|

市场调查报告书

商品编码

1687395

情感运算:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Affective Computing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

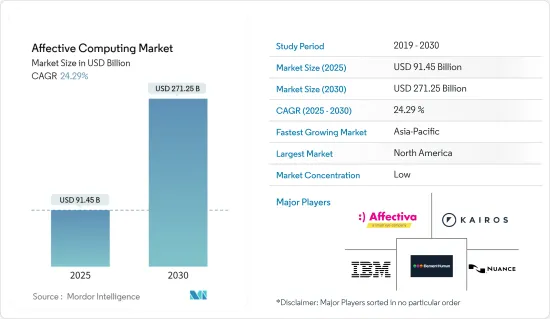

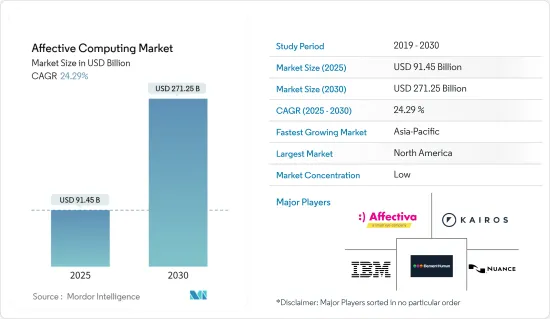

情感运算市场规模预计在 2025 年为 914.5 亿美元,预计到 2030 年将达到 2712.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 24.29%。

远端医疗中对情感运算解决方案的需求不断增长以及对社交智慧人工智慧代理的需求不断增长是预计在预测期内推动情感运算市场成长的关键因素。此外,由于穿戴式科技的使用日益增多、网路在工业领域的普及率不断提高以及世界各地的技术突破,对情感运算的需求预计还会成长。

主要亮点

- 由于各行各业对提高安全性的需求日益增长,以及对虚拟助理侦测诈欺活动的需求,情感运算市场正在不断发展。情感运算用于多种安全应用,例如语音激活生物识别以限制核准用户的存取。运算能力的增强、通讯技术的改进以及人工智慧等新解决方案正在带来新的可能性,对市场成长产生积极影响。

- 情感计算的出现正在推动各种应用的成长。情感运算的一个重要领域是设计表现出自然情感能力或能够令人信服的情感模拟的计算设备。例如针对有言语和情感残障人士的残障人士,开发了一个名为Gestele的原型,为残障人士添加情感、手势和其他形式的沟通。此技术也可用于个人化,侦测人的心情等因素并调节灯光、音乐类型、室温等。

- 此外,机器人技术的日益普及为采用这项技术提供了进一步的动力。机器人技术的最新进展对具有礼貌和社交智慧的人工智慧机器人产生了巨大的需求。国际机器人联合会(IFR)发布的《世界机器人报告》也指出,去年全球安装的工业机器人数量达到了5,17,385台。 2025年,全球工业机器人安装数量预计将达到约69万台。加入情感运算等附加功能可以使这些工业机器人更容易被接受,并改善人机互动。

- 凭藉当前的技术力,人工智慧可以支援三项基本业务需求:自动化业务流程、分析资料以获取洞察以及与客户和员工互动。第三个层次需要认知参与。机器学习提供的认知洞察不同于传统分析,需要更复杂的资料。由于这些因素,这些解决方案有望进一步改进。预计供应商将与最终用户建立策略伙伴关係,利用资料用于开发目的并提供全面的解决方案和服务。

- 此外,各种组织正在透过情感运算(也称为情感人工智慧)的应用进行创新,预计这将在预测期内推动市场成长。例如,2022年8月,在麻省理工学院(MIT),一个创新团队利用情绪AI来改善人们的心理健康和整体生活品质。麻省理工学院媒体实验室情感运算研究小组最近的研究提供了实证证据,表明富有同理心的人工智慧(AI)机器学习有可能减轻愤怒对人类创造性解决问题的负面影响。

- 情感运算市场的成长预计会受到其他重要考虑因素的阻碍,例如技术相容性问题和高昂的实施成本。情感运算需要大量的前期投资,而缓慢的实用化限制了该行业的扩张。系统成本高、使用者行为难以理解进一步限制了市场的发展。

情感运算市场趋势

包括汽车产业在内的各行各业对科技的采用日益增多

- 如今,一些最广泛使用的有效计算技术和解决方案可以在汽车领域找到。大多数市场参与企业至少提供一种针对汽车应用的产品或服务。在汽车产业,有效的计算经常被用来建构 ADAS(高级驾驶辅助系统)。

- ADAS 功能有两种类型:舒适功能和安全功能。舒适功能旨在透过触发闪光灯、声音、感觉和轻微转向建议等警报来警告驾驶。如果驾驶员未能对潜在的危险情况做出反应,安全功能将对汽车本身进行干预。预紧煞车、繫上安全带、升起引擎盖、自动煞车和规避转向是一些可能的操作的例子。

- 透过通知和警告驾驶员,汽车行业的一个重要且有效的计算应用还可以帮助减少事故。根据世界卫生组织估计,每年约有2,000万至5,000万人因道路交通事故而受到致命伤害,死亡人数约130万人。行人、摩托车骑士和骑自行车的人是最危险的道路使用者,占所有死亡人数的一半以上。 2030年永续议程设定了减少道路交通死亡和伤害的雄心勃勃的目标,包括透过在汽车行业使用有效的计算技术和经过验证的方法来降低事故和死亡的风险。

- 此外,Eyeris 和 Affectiva 还为汽车配备了摄像头,以追踪和回应驾驶员和乘客的行为和情绪。透过情绪技术监测驾驶员的困倦程度。它还可以用于启动警报、透过激活姿势、定位和连接智慧座椅来提高乘客舒适度、防止驾驶时愤怒和急躁事故等。

- 此外,根据美国公路安全保险协会的数据,美国到2025年,美国上的自动驾驶汽车数量将达到350万辆,到2030年将达到450万辆。该公司还于2021年收购了Affectiva,将Affectiva的汽车技术融入SmartEye突破性的内部感测解决方案中。这些见解使汽车製造商能够增强符合欧洲新车安全评估协会 (Euro NCAP) 标准的安全功能。汽车领域技术采用的大幅成长可能会为各种有效的运算解决方案提供者创造巨大的商机。

预计北美将占据最大市场占有率

- 北美是全球最大的情感运算市场之一,以美国为主导。该地区拥有一些最活跃的研究机构,致力于为最终用户开发创新有效的计算设备,特别是在医疗保健、市场研究和汽车领域。此外,随着人工智慧和其他先进技术基础设施的改善,该地区主要包括部署有效运算所需的各种基础设施。

- 此外,各组织正在积极研究情感运算的新技术。例如,2022年9月,密西根大学CSE系研究人员的一篇论文被选为《IEEE情感计算学报》上发表的五篇论文之一。研究人员提案了一种新方法来扩大情绪声音的范围,以提高整个资料集的辨识表现。

- 此外,麻省理工学院等研究机构也集中在该地区,进行多个研究计划,包括对触觉讯号的情绪反应和现实生活中的自动压力识别。麻省理工学院媒体实验室设有一个部门,名为情感运算小组,主要致力于研究传达情感和认知状态的新方法,以及发明个人技术以提高对情绪状态的自我认知。

- 过去十年,麻省理工学院媒体实验室的情感运算小组诞生了多家公司。例如,领先的情感运算公司Affectiva Inc.已经在全球市场上占有一席之地。自成立以来,该公司已筹集了超过 6000 万美元。

- 许多加拿大公司正专注于开发新的手势和语音辨识解决方案。加拿大公司 GestSure Systems 提供一种手势软体介面,使医生可以在无菌手术室外存取电脑化的病人记录。该公司还提供充当 USB 桥的硬件,允许 Kinect 将 CT 和 MRI资料传输到现有的医院 PC。滑鼠指令被转换成手势,让外科医生可以解放双手来操作影像。

- 此外,总部位于加拿大的Baanto公司开发了ShadowSense技术,这是一种基于光学定位的触控技术,可用于多个触控萤幕显示器。该公司刚刚宣布将于2022年3月推出一款适用于高性能军事应用的27吋夜视成像系统样品。

情感运算行业概况

情感运算市场现有参与者之间的竞争非常激烈,他们正在采取积极的收购策略来占领市场并透过新的解决方案增加先发优势。 Affectiva Inc.、IBM Corporation、Nuance Communications Inc.、Element Human Ltd. 和 Kairos AR Inc. 是占据市场重要份额的知名企业。

2022 年 6 月,Nuance Communications 宣布与 SCIENTIA Puerto Rico, Inc. 建立合作伙伴关係,以扩大 Nuance语音辨识解决方案 Dragon Medical One 的使用范围,让岛上的医生和护士能够使用,从而提高临床文件和患者治疗结果的质量,同时减少导致临床医生倦怠的行政业务。同样在 2022 年 6 月,临床级语音分析领域的领导者 Oral Analytics 宣布与数位生物标记开发商 Koneksa 建立合作伙伴关係,以利用 Oral Analytics 的技术 Speech Vitals 进一步加强其平台和研究能力。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 客服中心自动化的兴起

- 越来越多地采用云端基础和线上的解决方案

- 包括汽车产业在内的各行各业对科技的采用日益增多

- 市场挑战

- 医疗保健核准时间长

- 隐私和安全问题

第六章 技术简介

- 语音辨识

- 手势姿态辨识

- 脸部辨识

- 其他类型

第七章 市场区隔

- 按组件

- 硬体

- 感应器

- 相机

- 储存设备和处理器

- 其他组件

- 软体

- 分析软体

- 企业软体

- 脸部辨识

- 手势姿态辨识

- 语音辨识

- 硬体

- 按最终用户产业

- 卫生保健

- 车

- 零售

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 拉丁美洲

- 中东和非洲

第八章 竞争格局

- 公司简介

- Affectiva Inc.

- Element Human Ltd

- Kairos AR Inc.

- Nuance Communications Inc.(Microsoft Corporation)

- IBM Corporation

- Gesturetek Inc.

- Nemesysco Ltd

- Realeyes Data Services Ltd

- audEERING GmbH

- Eyesight Technologies Ltd

- Emotibot Technologies Limited

- Amazon Web Services Inc.

第九章投资分析

第十章 市场机会与未来趋势

The Affective Computing Market size is estimated at USD 91.45 billion in 2025, and is expected to reach USD 271.25 billion by 2030, at a CAGR of 24.29% during the forecast period (2025-2030).

The rise in demand for telehealth-related affective computing solutions and the rising need for socially intelligent artificial agents are some significant factors that are anticipated to propel the growth of the affective computing market during the projected period. Furthermore, the demand for effective computing is expected to develop due to the increasing use of wearable technology, increased internet penetration across industrial verticals, and global technical breakthroughs.

Key Highlights

- The affective computing market is developing due to the growing need for improved security in various industries and the demand for virtual assistants to detect fraudulent activities. Affective computing is used in multiple security applications, such as voice-activated biometrics, to restrict access to unapproved users. With the advancement in computing capacity, improved communication technology, and new solutions, such as AI, new possibilities are being realized, which will positively impact the market's growth.

- The emergence of affective computing has driven the growth of various applications. One of the significant areas in affective computing has been the design of computational devices that are proposed to showcase either natural emotional capabilities or capable of convincingly simulating emotions. For example, for speech impairments and emotionally handicapped people, Gestele, a prototype, was developed that adds to the affected people's emotions, gestures, or other forms of communication. The technology can also be used for personalization by adjusting light, type of music, and room temperature by detecting a person's mood, etc.

- Moreover, the increasing usage of robotics provides further incentives for implementing this technology. The recent advancement in robotics has led to an immense increase in the demand for artificially intelligent robots to behave politely and socially smartly. A report on World Robotics by the International Federation of Robotics (IFR) also showcased that worldwide industrial robot installations amounted to some 517,385 last year. It is prognosticated that by 2025, global industrial robot installations will amount to around 690,000. Additional feature inclusion, such as affective computing, can make these industrial robots much more acceptable and have better human-computer interaction.

- In its present technological capabilities, AI can support three essential business needs: automation of business processes, gaining insight through data analysis, and engaging with customers and employees. The third level requires cognitive engagement. Cognitive insights offered by machine learning differ from traditional analytics and require higher-level data. Due to such factors, these solutions are expected to improve further. Vendors are expected to form strategic partnerships with the end users to use the data for development purposes and offer them comprehensive solutions and services.

- Moreover, various organizations are engaged in innovations in applying affective computing (also called Emotional AI), which is expected to drive market growth during the forecast period. For instance, in August 2022, At the Massachusetts Institute of Technology (MIT), an innovative team used emotional AI to enhance people's mental well-being and general quality of life. Recent research from the MIT Media Lab's Affective Computing Research Group presents empirical proof that empathic artificial intelligence (AI) machine learning may mitigate the negative impacts of rage on human creative problem-solving.

- Affective computing market growth is anticipated to be hampered by issues with technical compatibility and high implementation costs, among other essential considerations. Implementing emotional computing requires a significant upfront investment, and delay in practical applications limits industry expansion. The system's expensive costs and difficulty comprehending user behavior further limit the market's development.

Affective Computing Market Trends

Rising Technology Adoptions in Various Industries such as Automotive

- Currently, some of the most widely used effective computing technologies and solutions are found in the automotive sector. The majority of market participants offer at least one good or service geared toward automobile applications. In the automotive industry, affective computing is frequently used to create Advanced Driver-Assistance Systems (ADAS).

- The two categories of ADAS functions are comfort functions and security functions. The comfort feature is designed to warn the driver by causing alerts like flashing lights, sounds, sensations, or light steering recommendations. In the event that the driver does not respond to a potentially hazardous scenario, the security feature is designed to intervene within the car itself. Brake preloading, seatbelt installation, hood pulling, automatic braking, and avoidance steering are examples of possible maneuvers.

- By notifying and warning the drivers, the key effective computing applications in the automotive industry also aid in reducing accidents. As per the WHO (World Health Organization), it is estimated that 20-50 million people suffer from fatal injuries in traffic accidents each year, killing around 1.3 million people. Pedestrians, motorcyclists, and cyclists are among the most at-risk road users, accounting for more than half of all fatalities. The 2030 Agenda for Sustainable Development sets lofty goals for reducing road traffic injuries, including effective computing technology in the automobile industry, using proven methods to lower the risk of accidents and fatalities.

- Moreover, to track and react to the actions and feelings of drivers and passengers, Eyeris and Affectiva put cameras in the automobiles. Driver drowsiness is monitored via emotional technology. It can also be used to start alarms, postures, and positioning, connect to intelligent seats to increase passenger comfort, prevent driving rage, impatient accidents, etc.

- Further, according to the Insurance Institute for Highway Safety, self-driving cars in the United States are anticipated to reach 3.5 million by 2025 and 4.5 million by 2030. Also, to incorporate Affectiva's automotive technology into SmartEye's ground-breaking interior sensing solution, the company bought Affectiva in 2021. These insights enable the Automakers to enhance safety features to meet Euro NCAP standards. Such a significant rise in technology adoption in the automotive segment would create considerable opportunities for various effective computing solution providers.

North America is Expected to Hold the Largest Market Share

- The North American region has been one of the largest markets for affective computing globally, majorly led by the United States. The area comprises some of the most active research organizations working toward developing innovative, effective computing devices capable of serving several end-user applications, especially in the healthcare, market research, and automotive sectors. Moreover, with the improved infrastructure for artificial intelligence and other advanced technologies, the region consists of various infrastructures that are primarily required to deploy effective computing.

- Also, various organizations actively research new technologies in affective computing. For instance, in September 2022, Researchers from Michigan University's CSE department identified one of their papers as one of the top five to appear in IEEE Transactions on Affective Computing. The researchers suggested new approaches for expanding the scope of representations of speech for emotion to boost recognition performance across datasets.

- Moreover, research organizations such as MIT have also been concentrated in the region, conducting multiple research projects, including Affective Response to Haptic Signals and Automatic Stress Recognition in Real-Life Settings, among others. The university has a department in the MIT media lab called the Affective Computing Group, which majorly researches new methods of communicating affective and cognitive states and inventing personal technologies for improving self-awareness of affective states, which is further anticipated to increase the investments in the region driving the growth of affective computing.

- Over the past decade, several companies emerged from the Affective Computing Group of MIT Media Lab (research laboratory at the Massachusetts Institute of Technology). For instance, Affectiva Inc., a major affective computing company, has established its footprint in the global market. The company has raised over USD 60 million since its inception.

- Many Canadian businesses are concentrating on developing new gesture and speech recognition solutions. The Canadian company GestSure Systems offers a gesture software interface that allows doctors to access patient records on computers in locations other than sterile operation rooms. Also, the company provides hardware that serves as a USB bridge to interchange CT and MRI data with an already installed hospital PC using Kinect. Surgeons can navigate images without using their hands since mouse commands are translated into gestures.

- Additionally, a Canadian-based company, Baanto, has developed ShadowSense Technology, an optical positioning-based touch technology that can be used on multiple touchscreen displays. In March 2022, the company recently announced 27-inch night vision imaging system samples for high-performance military applications.

Affective Computing Industry Overview

The competition among the existing market players in the affective computing market is high, making them prone to aggressive acquisition strategies to capture the market and enhance the first mover's advantage with new solutions. Affectiva Inc., IBM Corporation, Nuance Communications Inc., Element Human Ltd., and Kairos AR Inc. are a few prominent players with a significant share of the market.

In June 2022, Nuance Communications announced a partnership with SCIENTIA Puerto Rico, Inc. to expand access to Nuance's Dragon Medical One speech recognition solution for the island's physicians and nurses to improve clinical documentation quality and patient outcomes while reducing administrative workloads that contribute to clinician burnout. Also, in June 2022, Aural Analytics, Inc., a prominent player in clinical-grade speech analytics, announced a partnership with Koneksa, a player in digital biomarker development, to further strengthen its platform and research capabilities using Aural Analytics' technology, Speech Vitals.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Automation in Contact Centers

- 5.1.2 Increasing Adoption of Cloud-based Solutions and Online Solutions

- 5.1.3 Rising Technology Adoptions in Various Industries such as Automotive

- 5.2 Market Challenges

- 5.2.1 High Approval Times in Healthcare

- 5.2.2 Privacy and Security Concerns

6 TECHNOLOGY SNAPSHOT

- 6.1 Speech Recognition

- 6.2 Gesture Recognition

- 6.3 Facial Recognition

- 6.4 Other Types

7 MARKET SEGMENTATION

- 7.1 By Component

- 7.1.1 Hardware

- 7.1.1.1 Sensors

- 7.1.1.2 Cameras

- 7.1.1.3 Storage Devices and Processors

- 7.1.1.4 Other Components

- 7.1.2 Software

- 7.1.2.1 Analytics Software

- 7.1.2.2 Enterprise Software

- 7.1.2.3 Facial Recognition

- 7.1.2.4 Gesture Recognition

- 7.1.2.5 Speech Recognition

- 7.1.1 Hardware

- 7.2 By End-user Industry

- 7.2.1 Healthcare

- 7.2.2 Automotive

- 7.2.3 Retail

- 7.2.4 Other End-user Industries

- 7.3 By Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia

- 7.3.4 Latin America

- 7.3.5 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Affectiva Inc.

- 8.1.2 Element Human Ltd

- 8.1.3 Kairos AR Inc.

- 8.1.4 Nuance Communications Inc. (Microsoft Corporation)

- 8.1.5 IBM Corporation

- 8.1.6 Gesturetek Inc.

- 8.1.7 Nemesysco Ltd

- 8.1.8 Realeyes Data Services Ltd

- 8.1.9 audEERING GmbH

- 8.1.10 Eyesight Technologies Ltd

- 8.1.11 Emotibot Technologies Limited

- 8.1.12 Amazon Web Services Inc.