|

市场调查报告书

商品编码

1404380

高效资料分析:市场占有率分析、产业趋势与统计、2024年至2029年成长预测High-Performance Data Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

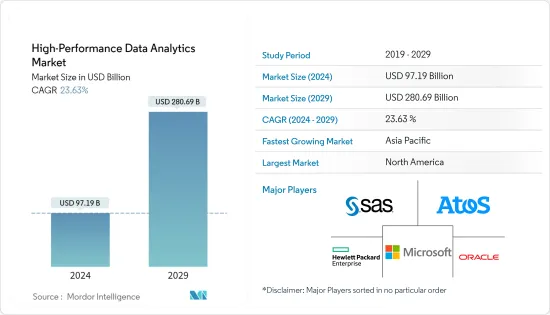

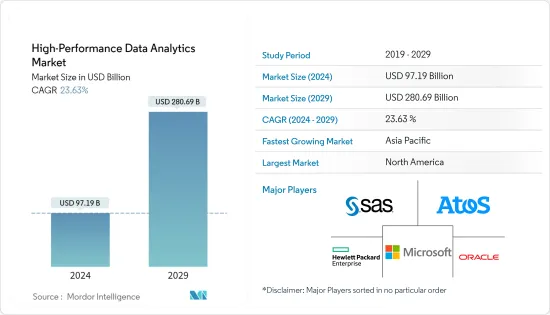

高效能资料分析市场规模预计到 2024 年为 971.9 亿美元,预计到 2029 年将达到 2,806.9 亿美元,在预测期内(2024-2029 年)复合年增长率为 23.63%。

在快速发展的科技世界中,创新推动产业向前发展。高性能资料分析(HPDA)是加速这项创新的主要催化剂。随着数位世界以前所未有的速度扩展,准确、快速地分析和处理大量资料的能力已成为技术进步的关键推动力。

主要亮点

- 由于最终用户级资料整合的激增,高效能资料分析市场正在蓬勃发展。为高效能资料分析市场创造巨大成长机会的最重要因素之一是技术创新和可近性。鑑于包括硬体和软体市场在内的各个层面技术的成长,高阶市场分析资料优化的前景更加光明。非结构化、结构化和非结构化类别在规模和机会上看起来相似。金融业的技术导向正在取得令人瞩目的成长。

- 在日益互联和电脑化的世界中,正在产生更多资料。然而,资料成长不是线性的,而是指数级的。依赖高效能运算 (HPC) 的公司正在为这一激增做好准备。企业越来越认识到采用支援开发分析和人工智慧操作的 HPC 功能的好处。为了帮助企业走在这场技术革命的最前沿,英特尔和惠普等公司正在提供将 HPC、人工智慧和其他工作负载结合的方法。

- 许多经济部门利用天气和气候预测来做出重要的商业决策。例如,农业部门利用这些预测来决定何时种植、灌溉和减少霜冻损失。能源部门根据地区估算能源需求高峰并平衡负载。这样,高效能运算 (HPC)主导的分析将透过更快、更准确地分析资料来帮助推进气候研究。

- 高效能资料分析结合了资料分析和 HPC。该技术利用 HPC 的平行处理能力,以超过兆次浮点运算(每秒 1 兆次浮点运算)的速度运行强大的分析软体。 HPC 营运和实施需要高昂的投资和资本成本,预计这将阻碍市场成长。

- 资料和分析可以阐明并支持您业务中的临床和营运决策。例如,治疗 COVID-19 患者所需药物的评估和检验依赖研究人员共用的真实临床资料。许多 HPDA 服务提供者正在为卫生系统提供软体解决方案,可以免费存取用于学术计划的 COVID-19资料科学工作区,以帮助临床研究人员对抗这一流行病。这促进了大流行期间的市场成长。

高性能资料分析市场的趋势

按需驱动成长

- 高效能资料分析是 HPC、资料分析和巨量资料的组合。 HPDA 利用 HPC 的速度和处理能力来快速洞察复杂的资料集。

- 按需运算,也称为云端处理,近年来成长显着。它使个人和企业可以透过互联网以订阅方式使用储存设备、处理能力和应用程式等运算资源。

- 此外,企业的目标是透过在这个新时代整合新技术来变得敏捷。迁移到云端环境是实现这一目标最有效的方法。成为云端的一部分意味着获得内建连接和智能,使智慧型操作能够协同工作,以及与云端保持一致的数位服务,这意味着建立坚实的基础。

- 除此之外,数位化转型等几个因素正在迅速扩大按需部署。企业越来越多地采用云端服务来简化IT基础设施并加速数位转型。云端处理提供敏捷性、扩充性和成本效率,使其成为各种规模企业的有吸引力的选择。

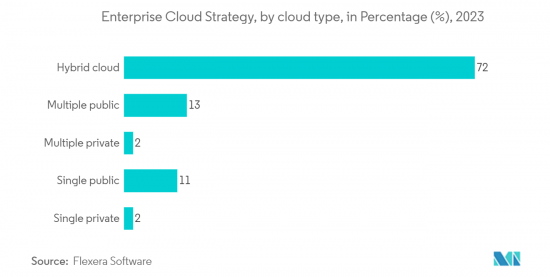

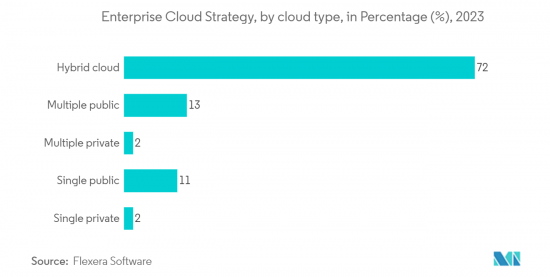

- Flexera 表示,72% 的企业受访者表示他们将在 2023 年部署混合云。混合云帮助企业更好地控制资料,将敏感资料储存在私有云中,并在公有云上运行企业应用程式。

- 总体而言,数位转型正在透过云端运算进入新阶段。云端运算将数位转型从简单地采用新技术转变为在远端虚拟环境中彻底重新设计流程、工具和体验。云端处理增强安全性、改善使用者体验并保护文件免遭劣化。因此,企业现在正在将云端处理纳入其生态系统,从而促进市场成长。

北美占据主要市场占有率

- 美国是采用高性能资料分析的主要创新者和先驱。预计该国将占据很大的市场份额。高效能资料分析供应商的强大立足点也推动了市场的成长。

- 供应商包括 IBM 公司、SAS Institute Inc.、英特尔公司和 Hewlett Packard Enterprise。新业务洞察的成长正在促进美国高性能资料分析市场的扩张。资料分析正在帮助该地区的许多企业实现绩效提升,例如改善客户体验和识别诈欺。

- 此外,能源创新高效能运算投资的增加将产生大量数据,需要先进的资料分析解决方案来获取洞察、优化业务并推动能源领域的创新。预计将产生大量资料,从而创造对能源领域的需求。该国的高效能资料分析解决方案。

- 加拿大专注于医疗保健、人工智慧和可再生能源等领域的研究和创新,需要高效能资料分析解决方案来分析复杂的资料集并获得研究见解,为市场提供支援。

- 加拿大政府已将各省和地区确定为卫生优先事项,以改善其人口的综合卫生保健,包括扩大家庭卫生服务的覆盖范围,并利用标准化的卫生资料和数位工具实现卫生系统现代化。我们正在与之合作。此类与医疗数位化相关的倡议将导致该行业资料量的增加,需要先进的资料分析解决方案进行处理以获得见解。

- 此外,与高效能运算相关的合作伙伴预计将结合各自的专业知识、技术和资源,开发更先进、更有效率的资料分析解决方案。这些合作有可能带来创新并推动加拿大高效能资料分析市场的成长和需求。

高效能资料分析产业概述

由于众多参与者的存在,高性能资料分析市场的竞争形势变得碎片化。由于这个市场提供的广阔前景,SAS Institute Inc、Hewlett Packard Enterprise Company、Oracle Corporation、ATOS SE 和 Microsoft Corporation 等主要供应商不断创新。公司正在进行併购,并在研发活动上投入大量资金。

2023 年 6 月,Applied Digital 宣布与惠普企业建立合作伙伴关係,Applied Digital 是一家建置、设计和营运主要为高效能运算应用程式设计的下一代数位基础设施的公司。作为合作的一部分,慧与将提供功能强大、节能的超级电脑,经证明可透过 Applied Digital 的人工智慧云端服务支援大规模人工智慧。

2023 年 2 月,SAS 将加入 CESMII,进一步加速并加强先进分析在整体製造领域的使用。越来越多的顶级製造商正在利用 SAS 人工智慧、机器学习和流程分析来转变其营运方式并更好地服务客户等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介

- 网格计算

- 资料库库内分析

- 记忆体内分析

第五章市场动态

- 市场驱动因素

- 全球 IT 和资料库产业的成长

- 资料量增加

- 高效能运算的进步

- 市场抑制因素

- 投资成本高

- 严格的政府法规

第六章市场区隔

- 按成分

- 硬体

- 软体

- 按服务

- 按配置

- 本地

- 一经请求

- 按组织规模

- 中小企业

- 大公司

- 按最终用户产业

- BFSI

- 政府/国防

- 能源/公共产业

- 零售/电子商务

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲

- 北美洲

第七章竞争形势

- 公司简介

- SAS Institute Inc.

- Hewlett Packard Enterprise Company

- Oracle Corporation

- ATOS SE

- Microsoft Corporation

- Dell Technologies Inc.

- IBM Corporation(Red Hat Inc.)

- Fujitsu Limited

- Intel Corporation

- Amazon Web Services Inc.(Amazon.com Inc.)

- Google LLC(Alphabet Inc.)

- Juniper Networks Inc.

第八章投资分析

第九章 市场机会及未来趋势

The High-Performance Data Analytics Market size is estimated at USD 97.19 billion in 2024, and is expected to reach USD 280.69 billion by 2029, growing at a CAGR of 23.63% during the forecast period (2024-2029).

In a rapidly growing world of technology, innovation drives the industry forward. High-performance data analytics (HPDA) is a major catalyst for accelerating this innovation. As the digital world is expanding at an unprecedented rate, the capability to analyze and process large amounts of data accurately and quickly has become a key enabler of technological progress.

Key Highlights

- High-performance data analytics market growth is at boom due to the surge in data integration at the end-user level. One of the most crucial factors that have given rise to dramatic growth opportunities in the High-Performance Data Analytics market is technological innovation and accessibility. The prospect of advanced market analytics data optimization is even more promising given the growing state of technology at all levels, including hardware and software markets. Unstructured, structured, and less structured categories seem the same in size and opportunity. An impressive range of growth in the financial industry's technological orientation is visible.

- More data are being generated in an increasingly linked and computerized world. However, the growth of data is not linear; it is exponential. High-performance computing (HPC)-reliant businesses are creating plans for this upsurge. Organizations are gradually aware of the advantages of employing HPC capabilities to enable development analytics and AI operations. For businesses to be at the forefront of this technological revolution, companies such as Intel, HP, and others offer a way to combine HPC, AI, and other workloads.

- Many economic sectors use weather and climate predictions to make crucial business decisions. For instance, the agricultural sector uses these forecasts to determine when to plant, irrigate, and mitigate frost damage. The energy sector estimated that peak energy demands based on geography would balance the load. Thus, HPC (high-performance computing)-driven analytics helps fuel progress in climate research by analyzing data even more quickly and accurately.

- High-performance data analytics combines data analytics and HPC. This technology leverages the parallel processing abilities of HPC to run robust analytics software at speeds in excess of teraflops, or one trillion floating point operations per second. High investment and capital costs for operating and installing HPC are expected to hinder market growth.

- Data and analytics can offer clarity and support for clinical and operational decision-making in businesses. For instance, evaluating and validating the medicines required to treat patients with COVID-19 depends on real-world clinical data that researchers may share. Many HPDA service providers have offered software solutions for health systems with free access to a COVID-19 data science workspace for academic projects to aid clinical researchers in their fight against the pandemic, which fueled the market growth during the pandemic.

High Performance Data Analytics Market Trends

On-Demand to Witness the Growth

- High-performance data analytics combine HPC, Data Analytics, and Big Data. In order to provide quick insight into complex data sets, HPDA uses the speed and processing power of HPC.

- In recent years, there has been strong growth in on-demand computing, also known as cloud computing. This will allow individuals and businesses to make use of computing resources on a subscription basis via the Internet, e.g., storage devices, processing power, or applications.

- Moreover, companies are aiming to become agile with the integration of new technologies in this new era. Moving to a cloud environment is the most effective way of doing this. Being a part of the cloud means obtaining an embedded connection and intelligence, enabling intelligent operations to work in cooperation with each other, as well as building solid foundations for digital services linked to the cloud.

- In addition to this, on-demand deployment has been growing rapidly owing to several factors like digital transformation. Organizations are progressively adopting cloud services to streamline their IT infrastructure and speed up digital transformation initiatives. Cloud computing offers agility, scalability, and cost-efficiency, making it an attractive option for businesses of all sizes.

- According to Flexera, as of 2023, 72% of the enterprise respondents indicated that they had deployed a hybrid cloud in their organization since it can provide businesses more control over their data, help store sensitive data in a private cloud and run enterprise applications on a public cloud.

- Overall, digital transformation has been given an extra dimension by cloud computing, which transforms it from simply adopting new technology to a complete rebuilding of processes, tools, and experiences in a remote, virtual environment. Cloud computing boosts security, enhances user experience, and protects documents from deterioration. Because of this, businesses are now incorporating cloud computing into their ecosystem, fueling the growth of the market.

North America to Hold Major Market Share

- The United States is among the leading innovators and pioneers in adopting high-performance data analytics. The country is expected to hold a prominent share of the market. It has a strong foothold in terms of high-performance data analytics vendors, which adds to the market's growth.

- Some vendors include IBM Corporation, SAS Institute Inc., Intel Corporation, and Hewlett Packard Enterprise, among others. The growth of new business insights contributes to expanding the high-performance data analytics market in the United States. Data analytics is helping many companies in the region to improve customer experience, identify fraud, and achieve other results that directly strengthen business performance.

- Furthermore, increasing investment in high-performance computing for energy innovation is expected to generate a large amount of data that needs sophisticated data analytics solutions to get insights, optimize operations, drive innovation in the energy sector, and create demand for high-performance data analytics solutions in the country.

- The strong focus on research and innovation in Canada in sectors like healthcare, artificial intelligence, and renewable energy is leading to support the market requiring high-performance data analytics solutions to analyze complex data sets and gain research insights.

- The government of Canada is working collaboratively with provinces and territories on health priorities to improve integrated health care for residents, such as expanding access to family health services and modernizing the health care system with standardized health data and digital tools. Such initiatives related to digitalization in healthcare would result in the growth in data volumes in the sector, which needs advanced data analytics solutions for processing to get insights creating the need for high-performance data analytics solutions for better healthcare service offerings in the country.

- Moreover, partnerships related to high-performance computing are expected to bring together their expertise, technology, and resources to develop more advanced and efficient data analytics solutions. These collaborations could lead to innovations, driving growth and demand in the high-performance data analytics market in Canada.

High Performance Data Analytics Industry Overview

The competitive landscape of the high-performance data analytics market is fragmented due to the presence of many players. Key vendors such as SAS Institute Inc, Hewlett Packard Enterprise Company, Oracle Corporation, ATOS SE, and Microsoft Corporation are continuously innovating in the technology due to the vast array of prospects the market projects. The companies are undergoing mergers and acquisitions, spending vast sums of money on R&D activities, etc.

In June 2023, Applied Digital Corporation, a builder, designer, and operator of next-generation digital infrastructure primarily designed for High-Performance Computing applications, declared a collaboration with Hewlett Packard Enterprise. As a part of the collaboration, HPE would provide its powerful, energy-efficient supercomputers that are proven to support large-scale AI through Applied Digital's AI cloud service.

In February 2023, SAS joined CESMII to promote further and enhance the utilization of advanced analytics across the manufacturing sector. More and more top manufacturers utilize artificial intelligence, machine learning, and streaming analytics from SAS, especially to transform operations and better serve its customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.4.1 Grid Computing

- 4.4.2 In-Database Analytics

- 4.4.3 In-Memory Analytics

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Number of IT & Database Industry Across the Globe

- 5.1.2 Growing Data Volumes

- 5.1.3 Advancements in High-Performance Computing Activities

- 5.2 Market Restraints

- 5.2.1 High Investment Cost

- 5.2.2 Stringent Government Regulations

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Deployment

- 6.2.1 On-Premise

- 6.2.2 On-Demand

- 6.3 By Organization Size

- 6.3.1 Small and Medium Enterprises

- 6.3.2 Large Enterprises

- 6.4 By End-user Industry

- 6.4.1 BFSI

- 6.4.2 Government & Defense

- 6.4.3 Energy & Utilities

- 6.4.4 Retail & E-Commerce

- 6.4.5 Other End-User Industry

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 France

- 6.5.2.4 Rest of Europe

- 6.5.3 Asia Pacific

- 6.5.3.1 China

- 6.5.3.2 India

- 6.5.3.3 Japan

- 6.5.3.4 Rest of Asia Pacific

- 6.5.4 Latin America

- 6.5.4.1 Mexico

- 6.5.4.2 Brazil

- 6.5.4.3 Rest of Latin America

- 6.5.5 Middle East and Africa

- 6.5.5.1 United Arab Emirates

- 6.5.5.2 Saudi Arabia

- 6.5.5.3 Rest of Middle East and Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SAS Institute Inc.

- 7.1.2 Hewlett Packard Enterprise Company

- 7.1.3 Oracle Corporation

- 7.1.4 ATOS SE

- 7.1.5 Microsoft Corporation

- 7.1.6 Dell Technologies Inc.

- 7.1.7 IBM Corporation (Red Hat Inc.)

- 7.1.8 Fujitsu Limited

- 7.1.9 Intel Corporation

- 7.1.10 Amazon Web Services Inc. (Amazon.com Inc.)

- 7.1.11 Google LLC (Alphabet Inc.)

- 7.1.12 Juniper Networks Inc.