|

市场调查报告书

商品编码

1404424

电容式感测器 -市场占有率分析、行业趋势和统计、2024-2029 年成长预测Capacitive Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

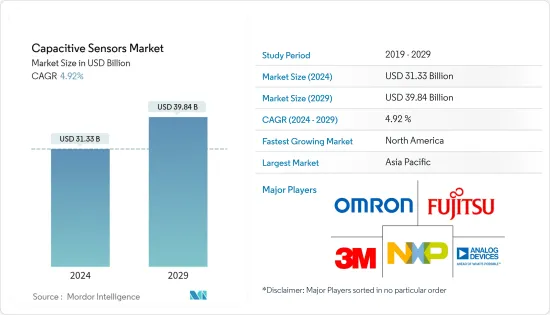

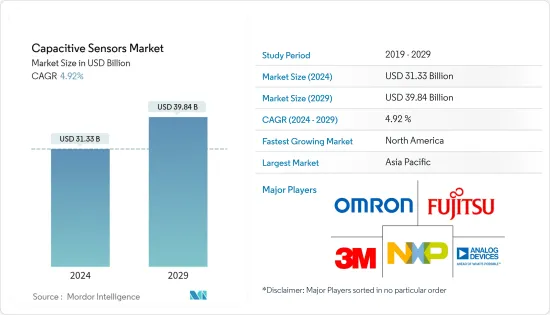

电容式感测器市场规模预计2024年为313.3亿美元,预计2029年将达到398.4亿美元,在预测期内(2024-2029年)复合年增长率为4.92%增长。

电容式感测技术正在迅速发展,以满足现代应用的高级用户介面要求。与电阻式和电感式感测器相比,电容式感测器具有卓越的耐用性、更高的灵敏度和更高的测量精度,因此越来越受到人们的青睐,这是推动市场成长的关键因素之一。

主要亮点

- 随着复杂的生产系统变得越来越自动化,对能够提供与生产过程相关的关键资料的组件的需求不断增长。这些感测器透过检测金属物体的存在和位置来促进工厂製程控制。

- 消费者、工业、汽车和医疗最终用户采用触控萤幕显示系统进行人机互动预计也将推动对电容式感测器的需求。此外,工厂生产过程自动化程度的提高预计将刺激医疗和汽车行业对电容式感测器的需求。

- 调查市场前景广阔。随着医疗和机器处理等高成长领域的增强应用的出现,预计将显着成长。这些感测器依靠规模经济提供比其他感测器更好的性价比。电容式陶瓷压力感测器的成长主要是由石油和天然气、海洋和化学工业中的医疗、工业和汽车应用的发展所推动的。

- 先进电子控制系统的普及为感测器使用者提供了更高的感测器精度、可靠性、响应时间、稳健性、小型化、通讯能力和效率。这刺激了感测器产业的研究和开发,并为工业领域的技术进步创造了机会。电容式陶瓷压力感测器製造商显着改进了工业测量技术。

- 铟用于製造触控萤幕和其他智慧型设备,但其供应并不能长期保证。氧化铟锡广泛用于各种高科技设备,包括触控显示器、智慧型手机、太阳能板和智慧窗户。这种材料既光学透明又导电,这是触控萤幕正常工作所必需的。然而,与氧化铟锡供不应求相关的问题预计将成为预测期内调查市场成长的挑战。

- 电容式感测器市场在疫情期间受到了中等程度的影响,预计到 2022 年将迅速恢復,到 2022年终恢復到 COVID-19 之前的需求。工业和汽车需求的加速成长可能会加速这一趋势。

电容式感测器的市场趋势

汽车最终用户产业预计将占据主要市场占有率

- 由于社会和各种汽车系统之间资讯交流的增加,人机介面技术正在经历模式转移。因此,对用于实现室内照明控制、导航控制等人机介面 (HMI) 应用的电容式感测器的需求正在迅速增加。

- 自动驾驶汽车将嵌套位置感测器、湿度感测器、温度感测器、电容感测器等。这些感测器用于资讯娱乐系统、免钥匙进入系统、3D 手势、内部照明控制等。随着全球汽车普及的提高,对这些感测器(包括电容式感测器)的需求在预测期内将会增加。

- 例如,在停车辅助系统中,这些感知器可以侦测倒车车辆路径中的物体并发出警报以提醒驾驶。这些感测器还可以防止与停车行人发生碰撞,预计在预测期内仍将保持需求。

- 去年,全球大流行对汽车和製造业产生了重大影响。受疫情影响,製造业大幅萎缩,厂商损失惨重,供应链和原物料采购面临前所未有的挑战。

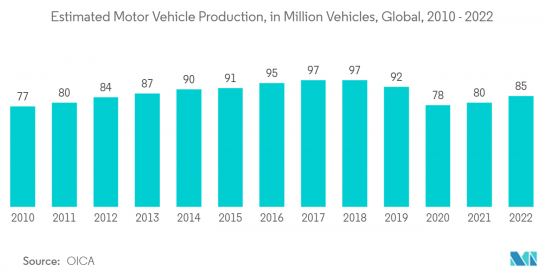

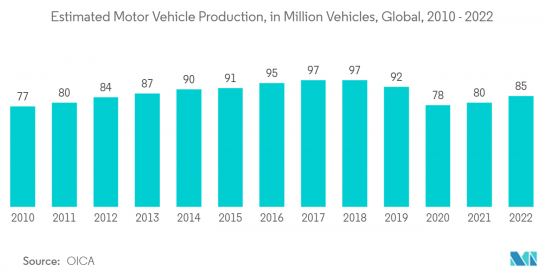

- 根据 OICA 的数据,2022 年全球汽车产量约为 8,500 万辆。这个数字比去年增加了约6%。 2022年,中国、日本和德国是最大的汽车和商用车生产国。

亚太地区预计将占据主要市场占有率

- 亚太地区成熟的电子工业和创新技术的采用为该地区的公司带来了竞争优势。此外,该地区也是多家主要电容式感测器供应商的所在地,包括欧姆龙公司(日本)和富士通有限公司(日本)。

- 扩大策略合作以促进电动车生产将提振该国市场。索尼集团公司和本田汽车于 2022 年 3 月宣布,他们将继续讨论和探索建立策略联盟的可能性,以开创行动和行动服务的新时代。两家公司签署了一份谅解备忘录,表示有意成立一家合资企业,共同开发和销售高付加电动车,并与行动服务合作将其商业化。

- 印度是电子和汽车製造业的领先国家之一。它是亚太地区最大的消费性电子市场之一。印度品牌股权基金会表示,到 2025 年,印度消费电子产业的规模预计将翻一番,达到 1.48 兆印度卢比(180 亿美元)。事实确实如此。印度零售商协会(RAI)的数据显示,21财年第三季家用电器电器产品年增23.5%。

- 此外,2020年,印度政府将对中国彩色电视和行动电话制定新规定,预计2022财年产量将增加5-8%。此外,政府预测,到2024-25年,印度电子製造业将达到3,000亿美元。

- 根据韩国政府制定的国家蓝图,三星电子公司和 SK 海力士公司将在 2030 年之前在半导体研究和生产方面投资超过 510 兆韩元。三星计画在 2030 年成长 30%,达到 1,510 亿美元,海力士计画投资 1,060 亿美元兴建四家新工厂,并在现有设施上投资 970 亿美元。

电容式感测器产业概况

电容式感测器市场较为分散,主要公司包括富士通有限公司、欧姆龙公司、3M公司、Analog Devices Inc.和NXP Semiconductors NV。市场参与企业正在采取联盟和收购等策略来加强其产品阵容并获得永续的竞争优势。

- 2022 年 2 月 - 索尼宣布推出最新的 PS VR2,这是 PlayStation VR2 Sense 控制器的更新最终设计图像,具有电容式传感器和用于位置跟踪的手指触摸检测 IR LED。

- 2022 年 1 月 - TDK 公司推出 TDK RoboKit1,这是 SmartRobotics 产品系列的解决方案。该机器人开发平台透过提供具有 ROS1 和 ROS2 相容驱动程式和软体演算法的强大硬体平台,为机器人设计师、爱好者和开发人员提供原型设计和开发。 TDK RoboKit1 提供独立的开发平台和完整的机器人参考设计。该板配备了多种 TDK 技术,包括 6 轴 IMU、电容式气压感测器、数位 I-TwiS 麦克风 (x4)、温度感测器、内建马达控制器和地磁感测器。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 越来越多地采用触控萤幕显示器作为人机互动系统

- 增加使用防刮非玻璃表面

- 市场抑制因素

- 氧化铟锡供不应求

- 技术简介

第六章市场区隔

- 按类型

- 触摸感应器

- 运动感应器

- 位置感测器

- 其他类型

- 按最终用户产业

- 家用电器

- 车

- 航太/国防

- 医疗保健

- 食品和饮料

- 油和气

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲

- 中东/非洲

- 北美洲

第七章竞争形势

- 公司简介

- Fujitsu Limited

- Omron Corporation

- 3M Company

- Analog Devices Inc.

- NXP Semiconductors NV

- Siemens AG

- Infineon Technologies AG

- Texas Instruments Inc.

- STMicroelectronics NV

- Microchip Technology Inc.

- TDK Corporation

- Sony Corporation

第八章投资分析

第九章 市场机会及未来趋势

The Capacitive Sensors Market size is estimated at USD 31.33 billion in 2024, and is expected to reach USD 39.84 billion by 2029, growing at a CAGR of 4.92% during the forecast period (2024-2029).

Capacitive sensing technology is witnessing swift developments to meet modern applications' advanced user interface requirements. The increasing preference for capacitive sensors, due to their exceptional durability, superior sensitivity, and higher measurement accuracy than resistive or inductive sensors, is one of the primary factors driving the market's growth.

Key Highlights

- The rise in automation of complex production systems has increased the demand for components capable of providing critical data related to the production process. These sensors facilitate process control in factories by detecting the presence and position of metal objects.

- Implementing touchscreen display systems as human-machine interaction by end-users, such as consumer, industrial, automotive, and medical, is also anticipated to drive the demand for capacitive sensors. Additionally, the increasing factory automation of production processes is expected to spur the demand for capacitive sensors in the healthcare and automotive industries.

- The outlook of the market studied is positive. It is expected to grow significantly due to the emergence of enhanced applications in high-growth sectors, such as healthcare and machine handling. These sensors offer better price-performance than other sensors by relying on economies of scale advantages. The growth of capacitive ceramic pressure sensors has been driven by the development of medical, industrial, and automotive applications, majorly in the oil and gas, marine, and chemical industries.

- The spread of advanced electronic control systems has provided sensor users with advances in sensor accuracy, reliability, response time, robustness, miniaturization, communications capability, and efficiency. This has fueled research and development in the sensors industry, creating opportunities for technological advancements in the industrial sector. Capacitive ceramic pressure sensor manufacturers have significantly improved measurement technology for industries.

- Indium is used to make touchscreens and other smart devices, but its supply is not guaranteed long-term. Indium tin oxide is utilized in a wide range of high-tech gadgets, including touch displays, smartphones, solar panels, and smart windows. This substance is both optically transparent and electrically conductive, which are necessary for touch screens to function correctly. However, issues related to the supply shortage of indium tin oxide are estimated to challenge the market's growth studied during the forecast period.

- The capacitive sensors market is moderately influenced during the pandemic and is expected to recover rapidly over the course of 2022 and return to pre-COVID-19 demand by the end of 2022. The accelerated growth in industrial and automotive industry demand may speed this up.

Capacitive Sensors Market Trends

The Automotive End-user Industry is Expected to Hold Significant Market Share

- Human-machine interface technologies have witnessed a paradigm shift due to the increasing information interchange between social and various car systems. This has resulted in a surge in demand for capacitive sensors deployed to implement human-machine interface (HMI) applications, such as indoor illumination control, navigation control, etc.

- The automated vehicle will be nested with a position, humidity, temperature, and capacitive sensor, among others. These sensors are used in the infotainment system, keyless entry system, 3D gesture, interior lighting control, etc. With the increase in global automotive penetration, the demand for these sensors, including the capacitive sensor, will increase in the forecast period.

- For example, in the parking assistance system, these sensors can detect the presence of objects in the pathway of the reversing vehicle and can raise the alarm to warn the driver. These sensors also prevent collisions with pedestrians while parking, and the demand is expected to continue during the forecast period.

- The global pandemic has influenced the automotive and manufacturing industries significantly over the period of last year. The manufacturing industry shrunk significantly due to the pandemic as the industry faced unprecedented challenges in the supply chain and procurement of raw materials, which resulted in significant losses for manufacturers.

- According to OICA, In 2022, approximately 85 million motor vehicles were produced globally. This figure translates into an increase of around six percent compared with the previous year. China, Japan, and Germany were the largest producers of cars and commercial vehicles in 2022.

Asia Pacific is Expected to Hold Significant Market Share

- The established electronics industry in Asia Pacific and the adoption of innovative technologies have provided the regional organizations a competitive edge in the market studied. Moreover, the region enjoys the presence of several major capacitive sensor vendors, such as Omron Corporation (Japan) and Fujitsu Ltd (Japan), among others.

- The growing strategic collaborations in the country to boost the electric vehicle production are set to boost the market in the country. Sony Group Corporation and Honda Motor Co., Ltd. stated in March 2022 that they would continue to discuss and explore the possibility of forging a strategic alliance to usher in a new era of mobility and mobility services. The two firms have signed a memorandum of understanding outlining their intention to form a joint venture to collaborate on the development and sale of high-value-added battery electric vehicles, as well as to commercialize them in conjunction with mobility services.

- India is one of the major countries leading in electronics and automotive manufacturing sector. The country is one of the largest consumer electronics market in Asia pacific region. As stated by the India Brand Equity Foundation, Indian appliance and consumer electronics industry is expected to double to reach RUP 1.48 lakh crore (USD 18 Billion) by 2025. According to Retailers Association of India (RAI), sales of consumer electronics and appliances in the third quarter of FY21 increased by 23.5 percent, as compared with same period in the last fiscal year.

- Moreover in 2020, the Indian government targeted China with new restrictions on color television and mobile phoneswhich isset to increase their production by 5-8 percent in FY22. Furthermore, the government anticipates that the Indian electronics manufacturing sector will reach USD 300 billion by 2024-25.

- Under a national roadmap devised by the South Korean Government, Samsung Electronics Co. and SK Hynix Inc. would lead more than 510 trillion won in investment in semiconductor research and production in the years through 2030. Samsung plans to increase its spending by 30 percent to USD 151 billion by 2030, while Hynix plans to invest USD 97 billion in current facilities in addition to its USD 106 billion investment in four new factories.

Capacitive Sensors Industry Overview

The capacitive sensors market is fragmented, with the presence of major players like Fujitsu Limited, Omron Corporation, 3M Company, Analog Devices Inc., and NXP Semiconductors NV. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- February 2022 - Sony announced the latest PS VR2 with an updated and final design image of PlayStation VR2 Sense controller that uses a capacitive sensor and finger touch detection IR LED for position tracking.

- January 2022 - TDK Corporation announced a solution to the SmartRobotics product family, TDK RoboKit1. The robotic development platform enables prototyping and development for robotic designers, enthusiasts, and developers by offering a robust hardware platform associated with full ROS1 and ROS2-compliant drivers and software algorithms. TDK RoboKit1 will provide a stand-alone development platform and a full robot reference design. The board would consist of a range of TDK technology, having a 6-axis IMU, capacitive barometric pressure sensor, digital I²S microphone (x4), temperature sensor, embedded motor controller, and magnetometer.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Implementation of Touch Screen Displays as Human Machine Interaction Systems

- 5.1.2 Rising Usage of Scratch-resistant Non-glass Surfaces

- 5.2 Market Restraints

- 5.2.1 Supply Shortage of Indium Tin Oxide

- 5.3 Technology Snapshot

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Touch Sensor

- 6.1.2 Motion Sensor

- 6.1.3 Position Sensor

- 6.1.4 Other Types

- 6.2 By End-user Industry

- 6.2.1 Consumer Electronics

- 6.2.2 Automotive

- 6.2.3 Aerospace and Defense

- 6.2.4 Healthcare

- 6.2.5 Food and Beverages

- 6.2.6 Oil and Gas

- 6.2.7 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Mexico

- 6.3.4.2 Brazil

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fujitsu Limited

- 7.1.2 Omron Corporation

- 7.1.3 3M Company

- 7.1.4 Analog Devices Inc.

- 7.1.5 NXP Semiconductors NV

- 7.1.6 Siemens AG

- 7.1.7 Infineon Technologies AG

- 7.1.8 Texas Instruments Inc.

- 7.1.9 STMicroelectronics NV

- 7.1.10 Microchip Technology Inc.

- 7.1.11 TDK Corporation

- 7.1.12 Sony Corporation