|

市场调查报告书

商品编码

1404378

抗菌塑胶 -市场占有率分析、行业趋势和统计、2024-2029 年成长预测Antimicrobial Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

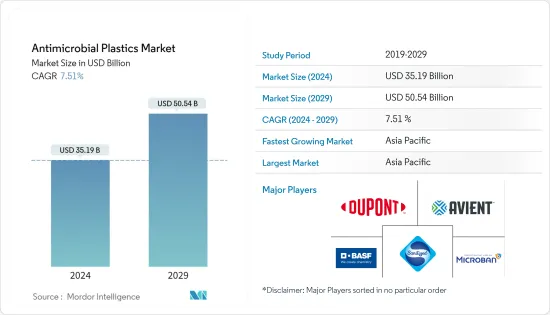

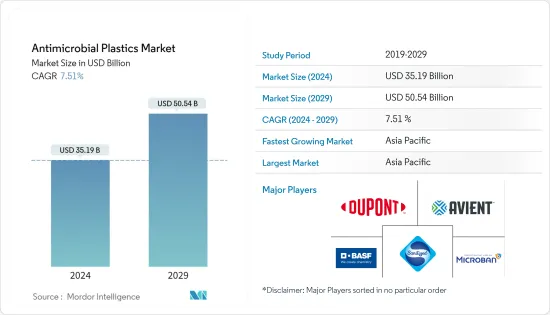

预计2024年抗菌塑胶市场规模为351.9亿美元,预计到2029年将达到505.4亿美元,在预测期内(2024-2029年)复合年增长率为7.51%。

COVID-19 大流行对该地区各国产生了重大影响,导致数百万人被困在家中,企业、生产和製造设施关闭,经济活动受到干扰。然而,市场在 2022 年保持了成长轨迹。

主要亮点

- 推动市场成长的主要因素包括在各种应用中以抗菌塑胶取代传统材料,以及医疗保健和包装行业的需求迅速增长。

- 然而,有关塑胶使用和处置的严格环境法规预计将限制市场成长。

- 不断增加的研发投资、不断增加的医疗保健投资以及对医疗工具和设备的需求可能会在预测期内为受访市场提供机会。

- 亚太地区因其在包装、医疗保健、食品和饮料和饮料以及消费品等行业的各种应用而在全球市场中占据主导地位。

抗菌塑胶市场趋势

医疗保健产业拉动市场需求

- 医疗保健产业是抗菌塑胶的主要消费者。与医疗保健行业的传统材料相比,抗菌塑胶具有多种优势,包括清洁、无菌、方便、易于使用和低成本。

- 复杂的流行病学情况、医疗保健相关感染 (HAIs)、微生物污染、医院感染以及医院和牙科设备的感染风险正在推动使用抗菌塑胶来预防微生物感染的需求。

- 回收一次性医疗产品的需求为抗菌解决方案的开发提供了无数的机会。

- 抗菌塑胶主要用于牙科诊所、医院、疗养院等,用于私人房间窗帘、床、护士呼叫系统、扶手、地板、门把、拉绳和病历夹等产品。

- 此外,抗菌塑胶也用于製造医疗设备,如管子、连接器、注射器、连接器以及各种模製零件。

- 因此,随着医疗保健行业中与医疗保健相关的感染的增加,预计抗菌塑胶的使用量在预测期内将大幅增加。

亚太地区主导市场

- 亚太地区的抗菌塑胶市场预计在预测期内将成长最快。该地区包装行业的扩张正在推动市场成长。随着塑胶消费量大幅增加,中国在该地区占有最大的市场占有率。预计这种成长趋势将在预测期内持续下去。

- 随着消费品、食品和饮料和饮料以及汽车等行业产量的增加,亚太地区对抗菌塑胶的需求预计将大幅增加。

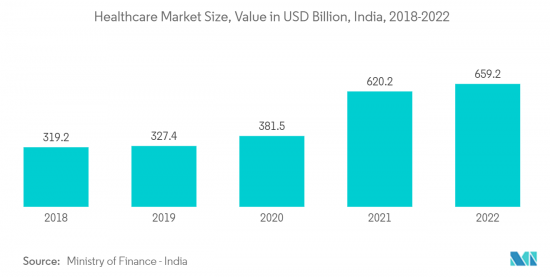

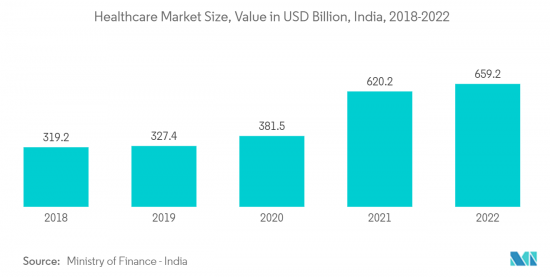

- 在2023-2024年联邦预算中,印度政府已向卫生与家庭福利部(MoHFW)累计891.6亿印度卢比(相当于107.6亿美元)。这将使印度的医疗中心和医院能够使用抗菌塑胶开发和改进医疗产品,以确保客户和患者的安全。

- 亚太地区的医疗保健产业在印度、印尼、韩国和越南等国家获得了大量投资。由于高龄化老化和医疗支出增加,该地区正在重点改善其医疗基础设施。

- 据OICA称,全球汽车产业目前正在经历显着成长,2022年将比2021年成长6%。 2022年,中国、韩国、印度等全球多个已开发国家和新兴国家的汽车产量都出现成长。 2022年,汽车产量超过8,500万辆。

- 据妙抗保称,汽车每天都会接触到许多污染物。诱发因素包括婴儿、动物、食物沉积,甚至温度变化。因此,使用抗菌塑胶可以打造更清洁的汽车内饰,并采用抗菌技术来消除细菌并确保您的汽车安全。

- 此外,该地区预计将成为全球包装产业成长最快的地区,其中中国和印度等国家引领市场。电子商务、线上食品配送、包装产业的创新和发展等因素预计将推动该地区包装产业的成长。

- 据IBEF称,印度已成为全球重要的包装材料出口国。印度包装材料出口年复合成长率为 9.9%,从 2018-19 年的 8.44 亿美元增加到 2021-22 年的 11.19 亿美元。

- 因此,预计所有这些市场趋势将在预测期内推动全球市场对抗菌塑胶的需求。

抗菌塑胶产业概况

抗菌塑胶市场因其性质而部分分散。研究市场的主要企业(排名不分先后)包括BASF SE、DuPont、Microban International、Avient Corporation、Sanitized AG 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 在各种应用中以塑胶取代传统材料

- 医疗保健和包装行业的需求快速增长

- 人们对抗菌塑胶的认识不断增强

- 抑制因素

- 严格的环境法规

- 原物料价格不规则波动

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 类型

- 一般塑胶

- 工程塑料

- 高性能塑料

- 其他类型(例如生物塑胶)

- 最终用户产业

- 车

- 建筑/施工

- 消费品

- 电力/电子

- 食品和饮料

- 卫生保健

- 包装

- 其他最终用户产业(纺织等)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- Avient Corporation

- BASF SE

- Bayer AG

- BioCote Limited

- CLARIANT

- Covestro AG

- DuPont

- King Plastic Corporation

- Lonza

- Microban International

- Milliken & Company

- Parx Materials NV

- Sanitized AG

- Symphony Environmental Technologies

第七章 市场机会及未来趋势

- 加大研发投入

- 加大医疗健康领域投资

The Antimicrobial Plastics Market size is estimated at USD 35.19 billion in 2024, and is expected to reach USD 50.54 billion by 2029, growing at a CAGR of 7.51% during the forecast period (2024-2029).

The COVID-19 pandemic majorly affected countries across the regions, resulting in severe lockdowns, confining millions of people in their homes, and shutting down businesses, production, and manufacturing facilities, resulting in no economic activity. However, the market retained its growth trajectory in 2022.

Key Highlights

- The major factors driving the market's growth include replacing conventional materials with antimicrobial plastics in various applications and rapidly increasing demand from the healthcare and packaging sectors.

- However, the stringent environmental regulations related to plastic usage and disposal are expected to restrain the market's growth.

- The increasing research and development investments, increasing healthcare investments, and demand for medical tools and equipment are likely to provide opportunities for the market studied during the forecast period.

- The Asia-Pacific region dominated the market globally, owing to the various applications in industries such as packaging, healthcare, food and beverage, and consumer goods.

Antimicrobial Plastics Market Trends

Healthcare Industry Driving the Market Demand

- The healthcare industry is the primary consumer of antimicrobial plastics. Antimicrobial plastics offer various advantages over conventional materials in the healthcare industry, such as cleanliness, sterility, convenience, ease of use, and low cost.

- Complex epidemiological situations, healthcare-associated infections (HAIs), microbial contamination, nosocomial infections, and infection risks in hospitals and dental equipment drive the need to use antimicrobial plastics to prevent microbial infections.

- The need for recycling disposable medical products provided innumerable opportunities for the development of antimicrobial solutions.

- Antimicrobial plastics are used in dental surgeries, hospitals, and care homes, primarily for products such as cubicle curtains, beds, nurse call systems, handrails, floors, door handles, pull cords, and case note holders.

- In addition, antimicrobial plastics are used for manufacturing medical devices, such as tubing, connectors, syringes, and connectors, as well as a wide variety of molded parts.

- Thus, with the increasing healthcare-associated infections in the healthcare industry, the usage of antimicrobial plastics is expected to increase significantly over the forecast period.

Asia-Pacific to Dominate the Market

- The antimicrobial plastics market in Asia-Pacific is expected to grow fastest during the forecast period. The expansion of the packaging industry in the region is driving the growth of the market. China has the largest market share in the region, as plastics consumption has expanded significantly. This upward trend is expected to continue during the forecast period.

- In the Asia-Pacific region, with increasing production in industries such as consumer goods, food and beverages, and automotive, the demand for antimicrobial plastics is expected to increase significantly.

- In the 2023-24 Union Budget, the government of India earmarked a sum of INR 89.16 billion (equivalent to USD 10.76 billion) for the Ministry of Health and Family Welfare (MoHFW). This allows the healthcare centers and hospitals in India to develop and improve their usage of medical products that are made of antimicrobial plastics, ensuring the safety of the customers and patients.

- The Asia-Pacific healthcare industry has been witnessing huge investments in countries such as India, Indonesia, South Korea, and Vietnam. The region has been focused on developing its healthcare infrastructure due to the growing aging population and increasing medical spending.

- As per OICA, the global automotive industry is currently growing at a substantial rate of 6% in 2022 over 2021. In 2022, various developed and developing countries across the world, including China, South Korea, India, and others, experienced an increase in automotive production. In 2022, over 85 million units of motor vehicles were manufactured.

- As per Microban, cars are subjected to many contaminants on a daily basis. These include drivers, young children, animals, food deposits, and even temperature changes. This allows the usage of antimicrobial plastics creating cleaner car interiors with built-in antimicrobial technology so as to remove the bacteria and keep the vehicle safe.

- Moreover, the region is expected to witness the fastest growth in the global packaging industry, where countries such as China and India have been leading the market. Factors such as e-commerce, online food deliveries, and innovation and development in the packaging industry are expected to drive the packaging industry's growth in the region.

- As per IBEF, India is gaining prominence as a significant global exporter of packaging materials. The export of packaging materials from India witnessed a CAGR of 9.9%, increasing from USD 844 million in 2018-19 to USD 1,119 million in 2021-22.

- Hence, all such market trends are expected to drive the demand for antimicrobial plastics in the global market during the forecast period.

Antimicrobial Plastics Industry Overview

The Antimicrobial Plastics Market is partially fragmented in nature. The major players in the studied market (not in any particular order) include BASF SE, DuPont, Microban International, Avient Corporation, and Sanitized AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Replacement of Conventional Materials by Plastics in Various Applications

- 4.1.2 Rapidly Increasing Demand from the Healthcare and Packaging Industries

- 4.1.3 Growing Consciousness of Antimicrobial Plastics

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations

- 4.2.2 Erratic Fluctuations in Raw Material Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Commodity Plastic

- 5.1.2 Engineering Plastic

- 5.1.3 High Performance Plastic

- 5.1.4 Other Types (Bioplastics, etc.)

- 5.2 End-User Industry

- 5.2.1 Automotive

- 5.2.2 Building and Construction

- 5.2.3 Consumer Goods

- 5.2.4 Electrical and Electronics

- 5.2.5 Food and Beverage

- 5.2.6 Healthcare

- 5.2.7 Packaging

- 5.2.8 Other End-user Industries (Textile, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Avient Corporation

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 BioCote Limited

- 6.4.5 CLARIANT

- 6.4.6 Covestro AG

- 6.4.7 DuPont

- 6.4.8 King Plastic Corporation

- 6.4.9 Lonza

- 6.4.10 Microban International

- 6.4.11 Milliken & Company

- 6.4.12 Parx Materials NV

- 6.4.13 Sanitized AG

- 6.4.14 Symphony Environmental Technologies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Investments in Research and Development

- 7.2 Increasing Investments in Healthcare Sector