|

市场调查报告书

商品编码

1404333

光子积体电路-市场占有率分析、产业趋势与统计、2024年至2029年成长预测Photonic Integrated Circuit - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

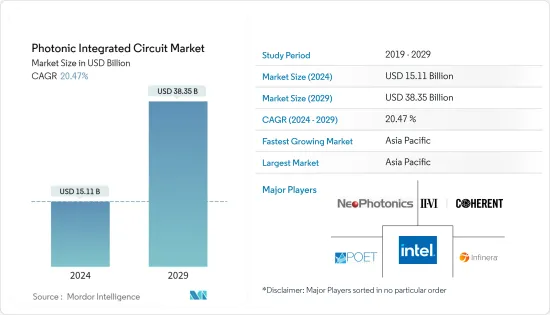

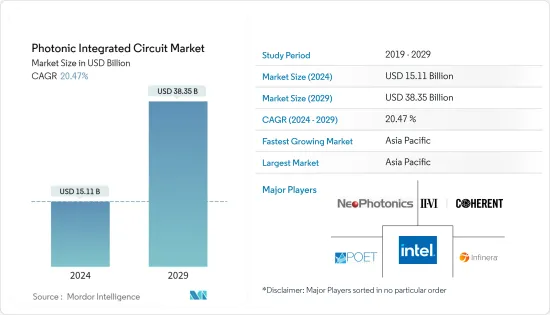

光子积体电路市场规模预计到2024年为151.1亿美元,预计到2029年将达到383.5亿美元,在预测期内(2024-2029年)复合年增长率为20.47%。

主要亮点

- 一旦安装了单一晶片,光子学的各种组件(例如波导管、雷射、调变和检测器)就被称为光子积体电路。光子积体电路比传统 IC 速度更快、频宽更高、能源效率更高。这些功能解决了传统 IC 的一些基本缺点。

- 光子 IC 可以将此类关键应用中的功耗降低至少 50%。光子可以覆盖的频率大约是微电子可以覆盖的频谱的 1,000 到 10,000 倍,透过使用光子 IC,最终用户可以获得比传统 IC 节能得多的更高频率。完成。

- 由于资料驱动的生态系统,采用混合晶片方法製造的光子装置的成本每年呈指数级增长,并且对终端用户应用的需求巨大。

- 此外,多个市场参与企业正在积极开发光子积体电路,作为高度整合光子技术的一部分,并解决因 COVID-19 大流行应对而增加的网路流量,特别是在资料中心内。我们正在努力利用它。

- 儘管混合光子 IC 效率很高,并且与前几代传统 IC 相比具有许多优势,但它们尚未达到传统 IC 的市场渗透水平。

- 由于 COVID-19 等威胁和场景,监控市场正在不断增长。世界各地的许多公共场所都配备了光学和光子感测器,将硅基数位视讯技术与半导体光电阴极技术相结合,以实现高灵敏度的夜视感测器、摄影机和系统。

光子积体电路市场趋势

通讯和资料中心应用的扩展推动市场发展

- 混合光子积体电路在通讯和资料中心提供广泛的应用。通讯和资料中心市场越来越多地采用混合光子积体电路的一个根本驱动因素是现有 IC 无法满足的高传输速率需求。

- 高容量网路和 5G 的发展也有助于提高速度。透过收发器和被动元件的发展和普及,光子积体电路技术已成为通讯领域的众所周知的技术。无线和无线电技术是5G发展的重点。

- 然而,光子学和光纤对于新一代基地台的讯号传输至关重要。

- 此外,许多製造商受益于先进的技术创新,开发符合其需求的低成本混合光子积体电路硬体。此外,由于云端应用程式的增加,必须在资料中心(DC)处理的流量正在迅速扩大。

- 根据Uptime Institute对资料中心产业的研究,大多数业者采用与资料中心营运相关的组合策略。由于 IT 工作负载分布在不同的服务和资料中心,Uptime 估计大约三分之一的工作负载正在转移到云端、主机代管、託管和软体即服务 (SaaS)共用商。

- 事实上,根据思科的说法,到2022年,预计92%的资料中心工作负载将是云端运算,对透过混合光子积体电路提供的更先进的交换和资料传输设备的巨大需求,这表明有这种需求。

- 此外,中小型企业对更高频宽的强烈需求以及对云端服务的大力采用(在 COVID-19 期间普遍增加)推动了对资料中心的需求。交换器资料和收发器资料速率增加的趋势正在推动光子积体电路的采用。

北美占据主要市场占有率

- 在北美,对基于光子积体电路的产品的需求是由资料中心和光纤通讯广域网路应用所驱动的。由于对高速资料传输的需求不断增长,云端运算流量不断增加,而光子互联网的快速引入可能会推动全部区域的IC产业发展。

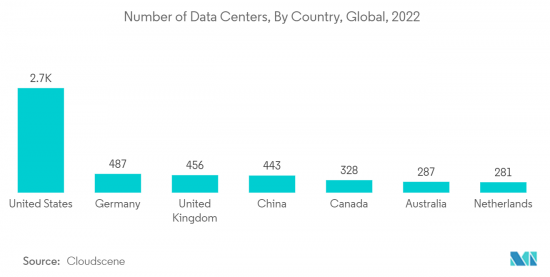

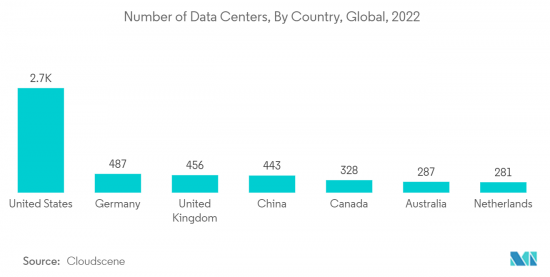

- 根据Cloudscene的数据,美国持有全球最多的资料中心,接近2,700个,占全球总数的近33%。

- 此外,随着行动、视讯和云端服务变得越来越关键,服务供应商必须满足日益增长的网路容量需求。特别是,企业有望建构基于光子积体电路的光纤网路,这可能对市场成长产生正面影响。致力于基于光子积体电路解决方案来应对通讯挑战的国际公司,包括 IBM 公司、英特尔公司和思科系统公司,已与该地区的学术、企业和政府合作伙伴合作。

- 官民合作关係正在为中小型企业开发国家研究项目,包括美国的 AIM Photonics(美国製造整合光子学研究所,纽约州丛集)、美国的光子学产业联盟佛罗里达光子学集群和安大略省光子产业网络。我们已经组成了联盟。

- 随着资料传输速度和频宽要求的增加,公司开始转向光子积体电路。光子积体电路利用光和光子而不是电和电子进行工作,有潜力提供更高的频宽和效率,使其适合未来的应用。光子积体电路找到了改进量子计算等技术的新方法。

- 2022年12月,OpenRight发表800G DR8光子积体电路,推动全球资料中心互连产业的发展。 OpenLite 使用 Tower Semiconductor 提供的雷射整合开放式硅光子代工平台製造并测试了这些晶圆。

光子积体电路产业概况

光子积体电路市场竞争激烈,Neophotonics公司、Poet Technologies、Cisco Systems Inc.和Infinera Corporation等主要公司进入该市场。从市场占有率来看,目前该市场由少数大公司主导。然而,随着技术创新和进步,许多公司正在透过赢得新契约和开拓新市场来增加其市场份额。以下是一些最近的市场开拓。

2023年3月,iPronics开发了一款可程式光子晶片,用于无线讯号处理、资料中心、机器学习和其他高阶运算应用。该公司开发基于光学硬体的可程式光子系统,可满足各种应用的需求。

2022年3月,EFFECT Photonics和Jabil Photonics宣布合作,设计新一代连贯光学模组。此模组专为寻求 QSFP 高 DD 效能、占用空间小、低功耗和成本、现场可替换互通性以及云端 DCI(资料中心互连)供应商之间的互通性等优势的网路企业而设计,为企业家和超大规模资料中心业者企业提供了独特的解决方案。新一代连贯光学模组可满足对资料流、服务连续性、安全性问题、全球部署和永续性的需求。

2022年3月,ColorChip Group与异构异质整合硅光子垂直整合先驱Skorpios Technologies Inc.宣布了一项策略,利用Skorpios的颠覆性光学技术以前所未有的价格生产光学模组,建立了合作伙伴关係。 ColorChip 销售自有品牌模组以及 Skorpios 销售的各种速度和性能等级的自有品牌模组。未来,我们计划共同开发Co-packaged Optics和Coherent Module等产品。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 评估关键宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 通讯和资料中心应用的成长

- 光子积体电路小型化投资与研究

- 市场挑战

- 对传统 IC 的持续需求

- 光纤网路容量不足

第六章市场区隔

- 依原料类型

- III-V族材料

- 铌酸锂

- 硅基二氧化硅

- 其他原料

- 按整合过程

- 混合

- 整体式的

- 按用途

- 通讯

- 生物医学

- 资料中心

- 其他应用(光感测器(LiDAR)、测量设备)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区 中东/非洲

第七章竞争形势

- 公司简介

- NeoPhotonics Corporation

- POET Technologies

- II-VI Incorporated

- Infinera Corporation

- Intel Corporation

- Cisco Systems Inc.

- Source Photonics Inc.

- Lumentum Holdings

- Caliopa(Huawei Technologies Co. Ltd)

- Effect Photonics

- Colorchip Ltd

第八章投资分析

第9章市场的未来

The Photonic Integrated Circuit Market size is estimated at USD 15.11 billion in 2024, and is expected to reach USD 38.35 billion by 2029, growing at a CAGR of 20.47% during the forecast period (2024-2029).

Key Highlights

- As soon as a single chip is attached, different components of the photonics, like waveguides, lasers, modulators, and detectors, become known as photonic integrated circuits. Photonic integrated circuits are extremely fast, accommodate higher bandwidth, and have high energy efficiency compared to traditional ICs. These features have dealt with some of the fundamental drawbacks associated with traditional ICs.

- In the case of photonic ICs, the power consumed in such critical applications could be reduced by at least 50%. The frequencies that could be covered with photons are about 1,000-10,000 times higher than the spectrum covered with microelectronics, implying that by using photonic ICs, end users can achieve much higher frequencies that are far more energy-efficient than traditional ICs.

- These low costs of photonics devices manufactured through the hybrid monolithic approach are growing exponentially every year as a result of DataDriven Ecosystems, finding great demand from end users' applications.

- In addition, several market participants are working to take advantage of PIC's active developments as part of a highly integrated photonic technology and in order to meet the growing volume of network traffic driven by COVID-19 pandemic responses, particularly within data centers.

- While hybrid photonic ICs are highly efficient and have a number of advantages compared to previous generations of conventional ICs, they do not achieve the level of market penetration found in traditional ICs.

- The surveillance market is growing with threats and scenarios like COVID-19. Many public places worldwide are deploying optical and photonic sensors that enable high-sensitivity night vision sensors, cameras, and systems combined with semiconductor photocathode technology with silicon-based digital video technology.

Photonic Integrated Circuit Market Trends

Growing Applications in Telecommunications and Data Centers to Drive the Market

- In telecommunication businesses and data centers, hybrid PICs offer a wide range of applications. The basic factor that has led to the increased adoption of hybrid PICs in the telecommunications and data center markets is their need for a higher transfer rate, which existing ICs cannot accommodate.

- The development of high-capacity networks and 5G have also contributed to an increase in speed. Through the development and widespread acceptance of transceivers and passive components, PIC technologies have emerged as a technology well-known within the telecommunications sector. Wireless and radio technology has become a focus of the development of 5G.

- However, photonics and fiber optics have been critical in transporting signals to and from the new generation of base stations.

- Moreover, many manufacturers are benefiting from the high degree of innovation that is allowing them to develop low-cost hybrid PIC hardware in line with their needs. In addition, an increasing number of cloud applications are rapidly upscaling the traffic that has to be handled by data centers (DC).

- According to the survey conducted by Uptime Institute on the data center industry, most operators employ a mix of strategies related to DC operations. With IT workloads spread across various services and data centers, Uptime shared that about one-third of all workloads shifted to the cloud, colocation, hosting, and Software-as-a-Service (SaaS) suppliers.

- As a matter of fact, according to Cisco, 92% of the workload in data centers will be cloud computing by 2022, which indicates that there is an important need for more advanced switching and data transfer devices available through hybrid PICs.

- Additionally, booming demand for larger bandwidth and strong adoption of cloud services by SMEs typically heightened amid COVID-19 boosted the demand for data centers. A growing trend of increasing switch data and transceiver data rates is driving PIC adoption.

North America to Hold Major Market Share

- In North America, the demand for photonic integrated circuits (PIC)-based products is driven by data centers and fiber optic communication WAN applications. A growing need to transmit data at fast speeds has led to an increase in cloud computing traffic, and the rapid introduction of the Internet of photonics is likely to lead to a flourishing IC industry across the region.

- According to Cloudscene, the United States holds the highest number of data centers globally, i.e., almost 2,700, which is almost 33% of the world's.

- In addition, service providers must meet the growing demand for network capacity as mobile, video, and cloud services increasingly become an integral part of their business. In particular, it is expected that companies will base their optical networks on PICs, which may have a positive effect on the growth of the market. International companies working on PIC-based solutions for telecommunications challenges, including IBM Corporation, Intel Corporation, and Cisco Systems Inc., have worked together with academia, business, and government partners throughout the region.

- Public-private partnerships have forged national research consortiums for smaller enterprises, such as the American Institute for Manufacturing Integrated Photonics (AIM Photonics, Rochester, NY) in the United States, the Canadian Photonic Industry Consortium Florida Photonics Cluster, and the Ontario Photonics Industry Network.

- With increasing data rates and bandwidth requirements, companies have started to push for a shift toward PICs. PICs working with light and photons instead of electricity and electrons could offer higher bandwidth and efficiency, making them well-suited for future applications. PICs have been finding new ways to improve technology, like quantum computing.

- In Dec 2022, OpenLight unveiled an 800 G DR8 photonic integrated circuit to advance the global data center interconnect industry. OpenLight has fabricated and tested these wafers using the open silicon photonics foundry platform with integrated lasers offered by open silicon photonics foundry platform with integrated lasers offered by Tower Semiconductor.

Photonic Integrated Circuit Industry Overview

The photonic integrated circuit market is moderately competitive and consists of several major players like Neophotonics Corporation, Poet Technologies, Cisco Systems Inc., and Infinera Corporation. In terms of market share, few major players currently dominate the market. However, with innovations and technological advancements, many companies are increasing their market presence by securing new contracts and tapping new markets. Some of the recent developments in the market are:

In March 2023, iPronics created a programmable photonic chip for wireless signal processing, data centers, machine learning, and other advanced computing applications. The company is developing programmable photonic systems based on optical hardware that can be adapted to meet the needs of different applications.

In March 2022, EFFECT Photonics and Jabil Photonics announced a cooperation with the aim of developing a new generation of coherent optical modules. The modules offer a unique solution for network operators and hyper-scalers seeking to benefit from QSFP-high DD's performance, small footprint, low power consumption and cost, field replaceability, and vendor interoperability for cloud DCIs (Data Center Interconnects). The next-generation coherent optical modules handle the increased demand for data flow, service continuity, security issues, global expansion, and sustainability.

In March 2022, ColorChip Group and Skorpios Technologies Inc., a vertically integrated pioneer in heterogeneously integrated silicon photonics, established a strategic partnership to use Skorpios' disruptive optical technology to produce optical modules at previously unheard-of prices. ColorChip will sell its brand of modules and private label modules for Skorpios to sell at various speeds and performance levels. Future products, such as Co-packaged Optics and Coherent Modules, will be developed in collaboration.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Assessment of the Impact of Key Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Applications in Telecommunications and Data Centers

- 5.1.2 Investments and Research to Miniaturize the PICs

- 5.2 Market Challenges

- 5.2.1 Continued Demand for Traditional ICs

- 5.2.2 Optical Networks Capacity Crunch

6 MARKET SEGMENTATION

- 6.1 By Type of Raw Material

- 6.1.1 III-V Material

- 6.1.2 Lithium Niobate

- 6.1.3 Silica-on-silicon

- 6.1.4 Other Raw Materials

- 6.2 By Integration Process

- 6.2.1 Hybrid

- 6.2.2 Monolithic

- 6.3 By Application

- 6.3.1 Telecommunications

- 6.3.2 Biomedical

- 6.3.3 Data Centers

- 6.3.4 Other Applications (Optical Sensors (LiDAR), Metrology)

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 NeoPhotonics Corporation

- 7.1.2 POET Technologies

- 7.1.3 II-VI Incorporated

- 7.1.4 Infinera Corporation

- 7.1.5 Intel Corporation

- 7.1.6 Cisco Systems Inc.

- 7.1.7 Source Photonics Inc.

- 7.1.8 Lumentum Holdings

- 7.1.9 Caliopa (Huawei Technologies Co. Ltd)

- 7.1.10 Effect Photonics

- 7.1.11 Colorchip Ltd