|

市场调查报告书

商品编码

1404367

碳复合材料 -市场占有率分析、产业趋势与统计、2024-2029 年成长预测Carbon Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

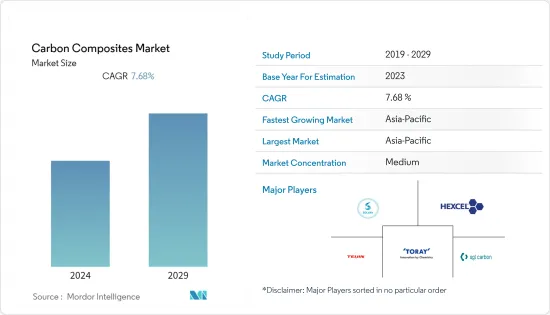

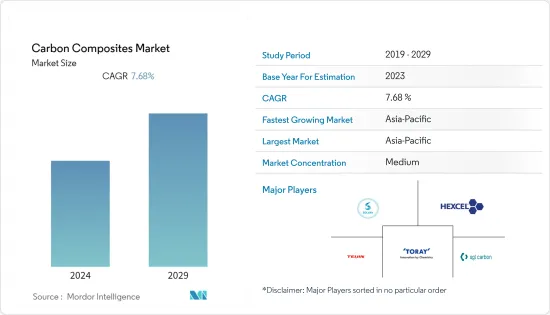

预计年终碳复合材料市场将达到205.90千吨。

预计未来五年将达298.10千吨,预测期内复合年增长率超过7.68%。

COVID-19 对碳复合材料产业产生了负面影响。全球封锁和政府实施的严格规定摧毁了大多数生产基地。儘管如此,业务自 2021 年以来已经復苏,预计未来几年将大幅成长。

主要亮点

- 推动市场的关键因素是航太和国防工业需求的增加以及风力发电领域需求的增加。

- 然而,与其他复合材料相比,製造成本较高以及替代品的存在阻碍了市场成长。

- 然而,碳复合材料在 3D 列印中的日益普及以及燃料电池电动车(FCEV) 需求的不断增加带来了市场机会。

- 亚太地区占据最高的市场占有率,预计在预测期内将主导市场。

碳复合材料市场趋势

航太和国防应用主导市场

- 航太和国防工业是碳复合材料市场的最大最终用户。最初,航太製造严重依赖铝、钢和钛等金属,这些金属约占飞机总重量的 70%。然而,近年来,由于人们对减重、极端耐用、隔热和雷达吸收等性能的日益偏好,碳复合材料在航太製造中的使用激增。

- 这些复合材料由嵌入碳基体中的碳纤维组成。这些复合材料还可以降低飞机的维护成本,因为它们不会生锈或腐蚀。

- 碳纤维复合材料在航太工业中的主要应用包括用于生产飞机零件,例如夹子、夹板、支架、肋骨、支柱、横樑、尖端、翼尖和其他特殊零件。

- 此外,航太也在探索将这些复合材料用于大型结构,例如机翼抗扭箱和机身面板。在国防工业中,碳复合材料用于飞弹防御、地面防御和军舰。

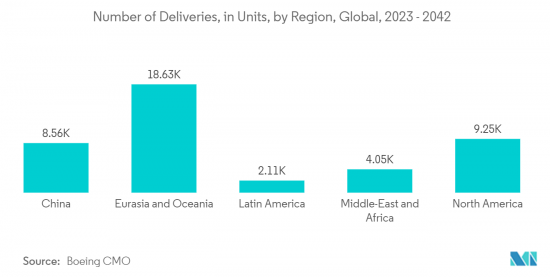

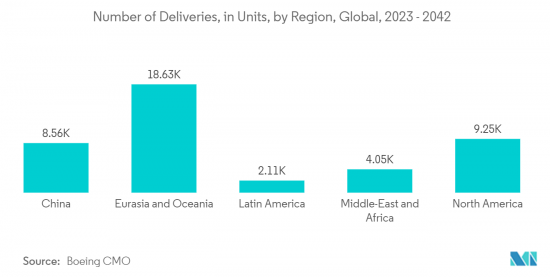

- 波音《2023-2042年商业展望》预测,随着国际交通量回升和国内航空旅行恢復到疫情前的水平,到2042年全球对新商用喷射机的需求将达到42,595架,预计其价值将达到8万亿美元。

- 北美地区将占据最大份额,共交付9,250 架飞机,其次是欧亚大陆和中国,预计到 2042 年,新飞机交付总量将达到 9,645 架,显示产业需求增加。

- 2022年,全球领先的飞机製造商之一空中巴士公司向84家客户交付了约661架民航机,较2021年成长8%。此外,我们在 2022 年又获得了 820 个新净订单。截至年终,空中巴士的订单订单为7,239架飞机,为2019年以来的最高水准。同时,波音公司报告称,2022 年商业订单约为 774 架飞机,其中约 480 架飞机将于 2022 年交付。

- 因此,由于上述因素,航太和国防领域预计将主导所研究的市场。

亚太地区主导市场

- 亚太地区占据全球碳复合材料市场的最高份额。碳复合材料的需求大多来自航太和国防、汽车以及运动和休閒应用。

- 碳复合材料由于其高强度重量比、耐腐蚀性和可加工性等特点,在汽车产业有着巨大的需求。由于它们重量轻、强度高并且有助于降低燃料消耗,因此它们在各种汽车应用中越来越多地取代金属。

- 根据国际汽车建设组织(OICA)预计,2022年中国汽车产量将达2,702万辆,较2021年同期成长3%。儘管受到COVID-19疫情、结构性晶片短缺、区域地缘政治衝突等负面因素的影响,2022年中国汽车市场仍实现成长。

- 根据国际贸易管理局(ITA)的数据,以年销售量和产量计算,中国仍是全球最大的汽车市场。预计2025年国内产量将达3,500万台。

- 印度汽车工业呈现正向发展态势,各领域成长显着。根据印度汽车工业商协会(SIAM)统计,2022年4月至2023年3月,国内汽车工业总合生产了2,599,318,867辆汽车,包括小客车、商用车、三轮车、两轮车和四轮车。2021年4月至2022年3月期间成长约12.5%。

- 日本汽车流通协会联合会(Jikaren)和全国轻型汽车协会联合会(Keijikyo)发布的统计数据显示,2022年国内新车销量为4,201,321辆,与前一年同期比较下降5.6%,这是四年来最低,这是连续年比下降。随着全球半导体短缺的持续,汽车製造商被迫限制生产。

- 此外,航太和国防工业是碳复合材料市场的最大最终用户。由于人们越来越偏好减重、极端耐用、隔热和雷达吸收等性能,碳复合材料在航太製造中的使用正在迅速增长。

- 根据航太航太公司空中巴士公司2023年4月发布的新闻稿,未来20年,中国空中交通量预计将以每年5.3%的速度成长,显着高于3.6%的全球平均水准。到 2041 年,这将需要 8,420 架客机和货机,约 39,500 架新飞机,或未来 20 年全球新飞机需求的 20% 以上。

- 根据国际航空运输协会(IATA)的报告,预计到预测期结束时,印度将成为全球第三大航空市场,并将超越中国和美国,成为全球第三大航空客运市场到2030 年。一定会的。

- 此外,碳复合材料由于其优越的强度、轻质和韧性而越来越多地用于运动器材。因此,运动器材需求的成长预计将对预测期内的市场成长产生正面影响。

- 官方资料显示,2022年中国电子产业稳定成长,支撑生产和投资稳健成长。根据工业资讯部统计,2021年该产业主要企业增加增加价值额年增7.6%,超过全部工增加价值额4个百分点。因此,电子产品需求的大幅成长支撑了产业对碳复合材料的需求。

- 由于2022年北京冬奥会的举办,中国体育用品市场正见证成长。奥运热潮加速了我国运动产业的发展。体育用品製造商和行业相关人员期望该行业能够激发消费者参与体育活动的慾望并增加消费。

- 所有上述因素预计将在未来几年推动碳复合材料市场的发展。预计亚太地区将在预测期内主导市场。

碳复合材料产业概况

全球碳复合材料材料市场因其性质而部分分散。主要参与企业(排名不分先后)包括东丽工业公司、索尔维、赫氏公司、帝人有限公司和西格里碳素公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 航太和国防工业的需求增加

- 风力发电领域需求增加

- 抑制因素

- 与其他复合材料相比製造成本较高

- 替代品的存在

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模(基于数量))

- 矩阵

- 混合

- 金属

- 陶瓷

- 碳

- 聚合物

- 热固性

- 热塑性塑料

- 过程

- 预灰化过程

- 牵引和缠绕

- 湿式层压和灌注工艺

- 压制和注射工艺

- 其他工艺

- 目的

- 航太/国防

- 车

- 风力发电机

- 运动、休閒

- 土木工程

- 海洋

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 亚太地区

第六章竞争形势

- 併购、合资、联盟、协议

- 市场排名分析

- 主要企业策略

- 公司简介

- Carbon Composites Inc.

- China Composites Group Corporation Ltd

- Epsilon Composite

- Hexcel Corporation

- Mitsubishi Chemical Corporation

- Nippon Carbon Co. Ltd

- Plasan

- Rockman

- SGL Carbon

- Solvay

- Teijin Limited

- Toray Industries Inc.

第七章 市场机会及未来趋势

- 扩大碳复合材料在 3D 列印的应用

- 对燃料电池电动车(FCEV)的需求增加

The carbon composites market is estimated to be at 205.90 kilotons by the end of this year. It is projected to reach 298.10 kilotons in the next five years, registering a CAGR of over 7.68% during the forecast period.

COVID-19 had a negative impact on the carbon composites sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business has been recovering since 2021 and is expected to rise significantly in the coming years.

Key Highlights

- The major factors driving the market are increasing demand from the aerospace and defense industry and increasing demand from the wind energy sector.

- However, the high cost of manufacturing in comparison to other composites and the presence of substitutes are hindering the market growth.

- Nevertheless, the growing adoption of carbon composites in 3D printing and increasing demand from fuel cell electric vehicles (FCEVs) will be the market opportunities.

- The Asia-Pacific region accounts for the highest market share and is expected to dominate the market during the forecast period.

Carbon Composites Market Trends

Aerospace and defense applications to dominate the market

- The aerospace and defense industry is the largest end-user of the carbon composite market. Initially, aerospace manufacturing used to rely heavily on metals like aluminum, steel, and titanium, which used to account for around 70% of the total aircraft weight. However, in recent years, owing to increasing preferences for properties like weight reduction, extreme resistance, insulation, and radar absorption, the usage of carbon composites in aerospace manufacturing has been growing rapidly.

- These composites consist of carbon fibers embedded in a carbon matrix. These composite materials also bring down the maintenance cost of the airplane as the materials do not rust or corrode.

- In the aerospace industry, some key applications of carbon-fiber-based composites include their use in manufacturing aircraft parts, such as clips, cleats, brackets, ribs, struts, stringers, chips, wing-leading edges, and other special parts.

- Moreover, the aerospace industry is also exploring the uses of these composites in larger structures, like wing torsion boxes and fuselage panels. In the defense industry, carbon composites are used in missile defense, ground defense, and military marine.

- According to the Boeing Commercial Outlook 2023-2042, with a resurgence in international traffic and domestic air travel back to pre-pandemic levels, the company is projected to exhibit a global demand for 42,595 new commercial jets by 2042, valued at USD 8 trillion.

- North America accounts for the largest share with 9,250 deliveries, followed by Eurasia and China, with the total deliveries of new airplanes estimated to be 9,645 units by 2042, indicating rising demand from the industry.

- In 2022, Airbus, one of the major aircraft manufacturers across the world, delivered around 661 commercial aircraft to 84 customers, which is an 8% increase compared to 2021. It also has received an additional 820 net new orders in 2022. At the end of 2022, Airbus' backlog was 7,239 aircraft, the highest number since 2019. On the other hand, Boeing has reported around 774 commercial orders for 2022 and has delivered around 480 aircraft in 2022.

- Hence, due to the aforementioned factors, the aerospace and defense sector is expected to dominate the market studied.

Asia Pacific to dominate the market

- Asia-Pacific accounts for the highest share of the global carbon composites market. Most of the demand for carbon composites comes from applications in aerospace and defense, automotive, sports and leisure, etc.

- Carbon composites have been witnessing tremendous demand in the automotive industry owing to their high strength-to-weight ratios, corrosion resistivity, and workability features. They have been replacing metals in various automotive applications due to their lightweight but tough features, which contribute to lesser fuel consumption.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), vehicle production in China reached a total of 27.02 million units in 2022, an increase of 3% over 2021 for the same period. China's auto market experienced growth in 2022 despite the impact of several negative factors, including the outbreak of COVID-19, a structural chip shortage, and local geopolitical conflicts.

- According to the International Trade Administration (ITA), China remains the world's largest auto market in terms of both annual sales and production. Domestic production is expected to reach 35 million units by 2025.

- The Indian automotive industry showed a positive development with remarkable growth across various sectors. According to the Society of Indian Automobile Manufacturers (SIAM), the automotive industry in the country produced a total of 2,59,31,867 vehicles, including passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles from April 2022 to March 2023, registering a growth of around 12.5% compared to April 2021-March 2022.

- According to statistics released by the Japan Automobile Dealers Association and the Japan Light Motor Vehicle Association, a total of 4,201,321 new cars were sold in Japan in 2022, down by 5.6% Y-o-Y, marking the fourth consecutive year of decline. The continuing global shortage of semiconductors has forced automakers to limit production.

- Furthermore, the aerospace and defense industry is the largest end user of the carbon composites market. With increasing preferences for properties like weight reduction, extreme resistance, insulation, and radar absorption, the usage of carbon composites in aerospace manufacturing has been growing rapidly.

- According to a press release from the aerospace company Airbus, in April 2023, over the next 20 years, China's air traffic is projected to grow at an annual rate of 5.3%, well above the global average of 3.6%. This would require 8,420 passengers and freighters by 2041, or more than 20% of the world's need for new aircraft over the next 20 years, around 39,500.

- According to the International Air Transport Association (IATA) Report, India is poised to become the third-largest aviation market in the world by the end of the forecast period, overtaking China and the United States as the world's third-largest air passenger market by 2030.

- Moreover, carbon composites are increasingly used in sports equipment owing to their superior strength, lightweight, and toughness. Thus, the rising demand for sports goods is anticipated to benefit the market's growth over the forecast period.

- According to official data, China's electronics sector recorded stable growth in 2022, supporting solid growth in terms of production and investment. According to the Ministry of Industry and Information Technology, the value added of major enterprises in the sector increased by 7.6% over the same period in 2021, exceeding the value added of all industries by four percentage points. Thus, a significant boost in demand for electronics goods supports the demand for carbon composites from the industry.

- The sports equipment market in China has witnessed growth owing to the Beijing Winter Olympic Games in 2022. The craze of the Olympics accelerated the sports industry in the country. Sports equipment makers and industry practitioners expect the sector to fuel consumers' appetite for sports activities and consumption.

- All the above-mentioned factors are expected to drive the market for carbon composites in the coming years. Asia-Pacific is expected to dominate the market studied during the forecast period.

Carbon Composites Industry Overview

The global carbon composites market is partially fragmented in nature. The major players (not in any particular order) include Toray Industries Inc., Solvay, Hexcel Corporation, Teijin Limited, and SGL Carbon SE, among other companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Aerospace and Defense Industry

- 4.1.2 Increasing Demand from the Wind Energy Sector

- 4.2 Restraints

- 4.2.1 High Cost for Manufacturing in Comparison to Other Composites

- 4.2.2 Presence of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Matrix

- 5.1.1 Hybrid

- 5.1.2 Metal

- 5.1.3 Ceramics

- 5.1.4 Carbon

- 5.1.5 Polymer

- 5.1.5.1 Thermosetting

- 5.1.5.2 Thermoplastic

- 5.2 Process

- 5.2.1 Prepeg Layup Process

- 5.2.2 Pultrusion and Winding

- 5.2.3 Wet Lamination and Infusion Process

- 5.2.4 Press and Injection Processes

- 5.2.5 Other Processes

- 5.3 Application

- 5.3.1 Aerospace and Defense

- 5.3.2 Automotive

- 5.3.3 Wind Turbines

- 5.3.4 Sport and Leisure

- 5.3.5 Civil Engineering

- 5.3.6 Marine Applications

- 5.3.7 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Carbon Composites Inc.

- 6.4.2 China Composites Group Corporation Ltd

- 6.4.3 Epsilon Composite

- 6.4.4 Hexcel Corporation

- 6.4.5 Mitsubishi Chemical Corporation

- 6.4.6 Nippon Carbon Co. Ltd

- 6.4.7 Plasan

- 6.4.8 Rockman

- 6.4.9 SGL Carbon

- 6.4.10 Solvay

- 6.4.11 Teijin Limited

- 6.4.12 Toray Industries Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Adoption of Carbon Composites in 3D-Printing

- 7.2 Increasing Demand from Fuel Cell Electric Vehicle (FCEV)