|

市场调查报告书

商品编码

1404410

智慧照明:市场占有率分析、产业趋势/统计、成长预测,2024-2029Smart Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

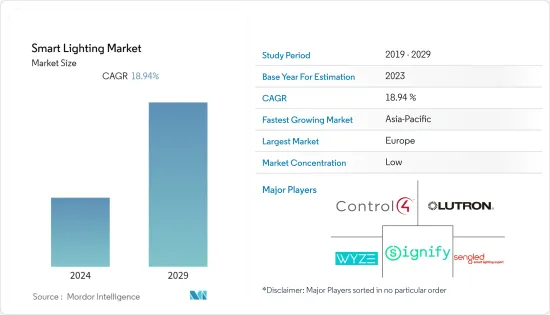

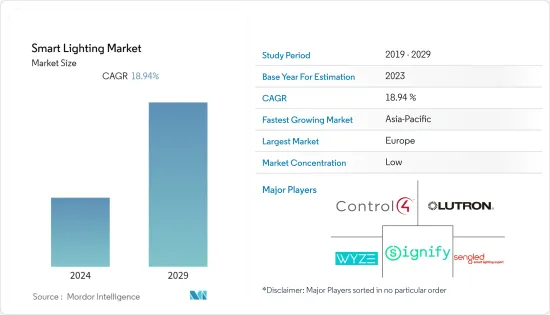

预计2024年智慧照明市场规模为196.5亿美元,到2029年预计将达到467.9亿美元,预测期内复合年增长率为18.94%。

由于其社会效益,消费者可能会迅速采用节能 LED 技术,从而有可能加速劣质紧凑型萤光和卤素照明技术的替代品。

主要亮点

- 在商业和住宅空间中,照明的受欢迎程度和需求都在不断增加,因为它可以连接到物联网设备,并仅使用智慧型手机或平板电脑即可产生各种环境照明。智慧灯可以根据情况调暗到不同的色调,安排开/关时间,追踪消费量,并透过 Wi-Fi、蓝牙、SmartThings、Z-Wave 和 ZigBee 连接到其他装置。您可以连接到其他装置。

- 办公空间也正在成为流行的智慧照明应用之一。在当今的商业世界中,企业主和管理者越来越重视员工的整体社会福利。透过改用智慧照明,办公室可以为员工提供更明亮的光线。这可以改善员工的视力并减少眼睛疲劳。此外,灯光的颜色有助于照亮心情并提供舒适感。

- 此外,由于政府对传统照明和能源消耗的有利法规,预计美国、欧盟 (EU)、中国和印度对连网型照明的市场需求将会增加。

- 然而,智慧照明市场的缓慢成长可能会给创业者带来挑战。如果智慧照明产品製造商未能进入市场,他们将遭受重大投资沉没和声誉损失。为了解决这些问题,製造商感到有必要考虑消费者如何看待整体智慧家庭技术和智慧照明产品。

- COVID-19 的出现导致整个供应链的生产停顿和中断,损害了工业产出成长并减少了主要製造地的轻工业产能。然而,随着人们待在家里的时间越来越多,升级内装的趋势增加,这对市场产生了正面影响。此外,LED 在家庭中的使用量不断增加以及智慧家居技术的普及预计将在未来几年进一步推动市场成长。

智慧照明市场趋势

政府法规强制 LED 使用驱动市场

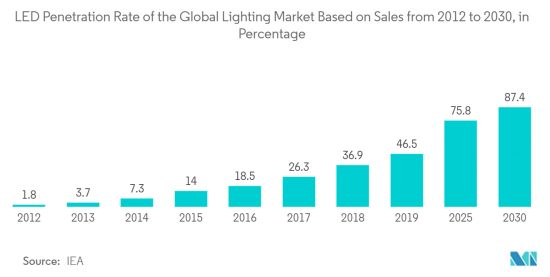

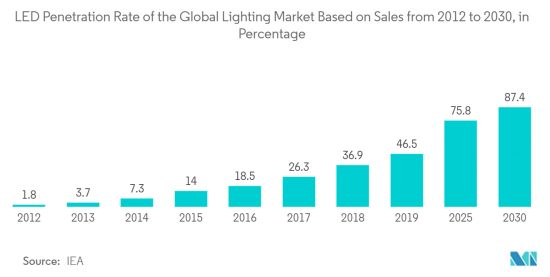

- 强制使用 LED 的政府法规正在推动多个地区的市场需求。例如,在美国,法律要求最常见类型的灯泡每瓦节能 45 流明,而典型的 60 瓦白炽灯泡每瓦节能约 15 流明,而卤素白炽灯泡则每瓦节能约 15 流明。 ,提供1 瓦。CFL灯泡每瓦产生约20 流明,CFL 灯泡每瓦产生65 流明,LED 每瓦产生80 到100 流明,使用的能量非常少。此外,LED 价格的下降正在推动智慧照明的进一步采用。

- 透过性能标准、标籤和奖励计划,世界各地许多政府正在迅速采取行动,逐步淘汰低效光源,例如在欧洲,阶段多年前就开始向 LED 技术过渡。我就是这样。欧盟 (EU) 最近更新了《生态设计指令》和《有害物质限制指令》,将在 2023 年之前阶段淘汰所有萤光。此外,2023年1月,乌克兰政府宣布核准一项发光二极体(LED)灯泡取代白炽灯泡的计画。该倡议是欧盟(EU)对乌克兰能源领域支持的一部分。

- 组成南部非洲发展共同体 (SADC) 的 16 个非洲国家已采用区域统一的照明标准。该标准的市场将在未来几年内完全过渡到 LED。东非共同体 (EAC) 也在六个成员国阶段萤光。其他地区,包括东南亚国家,也实施了类似的限制。预计这将推动所研究市场的成长。

- 据美国能源局称,LED照明的广泛普及预计将对美国的节能产生重大影响。因此,许多照明装置将采用 LED 技术,到 2035 年,LED 照明每年节省的能源可能达到 569 TWh,相当于约 92 个 1,000 MW 发电厂的年发电量。

亚太地区将经历最快的成长

- 物联网(IoT)的日益普及预计将进一步开拓中国的照明市场,并加速中国连网型智慧照明系统的成长。 GSMA预计,到2025年,中国的物联网连线数将达到约41亿个,占全球物联网连线数的近三分之一。预计智慧照明系统将成为预测期内此趋势的最大受益者。

- 在日本市场,Google、亚马逊等全球高科技巨头正在陆续发布专为日本订製的智慧家居产品。在日本,人们担心传统家电的普及与前一年同期比较有所下降,但随着配备人工智慧的产品和服务越来越多地引入家庭,智慧家庭产业预计未来将成长。可能性将是无限的。

- 中国的智慧照明市场也受到智慧型装置(包括智慧型手机)日益普及的推动,智慧型手机可以方便地与物联网设备连接。日本智慧型手机安全协会 (JSSEC) 预测,到 2022 年,日本智慧型手机用户数可能达到 6,880 万人。

- 由于对语音辨识、远端控制和智慧家庭自动化卓越体验等功能的需求不断增加,印度对智慧照明的需求预计将增长。 LED照明在住宅、医疗保健以及酒店和工作场所等商业空间等各个领域的日益采用,以及可支配收入的增加,也是未来几年推动这些设备成长的因素。

- 在亚太地区,韩国、泰国、新加坡、马来西亚、斯里兰卡、孟加拉、澳洲、印尼等也有可能在智慧照明市场获得重要份额。

智慧照明产业概况

智慧照明市场竞争激烈,多家主要参与者进入该市场。然而,许多公司正在透过赢得新契约或收购其他公司来扩大在智慧照明市场的影响力。主要企业包括 Signify Holding、Control4 Corp. (Snap One LLC)、Wyze Labs Inc.、Eaton Corporation 和 Savant。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 产业价值链分析

- COVID-19 对智慧照明产业的影响

- PESTLE分析

第五章市场动态

- 市场驱动因素

- 家庭节能需求不断增加

- 强制使用 LED 的政府法规

- 市场挑战

- 对产品选择和安装缺乏认识

- 市场机会

- 物联网在新兴国家的普及

第 6 章住宅智慧照明产品中使用的无线连线标准类型

- Wi-Fi

- Bluetooth

- ZigBee

第七章市场区隔

- 依产品类型

- 控制系统

- 有线

- 无线的

- 智慧灯具/照明设备

- 控制系统

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第八章竞争形势

- 公司简介

- Control4 Corp.(Snap One LLC)

- Lutron Electronics Co. Inc.

- Signify Holding

- Wyze Labs Inc.

- Sengled

- GE Lighting(Savant Systems Inc.)

- Inter IKEA Holding BV

- Acuity Brands Inc.

- Hubbell Incorporated

- Crestron Electronics Inc.

- Insteon(Smartlabs Inc.)

- EGLO Leuchten GmbH

- Eve Systems GmbH

- LG Electronics Inc.

- Wiz Connected Lighting Co. Ltd

- Wipro Lighting Limited

- Xiaomi Corporation

- LIFX(Feit Electric)

第9章控制系统供应商市场占有率分析

第十章投资分析

第十一章市场的未来

The Smart Lighting Market size is estimated at USD 19.65 billion in 2024 and is expected to reach USD 46.79 billion by 2029, registering a CAGR of 18.94% during the forecast period. Due to its societal benefits, consumers might adopt energy-efficient LED technology more rapidly, so replacing the inferior compact fluorescent or halogen lighting technologies could be accelerated.

Key Highlights

- The popularity and demand for lights have grown in both commercial and residential spaces due to their ability to connect with IoT devices and generate a variety of ambient lighting using only smartphones or tablets. Smart lights can be dimmed with different color tones depending on the situation, schedule their on/off times, track their energy consumption, and connect to other devices via Wi-Fi, Bluetooth, SmartThings, Z-Wave, or ZigBee.

- Office spaces are also emerging as one of the common smart lighting applications. In today's business world, owners and managers are placing more emphasis on the overall well-being of their employees. By switching to smart lighting, offices can provide bright light for their employees. This helps them see better and experience less eye fatigue. Additionally, the color of the light can help brighten moods and provide comfort.

- Furthermore, favorable government regulations regarding conventional lighting and energy consumption across the United States, the European Union, China, and India are anticipated to favor the market demand for connected LED lighting.

- However, the slow growth of the smart lighting market may result in entrepreneurial challenges. The consequences of a market entry failure for producers of smart-lighting products comprise significant sunk investments and reputational damage. To address these concerns, manufacturers are finding the need to consider consumer views of smart-home technologies in general and smart-lighting products in particular.

- The emergence of COVID-19 caused a halt in production and disruption throughout the supply chain, impairing industrial output growth and reducing the capacity for light manufacturing across important manufacturing hubs. However, as people spent more time at home, they became more inclined to upgrade the interiors, which positively impacted the market. Additionally, it is anticipated that the growing use of LEDs in homes and the penetration of smart home technology will further fuel market growth in the coming years.

Smart Lighting Market Trends

Government Regulations Mandating the Use of LEDs to Drive the Market

- Government regulations mandating the use of LEDs are boosting the market demand in several regions. For instance, in the United States, as the law mandates energy savings to be 45 lumens per watt for the most common types of light bulbs, a typical 60-watt incandescent light bulb puts out about 15 lumens per watt, a halogen incandescent bulb offers about 20 lumens per watt, CFL bulb offers 65 lumens per watt, and LEDs put out 80-100 lumens per watt with a fraction of energy. In addition, the price drop in LEDs has led to a further increase in smart lighting adoption.

- Through performance standards, labeling, and incentive programs, many governments worldwide are moving quickly to phase out inefficient light sources, as in Europe, where the switch to LED technology began more than 10 years ago. Recent updates to the Ecodesign Directive and the Restriction of Hazardous Substances Directive by the European Union will effectively phase out all fluorescent lighting by 2023. Further, in January 2023, the Government of Ukraine announced the approval of a program to replace incandescent light bulbs with light-emitting diode (LED) light bulbs. This initiative is part of the European Union's support of Ukraine's energy front.

- A regionally harmonized lighting standard has been adopted by 16 African nations that make up the Southern African Development Community (SADC). This standard's market will transition entirely to LED in the coming years. The East African Community (EAC) is also phasing out fluorescent lighting in six member nations. Other jurisdictions, including Southeast Asian nations, are implementing similar regulations. This is expected to drive the growth of the market studied.

- According to the US Department of Energy, widespread use of LED lighting is expected to impact energy savings in the US greatly. As a result, many lighting installations are expected to use LED technology, and energy savings from LED lighting could reach 569 TWh annually by 2035, equal to the annual energy output of approximately 92 1,000 MW power plants.

Asia-Pacific to Witness Fastest Growth

- The increasing adoption of the Internet of Things (IoT) is expected to brighten the development of the lighting market in China, thereby increasing the growth of connected smart lighting systems in the country. GSMA estimates that China may account for around 4.1 billion IoT connections, which is almost one-third of the worldwide IoT connections, by 2025. Smart lighting systems are expected to be the biggest beneficiary of the trend during the forecast period.

- The Japanese market has witnessed the launch of a series of smart home products tailored for them from global tech giants, such as Google and Amazon. Amid the gloom surrounding the reduced penetration rate of traditional home appliances Y-o-Y in the country, the smart home industry promises unlimited potential in the future, owing to the rising integration of AI-empowered products and services in homes.

- The market for smart lighting in the country is also driven by the increased adoption of smart devices, including smartphones, due to their ability to connect conveniently to IoT devices. Japan Smartphone Security Association (JSSEC) estimates that the number of smartphone users in the country may reach 68.8 million by 2022.

- The demand for smart lighting in India is expected to grow owing to the increasing demand for features such as voice recognition or remote operation and the exceptional experience of smart home automation. Rising adoption of LED lights in various sectors such as residential, healthcare, and commercial spaces like hotels and workspaces, as well as rising disposable income, are other factors that may drive the growth of these devices in the future.

- Under the Asia-Pacific region, other countries like South Korea, Thailand, Singapore, Malaysia, Sri Lanka, Bangladesh, Australia, Indonesia, etc., also have a high potential for gaining a considerable share in the smart lighting market.

Smart Lighting Industry Overview

The smart lighting market is highly competitive and consists of several major players. However, many companies are increasing their market presence with smart lighting by securing new contracts and acquiring other companies. Signify Holding, Control4 Corp. (Snap One LLC), Wyze Labs Inc., Eaton Corporation, and Savant are key players.

In February 2023, Signify helped the German municipality of Eichenzell become a future-proof smart city through intelligent street lighting. Its BrightSites solution brings fast, wireless broadband connectivity to the city, allowing Eichenzell to cater to next-generation IoT applications and future 5G densification. Signify installed LED lighting, which the Interact City System manages. Eichenzell can continuously monitor and manage all lights from a single dashboard.

In January 2023, Savant company GE Lighting announced the expansion of its smart home ecosystem, Cync. Cync unveiled its entire Dynamic Effects entertainment lineup, which includes 16 million colors, pre-set and custom light shows, on-device music syncing, and other features. In addition, following a successful launch last year, Cync has expanded its Wafer light fixture line.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Smart Lighting Industry

- 4.5 PESTLE Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Energy Saving at Homes

- 5.1.2 Government Regulations Mandating the Use of LEDs

- 5.2 Market Challenges

- 5.2.1 Lack of Awareness Regarding Selection and Installation of Products

- 5.3 Market Opportunities

- 5.3.1 Increasing Adoption of IoT in Emerging Economies

6 WIRELESS CONNECTIVITY STANDARD TYPES USED IN RESIDENTIAL SMART LIGHTING PRODUCTS

- 6.1 Wi-Fi

- 6.2 Bluetooth

- 6.3 ZigBee

7 MARKET SEGMENTATION

- 7.1 By Product Type

- 7.1.1 Control System

- 7.1.1.1 Wired

- 7.1.1.2 Wireless

- 7.1.2 Smart Lamps and Fixtures

- 7.1.1 Control System

- 7.2 By Geography

- 7.2.1 North America

- 7.2.1.1 United States

- 7.2.1.2 Canada

- 7.2.2 Europe

- 7.2.2.1 United Kingdom

- 7.2.2.2 Germany

- 7.2.2.3 France

- 7.2.2.4 Spain

- 7.2.2.5 Rest of Europe

- 7.2.3 Asia-Pacific

- 7.2.3.1 China

- 7.2.3.2 Japan

- 7.2.3.3 India

- 7.2.3.4 Rest of Asia-Pacific

- 7.2.4 Latin America

- 7.2.5 Middle East and Africa

- 7.2.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Control4 Corp. (Snap One LLC)

- 8.1.2 Lutron Electronics Co. Inc.

- 8.1.3 Signify Holding

- 8.1.4 Wyze Labs Inc.

- 8.1.5 Sengled

- 8.1.6 GE Lighting (Savant Systems Inc .)

- 8.1.7 Inter IKEA Holding BV

- 8.1.8 Acuity Brands Inc.

- 8.1.9 Hubbell Incorporated

- 8.1.10 Crestron Electronics Inc.

- 8.1.11 Insteon (Smartlabs Inc.)

- 8.1.12 EGLO Leuchten GmbH

- 8.1.13 Eve Systems GmbH

- 8.1.14 LG Electronics Inc.

- 8.1.15 Wiz Connected Lighting Co. Ltd

- 8.1.16 Wipro Lighting Limited

- 8.1.17 Xiaomi Corporation

- 8.1.18 LIFX (Feit Electric)