|

市场调查报告书

商品编码

1404366

离型纸-市场占有率分析、产业趋势与统计、2024-2029 年成长预测Release Liners - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

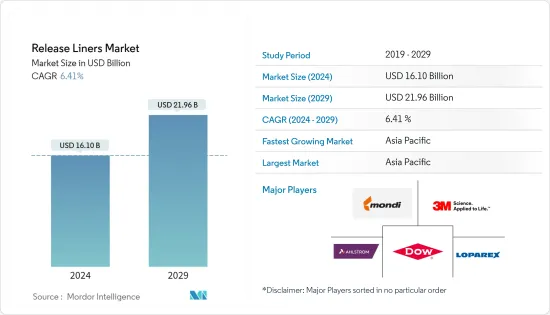

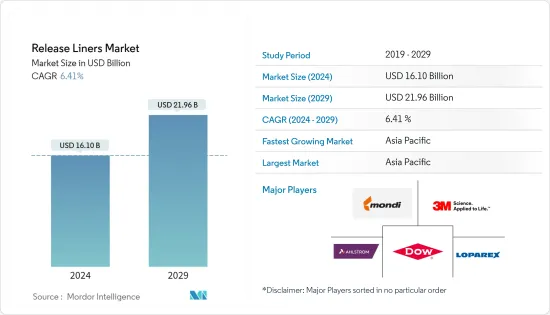

预计2024年离型纸市场规模为161亿美元,预计到2029年将达到219.6亿美元,在预测期内(2024-2029年)复合年增长率为6.41%。

主要亮点

- COVID-19 大流行对离型纸市场产生了负面影响。全球封锁和政府实施的严格规定摧毁了大多数生产基地。儘管如此,业务自 2021 年以来已经復苏,预计未来几年将大幅成长。

- 短期来看,食品和饮料产业对洁净标示的需求不断增长,对优质卫生产品的需求不断增长,以及医疗领域采用薄膜衬垫是推动所研究市场成长的一些因素。

- 另一方面,与离型纸废弃物相关的问题预计将阻碍市场成长。

- 然而,新兴国家包装产业的扩张预计将在预测期内提供许多机会。

- 亚太地区在市场上占据主导地位,预计在预测期内仍将保持最高的复合年增长率。

离型纸市场趋势

主导市场的标籤细分市场

- 标籤贴在包装上,以标明内容、产品规格、联络资讯、健康和安全警告和指南,以及可能适用于产品的其他行销、品牌和定价资讯。

- 由于新兴国家包装食品产业的需求不断增加,预计标籤细分市场将显着主导市场。在超级市场/大卖场,冷冻食品随处可见,不同成分、不同口味、不同包装风格。预计这将进一步吸引消费者前往超级市场和大卖场,提高市场的净销售额,进而增加对离型纸的需求。

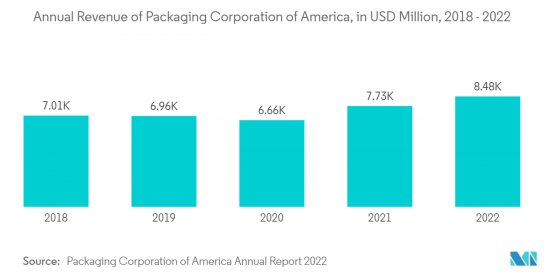

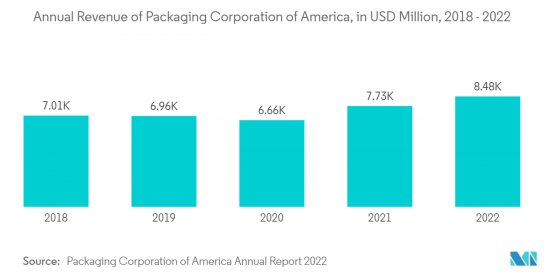

- 此外,根据美国包装公司(PCA)年报,2022年美国包装公司年收益约85亿美元,较2021年成长9.69%。因此,包装收益的增加预计将创造对标籤的需求,并增加标籤领域对离型纸的需求。

- 此外,世界多个国家零售业的不断扩张增加了对标籤应用离型纸的需求。例如,根据 StatCan 的数据,2022 年 1 月加拿大零售业国内生产总值总值为 1,065 亿加元(818.7 亿美元),较 2021 年 1 月增长 7.44%。

- 此外,对永续包装的关注、大型零售连锁店的扩张、消费者对简便食品(包装食品)的需求以及生活方式的改变正在推动标籤应用中对离型纸的需求,这反过来又推动了离型纸市场。生长。

亚太地区主导市场

- 亚太地区占据离型纸市场的主要份额,预计在预测期内将成长最快。

- 离型纸用于汽车生产的许多部分,从用于煞车灯、地毯、内装和车门装饰的感压胶带,到用于减振和隔音的各种垫片,再到新兴的电动电池生产车辆,一直如此。对离型纸的需求主要来自中国的汽车和医疗产业。随着该国汽车、医疗和包装行业投资的增加,预计在预测期内对离型纸的需求将会增加。

- 例如,根据国际汽车工业协会(OICA)的数据,2022年该国汽车产量为27,020,615辆,较2021年成长3%。因此,由于汽车产量的增加,该国的离型纸市场可能会扩大。

- 此外,女性卫生棉也需要防黏衬里。人们对私密卫生意识的增强以及对卫生棉、卫生棉条和卫生护垫等卫生产品的日益偏好正在推动对离型垫的需求。印度政府在全国范围内推出了多项有关女性月经卫生的宣传计划。例如,2022 年 1 月,拉贾斯坦邦政府启动了一项妇女友善计划「我是乌丹」。这项耗资 20 亿印度卢比(2,540 万美元)的计画将为该邦所有女孩和妇女提供免费卫生棉。预计这些政府措施将增加对离型纸的需求。

- 此外,离型纸是医疗产品(如经皮给药系统、医疗设备、先进创伤护理敷料和其他药品包装产品)整体开发和性能的关键组成部分。离型纸在医疗设备製造和药品包装中具有多种优势,因为它们有助于包装和保护各种产品。

- 医疗产品和医疗设备产业的显着成长预计将推动离型纸市场的成长。例如,根据印度品牌股权基金会(IBEF)的数据,22财年印度医疗设备出口额为29亿美元,预计2025年将增加至100亿美元。因此,该国医疗设备出口的增加预计将带动离型纸市场的需求上升。

- 此外,印度政府还推出了各种措施来加强医疗设备产业,重点是研发 (R&D) 和对医疗设备100% 直接投资,以提振市场。例如,据IBEF称,2022年8月,药政部将为21-25财年的「医疗设备园区推广」计画提供4,897万美元的财政投资,该计画下的最高支持金额为1000万美元每个医疗设备园区1224万,单位为美元。

- 因此,在政府支持下这些产业的进一步成长可能会增加预测期内对离型纸的需求,从而推动中国和印度等新兴市场的成长。

离型纸业概况

离型纸市场得到巩固。该市场的主要企业(排名不分先后)包括 Mondi、Dow、3M、Loparex 和 Ahlstrom。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 食品和饮料行业的洁净标示需求

- 优质卫生产品的需求不断增长以及医疗领域对薄膜内衬的采用

- 其他司机

- 抑制因素

- 离型纸废弃物的处理问题

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 目的

- 标籤

- 形象的

- 磁带

- 医疗保健

- 工业

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 南非

- 沙乌地阿拉伯

- 中东和非洲其他地区

- 亚太地区

第六章竞争形势

- 併购、合资、联盟、协议

- 市场占有率分析(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- Ahlstrom

- Dow

- Eastman Chemical Company

- Elkem ASA

- Felix Schoeller

- Gascogne Group

- LINTEC Corporation

- Loparex

- Mondi

- Sappi Group

- SJA Film Technologies Ltd

- The Griff Network

- UPM Global

第七章 市场机会及未来趋势

- 新兴国家包装产业的成长

- 其他机会

简介目录

Product Code: 61134

The Release Liners Market size is estimated at USD 16.10 billion in 2024, and is expected to reach USD 21.96 billion by 2029, growing at a CAGR of 6.41% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 pandemic had a negative impact on the release liners sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business has been recovering since 2021 and is expected to rise significantly in the coming years.

- Over the short term, increasing demand for clean labels from the food and beverage industry and rising demand for premium hygiene products, and adoption of film-based liners in the medical sector are some of the factors driving the growth of the market studied.

- On the flip side, issues related to the disposal of release liner waste are expected to hinder the market's growth.

- However, expanding the packaging sector in emerging economies is anticipated to provide numerous opportunities over the forecast period.

- Asia Pacific region is expected to dominate the market and will also witness the highest CAGR during the forecast period.

Release Liners Market Trends

Labels Segment to Dominate the Market

- Labels are applied to packaging to indicate the contents, product specifications, contact details, health and safety warnings and guidelines, and any additional marketing, branding, or pricing information that applies to a product.

- The labels segment is expected to dominate the market majorly due to the increased demand from the packaged foods sector in emerging economies. In supermarkets/hypermarkets, frozen-food meals are available in a wide range with a variety of ingredients and flavors in different packaging styles. This further attracts consumers to supermarkets and hypermarkets, driving the net sale in the market, in turn, is expected to create an upside demand for release liners.

- Moreover, according to the Packaging Corporation of America (PCA) annual report, in 2022, the annual revenue of the packaging corporation of America was approximately USD 8.5 billion, which shows an increase of 9.69% compared with 2021. Therefore, an increase in the revenue of packaging is expected to create demand for labels, which is expected to augment the demand for release liners from the labels segment.

- Additionally, the expanding retail sector in several countries across the world has increased the demand for release liners in labeling applications. For instance, according to StatCan, in Jan 2022, the gross domestic product for the retail trade industry in Canada amounted to CAD 106.5 billion (USD 81.87 billion), which showed an increase of 7.44% compared to Jan 2021.

- Moreover, the focus on sustainable packaging, the expansion of large retail chains, consumer demand for convenience foods (packaged foods), and lifestyle changes have driven the demand for release liners in labeling applications, in turn, boosting the growth of release liners market.

Asia-Pacific to Dominate the Market

- Asia-Pacific holds a significant share of the release liners market, and it is expected to witness the fastest growth during the forecast period.

- Release liners are found in many components of vehicle production, from pressure-sensitive tapes for brakes lights, carpets, upholstery, and door trim, to the wide variety of gaskets used for vibration reduction and sound dampening and the emerging production of batteries for EV vehicles. The demand for release liners majorly arises from the automotive and medical sectors in China. With the increasing investments in the country's automotive, medical, and packaging sectors, the demand for release liners is expected to increase during the forecast period.

- For instance, according to the International Organization of Motor Vehicle Manufacturers (OICA), in 2022, automobile production in the country amounted to 2,70,20,615 units, which showed an increase of 3% compared to 2021. Therefore, the release liners market in the country is likely to expand as a result of the rise in overall automobile manufacturing.

- Additionally, release liners are also required in sanitary pads for female hygiene. The increasing awareness about intimate hygiene and increasing preference for menstrual products, such as sanitary pads, tampons, and panty liners, are boosting the demand for release liners. The Government of India has launched several awareness programs across the country about women's menstrual hygiene. For instance, in January 2022, the Rajasthan government started "I am Udaan," a women-friendly project. This plan, which will cost INR 200 crore (USD 25.4 million), will provide free sanitary napkins to every girl and woman in the state. Such government initiatives are expected the increase the demand for release liners.

- Moreover, release liners are a critical component in the overall development and performance of medical products such as transdermal drug delivery systems, medical devices, advanced wound care dressings, and other pharmaceutical packaging products. Release liners provide several benefits in medical device manufacturing and pharmaceutical packaging as they help package and protect a wide range of products.

- The significant growth in the medical products and devices industry is expected to propel the growth of the release liners market. For instance, according to India Brand Equity Foundation (IBEF), the export of medical devices from India stood at USD 2.90 billion in FY22 and is expected to rise to USD 10 billion by 2025. Therefore, an increase in the exports of medical devices from the country is expected to create an upside demand for the release liners market.

- Furthermore, the government of India has commenced various initiatives to strengthen the medical devices sector, with emphasis on research and development (R&D) and 100% FDI for medical devices to boost the market. For instance, according to IBEF, in August 2022, the Department of Pharmaceuticals greenlit the "Promotion of Medical Devices Parks" program from FY21-25 with a total financial investment of USD 48.97 million, with a maximum support under the program of USD 12.24 million for each Medical Device Park.

- Hence, further growth in these industries, owing to the government's support, is likely to increase the demand for release liners during the forecast period, thus, boosting the market growth in developing nations such as China and India.

Release Liners Industry Overview

The release liners market is consolidated in nature. The major players in this market (not in a particular order) include Mondi, Dow, 3M, Loparex, and Ahlstrom, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Demand for Clean Labels in Food and Beverage Industry

- 4.1.2 Rising Demand from Premium Hygiene Products and Adoption of Film-Based Liners in Medical Sector

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Issues Related to the Disposal of Release Liner Waste

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Labels

- 5.1.2 Graphics

- 5.1.3 Tapes

- 5.1.4 Medical

- 5.1.5 Industrial

- 5.1.6 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 United Kingdom

- 5.2.3.2 France

- 5.2.3.3 Germany

- 5.2.3.4 Italy

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Ahlstrom

- 6.4.3 Dow

- 6.4.4 Eastman Chemical Company

- 6.4.5 Elkem ASA

- 6.4.6 Felix Schoeller

- 6.4.7 Gascogne Group

- 6.4.8 LINTEC Corporation

- 6.4.9 Loparex

- 6.4.10 Mondi

- 6.4.11 Sappi Group

- 6.4.12 SJA Film Technologies Ltd

- 6.4.13 The Griff Network

- 6.4.14 UPM Global

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growth in Packaging Sector in Emerging Economies

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219