|

市场调查报告书

商品编码

1404422

PLM 软体:市场占有率分析、产业趋势/统计、成长预测,2024-2029 年PLM Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

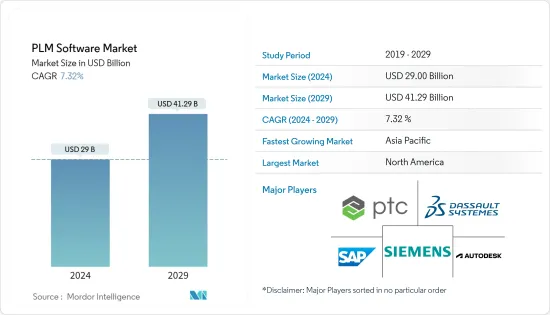

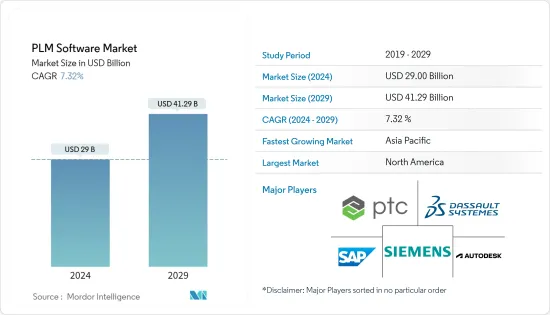

PLM 软体市场规模预计到 2024 年将达到 290 亿美元,预计到 2029 年将达到 412.9 亿美元,在预测期内(2024-2029 年)复合年增长率为 7.32%。

业界对强大的资料分析软体平台的需求不断增长。这一趋势也得到了整个製造业越来越多地采用物联网的支持。 PTC 的 Windchill 是 PLM 软体的一个范例,它为寻求 IoT 功能的离散製造商提供了分析功能。该软体可以提高 PLM 解决方案的弹性。

主要亮点

- 数位化将产品从实体商品和有形服务转变为数数位双胞胎,即实体产品的复製品。工业4.0是一项重要倡议,旨在透过降低生产成本来提高竞争力,同时利用产品数位化来提高产品品质和生产扩充性。 SAP正在探索数位供应链场景,让各个供应商直接向区块链平台提交报价,从而提高整个业务网路的效率。

- 此外,PLM 还可以缩短核准时间并加快产品上市速度,从而帮助实施公司减少延误和成本。例如,2022 年 9 月,AVEVA Solutions Limited 与 Aras 建立了策略OEM合作伙伴关係,提供工业「资产生命週期管理」解决方案。 AVEVA 已授权 Aras Innovator Platform 提供一套高度扩充性的资产生命週期管理解决方案,该解决方案将 Aras 灵活、开放的应用程式组合与 AVEVA 资产资讯管理和 AVEVA 统一工程整合在一起。

- 生产过程中越来越多地采用工业IoT(IIoT) 正在推动市场对软体应用程式的需求,预计 IIoT 的采用率将在预测期内激增。例如,根据 GSMA Intelligence 的数据,到 2025 年,IIoT 连线物件的数量预计将达到 137 亿个。

- 例如,电动车製造商Simple Energy于2022年1月与西门子合作,实现电动车製造业的数位转型。这家电动车製造商也提到共用技术,包括与 Prolim 共享技术,以加强其在印度的电动车产品组合。作为合作伙伴关係的一部分,Simple Energy 将采用西门子云端基础的产品生命週期管理 (PLM) 软体 Teamcenter X,为其电动车解决方案奠定强大的数位基础。

- 然而,随着两家公司不断提供不同的产品和产品系列来参与市场竞争,互通性问题已经出现,软体公司需要不断优化。软体产品的持续改进使得将软体实施到公司现有的产品系列中更加精简、更易于管理,并且更有可能产生更好的结果。

- 许多製造业受到了 COVID-19大流行的影响,导致供应链出现严重缺口和延误。这迫使许多产业加速工业 4.0 实施和数位转型工作,增加对 PLM 软体的需求,以推动必要的成长率。疫情后软体普及的增加也推动了市场的成长。

PLM软体市场趋势

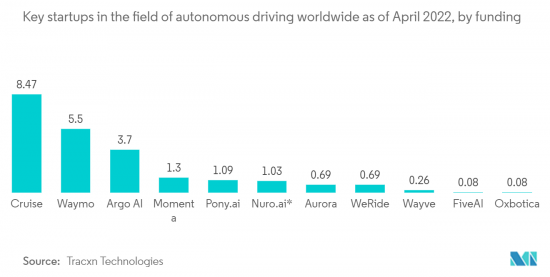

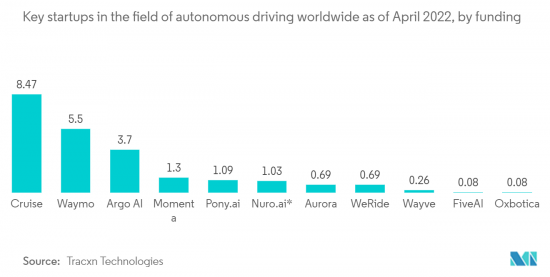

自动驾驶汽车产量的增加推动市场成长

- 随着自动驾驶汽车的快速普及,主要从事自动驾驶汽车开发的开发人员必须面对一些日益复杂的挑战,这需要重新设计现有流程和工具集,并需要进行评估。因此,克服这些挑战的日益增长的需求正在推动市场呈指数级增长。

- 此外,功能齐全的自动驾驶系统结合了各种资料馈送,包括来自感测器的资讯、来自云端的交通资料以及来自其他基础设施和车辆的资料,所有这些都连接到车辆的机械和电子系统。汽车製造商需要使用复杂的软体来连接组件并创建庞大的汽车系统网络,这些系统可以可靠地协同工作,无需用户输入或修改。需要实施。

- 整合的ALM(应用程式生命週期管理)和codeBeamer ALM 等产品开发平台旨在解决自动驾驶汽车领域产品复杂性增加以及产品对高级软体应用程式依赖所带来的挑战。我认为这将有助于实现开发流程的现代化。

- 数位化製造使用的增加和自动驾驶汽车需求的增加是预计在估计期间推动汽车行业 PLM 软体市场的主要趋势。例如,2022 年 10 月,西门子和 Applied EV 宣布建立合作伙伴关係,利用西门子的 PLM 软体来增强自动驾驶汽车的设计、组装和品质保证。西门子软体正在帮助电动车公司透过更好的变革管理和品质来满足对全自动驾驶汽车日益增长的需求。

- 2023 年 6 月,世界上最强大的低代码平台 Aras 宣布,全球汽车製造商 Nissan 将利用 Aras Innovators 来简化车上用软体版本的管理。 。此举正值日产汽车公司扩大电动车产量以满足不断增长的消费者需求之际。

北美占有很大份额

- 北美强大的金融基础使其能够进行大量投资,特别是在提高市场竞争力的先进技术和解决方案方面。此外,该地区也是许多主要产品生命週期管理软体供应商的所在地,包括 IBM 公司、PTC 公司和 Oracle 公司。因此,市场竞争异常激烈。

- 整个北美汽车工业正在快速成长。 PLM 软体主要在产品开发阶段使用,在汽车产业中,这个阶段早在製造开始之前就开始了。 PLM 软体可确保车辆的先进安全功能、电子设备和内建软体内容。因此,随着该地区汽车行业的崛起,预计该市场在整个预测期内将享受各种利润丰厚的成长机会。

- 其他製造业和市场正在探索实施 PLM 软体的好处,以增强其製造和生产流程。例如,2023 年 4 月,西门子和微软将利用生成式人工智慧的集体协作力量,帮助工业企业在其产品的工程、设计、製造和营运生命週期中提高效率和创新。此外,为了加强跨职能协作,两家公司专注于将西门子的 Teamcenter 产品生命週期管理软体与微软的协作平台 Teams、Azure OpenAI 服务的语言模型以及各种其他 Azure AI 功能整合。

- 2022 年 9 月,PTC 宣布推出 Onshape-Arena Connection,这是一项新功能,可连接主要云端原生的 Onshape 产品开发解决方案和 Arena 产品生命週期管理解决方案。透过此连接,公司只需单击一个按钮即可在 Arena 和 Onshape 解决方案之间即时共用产品资料,从而帮助公司增强产品开发流程并简化与供应链合作伙伴的协作。我可以。

- 此类合作强化了整体市场格局,并激励其他竞争和供应商启用 PLM 软体,从而塑造了庞大的 PLM 实施的整个北美市场。因此,产品供应链各个方面的彻底实施正在积极支持北美企业不断发展的工业4.0趋势。

PLM 软体产业概览

产品生命週期管理 (PLM) 软体市场高度分散且竞争激烈,这主要是由于众多全球参与者的存在。各市场参与者充分利用最新的软体技术进行研发,在市场上建立了较高的竞争力。主要参与者包括 Dassault Systemes Deutschland GmbH、Siemens、Autodesk Inc.、ANSYS Inc. 和 Infor Inc.。公司透过建立各种合作伙伴关係、投资计划以及向市场推出新产品来最大化其市场占有率。

2023 年 2 月,Hexagon 旗下公司、全球协作和设计解决方案提供商 Bricsys 宣布与 MechWorks(隶属于 ITI Technegroup、隶属于 WIPRO)建立合作伙伴关係,提供西门子 Teamcenter 软体与 BricsCAD 的整合。此解决方案主要提供业界领先的功能,可更快地连接 BricsCAD 流程,让设计人员能够专注于产品开发。

2022 年 9 月,欧洲数位转型联盟的主要股东 Holland Capital 成功收购了 OnePLM,与 Magnus Digital、Dimensys、Cards PLM Solutions 和 Appronto 形成互补。这创建了欧洲最大的软体服务供应商,使国际客户能够从一流专家提供的大量服务中受益。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- COVID-19 对产品生命週期管理软体市场的影响

第五章市场动态

- 市场驱动因素

- 引入数位化以提高生产力

- 引进云端技术进行资讯集中

- 市场抑制因素

- 不同产品版本之间缺乏互通性

第六章市场区隔

- 依部署类型

- 本地

- 云

- 专业的服务

- 按最终用户产业

- 电子、工业设备、高科技

- 航太/国防

- 车

- 架构、工程与施工 (AEC)

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章竞争形势

- 公司简介

- Siemens AG

- Dassault Systems Deutschland GmbH

- Autodesk Inc.

- PTC Inc.

- SAP SE

- ANSYS Germany GmbH

- Oracle Corporation

- Aras Corporation

- Arena Solutions

- Infor Inc.

第八章投资分析

第9章市场的未来

The PLM Software Market size is estimated at USD 29 billion in 2024, and is expected to reach USD 41.29 billion by 2029, growing at a CAGR of 7.32% during the forecast period (2024-2029).

The demand for robust data analytics software platforms in the industry is increasing. The increasing adoption of IoT across the manufacturing industry has augmented these trends. PTC's Windchill is an instance of the PLM software embedded with analytics for discrete manufacturers looking for IoT capabilities. This software can boost the PLM solution to sprint with flexibility.

Key Highlights

- Digitalization transforms products from physical goods and tangible services into digital twins, replicas of the physical product. Industry 4.0 is an important focus aiming at increasing competitiveness by targeting the reduction of production costs while improving product quality and production scalability by utilizing the digitalization of products. SAP explores digital supply chain scenarios where different suppliers submit offers directly to a blockchain platform to improve effectiveness across their business networks.

- In addition, PLM helps improve approval times and reduce delays by accelerating product introduction to the market, saving costs for adopters. For example, in September 2022, AVEVA Solutions Limited and Aras entered a strategic OEM partnership to deliver industrial 'Asset Lifecycle Management' solutions. AVEVA would license the Aras Innovator platform for providing a series of scalable Asset Lifecycle Management solutions that would integrate Aras' flexible and open portfolio of applications with AVEVA Asset Information Management and AVEVA Unified Engineering.

- The increased adoption of Industrial IoT (IIoT) in the production process is aiding the market demand for software applications, and IIoT adoption is expected to skyrocket over the forecast period. For instance, according to GSMA Intelligence, the number of IIoT-connected objects is expected to reach 13.7 billion by 2025.

- For example, in January 2022, Simple Energy, the EV maker, partnered with Siemens and enabled digital transformation in the EV manufacturing industry. The EV company also mentioned including Prolim to share its technologies to strengthen the EV portfolio in India. As part of the partnership, Simple Energy would adopt Siemen's cloud-based product lifecycle management (PLM) software Teamcenter X to establish a robust digital foundation in e-mobility solutions.

- However, as the companies continue to provide different products and product ranges to tackle market competitiveness, it creates interoperability issues, a matter of constant optimization for the software companies. As continuous improvements continue in the software products, the software implementation in a company's existing product line-up becomes streamlined and manageable, facilitating better results.

- Many manufacturing industries were affected by the COVID-19 pandemic, creating significant supply chain gaps, and leading to delays. This forced many industries to hasten the Industry 4.0 adoption and digital transformation initiatives, boosting the demand for PLM software to bolster the required growth rates. The increased software penetration after the pandemic has boosted market growth.

PLM Software Market Trends

Increasing Production of Autonomous Vehicles to Drive the Market Growth

- Due to the rapid penetration of autonomous vehicles, the developers primarily working on autonomous vehicles have to face several increasingly complex challenges and, consequently, need to reevaluate their existing processes and toolsets. Hence, the rising need to overcome these challenges is fuelling the market's growth exponentially.

- Moreover, the fully functional autonomous driving systems need some of the most complex and sophisticated software implementations that carmakers have ever faced for combining a variety of data feeds, like information from sensors, traffic data from the cloud, data coming from other infrastructure or vehicles, and tying it all into the automobiles's mechanical and electronic components to create a vast network of onboard systems that all work together reliably without the need for user input or correction.

- The integrated ALM (Application Lifecycle Management) and product development platforms, such as codeBeamer ALM, will be instrumental in modernizing development processes for tackling the challenges introduced by the increasing product complexity and the growing reliance of products on sophisticated software applications in the autonomous vehicle sector.

- The rising usage of digital manufacturing and the increasing demand for autonomous cars is a key trend expected to drive the PLM software market in the automotive sector during the estimated period. For instance, in October 2022, Siemens and Applied EV declared a partnership with the EV company to utilize Siemens' PLM software to enhance autonomous vehicle design, assembly, and quality assurance. Siemens' software was helping the EV firm meet the growing demand for fully autonomous vehicles through better change management and quality.

- In June 2023, Aras, which provides the most powerful low-code platform with applications to design, build, and operate complex products, declared that global car manufacturer Nissan Motor Co. Ltd. is utilizing Aras Innovator to streamline the management of complex in-vehicle software variants. This move comes as Nissan extends its electric car production to fulfill the rising consumer demand.

North America to Account for a Significant Share

- North America's strong financial position allows it to invest massively, especially in advanced technologies and solutions that have offered a strong competitive edge within the market. Moreover, the region has a robust presence of several significant product lifecycle management software vendors like IBM Corp., PTC Inc., Oracle Corporation, and many others. Hence, there lies intense competition among the market players.

- The entire automotive industry in North America is growing at a rapid pace. PLM software is primarily utilized in the product development stage, which starts long before manufacturing begins in the automotive industry. It ensures the vehicles' advanced safety features, electronics, and embedded software content. Hence, with the rise in the automotive industry within the region, the market is expected to have various lucrative growth opportunities throughout the forecast period.

- Other manufacturing industries and markets explore the benefits of deploying PLM software to augment manufacturing and production processes. For instance, in April 2023, Siemens and Microsoft are harnessing the overall collaborative power of generative artificial intelligence mainly to help industrial companies drive efficiency and innovation across the engineering, design, manufacturing, and operational lifecycle of the products. Also, to enhance cross-functional collaboration, the companies are focused on integrating Siemens' Teamcenter software for product lifecycle management with the collaboration platform of Microsoft, Teams, and its language models in Azure OpenAI Service, as well as various other Azure AI capabilities.

- In September 2022, PTC declared the availability of the Onshape-Arena Connection, a new functionality that mainly connected its cloud-native Onshape product development and Arena product lifecycle management solutions. The Connection allowed the product data to be shared instantly between the Arena and Onshape solutions with the single click of a button, assisting the companies in augmenting the product development process and simplifying collaboration with the supply chain partners.

- Such collaborations enhance the entire market scenario, stimulating other competitors and vendors to enable PLM software and shaping the whole North American market for vast PLM implementation. Hence, the in-depth implementation throughout several aspects of the product supply chain is actively helping North America's businesses with the evolving Industry 4.0 trends.

PLM Software Industry Overview

The Product Lifecycle Management (PLM) software market is highly fragmented and competitive, mainly due to the presence of numerous global players. Various market players are moving in R&D with the latest software techniques, building a high level of competitiveness throughout the market. The key players include Dassault Systemes Deutschland GmbH, Siemens, Autodesk Inc., ANSYS Inc., Infor Inc., and many others. The companies are thus maximizing their market share by forming various partnerships, investing in projects, and introducing new products in the market.

In February 2023, Global provider of collaboration and design solutions Bricsys, part of Hexagon, declared its partnership with MechWorks, part of ITI Technegroup, a WIPRO Company, to offer an integration between Siemens' Teamcenter software and BricsCAD. The solution primarily provides industry-best features to connect BricsCAD's processes faster and enable designers to focus on its product development.

In September 2022, Holland Capital, the key shareholder of the European Digital Transformation consortium, successfully acquired OnePLM to complement Magnus Digital, Dimensys, Cards PLM Solutions, and Appronto. This created the largest software and service provider of its kind in Europe and allowed international customers to benefit from a vast range of best-in-class expert services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Product Lifecycle Management Software Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Adoption of Digitalization to Improve Production

- 5.1.2 Introduction of Cloud Technology to Consolidate the Information

- 5.2 Market Restraints

- 5.2.1 Lack of Interoperability among Dissimilar Product Versions

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.1.3 Professional Services

- 6.2 By End-user Industry

- 6.2.1 Electronics, Industrial Equipment, and High-tech

- 6.2.2 Aerospace and Defense

- 6.2.3 Automotive

- 6.2.4 Architecture, Engineering, and Construction (AEC)

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siemens AG

- 7.1.2 Dassault Systems Deutschland GmbH

- 7.1.3 Autodesk Inc.

- 7.1.4 PTC Inc.

- 7.1.5 SAP SE

- 7.1.6 ANSYS Germany GmbH

- 7.1.7 Oracle Corporation

- 7.1.8 Aras Corporation

- 7.1.9 Arena Solutions

- 7.1.10 Infor Inc.