|

市场调查报告书

商品编码

1404379

贵金属催化剂:市场占有率分析、产业趋势与统计、2024-2029 年成长预测Precious Metal Catalysts - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

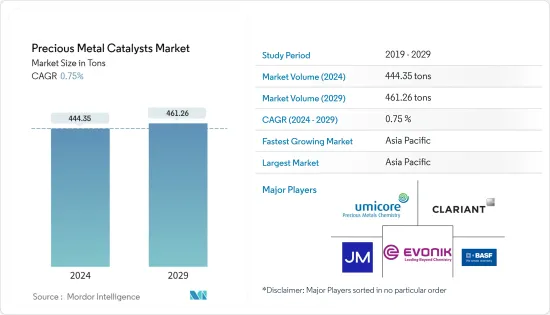

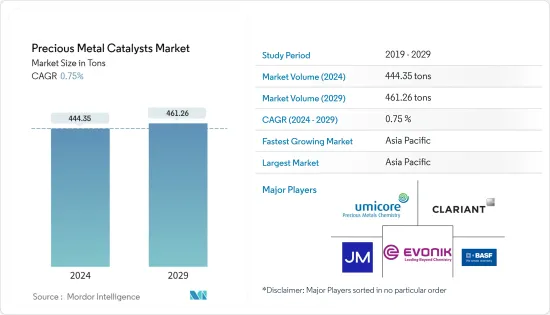

贵金属催化剂市场规模预计到 2024 年为 444.35 吨,预计到 2029 年将达到 461.26 吨,在预测期内(2024-2029 年)复合年增长率为 0.75%。

COVID-19严重影响了贵金属催化剂市场的需求和供应链。作为市场主要应用的汽车产业和石化产业,受疫情影响,因政府交通管製而受到负面影响,进而影响了贵金属催化剂市场。但2021年产业开始復苏,贵金属催化剂市场需求恢復。

主要亮点

- 从中期来看,对高性能运输燃料的需求加速是推动市场的关键因素之一。

- 相反,製造成本急剧上升可能会阻碍市场成长。

- 此外,贵金属催化剂新应用的开拓也可能为市场带来机会。

- 亚太地区占据市场主导地位,其中中国、东南亚国协和印度是最大的消费国。

贵金属触媒市场趋势

主导市场的汽车

- 汽车是市场的关键领域之一,因为铂金催化剂等贵金属催化剂有助于减少二氧化碳排放。在汽车领域,它主要用于减少工业加工设备排放污染物的影响。柴油车销售量的增加可能带动很大一部分铂金消费量。此外,铂也用作废气控制催化剂。因此,随着欧洲市场更严格的EURO6和EURO7排放法规的出台,铂金预计将主导市场。

- 自动催化剂有助于减少汽油和柴油引擎的排放气体并提高工业製程的能源效率。 35 年来,含有铂族金属的汽车催化剂已被证明是解决所有汽油和柴油车辆污染最有效的方法。

- 汽车触媒可去除引擎废气排放98% 的有害物质。如果没有这个,普通家用汽车在 10 年使用寿命内将排放15 吨污染气体。

- 铂金和抗污染催化剂也用于各种汽车应用,包括引擎控制感知器、安全气囊驱动装置、引擎管理系统电子设备和火星塞。

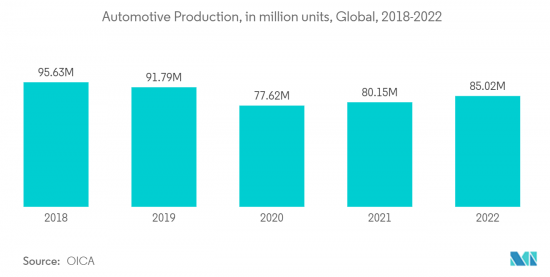

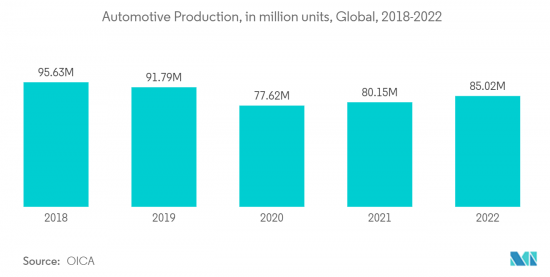

- 根据OICA统计,2022年全球汽车产量达8,502万辆,较2021年成长6%。印度、印尼、马来西亚等亚太地区开发中国家产量分别成长24%、31%及46%。这显示该地区的汽车产业正在蓬勃发展。

- 中国是全球最大的汽车生产和销售市场。根据OICA的数据,2022年该国生产了27,021,000辆汽车,同期销量达到26,864,000辆。产量与前一年同期比较增长3.4%,销量成长2.1%。

- 美国是仅次于中国的第二大汽车製造国,2022年产量为1,006万辆,较2021年产量增加10%。 2022年,全国轿车产量175万辆,商用车830万辆。

- 所有上述因素预计将提振贵金属催化剂的需求。

中国主导亚太市场

- 中国是全球成长最快的经济体之一。此外,由于人口、生活水准和人均收入的增加,几乎所有最终用户行业都在经历成长。

- 中国是化学加工中心,占全球化工产品产量的大部分。该国占全球化学品销售额的35%以上。化工产业也是中国重要的终端用户产业。许多市场领先公司在中国设有化工厂。由于全球对各种化学品的需求不断增加,预计该行业对贵金属催化剂的需求在预测期内将扩大。

- 中国是全球第二大医药市场,被大多数跨国公司视为优先发展的市场。贵金属催化剂对製药工业特别感兴趣,因为许多重要的催化剂依赖铂、钯、钌、铑、铱和锇。中国的医疗保健产业正在快速成长。作为北京「中国製造2025」工业计画的一部分,习近平主席宣布计画重点关注医药领域的创新和国内研发。

- 儘管面临COVID-19频繁爆发、结构性晶片短缺、地区地缘政治衝突等负面因素,2022年中国汽车市场仍实现了成长。根据中国工业协会统计,2022年汽车生产量达2,702.1万辆,汽车销售量达2,686.4万辆,与前一年同期比较增长3.4%及2.1%。

- 此外,该国的汽车产业正在经历趋势的转变,消费者越来越倾向于电池驱动的汽车。此外,中国政府预计2025年电动车产量的普及将达到20%。这反映在该国的电动车销售趋势上,2022年电动车销量创下历史新高。根据中国小客车协会的数据,2022年中国电动车和插电式混合动力车销量为567万辆,几乎是2021年销量的两倍。

- 由于这些因素,亚太地区可能在预测期内主导市场,其中中国在其成长中占据最大份额。

贵金属催化剂产业概况

贵金属催化剂市场部分整合,五家主要企业占据了重要的全球市场占有率。该市场的知名企业包括科莱恩、BASF、赢创工业股份公司、庄信万丰和 Umicore Galvanotechnik GmbH。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 对高性能运输燃料的需求不断增加

- 加大炼油厂投资

- 其他司机

- 抑制因素

- 製造成本急剧上升

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模)

- 种类

- 铂

- 钯

- 铑

- 铱

- 钌

- 其他的

- 目的

- 车

- 药品

- 石油化学

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 亚太地区其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 亚太地区

第六章竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Alfa Aesar, Thermo Fisher Scientific

- ALS Limited

- American Elements

- BASF SE

- Catalytic Products International

- CHIMET

- Clariant

- Evonik Industries AG

- Heraeus Holding

- J&J Materials, Inc.

- Johnson Matthey

- Kaili Catalyst New Materials CO., LTD.

- ReMetall Deutschland AG

- Sabin Metal Corporation

- Shaanxi kaida chemical co. LTD

- Souvenier Chemicals

- Stanford Advanced Materials

- Umicore Galvanotechnik GmbH

第七章 市场机会及未来趋势

- 开发贵金属催化剂的新应用与改进应用

- 其他机会

The Precious Metal Catalysts Market size is estimated at 444.35 tons in 2024, and is expected to reach 461.26 tons by 2029, growing at a CAGR of 0.75% during the forecast period (2024-2029).

COVID-19 severely impacted the demand and supply chain of the precious metal catalysts market. The automobile and petrochemical industries, the market's major applications, were negatively impacted by the pandemic due to the lockdown regulations on transportation issued by governments, thus affecting the precious metal catalysts market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- In the medium term, one of the major factors driving the market studied is the accelerating demand for high-performance transportation fuel.

- Conversely, high production costs will likely hinder the studied market's growth.

- Moreover, developing new and improved applications for precious metal catalysts will likely offer opportunities to the market studied.

- Asia-Pacific dominated the market, with the largest consumption coming from China, ASEAN countries, and India.

Precious Metal Catalysts Market Trends

Automotive Segment to Dominate the Market

- Automotive is one of the major segments of the market, as precious metals catalyst such as platinum catalyst helps to reduce CO2 emission. It is largely used in the automobile sector to reduce the effect of pollutants released by industrial processing units. The rise in the sale of diesel vehicles can validate most platinum consumption. In addition to it, platinum is used as one of the emission control catalysts. Thus it is estimated to dominate the European market owing to the region's introduction of more stringent Euro 6 and Euro 7 emission rules.

- The auto-catalysts help to reduce emissions from gasoline and diesel engines and improve the energy efficiency of industrial processes. For over 35 years, autocatalysts containing platinum group metals proved the most effective way to tackle pollution from all petrol and diesel vehicles.

- Autocatalysts eliminate 98% of harmful emissions from engine exhausts. Without them, the average family car would emit 15 tonnes of polluting gases over a 10-year lifespan.

- Platinum and pollution control catalysts are also used for various automobile applications, such as Engine control sensors, airbag initiators, Electronics for engine management systems, and spark plugs.

- According to OICA, the global production of motor vehicles reached 85.02 million in 2022, registering a year-on-year growth of 6% compared to 2021. In developing countries across the Asia-Pacific region, such as India, Indonesia, and Malaysia, the production volume increased by 24%, 31%, and 46%, respectively. It signifies the booming automotive industry in the region.

- China is the world's largest automobile market in production and sales. According to OICA, 27.021 million motor vehicles were manufactured in the country in 2022, whereas sales figures reached 26.864 million units during the same period. Production and sales grew by 3.4% and 2.1% year-on-year, respectively.

- The United States is the second-largest automotive manufacturer after China and produced 10.06 million vehicles in 2022, registering a growth of 10% compared to the production in 2021. The country produced 1.75 million cars and 8.3 million commercial vehicles in 2022.

- All the abovementioned factors are expected to boost the demand for precious metal catalysts.

China to Dominate the Asia-Pacific Market

- China is one of the fastest-growing economies globally. Furthermore, almost all the end-user industries are witnessing growth, owing to the growing population, living standards, and per capita income.

- China is a hub for chemical processing, accounting for a major chunk of the chemicals produced globally. The country contributes more than 35% of global chemical sales. The chemical industry is another prominent end-user industry in China. Many major companies in the market include their chemical plants in China. With the growing demand for various chemicals globally, this sector's demand for precious metal catalysts is projected to grow during the forecast period.

- China is the world's second-largest pharmaceutical market and is considered a priority for most global players. Precious metal catalysts are particularly interesting to the pharmaceutical industry because many important catalysts rely on platinum, palladium, ruthenium, rhodium, iridium, and osmium. The Chinese healthcare sector is growing at a rapid pace. As a part of Beijing's "Made in China 2025" industry plan, President Xi Jinping announced his plans to focus on innovation and homegrown R&D concerning the pharmaceutical sector.

- China's auto market experienced growth in 2022 despite several negative factors, including the occurrence of COVID-19 outbreaks frequently, a structural chip shortage, and local geopolitical conflicts. According to the China Association of Automobile Manufacturers, automobile production and sales reached 27.021 million and 26.864 million in 2022, up 3.4% and 2.1% from the previous year.

- Further, the automobile industry in the country is witnessing switching trends as the consumer inclination towards battery-operated vehicles is on the higher side. Moreover, the government of China estimates a 20% penetration rate of electric vehicle production by 2025. It is reflected in the electric vehicle sales trend in the country, which went record-breaking high in 2022. As per the China Passenger Car Association, the country sold 5.67 million EVs and plug-ins in 2022, almost double the sales figures achieved in 2021.

- Owing to all the factors mentioned, the Asia-Pacific region will dominate the market during the forecast period, with China accounting largest share in the growth.

Precious Metal Catalysts Industry Overview

The precious metal catalysts market is partially consolidated, with the top five players accounting for a considerable global market share. Some prominent players in the market include Clariant, BASF SE, Evonik Industries AG, Johnson Matthey, and Umicore Galvanotechnik GmbH, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Accelerating Demand for High-Performance Transportation Fuel

- 4.1.2 Increasing Investment in Refineries

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Production Costs

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Platinum

- 5.1.2 Palladium

- 5.1.3 Rhodium

- 5.1.4 Iridium

- 5.1.5 Ruthenium

- 5.1.6 Other Types

- 5.2 Application

- 5.2.1 Automotive

- 5.2.2 Pharmaceutical

- 5.2.3 Petrochemicals

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations and Agreements

- 6.2 Market Share (%)** /Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alfa Aesar, Thermo Fisher Scientific

- 6.4.2 ALS Limited

- 6.4.3 American Elements

- 6.4.4 BASF SE

- 6.4.5 Catalytic Products International

- 6.4.6 CHIMET

- 6.4.7 Clariant

- 6.4.8 Evonik Industries AG

- 6.4.9 Heraeus Holding

- 6.4.10 J&J Materials, Inc.

- 6.4.11 Johnson Matthey

- 6.4.12 Kaili Catalyst New Materials CO., LTD.

- 6.4.13 ReMetall Deutschland AG

- 6.4.14 Sabin Metal Corporation

- 6.4.15 Shaanxi kaida chemical co. LTD

- 6.4.16 Souvenier Chemicals

- 6.4.17 Stanford Advanced Materials

- 6.4.18 Umicore Galvanotechnik GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Development of New and Improved Applications for Precious Metal Catalysts

- 7.2 Other Opportunities