|

市场调查报告书

商品编码

1404386

水泥板市场占有率分析、产业趋势与统计、2024年至2029年成长预测Cement Board - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计2024年全球水泥板市场规模为63701万平方公尺。

预计到 2029 年将达到 8.173 亿平方公尺,预测期内(2024-2029 年)复合年增长率为 5%。

未来几年,全球住宅将会增加,理想的抗衝击性和耐用性将成为推动市场成长的关键因素。

另一方面,与传统产业相比,初始成本较高是限制目标产业在预测期内成长的主要因素。

然而,美学改善的日益增长的趋势可能会在不久的将来为全球市场提供利润丰厚的成长机会。

预计在评估期间,亚太地区水泥板市场将呈现健康成长。

水泥板市场趋势

商业部门的需求增加

商业领域是水泥板市场的主要部分。办公领域是商业领域水泥板应用的重要市场之一。随着全球商业活动的活性化,该领域对水泥板的需求正在快速成长。

亚太地区的办公空间市场近年来蓬勃发展,是最大的商业建筑市场之一。印度和中国对办公空间的需求多年来一直在增加。对科技、电子商务公司、银行和金融服务的需求显着增加了对办公空间的需求,导致该地区出现了新的办公大楼建设。

亚太地区一直是全球酒店业成长的驱动力。快速成长仍在继续,计划到 2022 年新增 444 家酒店和 111,798 间客房,併计划到 2023 年新增 179 家酒店和 43,735 间客房。 2024 年已确定约 515 间饭店和 127,104 间客房。

中国是购物中心建设领先的国家之一。中国约有4,000家购物中心,预计到2025年还将开幕7,000家。

此外,生态建筑的日益普及预计也将推动对纤维水泥板永续建筑材料的需求。

2022 年 6 月,高性能纤维水泥建筑材料製造商 James Hardie 宣布计划扩大位于阿拉巴马州普拉特维尔的水泥板等各种水泥基产品的生产能力。

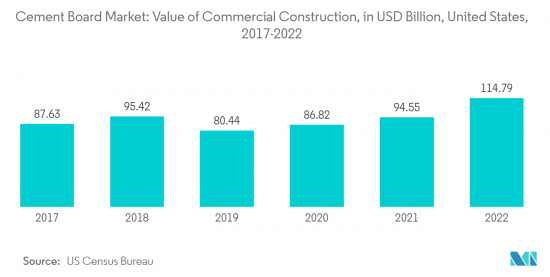

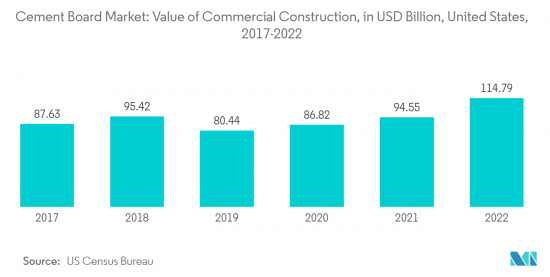

美国拥有世界上最大的建筑业之一。根据美国人口普查局统计,2022年美国商业建筑完工金额1,150亿美元,与前一年同期比较增21.4%。

这些因素持续推动商业建筑水泥板的需求,预计在预测期内将大幅成长。

亚太地区主导市场

以中国为中心的亚太地区主导全球市场占有率。中国是亚太地区水泥板的主要消费国之一。该国在广泛的建设活动,包括住宅和商业建筑。

中国持续推动都市化进程,目标是2030年都市化率达70%。随着都市化的推进,都市区生活空间不断扩大,都市区中阶居民对居住环境的改善提出了更高的要求,这对住宅住宅产生了重大影响。预计将对国内水泥板市场产生积极影响。

然而,供给过剩、监管收紧和需求疲软等因素共同给房地产开发人员的资产负债表带来压力,中国房地产市场也因一系列开发人员违约而受到衝击。受此影响,2022年1月至8月房地产投资年减7.8%。

印度建筑业预计将成为世界第三大建筑市场。印度政府实施的智慧城市计划、全民住宅等多项政策预计将为印度建设产业提供必要的动力。

印度政府正在未来几年推行大型计划。政府的「全民住宅」计画已于 2022 年为城市贫困阶级建造了超过 2,000 万套经济适用住宅。这将成为住宅的主要推动力,到 2023 年,住宅建设可能占该行业总量的三分之一以上。

根据统计和规划实施部的数据,在基数效应和经济成长的帮助下,建筑业在 2022 财年实现了 10.7% 的两位数成长,从去年 8.6% 的收缩中恢復过来。

总体而言,在预测期内,其他受访的亚太市场的需求成长预计将保持温和。

水泥板产业概况

水泥板市场因其性质而部分分散。然而,前四、五名的公司占据了很大的市场占有率。市场上的主要企业(排名不分先后)包括 James Hardie Industries PLC、Etex Group、Saint-Gobain、Johns Manville 和 NICHIHA。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 全球住宅增加

- 理想的抗衝击性和耐用性

- 抑制因素

- 初始成本高于传统产品

- 其他阻碍因素

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 进出口趋势

- 生产流程

第五章市场区隔(市场规模(基于数量))

- 产品类别

- 纤维水泥板(FCB)

- 木丝水泥板(WWCB)

- 木线水泥板(WSCB)

- 水泥黏合塑合板(CBPB)

- 目的

- 地板

- 外墙与隔墙

- 屋顶材料

- 柱和樑

- 外墙、挡风板和覆层

- 隔音/隔热材料

- 其他用途(活动板住宅、永久百叶窗、防火结构等)

- 最终用户产业

- 住宅

- 商业的

- 产业/设施

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 亚太地区

第六章竞争形势

- 併购、合资、联盟、协议

- 市场排名分析

- 主要企业策略

- 公司简介

- Etex Group

- Elementia Materials

- Everest Industries Limited

- James Hardie Industries PLC

- Johns Manville

- Knauf Gips KG

- Saint-Gobain

- BetonWood SRL

- Cembrit Holding A/S

- HIL Limited

- GAF

- NICHIHA Co. Ltd

第七章 市场机会及未来趋势

- 追求美丽的趋势日益盛行

The global cement board market size is estimated at 637.01 million square meters in 2024. It is expected to reach 817.3 million square meters by 2029, registering a CAGR of 5% during the forecast period (2024-2029).

For the next few years, the rising residential construction worldwide and desirable properties of impact resistance and durability are major factors driving the market's growth.

On the other hand, the high initial cost compared to its traditional counterparts is a key factor anticipated to restrain the growth of the target industry over the forecast period.

Nevertheless, the rising trends for aesthetic improvement are likely to create lucrative growth opportunities for the global market soon.

Asia-Pacific is estimated to witness healthy growth over the assessment period in the cement board market.

Cement Board Market Trends

Increasing Demand in the Commercial Sector

The commercial segment is a key segment in the cement board market. The office sector is one of the crucial markets for the applications of cement boards in the commercial segment. With increasing commercial activities around the world, the demand for cement boards in this segment is increasing at a grand pace.

The Asia-Pacific region has been a thriving market for office spaces in recent years and is one of the largest markets for the commercial construction sector. Demand for office spaces in India and China has been increasing for many years. With demand from technology, e-commerce companies, and banking financial services, the office space requirement is significantly rising, resulting in the construction of new offices in the region.

Asia-Pacific has been driving growth in the global hotel industry; the rapid growth was planned in 2022 with 444 planned hotels and 111,798 rooms, followed by another 179 properties with 43,735 rooms for 2023. About 515 hotels with 127,104 rooms are confirmed for 2024.

China is one of the leading countries in shopping center construction. China has almost 4,000 shopping centers, while 7,000 more are estimated to be open by 2025.

Furthermore, the increasing popularity of green building is also expected to boost demand for fiber cement boards, as they are a sustainable building material.

In June 2022, James Hardie, a high-performance fiber cement building solutions producer, announced the planned expansion of its manufacturing capabilities in Prattville, Alabama, for different cement-based products, including cement boards.

The United States has one of the world's largest construction industries. According to the US Census Bureau, the value for commercial construction put in place in the United States accounted for around USD 115 billion in 2022, registering a growth rate of 21.4% compared to the previous year.

Such factors continuously drive the demand for cement boards for commercial construction, and handsome growth is expected during the forecast period.

The Asia-Pacific Region to Dominate the Market

The Asia-Pacific region dominated the global market share, with China dominating the market. China is one of the major consumers of cement boards in the Asia-Pacific region. The country uses cement board in a wide range of construction activities, including both residential and commercial places.

China is promoting and undergoing a process of continuous urbanization, with a target rate of 70% for 2030. The increased living spaces required in the urban areas resulting from urbanization and the desire of middle-class urban residents to improve their living conditions may have a profound effect on the housing market and thereby increase the residential construction in the country, which, in turn, is expected to have a positive effect on the cement board market in the country.

However, China's real estate market has been rocked by a series of developer defaults as the combination of housing oversupply, a tightened regulatory environment, and subdued demand squeezed property developers' balance sheets. This resulted in a 7.8% Y-o-Y decline in property investments during the first eight months of 2022.

The Indian construction sector is expected to become the world's third-largest construction market. Various policies implemented by the Indian government, such as the Smart Cities project, Housing for All, etc., are expected to bring the needed impetus to the Indian construction industry.

The Indian government is pushing for huge projects in the next few years. The government's 'Housing for All' initiative built more than 20 million affordable homes for the urban poor in 2022. This provided a significant boost to residential construction, which may account for more than a third of the industry's total value by 2023.

According to the Ministry of Statistics and Programme Implementation, the construction sector grew in double digits at 10.7% in FY22 in a rebound from a contraction of 8.6% last year, aided by the base effect and growth in the economy.

Overall, the demand growth for the market studied in the rest of Asia-Pacific is expected to remain moderate during the forecast period.

Cement Board Industry Overview

The cement board market is partially fragmented in nature. However, the top four or five players own a significant market share. Some of the major players in the market (in no particular order) include James Hardie Industries PLC, Etex Group, Saint-Gobain, Johns Manville, and NICHIHA Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Residential Construction Across the World

- 4.1.2 Desirable Properties of Impact Resistance and Durability

- 4.2 Restraints

- 4.2.1 High Initial Cost in Comparison to Traditional Counterparts

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Import/Export Trends

- 4.6 Production Process

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Fiber Cement Board (FCB)

- 5.1.2 Wood Wool Cement Board (WWCB)

- 5.1.3 Wood Strand Cement Board (WSCB)

- 5.1.4 Cement Bonded Particle Board (CBPB)

- 5.2 Application

- 5.2.1 Flooring

- 5.2.2 Exterior and Partition Walls

- 5.2.3 Roofing

- 5.2.4 Columns and Beams

- 5.2.5 Facades, Weatherboard, and Cladding

- 5.2.6 Acoustic and Thermal Insulation

- 5.2.7 Other Applications (Prefabricated Houses, Permanent Shuttering, Fire-resistant Construction, etc.)

- 5.3 End-user Industry

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial and Institutional

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 France

- 5.4.3.3 United Kingdom

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Etex Group

- 6.4.2 Elementia Materials

- 6.4.3 Everest Industries Limited

- 6.4.4 James Hardie Industries PLC

- 6.4.5 Johns Manville

- 6.4.6 Knauf Gips KG

- 6.4.7 Saint-Gobain

- 6.4.8 BetonWood SRL

- 6.4.9 Cembrit Holding A/S

- 6.4.10 HIL Limited

- 6.4.11 GAF

- 6.4.12 NICHIHA Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Trends for Aesthetic Improvement