|

市场调查报告书

商品编码

1404420

汽车超级电容器 -市场占有率分析、产业趋势/统计、2024-2029 年成长预测Automotive Ultra-capacitor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

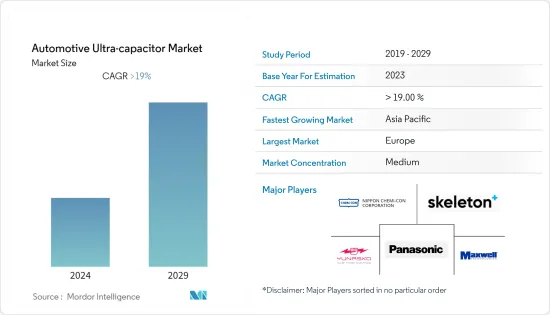

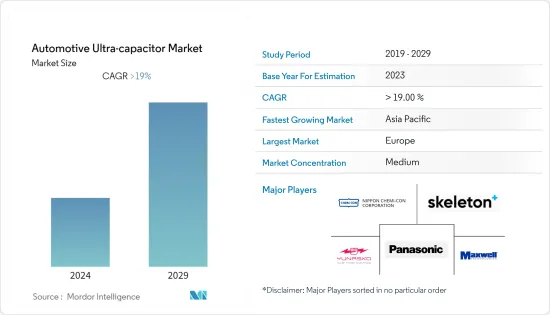

汽车超级电容器市场目前价值15亿美元。

预计未来五年将成长至 42.7 亿美元,预测期内收益复合年增率为 19%。

从中期来看,由于颁布了更严格的排放气体和燃油效率法规,以及政府加强补贴和福利等措施来增加电动车的普及,预计在预测期内将出现强劲增长。

超级电容器的使用扩大了电池负载,使汽车製造商能够实现燃油效率、延长电池寿命、减轻车辆重量并减少二氧化碳排放。超级电容器可能会在所有类型的车辆中迅速普及,包括传统车辆、混合和电动车,以满足世界各地日益严格的排放法规。

超级电容器通常与汽车电池并联,以支援启动/停止和再生煞车应用中出现的短时(小于 30 秒)尖峰负载需求。超级电容器提供的高能量、快速充电和放电能力促使汽车製造商将其部署在启动/停止和再生煞车系统中。汽车内燃机、燃料电池和蓄电池等初级能源已被认为在满足峰值功率需求和为上述应用捕获能量方面效率低下。

汽车超级电容器市场趋势

日益严格的废气法规和对电动车的需求不断增加

世界各国政府都在製定雄心勃勃的排放目标,而增加电动车的使用被视为实现这些目标的一种方式。例如,欧盟(EU)的目标是到2030年将温室气体排放减少55%,中国则制定了2025年使新车销售量的25%为电动车的目标。

大多数电动车所使用的锂离子电池在能量密度、充电时间和整体性能方面都有了很大的改善。这使得电动车更加实用,对消费者也更有吸引力。

对电动车不断增长的需求将导致电池化学和材料的技术进步。需要更先进、更有效率的汽车电池来确保安全和性能。许多着名的汽车製造商都致力于与汽车电池製造公司建立长期的业务关係。例如

- 2023年6月,Panasonic控股的负责人表示,该日本公司打算在三年内将与特斯拉共同管理的内华达州工厂的电动车电池产量提高10%。松下能源计画在内华达州超级工厂增设第 15 条生产线。松下能源在会上宣布,计划在2026年3月将内华达工厂的产能提高10%。

美国环保署 (EPA) 和美国运输部国家公路交通安全管理局 (NHTSA) 正在推动环保车辆(小客车和商用车)的生产,以确保提高燃油效率并减少碳排放。正在努力支持。透过这些努力,政府计画在2025年减少约31亿吨二氧化碳排放,节省约60亿桶石油。

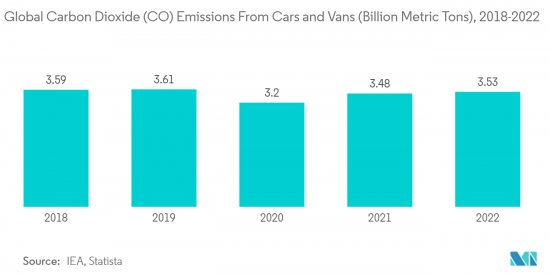

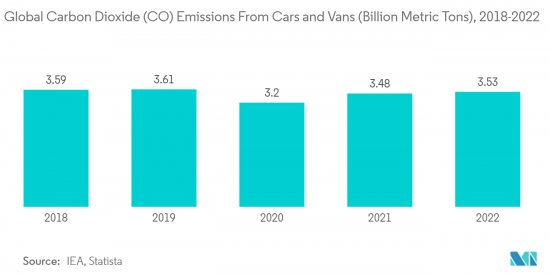

此外,欧盟 (EU) 还制定了排放标准,规范小客车和商用车的二氧化碳排放量。近年来,交通运输排放增加,目前占欧盟温室气体排放的四分之一。

因此,欧盟委员会、欧洲议会和欧盟成员国正准备将轻型车辆的二氧化碳排放法规从 2025 年延长至 2030 年。此外,为了满足上述标准,超级电容器的采用正在增加,预计在预测期内也会出现类似的趋势。

由于上述全球市场的开拓,市场可能在预测期内显着成长。

亚太地区和欧洲主导汽车超级电容器市场

欧洲地区混合动力汽车和电动车的销售量快速成长,超级电容器的需求预计将成长,以满足车辆电能的最佳利用。

每个地区的汽车製造商和生态系统相关人员已经开始根据客户需求和偏好来适应不断变化的地区模式。由于汽车需求的增加和全球生活水准的提高,研究目标市场预计将扩大。此外,都市化的加速和人口增长创造了对汽车的需求。

由于基础设施的开拓和汽车销售的增加,预计亚太市场在预测期内将以更快的速度成长。此外,汽车中大量使用电子元件的中国在收益方面领先市场,其次是日本、韩国和印度。

中国是全球最大的电动车生产国和消费国。销售目标、有利的立法和城市空气品质目标支持国内需求。例如,

- 中国对电动车和混合动力汽车製造商实施了配额,其销量必须至少占新车销量的10%。此外,为了鼓励民众转换电动车,北市每月只发放1万张内燃机汽车登记许可证。

中国已经在混合公车中使用超级电容。这些公车配备了起停引擎和超级电容,可减少电池的负载,并延长其使用寿命。

随着不断的技术创新,中国製造商正在扩大其超级电容产品组合。中国中车是中国国有铁路车辆製造商和全球最大的铁路建设公司,它开发了一种基于石墨烯的超级电容,有潜力为电动公车提供更高效率和更长的供电。

汽车超级电容器产业概况

汽车超级电容器市场由 Maxwell Technologies、Skeleton Technologies、Kemet Corporation 和 Panasonic Corporation 等几家主要企业主导。在预测期内,製造设施的快速扩张、汽车製造商和零件製造商之间合作伙伴关係的加强可能会显示出市场的显着成长。例如

- 2023 年 3 月,Invest Estonia 和 Skeleton Technologies 从德国政府和萨克森州获得了 5,374 万美元,用于在莱比锡建造第二个生产装置。透过这笔基金,该公司扩大了超级电容器等产品范围。

- 2022 年 10 月,Skeleton Technologies 发布了超级电池,并宣布壳牌作为合作伙伴。 SuperBattery是一项结合了超级电容器和电池特性的创新技术。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 电动车需求增加

- 市场抑制因素

- 与产品相关的高成本

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(市场规模(美元))

- 按用途

- 开始/停止操作

- 再生煞车系统

- 其他用途

- 按车型

- 小客车

- 商用车

- 按销售管道

- 目的地设备製造商(OEM)

- 售后市场

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 欧洲其他地区

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 其他的

- 南美洲

- 中东/非洲

- 北美洲

第六章竞争形势

- 供应商市场占有率

- 公司简介

- Maxwell Technologies

- Skeleton Technologies

- Panasonic Corporation

- Nesscap Battery

- Nippon Chem-Con Corporation

- Hitachi AIC Inc.

- ELNA America Inc.

- LOXUS Inc.

- Yunasko Ltd

- Nichicon Corporation

- LS Mtron Ltd

第七章 市场机会及未来趋势

The automotive ultra-capacitor market is valued at USD 1.50 billion in the current year. It is anticipated to grow to USD 4.27 billion by the next five years, registering a CAGR of 19% in terms of revenue during the forecast period.

Over the medium term, the enactment of stringent emissions and fuel economy norms and increasing government initiatives, in terms of subsidies and benefits for increasing the adoption rate of electric vehicles, is expected to witness major growth during the forecast period.

The use of ultra-capacitors expanded the battery load and enabled vehicle manufacturers to achieve fuel efficiency, extended battery life, reduced vehicle weight, and reduced CO2 emissions. Ultra-capacitors are likely to penetrate at a faster rate in all vehicle types, including conventional, hybrid, and electric vehicles, to meet the growing stringent emission rules across the world.

Ultra-capacitors, typically connected in tandem with vehicle batteries, support peak load demands for short intervals (which are less than 30 seconds) encountered during start/stop and regeneration braking applications. The capacity for quick recharge and discharge of high energy offered by ultra-capacitors drove the vehicle manufacturers to deploy them in the start/stop systems and regenerative braking systems. Primary energy sources, like internal combustion engines, fuel cells, and batteries in vehicles, were identified to be inefficient in handling peak power demand or recapturing energy during the applications above.

Automotive Ultra-capacitor Market Trends

Growing Stringent Emission Regulations and Increase in demand for Electric Vehicles

Governments around the world are setting ambitious targets to reduce emissions, and promoting the use of electric vehicles is seen as one way to achieve these goals. For instance, the European Union aims to reduce its greenhouse gas emissions by 55% by 2030, and China set a target of having 25% of new cars sold by 2025 to be electric.

Lithium-ion batteries, which are used in most electric vehicles, saw a significant improvement in terms of energy density, charging time, and overall performance. It made electric vehicles more practical and appealing to consumers.

The growing demand for EVs will lead to technological advancements in battery chemistry and materials. It will require more sophisticated and efficient automotive batteries to ensure safety and performance. Many prominent automobile manufacturers are focusing on building long-term business relationships with automotive battery manufacturing companies. For instance,

- In June 2023, according to a Panasonic Holdings representative, the Japanese corporation intends to increase the output of electric vehicle batteries at a Nevada factory jointly managed with Tesla by 10% within three years. Panasonic Energy plans to add a 15th production line to the Gigafactory Nevada. At a meeting, Panasonic Energy announced a proposal to boost the Nevada factory's manufacturing capacity by 10% by March 2026.

The United States Environmental Protection Agency (EPA) and the National Highway Traffic Safety Administration (NHTSA) are taking initiatives to support the production of eco-friendly vehicles (both passenger vehicles and commercial vehicles) to ensure improved fuel economy and reduced carbon emissions. Through these initiatives, the government is planning to reduce about 3,100 million metric tons of CO2 emissions and save about 6 billion barrels of oil by 2025.

Additionally, the European Union (EU) set emission standards to regulate the CO2 emission levels of passenger cars and commercial vehicles. Transport emissions increased in recent years and now account for a quarter of the EU's total GHG emissions.

As a result, the European Commission, European Parliament, and EU member states are preparing to extend the light-duty vehicles' CO2 regulation to 2025-2030. Furthermore, to meet the standards above, the adoption of the ultra-capacitor is increasing and is expected to witness the same trend during the forecast period.

With the development mentioned above across the globe, the market is likely to witness major growth during the forecast period.

Asia-Pacific and Europe to Dominate the Automotive Ultra-capacitor Market

With the rapidly growing hybrid and electric vehicle sales in the European region, the demand for ultra-capacitors is anticipated to grow to meet the optimal utilization of electric energy in vehicles.

Automotive manufacturers and ecosystem stakeholders in each region began to adapt to the changing regional patterns based on customer needs and preferences. The market studied is expected to expand due to rising vehicle demand and rising living standards around the globe. Furthermore, increased urbanization and an increasing population created a demand for automobiles.

The Asia-Pacific market is expected to grow at a faster pace during the forecast period, owing to development in infrastructure and increased vehicle sales. Furthermore, China is leading the market in terms of revenue due to its massive use of electronic components in vehicles, followed by Japan, Korea, and India.

China is the largest manufacturer and consumer of electric vehicles in the world. Sales targets, favorable laws, and municipal air-quality targets are supporting domestic demand. For instance,

- China imposed a quota on manufacturers of electric or hybrid vehicles, which must represent at least 10% of total new sales. Also, the city of Beijing only issues 10,000 permits for the registration of combustion engine vehicles per month to encourage its inhabitants to switch to electric vehicles.

China is already using supercapacitors in hybrid buses. These buses are equipped with stop-start engines, in which supercapacitors reduce the load on the battery, which increases the lifetime of the batteries.

Due to continuous innovation, Chinese manufacturers are expanding their supercapacitor portfolio. The CRRC, the Chinese state-owned rolling stock manufacturer and the world's largest train builder developed graphene-based supercapacitors that may power electric buses with higher efficiency and for a longer period.

Automotive Ultra-capacitor Industry Overview

The automotive ultra-capacitor market is dominated by several key players, such as Maxwell Technologies, Skeleton Technologies, Kemet Corporation, and Panasonic Corporation, among others. The rapid expansion of manufacturing facilities and an increase in partnership between the vehicle manufacturer and the component manufacturer is likely to witness major growth for the market during the forecast period. For instance,

- In March 2023, Invest Estonia and Skeleton Technologies received USD 53.74 million from the German government and the state of Saxony for its second production unit to be built in Leipzig. Through this fund, the company expanded its products, including ultra-capacitor.

- In October 2022, Skeleton Technologies introduced its SuperBattery and unveiled Shell as a partner. SuperBattery is an innovative technology combining the characteristics of supercapacitors and batteries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rise in demand for Electric Vehicles

- 4.2 Market Restraints

- 4.2.1 High Cost Associated With Product

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value (USD))

- 5.1 By Application

- 5.1.1 Start-stop Operation

- 5.1.2 Regenerative Braking System

- 5.1.3 Other Applications

- 5.2 By Vehicle Type

- 5.2.1 Passenger Car

- 5.2.2 Commercial Vehicle

- 5.3 By Sales Channel

- 5.3.1 Original Equipment Manufacturer (OEM)

- 5.3.2 Aftermarket

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Maxwell Technologies

- 6.2.2 Skeleton Technologies

- 6.2.3 Panasonic Corporation

- 6.2.4 Nesscap Battery

- 6.2.5 Nippon Chem-Con Corporation

- 6.2.6 Hitachi AIC Inc.

- 6.2.7 ELNA America Inc.

- 6.2.8 LOXUS Inc.

- 6.2.9 Yunasko Ltd

- 6.2.10 Nichicon Corporation

- 6.2.11 LS Mtron Ltd