|

市场调查报告书

商品编码

1404332

卫星转发器:市场占有率分析、产业趋势与统计、2024-2029 年成长预测Satellite Transponder - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

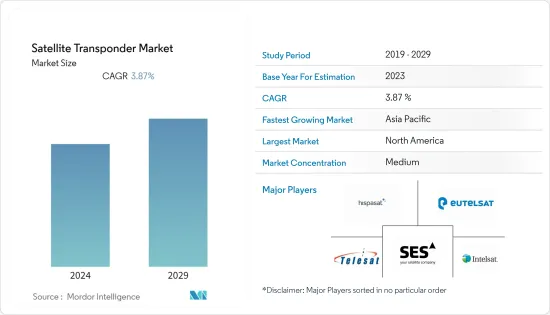

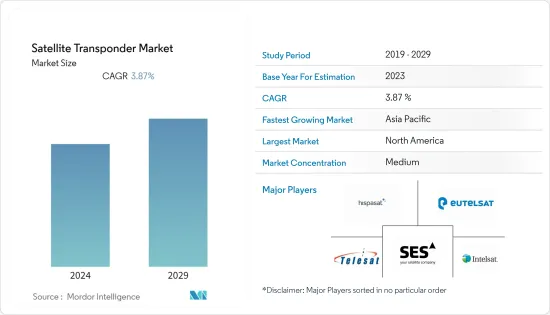

上年度卫星转发器市值为141.4亿美元,预计未来五年将达到187.6亿美元,预测期内复合年增长率为3.87%。

卫星转发器是内建在卫星中的小型晶片大小电路,用于将上行资料和资讯传输到下行链路,反之亦然。开拓的新的具有成本效益的卫星技术、对通讯服务不断增长的需求、高效实用的技术解决方案的可用性以及对Ku波段和Ka波段不断增长的需求预计将在预测期内推动卫星转发器市场的发展。

主要亮点

- 随着世界与网路的普及,宽频连线已成为重要的资讯来源。再加上对高速网路不断增长的需求,可能会在未来几年显着推动对卫星转发器的需求。例如,根据国际电信联盟的资料,全球网路用户数将从2018年的37.29亿增加到2021年的49.01亿。

- 世界商业部门对 C 频段(在较大的地理区域内提供较低的发射功率,通常需要大型地面设备进行接收)和Ku波段(在较小的地理区域内提供较高的发射功率)。可以由较小的地面设备发送和接收)预计将在未来促进卫星转发器市场的成长。

- 此外,通讯业者目前正在开发利用Ku波段和Ka波段频宽的应用程序,有可能使用较小的地面设备来提高传输速度并促进关键资讯传输。 Ka波段和Ku波段频宽/转发器租约预计将占卫星转发器市场成长的大部分。其中, Ka波段预计在预测期内将呈现最高成长率。

- 此外, Ku波段服务需求的成长预计将在预测期内对卫星转发器产生巨大的吸引力。 Ku波段卫星通讯系统越来越多地被部署用于自然灾害期间的各种紧急通讯以及电视广播广播公司在光纤或有线网路不可用的偏远和农村地区的卫星新闻采集(SNG)。

- 此外,随着物联网 (IoT) 和工业 4.0 在全球的兴起,宽频连线在向个人提供资讯方面发挥着关键作用。通讯业的参与企业正在租赁卫星转发器,不仅在偏远地区而且在世界各地提供宽频设施。像新加坡电信这样的各种市场供应商正在利用这一机会,提供广泛的覆盖范围、无限的转发器容量频宽以及灵活的卫星转发器租赁服务,以满足业务需求。

- 在 COVID-19 大流行期间,卫星通讯使远端医疗能够诊断疾病和治疗隔离患者,从而减少了医务负责人和患者之间面对面接触的需要。卫星转发器应用主要支援此类案例并对市场成长产生积极影响。然而,由于COVID-19大流行对全球经济的影响,多个卫星通讯计划被推迟、延迟或取消,卫星转发器租赁业务受到极大影响。

卫星转发器市场趋势

应答器租赁作为一项服务预计将获得巨大的吸引力

- 转发器租约预计将在卫星转发器市场中获得巨大吸引力,因为它将提高全球转发器的成本。此外,对可靠频宽密集型应用的需求不断增长,推动了各种应用中转发器租赁的需求。

- 卫星转发器租赁服务有助于将企业和社区与世界连接起来。安全可靠的卫星连线使企业无论身在何处都可以保持联繫。快速点对点进入新市场、灵活的应答器租赁以及稳定的地面控制设备使开展业务变得更加轻鬆。

- Thaicom 和 Singtel 等各种知名市场供应商不断创新其卫星转发器服务,以满足对Ku波段等先进频段不断增长的需求,在全球范围内提供资料、广播和行动服务。我们为回程传输连接提供有效的转发器租赁服务。此外,市场供应商还提供灵活的应答器租赁服务,预计这将影响未来几年应答器租赁领域的成长。

- 通讯转发器租赁高度依赖高清视讯广播的采用和高动态范围(HDR)应用的普及。此外,新电视平台的进步加上 OTT 平台用户群的增加也增加了转发器租赁的需求,对市场成长有正面影响。

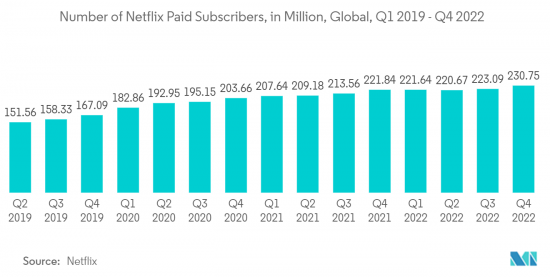

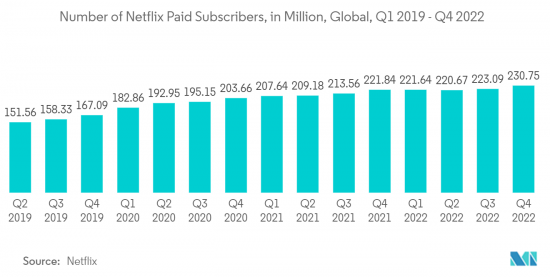

- 此外,影像分发、宽频和 DTH 领域对可靠卫星通讯的需求不断增长,也为市场成长带来了光明的前景。 Netflix、Amazon Prime 等主要 OTT 和串流平台参与企业的出现以及用户数量的不断增加也推动了市场的成长。例如,根据Netflix 2022年第四季报告的资料,Netflix的付费订阅用户从2019年第一季的1.4886亿增加到2022年第四季的2.3075亿。

北美占有很大的市场份额

- 北美是一个反应非常灵敏的市场,随着时间的推移见证了许多技术变革。在许多方面,北美C波段影片服务领域是商业卫星转发器租赁服务成长的主要贡献者。总体而言,卫星产业和通讯业者正在认识到Ka波段在提供4K-UHD(超高清)和OTT电视服务方面的潜力。这种市场演变预计将推动北美对 KaKa波段转发器的需求,因为Ka波段转发器在很大程度上消除了雨水引起的衰减。

- 预计在预测期内,北美地区将占据卫星转发器市场的最大份额。主要卫星转发器供应商的广泛存在以及对安全可靠的卫星通讯的广泛需求促成了北美地区在该市场的主导地位。

- 此外,随着卫星通讯技术的不断发展和进步,卫星通讯能力不断提高,卫星通讯的使用日益广泛,该地区的服务品质不断提高。此外,由于通讯、电子、航太等技术的不断进步,也得到了快速的发展。这些因素进一步加速了该地区的市场成长。

- 此外,美国资讯/导航卫星讯号的商业应用数量正在增加。卫星发射的精确时间讯号有多种用途,包括控制自动化农场设备、无线电话产业紧急定位服务的讯号定时以及美国国家空中交通管制系统的基础。

- 例如,2023年4月,SpaceX宣布将发射Intelsat的IS-40e通讯。该卫星将为美国宇航局携带第一个託管有效载荷,同时满足对飞行中连接不断增长的需求。该卫星具有Ku波段和Ka波段通讯能力,设计发射时重量约6吨,输出功率约8千瓦。

- 同样,2023年5月,美国国防承包SAIC宣布与欧洲製造商GomSpace建立战略合作伙伴关係,为美国政府机构、大学和私人公司开发小型卫星。透过此次合作,上汽集团旨在利用其在传统航太系统开发方面的传统和深厚的技术专长,巩固其在新航太经济中的地位。

- 国防和安全管理、紧急服务和国防安全保障对先进商业成像卫星的需求正在上升。预计该地区的卫星产业在产品开发方面的投资也将增加。配备先进和创新功能的商业卫星正在推动该地区卫星转发器市场的成长。

卫星转发器产业概况

卫星转发器市场的竞争适度,由几家大公司组成。从市场占有率来看,目前少数大公司占据市场主导地位。 SES SA、Arabsat、Embratel Star One、Eutelsat Communications SA、Hispasat、Intelsat SA等是全球卫星转发器市场的主要企业。公司正在寻求多种成长和扩大策略来获得竞争优势。产业参与者正在遵循价值链整合,在多个价值链阶段运作。

2023 年 5 月,Inmarsat 宣布推出一颗新的 Inmarsat-8 小型卫星,将于 2026 年发射,以提供关键的安全服务并支援紧急追踪的进步。三颗 I-8 卫星增强了网路弹性并确保 Inmarsat 全球L波段安全服务的未来。

2022 年 9 月,全球领先的卫星内容连接解决方案供应商 SES 与数位发展、创新和航太工业部下属的共和国航太通讯中心 (RCSC) 将为全球各地的组织提供高速连接。哈萨克宣布,双方将共同提供互联互通服务。该服务将透过 SES 的第二代非对地静止 (NGSO) 卫星系统 O3b mPOWER 提供。该服务将透过 RCSC 向多种行业提供,包括陆上能源、采矿、航运、通讯和企业,为这些企业扩展其高效能网路能力并推动其所在地区的数位化创造机会。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 对新电视平台和技术的需求增加

- KU 频段和 KA 频段服务的成长

- 市场抑制因素

- 与光纤传输电缆网路的竞争

- 需要昂贵的资本投资

- 技术简介

- C波段

- KU波段

- KA带

- S波段、 L波段、 X波段

第六章市场区隔

- 按用途

- 商业通讯

- 政府通讯

- 导航

- 遥感

- 其他用途

- 按服务

- 租

- 维护/支持

- 其他服务

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章竞争形势

- 公司简介

- SES SA

- Telesat

- Intesat SA

- Eutelsat Communications SA

- Hispasat SA(Red Electrica)

- Singapore Telecommunication Ltd(Singtel)

- SKY Perfect JSAT Corporation

- EchoStar Corporation

- China Satellite Communications Co. Ltd.

- Russian Satellite Communications Company

第八章投资分析

第九章 市场机会及未来趋势

The Satellite Transponder Market was valued at USD 14.14 billion in the previous year and is expected to register a CAGR of 3.87 % during the forecast period to become USD 18.76 billion by the next five years. Satellite transponders are minor chip-size circuits integrated into satellites to transmit the uplink data or information to the downlink and vice-versa. The development of new cost-effective satellite technologies, growing demand for telecommunication services, and availability of efficient and practical technological solutions coupled with growth in demand for Ku-band and Ka-band are likely to drive the satellite transponder market over the forecast period.

Key Highlights

- With the rise of internet penetration worldwide, broadband connectivity has become a critical source of information. This, coupled with the growing demand for high-speed internet, will significantly drive the demand for satellite transponders in the coming years. For instance, according to the ITU data, internet users worldwide increased from 3,729 million in 2018 to 4,901 million in 2021.

- The increasing demand for C band (which provides lower transmission power over vast geographic areas and typically requires larger ground equipment for reception) and Ku band (which offers higher transmission power over smaller geographic regions and can be received with smaller ground equipment) transponder by the commercial sector worldwide, is expected to augment the growth of the satellite transponders market in the future.

- In addition, satellite operators are now developing applications over the Ku-band and Ka-band frequency bands, which may facilitate increased transmission speeds and important information transfer with the usage of small ground equipment. Ka-band and Ku-band bandwidth/transponders' leasing is expected to account for the majority of the growth in the satellite transponder market. Of this leasing, Ka-band is expected to witness the highest growth rate in the forecast period.

- Moreover, growth in Ku-band service demand is expected to generate significant traction for satellite transponders over the forecast period. Ku-band satellite communication systems are increasingly being deployed for various emergency communications during natural disasters and for satellite news gathering (SNG) by TV broadcasters in remote or rural areas where fiber and cable networks are unavailable.

- Further, with the emergence of the Internet of Things (IoT) and Industry 4.0 across the globe, broadband connectivity plays a crucial role in providing information to individuals. The telecom industry players are looking to lease satellite transponders to deliver broadband facilities to isolated places as well as across the globe. Various market vendors, such as Singtel, are capitalizing on the opportunity and offering extensive coverage, myriad transponder capacity bandwidths, and flexible satellite transponder lease services to fulfill business needs.

- During the COVID-19 pandemic, satellite communications enabled access to telemedicine to diagnose diseases or treat individuals who were quarantined, reducing the need for face-to-face interaction between healthcare personnel and patients. The applications of satellite transponders primarily supported such instances, thus positively impacting the market's growth. However, the impact of the COVID-19 pandemic on the global economy resulted in some satellite communication projects being postponed, delayed, and canceled, significantly impacting the satellite transponder leasing business.

Satellite Transponder Market Trends

Transponders Leasing as Service is Expected to Gain Significant Traction

- Transponder leasing is expected to gain significant traction in the satellite transponder market owing to fuelling the cost of transponders throughout the globe. In addition, the increasing demand to support bandwidth-intensive applications with reliability drives the need for transponder leasing in various applications.

- Satellite transponder lease service helps to connect businesses and communities globally. With the help of secure and reliable satellite connectivity, organizations can be connected wherever they are. The faster point-to-point access to new markets, flexible transponder leases, and stable on-ground control facilities help businesses get easier.

- Various prominent market vendors such as Thaicom and Singtel are continuously innovating their satellite transponder services to cater to the growing demand for advanced spectrum such as Ku-band to provide effective transponder leasing services for data, broadcast, and mobile backhaul connectivity across the world. In addition, market vendors are also providing flexible transponder leases, which is expected to influence the transponder leasing segment growth in the coming years.

- The leasing of communication satellite transponders is extremely dependent upon the adoption of HD video broadcasting and the widespread of High Dynamic Range (HDR) applications. Moreover, the advancement in new TV platforms coupled with an increase in subscriber base in OTT platforms is also augmenting the demand for transponder leasing, thus positively impacting the market growth.

- In addition, the growing need for reliable satellite-based communication in video distribution, broadband, and DTH is providing a promising future for the market's growth. The presence of major OTT and streaming platform players such as Netflix, Amazon Prime, etc., and its increasing subscriber base also aid the market's growth. For instance, according to the data from Netflix's Q4 2022 report, the number of Netflix paid subscribers rose to 230.75 million in Q4 2022 from 148.86 million in Q1 2019.

North America to Occupy Significant Share in the Market

- North America has been an extremely responsive market and has witnessed various technological changes over a long period. In many ways, the North American C-band video services segment is the major contributor to the growth of commercial satellite transponder leasing services. Overall, the satellite industry and satellite operators have realized the potential of Ka-band in delivering 4K-UHD (Ultra-high-definition) and OTT TV services. These evolving markets would drive demand for Ka-band transponders in the North American region as the Ka-band transponders eliminate rain attenuation to a great extent.

- North American region is expected to amount to the largest share of the satellite transponder market over the forecast period. The extensive presence of key satellite transponder providers and the widespread necessity for secure and reliable satellite-based communication are contributing to the dominance of the North American region in this market.

- Moreover, as satellite communication technology continues to develop and advance, and the satellite communication capability continues to improve, the utilization of satellite communication is becoming increasingly widespread, and the quality of service in the area is continuously improving. In addition, there is a swift development owing to the augmented technology advancement of communications, electronics, aerospace, etc. Such factors are further augmenting the growth of the market in the region.

- Moreover, the number of commercial applications for location/navigation satellite signals is growing in the United States. The accurately and precisely timed signals emitted by the satellites are used for many purposes, including the control of automated farm equipment, the timing of signals for the wireless telephone industry emergency location services, and as the basis for a U.S. national air traffic control system.

- For instance, in April 2023, SpaceX announced the launch of Intelsat's IS-40e communications satellite to help the operator meet the growing demand for connectivity on planes while also carrying its first hosted payload for NASA. The satellite is equipped with Ku- and Ka-band capacity; the satellite weighed around six metric tons at launch and is designed to have roughly eight kilowatts of power.

- Similarly, in May 2023, SAIC, a U.S. defense contractor, announced a strategic partnership with GomSpace, a European manufacturer, to develop small satellites for U.S. government agencies, universities, and commercial firms. Through this partnership, SAIC aims to leverage its heritage and deep technical expertise in legacy space systems development and strengthen its position in the new space economy.

- The demand for advanced commercial imaging satellites for defense and security administration, emergency services, and homeland security is on the rise. The satellite industry in the region is also expected to witness increased investments in product development. The availability of advanced and innovative features in commercial satellites propels the growth of the satellite transponder market in the region.

Satellite Transponder Industry Overview

The satellite transponder market is moderately competitive and consists of several major players. In terms of market share, few major players currently dominate the market. SES S.A., Arabsat, Embratel Star One, Eutelsat Communications S.A., Hispasat, Intelsat S.A., and others are among the major players in the global Satellite Transponder market. The companies are involved in several growth and expansion strategies to gain a competitive advantage. Industry participants follow value chain integration with business operations in multiple value chain stages.

In May 2023, Inmarsat announced the introduction of its new Inmarsat-8 small satellites, which will be launched in 2026 to provide crucial safety services and support advances in emergency tracking. The three I-8 satellites will provide additional network resilience, securing the future of Inmarsat's global L-band safety services.

In September 2022, SES, one of the leading global content connectivity solutions providers via satellite and Republican Centre for Space Communications (RCSC), a subsidiary of the Ministry of Digital Development, Innovations, and Aerospace Industry, announced to offer high-speed connectivity services to organizations across Kazakhstan jointly. The services will be provided via O3b mPOWER, SES's second-generation non-geostationary (NGSO) satellite system. They will be made available to various industries, including onshore energy, mining, maritime, telecommunications, and enterprises via RCSC, offering these companies the opportunity to drive digitalization in the region with expanded high-performance network capabilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Demand for New TV Platforms and Technologies

- 5.1.2 Growth in KU-Band and KA-Band Services

- 5.2 Market Restraints

- 5.2.1 Competition From Fiber-Optic Transmission Cable Networks

- 5.2.2 Requirement of High Capital Investment

- 5.3 Technolgy Snapshot

- 5.3.1 C-Band

- 5.3.2 KU-Band

- 5.3.3 KA-Band

- 5.3.4 S-band and L-band and X-band

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Commercial Communications

- 6.1.2 Government Communications

- 6.1.3 Navigation

- 6.1.4 Remote Sensing

- 6.1.5 Other Applications

- 6.2 By Service

- 6.2.1 Leasing

- 6.2.2 Maintenance and Support

- 6.2.3 Other Services

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SES SA

- 7.1.2 Telesat

- 7.1.3 Intesat SA

- 7.1.4 Eutelsat Communications SA

- 7.1.5 Hispasat SA (Red Electrica)

- 7.1.6 Singapore Telecommunication Ltd (Singtel)

- 7.1.7 SKY Perfect JSAT Corporation

- 7.1.8 EchoStar Corporation

- 7.1.9 China Satellite Communications Co. Ltd.

- 7.1.10 Russian Satellite Communications Company