|

市场调查报告书

商品编码

1404364

住宅电池 -市场占有率分析、行业趋势和统计、2024-2029 年成长预测Residential Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

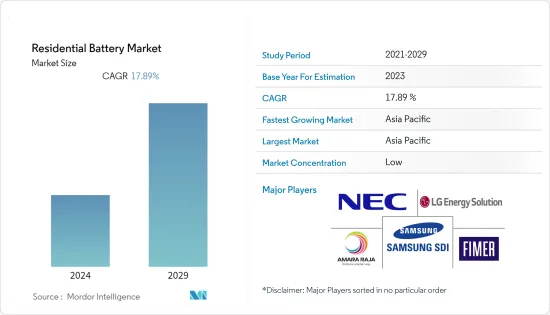

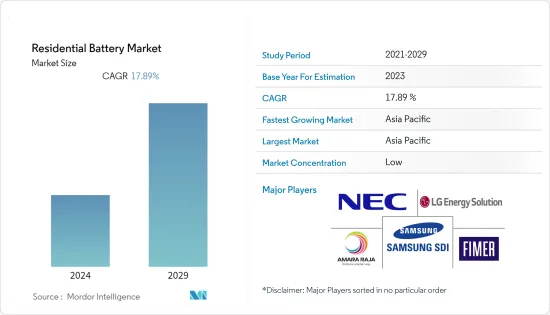

预计到年终,全球住宅电池市场将达到 130.1 亿美元,并预计在预测期内复合年增长率为 17.89%。

受访的市场在2020年曾受到COVID-19的影响,但现已恢復并达到疫情前的水准。

锂离子电池价格下降预计将在预测期内推动市场成长。然而,铅电池的环境缺点预计将阻碍预测期内的市场成长。预计离网太阳能使用量的增加将在预测期内为全球住宅电池市场提供利润丰厚的成长机会。

亚太地区在研究市场中占据主导地位,预计在预测期内复合年增长率最高。这一增长是由中国、印度和日本住宅屋顶太阳能装置的投资和部署增加所推动的。

住宅电池市场趋势

锂离子电池领域可望主导市场

与铅电池等其他技术相比,锂离子 (Li-ion) 电池具有许多技术优势。可充电锂离子电池平均可循环超过 5,000 次。

锂离子电池不像铅电池需要经常维护或更换。锂离子电池在整个放电週期中保持电压,因此其电气元件效率更高、使用寿命更长。虽然锂离子电池的初始成本较高,但当考虑寿命和性能时,实际成本远低于铅电池。

电池在能源储存系统中发挥重要作用,占系统总成本的很大一部分,特别是用于住宅能源储存系统係统的电池。全球再生能源来源总设备容量正在显着增加,住宅太阳能屋顶的安装也不断增加。

太阳能屋顶容量的增加可能会推动电池能源储存需求的增加。因此,住宅用新型能源储存系统(ESS)的出现预计将在预测期内推动锂离子电池的需求。锂离子电池重量轻、充电时间短、充电循环次数多且价格低廉,因此非常适合此应用。

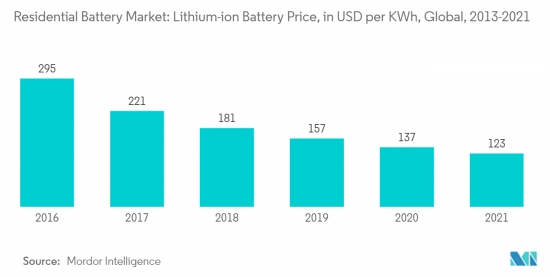

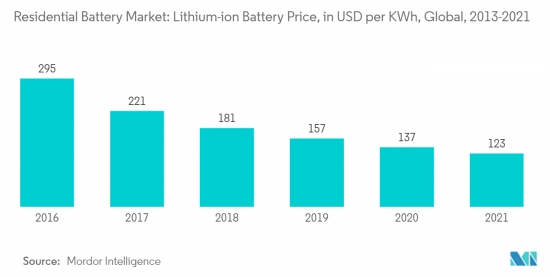

由于价格下降,锂离子电池最近作为住宅太阳能发电和家用逆变器的储能係统变得流行。 2021年,锂离子电池价格为123美元/度数,较2013年的668美元/度下降81.58%。迄今为止,住宅能源储存政策仍不完善。然而,美国、德国等国家正试图透过国家政策行动和监管措施,在区域能源储存市场创造机会。

例如,2022年10月,作为总统两党基础设施法案的一部分,美国能源局(DOE)宣布了第一批扩大从海外进口的电池、材料和零件的国内製造的计划。总合将花费28亿美元在12个州建造和扩大商业规模的设施,以提取、加工和展示新方法,例如用回收材料、锂、石墨和其他电池组件材料製造组件,并授予20家公司。 2021 年 11 月,金霸王推出了与美国新建或现有住宅太阳能发电系统相容的磷酸铁锂 (LFP) 电池。该电池的额定功率输出功率为5kW,储存容量为14kWh。电压范围44.5~53.5V,最大充放电电流74.0A,往返效率超过85.7%,性能保证超过6000次循环。

因此,由于上述因素,锂离子电池产业预计将在预测期内主导市场。

亚太地区预计将主导市场

亚太地区拥有多个经济成长区域,自然资源和人力资源丰富。该地区以中国和印度为主,其中中国和印度是主要收益。预计这些国家在预测期内将展现出巨大的成长潜力。

由于政府政策和监管支持,中国住宅电池市场预计在预测期内将成长。中国政府已经展示了透过补贴和安装目标来刺激国内太阳能相关设备需求高速成长的能力。

2020年1月至9月,我国住宅屋顶太阳能总装置容量为741万千瓦,2021年成长64.61%。 2021年9月,新增住宅屋顶太阳能发电容量214千万瓦。 2022年2月,Bslbatt在中国推出了用于离网太阳能能源储存的模组化锂离子电池。该电池的储存容量为5.1至30.7kWh,可稳定运作多达6,000次充电循环。因此,住宅领域的此类新电池技术预计将在预测期内增加所研究市场的成长。

该地区的另一个重要国家是印度,截至2021年12月,其发电量排名世界第五,装置容量为393.83GW。然而,印度正面临停电。印度政府的目标是透过大幅增加包括屋顶太阳能发电在内的可再生能源发电能力来实现全天24小时供电,住宅电池的需求预计将增加。

随着印度政府正在推动在印度建立锂离子电池製造工厂并于2022年开始生产,锂离子电池的成本预计将下降。例如,2022年10月,中央电化学研究所(CECRI)开始在印度清奈建造专有的锂离子电池製造工厂,产能为每天生产1,000个电池。该设施预计将于 2024 年在塔拉马尼科学与工业研究委员会 (CSIR) 马德拉斯综合体竣工。

亚太地区是一些都市化速度最快的国家的所在地,预计消费性电子产品和备用电源系统等各种应用对住宅电池的需求强劲。

住宅电池产业概况

住宅电池市场分散。市场主要企业(排名不分先后)包括 FIMER SpA、Amara Raja Batteries Ltd、Samsung SDI、NEC Corporation 和 LG Energy Solution Ltd。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 2027年之前的市场规模与需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 按类型

- 锂离子电池

- 铅蓄电池

- 其他类型

- 按地区

- 北美洲

- 亚太地区

- 欧洲

- 南美洲

- 中东/非洲

第六章竞争形势

- 併购、合资、联盟、协议

- 主要企业策略

- 市场占有率分析

- 公司简介

- Duracell Inc.

- Energizer Holding Inc.

- BYD Co. Ltd

- FIMER SpA

- LG Energy Solution Ltd

- Panasonic Corporation

- Samsung SDI Co. Ltd

- Siemens AG

- Luminous Power Technologies Pvt. Ltd

- Amara Raja Batteries Ltd

- Delta Electronics Ltd

- NEC Corporation

- Tesla Inc.

第七章 市场机会及未来趋势

The global residential battery market is expected to reach USD 13.01 billion by the end of the current year, and it is projected to register a CAGR of 17.89% during the forecast period.

Although the market studied was affected by COVID-19 in 2020, it recovered and reached pre-pandemic levels.

The declining prices of lithium-ion batteries are expected to drive the growth of the market studied during the forecast period. However, the environmental disadvantages of lead-acid batteries are expected to hamper the growth of the market studied during the forecast period. An increase in off-grid solar utilization is expected to create lucrative growth opportunities for the global residential battery market during the forecast period.

Asia-Pacific is dominating the market studied, and it is expected to witness the highest CAGR during the forecast period. This growth is attributed to the increasing investments and the adoption of residential rooftop solar installations in China, India, and Japan.

Residential Battery Market Trends

Lithium-ion Battery Segment Expected to Dominate the Market

Lithium-ion (Li-ion) batteries offer various technical advantages over other technologies, such as lead-acid batteries. Rechargeable Li-ion batteries, on average, offer cycles more than 5,000 times compared to lead-acid batteries that last around 400-500 times.

Li-ion batteries do not need as frequent maintenance and replacement as lead-acid batteries. Li-ion batteries maintain their voltage throughout the discharge cycle, allowing greater and longer-lasting efficiency of electrical components, whereas the voltage of lead-acid batteries drops consistently throughout the discharge cycle. Despite the higher upfront cost of Li-ion batteries, the true cost is much lesser than lead-acid batteries when considering lifespan and performance.

Batteries play a crucial part in energy storage systems and are responsible for a major portion of the total cost of the system, especially used in residential energy storage systems. The total installed capacity of renewable energy sources is increasing at a significant rate worldwide, and so is the installation of solar rooftops on residential buildings.

The increase in solar rooftop capacity is likely to foster an increase in the demand for battery energy storage. Therefore, the emergence of new energy storage systems (ESS) for residential applications is expected to boost the demand for lithium-ion batteries during the forecast period. Properties of lithium-ion batteries, such as less weight, low charging time, a higher number of charging cycles, and declining cost, make it preferable for this application.

Due to their declining prices, lithium-ion batteries have recently gained popularity as battery storage systems for residential solar and home inverters. In 2021, the price of the lithium-ion battery was USD 123/kWh, which declined by 81.58% from USD 668/KWh in 2013. The residential energy storage policies to date are quite nascent. However, countries, like the United States and Germany, through state policy action and regulatory action, are creating opportunities in the local energy storage markets.

For instance, in October 2022, as part of the President's Bipartisan Infrastructure Law, the US Department of Energy (DOE) announced the first set of projects to expand domestic manufacturing of batteries, materials, and components imported from overseas. A total of USD 2.8 billion will be awarded to the 20 companies for building and expanding commercial-scale facilities in 12 states for extracting, processing, and demonstrating new approaches, such as manufacturing components from recycled materials, lithium, graphite, and other components battery materials. In November 2021, Duracell launched a lithium iron phosphate (LFP) battery compatible with new or existing residential PV systems in the United States. The battery has a power rating of 5 kW and a storage capacity of 14 kWh. It has a voltage range from 44.5 to 53.5 V and a maximum charge and discharges current of 74.0 A. The roundtrip efficiency is over 85.7%, with a guaranteed performance of over 6,000 cycles.

Therefore, owing to the above-mentioned factors, the lithium-ion battery segment is expected to dominate the market during the forecast period.

Asia-Pacific Expected to Dominate the Market

Asia-Pacific has multiple growing economies with substantial natural and human resources. The region holds the majority share in revenue, with China and India being the major contributors. These countries are anticipated to exhibit immense growth potential during the forecast period.

Due to the government's policy and regulatory support, the Chinese residential battery market is expected to grow during the forecast period. The Chinese government has already shown its ability to stimulate high growth in domestic demand for solar-related equipment through subsidies and installation targets.

In the first nine months of 2020, China's total residential rooftop solar capacity installed stood at 7.41 GW, which increased by 64.61% in 2021. The country added 2.14 GW of residential rooftop solar capacity in September 2021. In February 2022, Bslbatt unveiled a modular lithium-ion battery for off-grid solar energy storage in China. The battery has a storage capacity ranging from 5.1 to 30.7 kWh and can provide steady operation for up to 6,000 charge cycles. Thus, such new battery technologies in the residential sector are anticipated to increase the growth of the market studied during the forecast period.

Another important country in the region is India, which accounts for the world's fifth-largest power generation capacity, with an installed capacity of 393.83 GW, as of December 2021. However, India faces power outages. The Government of India aimed to supply electricity 24 hours a day by significantly adding to renewable energy generation capacity, including rooftop solar power, which is anticipated to increase the demand for residential batteries.

With the government of India pushing to install lithium-ion battery manufacturing plants in India and start production in 2022, the cost of lithium-ion batteries is expected to drop. For instance, in October 2022, the Central Electrochemical Research Institute (CECRI) started building an indigenously-developed lithium-ion battery manufacturing plant in Chennai, India, with the capacity to produce 1,000 batteries per day. The facility will be completed by 2024 at the Council of Scientific and Industrial Research (CSIR) Madras Complex at Taramani.

Asia-Pacific is home to the fastest urbanizing countries, which is anticipated to create a significant demand for residential batteries for various applications, including consumer electronics, backup power supply systems, etc.

Residential Battery Industry Overview

The residential battery market is fragmented. Some of the major companies in the market (in no particular order) include FIMER SpA, Amara Raja Batteries Ltd, Samsung SDI Co. Ltd, NEC Corporation, and LG Energy Solution Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-acid Battery

- 5.1.3 Others Types

- 5.2 By Geography

- 5.2.1 North America

- 5.2.2 Asia-Pacific

- 5.2.3 Europe

- 5.2.4 South America

- 5.2.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 Duracell Inc.

- 6.4.2 Energizer Holding Inc.

- 6.4.3 BYD Co. Ltd

- 6.4.4 FIMER SpA

- 6.4.5 LG Energy Solution Ltd

- 6.4.6 Panasonic Corporation

- 6.4.7 Samsung SDI Co. Ltd

- 6.4.8 Siemens AG

- 6.4.9 Luminous Power Technologies Pvt. Ltd

- 6.4.10 Amara Raja Batteries Ltd

- 6.4.11 Delta Electronics Ltd

- 6.4.12 NEC Corporation

- 6.4.13 Tesla Inc.