|

市场调查报告书

商品编码

1404391

应用交付控制器 (ADC) -市场占有率分析、行业趋势和统计、2024-2029 年成长预测Application Delivery Controllers (ADC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

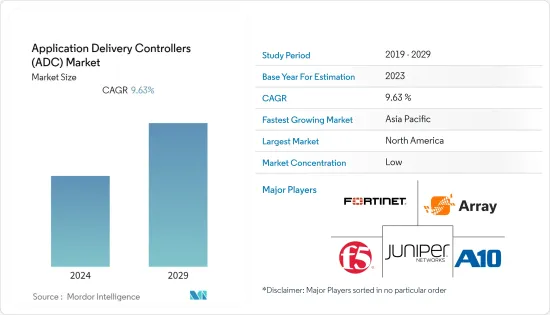

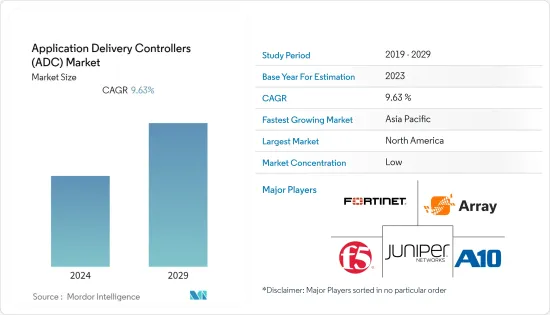

本财年应用交付控制器(ADC)市场规模预估为26.5亿美元,复合年增长率为9.63%,预计五年内将达到46.1亿美元。

由于对高效、安全的应用程式交付解决方案的需求不断增长,该市场正在经历显着增长。

主要亮点

- ADC 市场的成长要素包括基于 Web 的应用程式的普及、云端运算和虚拟的兴起,以及企业快速、安全地向最终用户交付应用程式的需求不断增长。

- 应用程式交付控制器在过去几年中获得了广泛的欢迎,这主要是由于对负载平衡、提高效能以及处理与应用传输相关的更高级要求的需求不断增长。这些解决方案提供可用性、可扩展性、效能、安全性、自动化和控制,以保持应用程式和伺服器正常运作。这些功能还可以帮助想要或已经迁移到云端环境的组织。

- 近年来,随着网路攻击的频率和复杂性不断增加,对应用交付控制器(ADC)的需求也随之增加。 ADC 在加强应用程式和基础设施的安全状况方面发挥关键作用,使其成为防范各种网路威胁的重要组成部分。

- 透过向网路添加新服务来扩展应用程式(通常由不同供应商的解决方案组成)的需求日益增长,可能会增加网路复杂性并增加故障点。因此,向用户提供服务变得更加复杂,并可能导致严重的延迟,从而导致收益流损失并降低用户的体验品质。

- 此外,COVID-19大流行进一步凸显了应用程式视觉性和控制的重要性,因为远距工作者迅速改变了工作环境,以保持员工在任何地方的工作效率。预计这将在预测期内扩大应用交付控制器市场。

应用交付控制器 (ADC) 市场趋势

BFSI 最终用户部分预计将占据主要市场占有率

- 由于各种改革和发展,BFSI 领域对应用交付控制器的需求正在不断增长。科技普及的提高,加上网路银行和手机银行等数位管道,使银行业务成为银行服务的首选。利用先进的身份验证和存取控制流程已成为银行日益重要的要求。

- 围绕银行的数位生态系统正在迅速扩张。随着消费者需求的不断变化,银行面临着客製化产品以满足消费者需求的压力。此外,采用行动生活方式并在数位平台上互动的消费者希望银行在同一平台上与他们建立联繫。因此,BFSI 领域对应用交付控制器的需求不断增加。

- 此外,随着网路银行、网路银行和手机银行数位流量的增加,BFSI部门也面临因维护工作而停机的情况。为此,银行需要实现负载均衡,支援轮询分配,将领先优势从伺服器1转移到伺服器2、伺服器3等,但他们引入了ADC,这样就没有必要了。

- 巨量资料和分析等新一代技术和服务的日益普及需要对传统网路进行转型。软体定义网路为各种规模的企业提供更大的弹性、更低的成本和更轻鬆的管理。

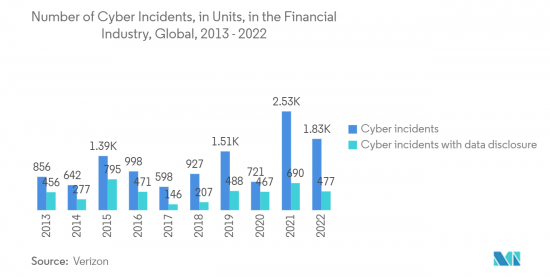

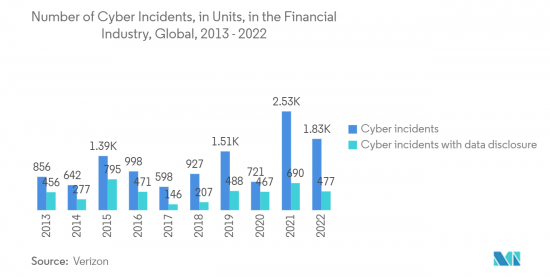

- 根据 Verizon 统计,2022 年全球金融业共通报了 1,829 起网路事件。金融业数以百万计的敏感资料洩露给骇客,导致多家公司损失数百万美元的资料外洩事件日益增多,引发了新兴国家对强大安全性的关注。随着全球业务的发展,DDoS 等威胁使关键资料面临风险。这促使企业实施更好的解决方案来保护其端点和网路内的资料免受攻击。

亚太地区预计将占据主要市场占有率

- 预计亚太地区在预测期内将呈现最高成长率。该地区云端运算的快速成长预计将成为云端基础的应用程式交付控制器的关键驱动力。

- 此外,由于中小企业的投资,该地区预计将实现成长。中小型企业正在为其云端基础的应用程式投资经济高效、云端基础且技术先进的解决方案。中国和印度等国家为该地区提供了巨大的成长机会。

- 由于技术进步,所研究的市场中连接设备的数量正在增加。此外,中国云端处理产业的成长得到了政府的大力支持和私营部门的大量投资的支持。此外,5G和支援5G的设备将大大提高设备的互连性。其结果是连接设备的增加,这直接增加了对云端基础的应用程式的资料流量和安全性的控制需求。

- 此外,数位印度计划旨在将旧有系统迁移到云端基础模式云端基础模式的模型或与基于云端的模型集成,并透过云端平台託管向公民提供电子服务。

- 此外,中国、印度和印尼等国家的网路用户和资料流量正在增加,进一步推动了该地区 ADC 解决方案的成长。随着数位时代的进步,市场供应商透过为最终用户提供更多创新的网路解决方案和产品并确保最佳的技术体验来引领细分市场。

应用交付控制器 (ADC) 产业概述

应用交付控制器 (ADC) 市场高度分散,主要参与者包括 F5 Networks Inc.、Fortinet Inc.、Juniper Networks Inc.、A10 Networks Inc. 和 Array Networks Inc.。市场参与企业正在采取联盟和收购等策略来加强其产品阵容并获得永续的竞争优势。

2022 年 9 月,自动化机器身分管理 (MIM) 和应用程式基础架构安全领域的领导者 AppViewX 宣布加入 F5 的技术联盟计画 (TAP)。透过此次合作,F5 和 AppViewX 将共同推动企业应用程式安全和交付解决方案,专注于管理和确保本地、云端和边缘应用程式的网路安全。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 可靠应用效能的需求不断增长

- 网路攻击增加

- 市场抑制因素

- 网路复杂度

- ADC 管理挑战与成本上升

第六章市场区隔

- 按发展

- 云

- 本地

- 按公司规模

- 中小企业 (SME)

- 大公司

- 按行业分类

- 金融机构

- 零售

- 资讯科技/通讯

- 医疗保健

- 其他行业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区 中东/非洲

第七章竞争形势

- 公司简介

- F5 Networks Inc.

- Fortinet Inc.

- Juniper Networks Inc.

- A10 Networks Inc.

- Array Networks Inc.

- Citrix Systems Inc.

- Radware Corporation

- Akamai Technologies Inc.

- Barracuda Networks Inc.

- Piolink Inc.

- Sangfor Technologies Inc.

- HAProxy Technologies LLC

- Loadbalancer.org Inc.

- Kemp Technologies Inc.

第八章供应商市场占有率分析

第九章投资分析

第十章投资分析市场的未来

The Application Delivery Controllers (ADC) Market was valued at USD 2.65 billion in the current year and is expected to register a CAGR of 9.63%, reaching USD 4.61 billion in five years. The market was experiencing significant growth due to the increasing demand for efficient and secure application delivery solutions.

Key Highlights

- Factors contributing to the ADC market's growth include the proliferation of web-based applications, the rise of cloud computing and virtualization, and the increasing need for businesses to deliver applications faster and securely to end-users.

- Application delivery controllers have gained significant traction in the past few years, primarily owing to the rising need for load balancing, improving performance, and handling much more advanced requirements associated with application delivery. These solutions provide availability, scalability, performance, security, automation, and control to keep the applications and servers running in their power band. These capabilities also aid organizations that want to or have already migrated to the cloud environments.

- The increasing frequency and sophistication of cyber attacks have driven the demand for application delivery controllers (ADCs) in recent years. ADCs play a crucial role in enhancing the security posture of applications and infrastructure, making them a vital component in defending against various cyber threats.

- The increasing need to scale out applications, which in various cases consists of solutions from different vendors along with the addition of new services to the network, can result in increased complexities and increased points of failure in the network. As a result, delivering these services to the consumers becomes more complex and can result in significant delays, leading to loss of revenue streams and lowered subscriber quality of experience.

- Additionally, with the COVID-19 pandemic, application visibility and management took on even more importance as remote workers quickly changed their working environments to maintain staff productivity from any place. This is expected to boost the market for application delivery controllers over the forecast period.

Application Delivery Controllers (ADC) Market Trends

BFSI By End-user Vertical Segment is Expected to Hold Significant Market Share

- The demand for application delivery controllers in the BFSI sector gained traction owing to various reforms and developments. The growing technological penetration, combined with digital channels, such as Internet banking, mobile banking, etc., is becoming a preferred choice for banking services. There is a more significant requirement for banks to leverage advanced authentication and access control processes.

- The digital ecosystem surrounding a bank is increasing at a rapid pace. With the constant change in consumer demand, banks have been pressured to customize their product offerings according to their demands. Moreover, consumers embracing a mobile lifestyle and socializing on digital platforms expect banks to connect with them on the same platforms. This is increasing the demand for application delivery controllers in the BFSI sector.

- Further, with increased digital traffic toward net banking, online banking, and mobile banking, the BFSI sector also faces downtime due to maintenance work. This requires the banks to implement load balancing where the banks would have to support round-robin distribution that is shifting lead from server 1 to server 2, followed by server 3, and so on, which is now eliminated with ADC.

- The rising popularity of next-generation technologies and services, such as Big Data and analytics, requires the transformation of legacy networks. Software-defined networks offer greater flexibility, lower cost, and easier management for businesses of all sizes.

- According to Verizon, in 2022, there were 1,829 reported cyber incidents in the financial industry worldwide. The instances of data breaches across financial industries that have leaked millions of crucial data to hackers and the loss of millions of dollars for multiple companies have increased the focus on robust security across emerging economies. As businesses worldwide grow, threats like DDoS have exposed critical data to risk. This has encouraged organizations to deploy better solutions to safeguard their data within endpoints and networks against attacks.

Asia Pacific is Expected to Hold Significant Market Share

- Asia Pacific is expected to witness the highest growth rate over the forecast period. The rapid increase in cloud computing in this region is expected to be a significant driver for cloud-based application delivery controllers.

- Additionally, the region is expected to witness growth, owing to the investments of small and medium organizations. SMEs are investing in cost-effective cloud-based and technologically advanced solutions for cloud-based applications. Countries such as China and India provide significant growth opportunities in the region.

- Owing to technological advancements, there is an increase in the number of connected devices in the studied market. Moreover, Strong government backing and substantial private sector investment are behind the growth of China's cloud computing industry. Furthermore, 5G and 5 G-enabled devices will exponentially increase the devices' interconnectivity. As a result, it increases connected devices, thereby directly augmenting the need for controlling the data traffic and security of cloud-based applications.

- Additionally, the Digital India initiative aims to move legacy and on-premise systems to a cloud-based model or integrate with it, and the cloud platform is expected to host the delivery of e-services to citizens.

- In addition, the increasing internet users and data traffic in countries like China, India, and Indonesia further augment the growth of ADC solutions in the region. With the evolving digital era, market vendors offer more innovative network solutions and products for end users, ensuring they have the best technology experience and driving the market segment.

Application Delivery Controllers (ADC) Industry Overview

The Application Delivery Controllers (ADC) Market is highly fragmented, with the presence of major players like F5 Networks Inc., Fortinet Inc., Juniper Networks Inc., A10 Networks Inc., and Array Networks Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In September 2022, AppViewX, the leader in automated machine identity management (MIM) and application infrastructure security, announced that the company joined F5's Technology Alliance Program (TAP). Through the partnership, F5 and AppViewX will jointly promote enterprise application security and delivery solutions focused on managing applications and ensuring cybersecurity across on-premises, cloud, and edge locations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Reliable Application Performance

- 5.1.2 Increasing Cyberattacks

- 5.2 Market Restraints

- 5.2.1 Increasing Network Complexity

- 5.2.2 Management Challenges and Higher Costs of ADCs

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 Cloud

- 6.1.2 On-premise

- 6.2 By Enterprise Size

- 6.2.1 Small and Medium Enterprises (SMEs)

- 6.2.2 Large Enterprises

- 6.3 By End-user Vertical

- 6.3.1 BFSI

- 6.3.2 Retail

- 6.3.3 IT and Telecom

- 6.3.4 Healthcare

- 6.3.5 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 F5 Networks Inc.

- 7.1.2 Fortinet Inc.

- 7.1.3 Juniper Networks Inc.

- 7.1.4 A10 Networks Inc.

- 7.1.5 Array Networks Inc.

- 7.1.6 Citrix Systems Inc.

- 7.1.7 Radware Corporation

- 7.1.8 Akamai Technologies Inc.

- 7.1.9 Barracuda Networks Inc.

- 7.1.10 Piolink Inc.

- 7.1.11 Sangfor Technologies Inc.

- 7.1.12 HAProxy Technologies LLC

- 7.1.13 Loadbalancer.org Inc.

- 7.1.14 Kemp Technologies Inc.