|

市场调查报告书

商品编码

1404411

施工机械远端资讯处理-市场占有率分析、产业趋势与统计、2024年至2029年成长预测Construction Machinery Telematics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

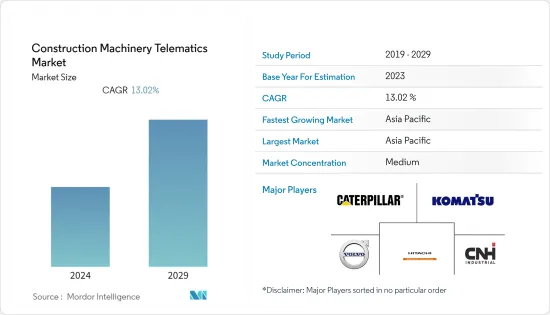

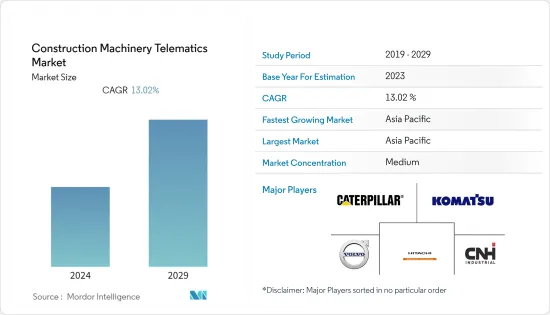

施工机械远端资讯处理市场规模预计为 11.9 亿美元,预计将达到 24.8 亿美元,预测期内复合年增长率为 13.02%。

主要亮点

- 施工机械远端资讯处理市场是施工机械产业中一个动态发展的领域。快速都市化、工业化、政府对基础设施开发的投资增加、全部区域房地产和建设公司的扩张和成长活动等因素预计将推动市场需求。

- 施工机械远端资讯处理市场是由消费者对机器效率日益增长的需求所推动的。行动技术在施工机械中的使用迅速增加,例如智慧型手机和接近侦测警报和防撞系统等 ADAS(高级驾驶辅助系统)功能,也推动了远端资讯处理在施工机械中的采用。然而,由于复杂性和高价格的特点,车队营运商不愿意采用这些技术,这对预测期内施工机械远端资讯处理市场的成长产生了负面影响。

- 推动市场成长的关键因素之一是不断成长的建筑业,尤其是在新兴国家,因为基础设施、住宅和非住宅领域存在许多成长机会。随着人口成长和都市化进程,道路、高速公路、智慧城市、地铁、桥樑、高速公路建设的建设公司不断增多,投资不断增加。

- 中国、印度和巴西等新兴经济体的人口成长和快速都市化导致建设活动和基础设施发展激增,推动了对重型设备的需求。重型施工机械的增加预计将有助于未来几年机械远端资讯处理市场的成长。

施工机械远端资讯处理市场趋势

挖掘机领域主导施工机械远端资讯处理市场

- 近年来,远端资讯处理在挖土机中的采用经历了显着增长,这主要归功于技术的进步和电动模型的引入。远端资讯处理技术已在挖土机中使用了数十年,但近年来车队所有者和营运商对远端资讯处理解决方案的需求激增。

- 例如,2023年3月,凯斯建筑设备公司宣布推出两款电动迷你挖土机CX15EV和CX25EV,标配SiteWatch远端资讯处理系统。此培训提供了对机器性能的宝贵见解,并促进与当地 CASE 经销商合作的无缝车队管理。

- 然而,该行业面临的一个主要挑战是小型挖土机车队营运商需要更多地采用远端资讯处理技术。这是由于使用远端资讯处理的复杂性以及与获取此类模型相关的成本。如今,远端资讯处理的主要用户是大型挖土机车队的操作员,他们利用这些资料来改善设备管理和整体业务效率。

- 市场上的许多公司都在积极推广整合了先进远端资讯处理解决方案的挖土机,这些解决方案可实现远距离诊断、GPS 追踪和全面的车队管理等功能。例如,2023 年 5 月,德维隆宣布推出两款新 6 吨 Stage V 迷你挖土机 DX62R-7 和 DX63-7,它们标配了 DevelonFleet Management TMS 3.0 Cellular 系统。该系统透过收集挖掘机上安装的各种感测器的资料,为挖土机提供强大的远端资讯处理管理平台。

- 考虑到这些因素,远端资讯处理在挖土机中的使用预计在未来几年将继续快速扩大。

亚太地区预计将继续保持较高的市场占有率

- 推动市场研究的关键因素包括该地区建设业的成长、大量重型设备的可用性以及行动装置消费群的不断增长。

- 中国是亚太地区主要国家之一,在经济成长的支撑下,建设活动蓬勃发展。该国的成长率很高,但逐渐放缓(随着人口老化和经济从投资转向消费、从製造业转向服务业、从外需转向内需的再平衡)。

- 儘管房地产行业成长不稳定,但中国政府大力发展铁路和公路基础设施(以满足工业和服务业需求),导致建筑业强劲成长。由于公共和私人公司在建筑业占据主导地位,公共支出和私人支出的增加可能会推动该行业进入全球领导地位。近年来,中国大型建设公司(来自欧盟)的涌现进一步刺激了该行业的发展。

- 2022-23财年,印度施工机械产业成长率约15%。施工机械製造业的成长与需求驱动因素密切相关。主要需求属性为道路建设、灌溉、城市发展和采矿。由于都市化、基础设施发展以及建筑和采矿业的成长等多种因素,印度工业对土木机械的需求不断增加。印度政府透过国家基础设施管道(NIP)和使命智慧城市等措施重点关注基础设施发展,进一步拉动了对陆路运输设备的需求。

- 儘管一些建筑业面临短期挑战,但印度的中长期成长故事保持不变。由于基础建设产业部门是印度经济成长的重要支柱,预计印度建筑业在预测期内将稳定成长。该国政府正在采取各种倡议,在没有时间限制的情况下发展优良的基础设施。

- 日本政府也密切关注该国未来预计将确认的重大长期计划(磁浮列车的长期和短期发展计画)。例如,高速公路网的升级以及通往东京羽田机场的新铁路线。预计2022年开工,投资3亿日圆,2029年开工。因此,这些积极的成长趋势预计将提振日本建筑市场。

- 其他亚太国家包括马来西亚、印尼、新加坡、越南、澳洲和韩国东南亚国协。这些国家经历了持续成长,对住宅和商业建筑的需求不断增加。

- 地区当局的此类积极倡议预计将在预测期内扩大,从而支持施工机械远端资讯处理市场在预测期内的成长。

施工机械联网产业概况

几家主要企业主导市场,包括卡特彼勒、小鬆有限公司、日立建筑设备公司、现代建筑设备有限公司和沃尔沃建筑设备公司。为了满足施工机械营运商不断增长的需求,许多施工机械製造商都致力于将尖端的远端资讯处理解决方案融入他们的产品中。例如

2023 年 6 月,总部位于苏塞克斯的 Southern Cranes 宣布与 Webfleet 合作伙伴 AES 车队建立合作关係。该公司已开始在其 91 辆起重机、货车和重型车辆组成的庞大车队中推出整合式摄影机远端资讯处理解决方案。

2023 年 5 月,特雷克斯越野起重机推出了越野起重机 TRT 65,配备了特雷克斯T-Telematics 解决方案,为起重机提供即时性能资料。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 建筑和基础设施活动的活性化推动了需求

- 连网型技术推动市场成长

- 市场挑战

- 初始成本高

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(市场规模-美元)

- 按机器类型

- 起重机

- 挖土机

- 伸缩搬运

- 装载机和后铲

- 其他机器类型

- 按销售管道

- OEM

- 售后市场

- 透过远端资讯处理功能

- 追踪

- 诊断功能

- 其他远端资讯处理功能

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 其他的

- 南美洲

- 中东/非洲

- 北美洲

第六章竞争形势

- 供应商市场占有率

- 公司简介

- Komatsu Ltd

- Caterpillar Inc.

- Volvo Construction Equipment

- Joseph Cyril Bamford Excavators Ltd(JCB)

- Hitachi Construction Machinery Co. Ltd

- CNH Industrial NV

- Deere & Company

- Hyundai Construction Equipment

- Liebherr Group

- Doosan Infracore Ltd

- ACTIA Group

- Geotab

- Trimble Inc.

- Orbcomm

- Octo Telematics

第七章 市场机会及未来趋势

- 改变车主对远距资讯处理的偏好

The construction machinery telematics market size is estimated at USD 1.19 billion and is expected to reach USD 2.48 billion, registering a CAGR of 13.02% during the forecast period.

Key Highlights

- The construction machinery telematics market is a dynamic and evolving sector within the construction machinery industry. Factors such as rapid urbanization, industrialization, rising government investments in infrastructure development, and expansion and growth activities of the real estate and construction companies across the region are expected to enhance demand in the market.

- The construction machinery telematics market is driven by consumers' growing demand for machinery efficiency. The surge in the usage of portable technology in construction machinery, such as smartphones and advanced driver assistance systems (ADAS) features, like proximity detection alerts and collision avoidance systems, has also pushed the adoption of telematics in construction machinery. However, complexity and high price features make fleet operators reluctant toward these technologies, negatively affecting the growth of the construction machinery telematics market during the forecast period.

- One of the major factors driving the market's growth is the growing construction industry, especially in developing countries, owing to numerous growth opportunities in infrastructure, residential, and non-residential sectors. The rise in construction companies and increasing investments in the construction of roads, highways, smart cities, metros, bridges, and expressways due to the growing population and urbanization.

- Growing population and rapid urbanization in emerging economies such as China, India, and Brazil have resulted in a surge in construction activities and infrastructure development, fueling demand for heavy machinery. The increasing heavy machinery for construction machinery is likely to contribute to the growth of the machinery telematics market over the coming years.

Construction Machinery Telematics Market Trends

The Excavators Segment Dominated the Construction Machinery Telematics Market

- The adoption of telematics in excavators has experienced significant growth in recent years, primarily due to technological advancements and the introduction of electric models into the market. While telematics has been in use in excavators for decades, the demand from fleet owners and operators for telematics solutions has surged in recent times.

- For instance, in March 2023, CASE Construction Equipment unveiled two electrified mini excavators, the CX15EV and CX25EV, both equipped with SiteWatch telematics as a standard feature. This inclusion provides invaluable insights into machine performance and facilitates seamless fleet management in collaboration with local CASE dealers.

- However, a major challenge facing the industry is the need for more adoption of telematics technology among small-scale excavator fleet operators. This can be attributed to the perceived complexity of telematics usage and the cost associated with acquiring such models. Presently, the primary users of telematics are operators of large-scale excavator fleets who leverage this data to enhance equipment management and overall business efficiency.

- Many companies in the market are actively promoting excavators integrated with advanced telematics solutions, enabling features like remote diagnostics, GPS tracking, and comprehensive fleet management. For instance, in May 2023, Develon introduced two new 6-tonne Stage V mini-excavators, the DX62R-7 and DX63-7, both featuring the DevelonFleet Management TMS 3.0 Cellular system as a standard component. This system offers a robust telematics management platform for excavators by collecting data from various sensors installed on the machines.

- Considering these factors, the usage of telematics in excavators is expected to continue its rapid expansion in the coming years.

The Asia-Pacific Region is Expected to Continue to Account Highest Market Share

- Some of the major factors that may aid in driving the market studied are the growing construction industry in the region, the availability of a large number of heavy equipment, and the rising consumer base of mobile devices.

- China is also one of the major countries in the Asia-Pacific, with ample construction activities being supported by its growing economy. The country's growth rate is high but is gradually moving toward moderate (as the population ages and the economy rebalances from investment to consumption, from manufacturing to services, and from external to internal demand).

- Despite the volatile growth of the real estate sector, significant developments by the Chinese government in rail and road infrastructure (to meet demand from industries and services) are growing services) has led to significant growth in the construction sector. As public and private companies dominate the construction sector, increasing public and private spending will propel the sector to a global leadership position. In recent years, the emergence of large construction companies (from the European Union) in China has further fueled the development of this sector.

- During the financial year 2022-23, the Indian construction equipment sector recorded a growth rate of about 15%. Growth in construction equipment manufacturing is tied to demand drivers. The key demand attributes are road construction, irrigation, urban development, and mining. The demand for earthmoving equipment in the Indian industry is increasing due to various factors such as urbanization, infrastructure development, and growth in the construction and mining sectors. Mine. Demand for land transport equipment is further fueled by the Indian government's focus on infrastructure development through initiatives such as the National Infrastructure Pipeline (NIP) and Mission Smart City.

- Despite near-term challenges in certain construction sectors, the medium to long-term growth story in India remains intact. The construction industry in India is expected to grow steadily over the forecast period, as the infrastructure sector is a key pillar for the growth of the Indian economy. The government is taking various initiatives to ensure the time-bound creation of excellent infrastructure in the country.

- The Japanese government is also constantly focusing on major long-term projects (the Maglev railway long-term and short-term development plans) that the country is expected to witness in the future. For instance, an upgrade of highway networks and a new rail link to Haneda Airport in Tokyo. The construction is expected to begin by 2022 with an investment of JPY 300 million and open the line by 2029. Hence, such positive growth trends are anticipated to boost the Japanese construction market.

- The Rest of Asia-Pacific includes ASEAN countries, such as Malaysia, Indonesia, Singapore, Vietnam, Australia, as well as South Korea. With the consistent growth in these countries, the demand for both residential and commercial buildings is continually increasing.

- Such active initiatives by regional authorities are expected to grow over the forecast period and hence support the growth of the construction machinery telematics market over the forecast period.

Construction Machinery Telematics Industry Overview

Several key players dominate the market, including Caterpillar, Komatsu Ltd., Hitachi Construction Equipment Co. Ltd., Hyundai Construction Equipment Ltd, Volvo Construction Equipment, and others. To meet the growing demands of construction fleet operators, many construction machinery manufacturers are placing a strong emphasis on integrating cutting-edge telematics solutions into their product offerings. For instance:

In June 2023, Southern Cranes, based in Sussex, announced a partnership with Webfleetpartner AES fleet. They have initiated the deployment of an integrated camera telematics solution across their extensive fleet, which consists of 91 cranes, vans, and heavy haulage transport vehicles.

In May 2023, Terex Rough Terrain Cranes introduced the TRT 65, an off-road crane equipped with the TerexT-Telematics solution, providing real-time performance data for the crane.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Construction and Infrastructure Activities to Drive Demand

- 4.1.2 Connected Technology to Aid in the Growth of the Studied Market

- 4.2 Market Challenges

- 4.2.1 High Upfront Cost

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Machinery Type

- 5.1.1 Crane

- 5.1.2 Excavator

- 5.1.3 Telescopic Handling

- 5.1.4 Loader and Backhoe

- 5.1.5 Other Machinery Types

- 5.2 By Sales Channel Type

- 5.2.1 OEM

- 5.2.2 Aftermarket

- 5.3 By Telematic Feature

- 5.3.1 Tracking

- 5.3.2 Diagnostic

- 5.3.3 Other Telematics Features

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Komatsu Ltd

- 6.2.2 Caterpillar Inc.

- 6.2.3 Volvo Construction Equipment

- 6.2.4 Joseph Cyril Bamford Excavators Ltd (JCB)

- 6.2.5 Hitachi Construction Machinery Co. Ltd

- 6.2.6 CNH Industrial NV

- 6.2.7 Deere & Company

- 6.2.8 Hyundai Construction Equipment

- 6.2.9 Liebherr Group

- 6.2.10 Doosan Infracore Ltd

- 6.2.11 ACTIA Group

- 6.2.12 Geotab

- 6.2.13 Trimble Inc.

- 6.2.14 Orbcomm

- 6.2.15 Octo Telematics

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Fleet Owners Preferences Towards Telematics