主动地理围栏的进步正在不断增加。市场成长将受到数位行销、丛集、自动驾驶汽车和自带设备等趋势的推动。因此,预计所研究的市场将保持强劲,市场参与企业将做出显着的成长贡献。

- 关于位置追踪的日益关注和法规可能会威胁到主动地理围栏技术。此外,由于各地区缺乏处理隐私和资料收集的监管机构,主动地理围栏解决方案也受到阻碍。

- COVID-19 病毒增加了主动地理围篱在医学、工业等多个领域的使用。例如,每家公司都必须提交一份申请,以识别其场所内的员工身份,并立即直接与他们联繫。主动地理围篱有助于在紧急情况下安全、及时地通讯。

主动地理围篱市场趋势

零售部门确认显着成长

- 主动地理围栏允许零售商识别特定销售点周围指定半径内的潜在客户,向他们发送客製化讯息和特别优惠,以帮助他们进入商店和购买。我可以。此外,随着数位化继续在零售业的各个领域蔓延,零售业对有效地理围栏的需求正在迅速增加。

- 利用地理围篱资料的广告宣传往往会获得更高的支出回报,因为零售商可以针对最有可能接触其服务或产品的消费者。因此,零售企业的利润增加。

- 此外,未来,主动地理围栏将与先进技术和扩增实境(AR)相结合,因此客户可以期待更加数位化和个人化的购物体验。随着越来越多的行动装置成为穿戴式设备,客户期望获得更数位化和个人化的购物体验。因此,我们预计在下一个预测期内,零售业将更多地采用主动地理围栏。此外,在预测期内,零售业主动地理围篱市场的成长前景预计将受到零售商越来越多地采用促销其优惠和广告的推动。

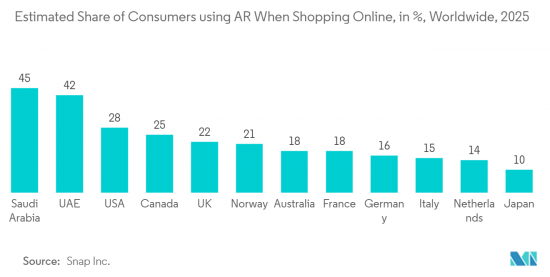

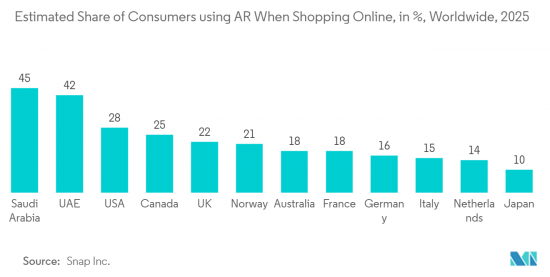

- 换句话说,根据Snap公司最近分析的趋势,预计近三分之一的美国消费者将在两年内使用AR技术透过网路购买商品,并将定义购物的未来。网路购物时,您可以使用扩增实境 (AR) 技术虚拟检视产品。报告显示,欧洲的 AR 使用率高达 45%,但在阿联酋等国家则较低。零售业的扩增实境可能会为这个研究市场创造成长机会。

北美预计将占据主要市场份额

- 北美在医疗保健、交通、物流、金融服务部门和安全等各个端点上都出现了积极的地理围栏投资和创新。在该地区,空间资讯和即时资讯技术的整合正在推动市场发展。

- 此外,该地区主要由来自 BFSI 行业、零售、运输和物流行业的公司主导,这些公司可以使用主动地理围栏。此外,北美是世界上最新兴经济体的所在地:美国和加拿大。由于该地区强大的通讯和互联网基础设施,该地区也处于市场领先地位。

- 此外,数位技术的广泛部署以及每个企业对商业智慧工具的需求不断增加,导致越来越多地采用采用各种地理围栏解决方案的自动化工具。

- 然而,许多本地零售商越来越多地透过数位优惠和促销活动积极应用地理围栏,以增强客户忠诚度。零售商还可以更好地了解顾客在访问特定商店之前和之后来自哪里。

主动地理围篱产业概述

由于 Bluedot Innovation Pty Ltd、Infillion Inc. (GIMBLE)、IBM Corporation、Microsoft Corporation、Radar Labs Inc. 等知名供应商的参与,主动地理围篱市场适度分散。主要企业参与收购和合作等各种策略,以提高市场占有率并提高所研究市场的盈利。

2023 年 7 月,Radar 宣布与 Cordial 建立合作伙伴关係,透过基于定位的体验(例如本地应用程式模式、商店地图和定位器以及地址自动完成)来提高参与度和收益。透过将 Radar 业界领先的资讯基础设施与 Cordial 的行销和资料平台相结合,JOANN 等品牌可以即时为其客户提供高度个人化、与环境相关的体验。

2022年9月,M3宣布其专有劳动力管理软体「M3 Labor」的重大演变,该软体由地理围栏和信标技术组成。这项新功能让M3劳工服务用户设定员工上下班打卡的半径。这些新功能可以让饭店员工在需要的时间和地点打卡和签退,同时防止他们在其他地点打卡和签退,避免了错误签到或签到的可能性。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 增加空间资料的使用和即时资讯技术的改进

- 消费者中位置资讯使用的渗透率

- 市场抑制因素

- 提高消费者对位置资讯追踪的安全意识

第六章市场区隔

- 按组织规模

- 中小型企业

- 大型企业

- 按最终用户产业

- 银行、金融服务和保险

- 零售

- 国防、政府、军队

- 医疗保健

- 製造业

- 运输/物流

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章竞争形势

- 公司简介

- Bluedot Innovation Pty Ltd

- Infillion Inc.(GIMBLE)

- IBM Corporation

- Microsoft Corporation

- Radar Labs Inc.

- Google LLC

- Samsung Electronics Co.

- Verve Inc.

- Apple Inc.

- LocationSmart

- SZ DJI Technology Co.

- ESRI

第八章投资分析

第9章市场的未来

The Active Geofencing Market size is estimated at USD 1.81 billion in 2024, and is expected to reach USD 5.16 billion by 2029, growing at a CAGR of 23.23% during the forecast period (2024-2029).

Active geofencing is growing due to more effective use of Spatial Data, improving Real Time Location Technologies, and increased adoption worldwide for location-bassed applications by consumers.

Key Highlights

- Geofencing is a location-based service used by each end user, for which an application or software uses technologies such as GPS, PFID, WiFI, and mobile data to enable them to trigger preprogrammed actions when the device leaves virtual boundaries of geographical zones known as geofences.

- How people and businesses interact with the world and make huge savings has changed due to the increased use of spatial data and real-time location technologies. All kinds of devices and systems are connected to the Internet, such as phones, Smart buildings, car navigation systems, industries, or fleets of autonomous vehicles. Technology that provides real-time location data is required to maintain the system's proper functioning on a daily basis.

- With technological flexibility and capabilities, advancement in Active Geofencing is increasing. The market's growth is driven by trends such as digital marketing and clustering, autonomous cars, increased adoption of Bring Your Own Device, etc. The market studied, therefore, is expected to remain robust and will have a significant growth contribution from players in the market.

- Increasing concerns and regulations regarding location tracking can threaten active geofencing technologies. Moreover, active geofencing solutions are being held back due to the lack of regulatory bodies dealing with privacy and data collection in various regions.

- The COVID-19 virus increased the use of Active Geofences in several sectors, such as healthcare, industry, and many others. For example, an application had to be submitted by individual companies to identify staff at their premises and communicate with them directly and immediately. Active geofencing has facilitated secure, timely communication during an emergency.

Active Geofencing Market Trends

Retail Segment to Witness Significant Growth

- Active geofencing allows retailers to identify potential customers within a specified radius around a particular point of sale, sending them customized messages and special offers to walk into the store and buy. Moreover, demand for effective geofencing is increasing rapidly in the retail sector as digitization continues to spread across all sectors of retailing.

- The advertising campaigns using geofenced data tend to deliver a higher return on expenditure due to their ability for retailers to target consumers who are at the highest risk of engaging with their services or products. Thus, the profits of retail organizations are increased.

- Moreover, In the future, active geofencing combined with advanced technologies and augmented reality (AR), customers expect a more digital-first, personalized shopping experience. Customers expect a more digital-first, personalized shopping experience as more mobile devices become wearables. This will lead to increased uptake of active geofencing in retail during the coming forecast period. Moreover, the prospects for growth of the Active Geofencing Market in the Retail Industry over the forecast period are expected to be driven by increasing adoption between retailers regarding promoting their offers and advertising.

- In other words, almost a third of US consumers are expected to use AR technology to purchase goods on the Internet in two years, based on Snap Inc.'s recently analyzed trends, which will define the future of shopping over two years. Virtual browsing of products is possible using Augmented Reality technologies when shopping online. According to the report, while the predicted use of AR was as high as 45% in Europe, this was much lower in countries such as the United Arab Emirates. Augmented Reality in retail could provide a growth opportunity for this study market.

North America is Expected to Hold the Major Share of the Market

- In North America, active geofencing investments and innovation have been made at various endpoints, such as healthcare, transport, logistics, financial services sector, security, and many others. Market forces push for integrating spatial information and real-time location technologies in this region.

- Further, this region is dominated by companies in the BFSI sector, retail and transport, and logistics sectors capable of using active geofencing. In addition, North America has one of the most developed economies in the world in the form of the United States and Canada. As a result of the strong communication and Internet infrastructure in the region, it is also leading the market.

- In addition, the adoption of automated tools that take different geofence solutions has increased due to the wide deployment of digital technologies and the growing demand for business intelligence tools in all kinds of enterprises.

- However, many regional retailers are increasingly applying active geofencing through digital offers and promotions to strengthen customer loyalty. Retailers can also better understand where their customers are coming from before and after they visit one particular shop.

Active Geofencing Industry Overview

The active geofencing Market is moderately fragmented due to prominent vendors like Bluedot Innovation Pty Ltd, Infillion Inc. (GIMBLE), IBM Corporation, Microsoft Corporation, Radar Labs Inc., etc. The key players are involved in various strategies, such as acquisitions and partnerships, to improve their market share and enhance their profitability in the market studied.

In July 2023, Radar announced our partnership with Cordial, Increasing engagement and revenue through location-based experiences like on-premise app modes, store maps and locators, and address autocomplete. By combining Radar's industry-leading location infrastructure with Cordial's marketing and data platform, brands like JOANN deliver highly personalized, contextually relevant experiences to their customers in real-time.

In September 2022, M3 announced significant advancements to its proprietary Labour Management software, M3 labor, consisting of geofencing and beacon technologies. With this new functionality, users of the M3 Labour service can create an area radius where staff can punch in and out at work. These new features are intended to ensure that hotel staff clock in and out when and where they should while preventing them from doing so elsewhere, thereby avoiding the possibility of false and erroneous punching.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Use of Spatial Data and Improved Real-time Location Technology

- 5.1.2 Higher Adoption of Location-based Application among Consumers

- 5.2 Market Restraints

- 5.2.1 Rising Awareness Regarding Safety and Security among Consumers of Location Tracking

6 MARKET SEGMENTATION

- 6.1 By Organization Size

- 6.1.1 Small-Scale and Medium-Scale Businesses

- 6.1.2 Large-Scale Businesses

- 6.2 By End-user Industry

- 6.2.1 Banking, Financial Services, and Insurance

- 6.2.2 Retail

- 6.2.3 Defense, Government, and Military

- 6.2.4 Healthcare

- 6.2.5 Industrial Manufacturing

- 6.2.6 Transportation and Logistics

- 6.2.7 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Bluedot Innovation Pty Ltd

- 7.1.2 Infillion Inc. (GIMBLE)

- 7.1.3 IBM Corporation

- 7.1.4 Microsoft Corporation

- 7.1.5 Radar Labs Inc.

- 7.1.6 Google LLC

- 7.1.7 Samsung Electronics Co.

- 7.1.8 Verve Inc.

- 7.1.9 Apple Inc.

- 7.1.10 LocationSmart

- 7.1.11 SZ DJI Technology Co.

- 7.1.12 ESRI