|

市场调查报告书

商品编码

1404433

汽车线束:市场占有率分析、产业趋势/统计、2024年至2029年成长预测Automotive Wiring Harness - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

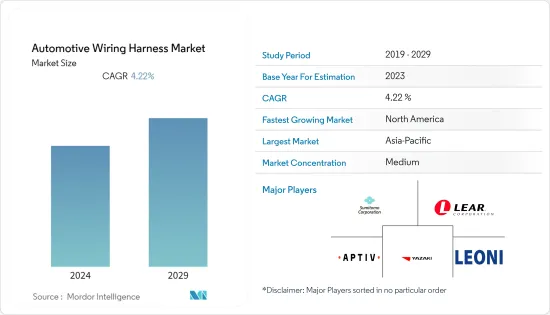

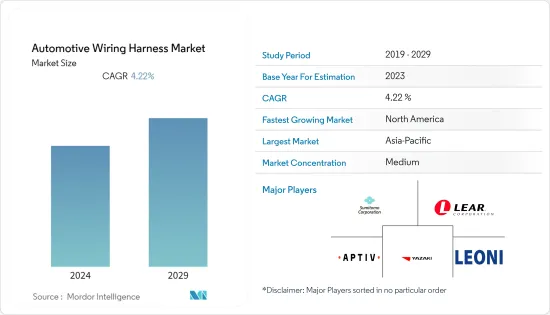

汽车线束市场规模预计到2024年将达到402.2亿美元,2029年将达到515.5亿美元,预测期内复合年增长率为4.22%。

COVID-19 的爆发对全球一体化的汽车产业产生了迅速而严重的影响。多家OEM生产线的停产对汽车线束市场产生了间接影响。然而,一些国家解除封锁指导方针以及汽车需求的小幅增长预计将推动未来几年的市场成长。例如,2024年小客车销量将达到5,749万辆,高于2021年的5,644万辆。因此,线束公司在2022年也增加了製造投资,以满足因COVID-19大流行后復苏导致汽车销售增加而导致的线束产品需求增加。例如

主要亮点

- 2022 年 7 月:住友电装系统有限公司在柬埔寨皇家集团金边经济特区开设了一家新的汽车线束产品製造工厂。

对安全解决方案的日益关注、混合动力汽车和电动车的需求和使用的增加以及车辆电动的提高是市场成长的关键驱动力。然而,可靠性和耐用性等挑战可能会限制市场成长。

电动车车销量的成长也是汽车线束行业成长的主要推动力,因为线束是用于控制电动电动车几乎所有关键功能的线束系统的关键组件。我是。

由于自动化缺陷导致事故不断发生,客户和政府对先进的安全功能越来越感兴趣。他们正在致力于增强汽车安全系统,预计这将推动线束市场的发展。导航和资讯娱乐系统是全球大多数汽车的标准配备。

长期来看,行业巨头研发投入的增加、电动车和混合动力汽车销量的增加以及汽车连接功能需求的不断增长将推动汽车线束行业汽车线束系统销量的激增。需求。

预计亚太地区将在预测期内主导市场。由于收紧和监管,汽车需求预计将增加,这有望进一步推动该地区汽车线束市场的成长。此外,世界各国政府正在采取各种措施来促进电动车的采用。

汽车线束市场趋势

电动车可望推动市场成长

电动车正迅速成为汽车产业的主流。电动车帮助车主降低车辆营业成本,政府协助实现更清洁的环境和能源独立,减少污染物和其他温室气体的排放,并减少石油进口。这很有帮助。对环境问题的日益关注和积极的政府倡议是推动全球普及电动车的主要因素。

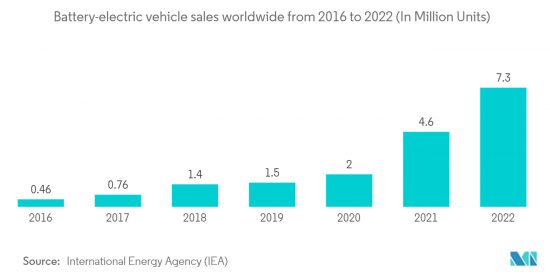

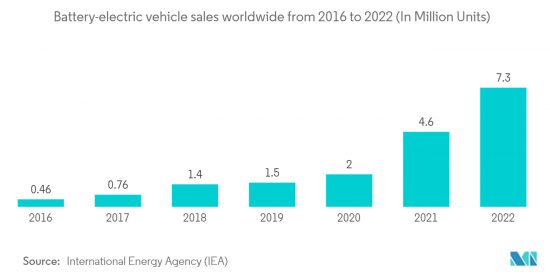

电动车市场取得显着成长,2022年销量将突破1,000万辆。到今年,电动车车占所有销售车的 14%,比 2020 年增加了五倍,当时电动车占新车的比例不到 5%,比 2021 年增加了 55%,当时电动车车占新车购买量的约9%。 。

中国再次占全球电动车销量的60%左右。全球上路的电动车一半以上在中国,中国已超额完成2025年新能源车销售目标。在第二大市场欧洲,电动车销量到2022年将成长15%以上,售出的汽车中超过五分之一是电动车。 2022年美国电动车销量将翻倍55%,达到销量揭露的8%。

随着电动车在全球越来越普及,一些电线电缆製造商正在大力投资以提高产能,以满足不断增长的需求。例如

2022年9月,矢崎公司在摩洛哥拉巴特附近的盖尼特拉开设了第四家製造工厂,投资额为3,000万美元。

由于上述趋势以及新兴市场的开拓,电动车的增加预计将暂时带动线束市场的需求。

亚太地区预计将主导目标市场

预计亚太地区将占据汽车线束市场的大部分。亚太地区可支配收入的增加和国内生产总值的成长正在推动市场。汽车零件製造的便利性、汽车销售、扩大政府法规以提高电动车采用率,以及该地区OEM和供应商为满足亚太汽车行业不断增长的需求而采取的强劲扩张,预计将产生期内市场成长前景光明。

政府法规的扩展和稳步扩展旨在提高该地区OEM和供应商对电动车的采用,以满足中国汽车行业不断增长的需求,预计将为市场成长提供积极的前景。

- 中国市场在2022年上半年迎头赶上。在小客车新註册量中,纯电动车占19%,电动车占5%。这比前一年的市场占有率高出8个百分点,是2020年市占率的四倍。如此一来,距离2025年目标年还有两年,中国就已经超额完成了「十四五」排放减排工作规划中设定的电动车占20%的目标。

该地区其他重要国家包括印度和韩国。印度对于汽车线束市场製造商来说是一个有利的市场,因为政府允许汽车产业100%的外资投资。此外,印度新车註册数量逐年增加,为汽车线束製造业创造了良好的成长环境。印度也是汽车线束系统领先製造商 Motjrson Sumi Ltd. 的总部。

由于传统的布线方法不适合汽车製造商提供的功能升级,汽车线束正在稳步成长。此外,安装这样的线束系统还可以提高车辆的燃油效率,并符合印度政府的燃油使用和排放气体法律。由于这些因素,汽车线束市场预计将以合理的成长率成长,并且在预测期内需求预计将扩大。

汽车线束产业概况

汽车线束市场高度整合,跨国公司和少数本土企业主导市场。主要参与企业包括住友商事株式会社、Aptiv Plc、矢崎株式会社、Motherson Group、Leoni AG 和 Lear Corporation。市场竞争适度。

不同的线束製造商在汽车的其他控制系统中表现突出。 Leoni AG 集团专注于汽车市场的电线、布线系统和光纤。莱尼约 45% 的销售额仅来自欧洲、中东和非洲地区。为了获得相对于其他市场参与企业的显着优势,许多公司建立合作伙伴关係,以提供其产品的最新功能并扩大其生产能力。

例如,矢崎公司于2022年6月宣布将在危地马拉圣马科斯省阿尤特拉建立试点生产设施。该工厂投资1,000万美元,将僱用1,000名员工,预计于2023年1月运作。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 汽车产量的成长

- 对先进安全功能的需求不断增长

- 市场抑制因素

- 原物料价格波动

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(单位:美元)

- 按使用类型

- 点火系统

- 充电系统

- 传动系统和动力传动系统系统

- 资讯娱乐系统和仪表板

- 车辆控制和安全系统

- 车身及驾驶室线束

- 按线材类型

- 铜

- 铝

- 按车型

- 小客车

- 商用车

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 其他的

- 南美洲

- 中东/非洲

- 北美洲

第六章竞争形势

- 供应商市场占有率

- 公司简介

- LEONI AG

- Yazaki Corporation

- Aptiv PLC

- Sumitomo Electric Industries Ltd.

- Lear Corporation

- Motherson Sumi Systems Ltd.

- Furukawa Electric Co. Ltd.

- Fujikura Ltd.

- Coroplast Fritz Muller GmbH & Co.

- Jiangsu Kyungshin Electronic Co. Ltd.

- Nexans

- THB Group

第七章 市场机会及未来趋势

- 联网汽车的普及

The automotive wiring harness Market size was USD 40.22 billion in 2024 and is expected to reach USD 51.55 billion by 2029, registering a CAGR of 4.22% during the forecast period.

The COVID-19 outbreak swiftly and severely impacted the globally integrated automotive industry. The shutdown of many OEM production lines indirectly affected the automotive wiring harness market. However, with the removal of lockdown guidelines in several countries, the demand for vehicles slightly increased, which is expected to propel the market growth forward in the coming years. For instance, passenger vehicle sales in 2024 reached 57.49 million units, up from 56.44 million in 2021. Thus, wiring harness companies also increased their manufacturing investments in 2022 to address the increased demand for wiring harness products due to growing automotive sales resulting from the post-COVID-19 pandemic recovery. For instance

Key Highlights

- July 2022: Sumitomo Wiring Systems Ltd inaugurated a new manufacturing facility for automobile wiring harness products at Royal Group Phnom Penh Special Economic Zone in Cambodia.

The growing emphasis on safety solutions, expanding demand and usage of hybrid and electric vehicles, and increasing electrification of vehicles are some of the primary driving factors for the market's growth. However, challenges such as reliability and durability may limit the market's growth.

The rising sales of electric vehicles also provide a major impetus to the growth of the automotive wiring industry since wiring harnesses are a major component of wiring systems used to control almost all the critical functions of an electric vehicle.

The continual rise in accidents caused by automation faults has led customers and governments to exhibit increased interest in advanced safety features. They are working on enhancing their vehicle's safety systems, which is expected to drive the wire harness market. The adoption of navigation and infotainment systems has become standard features in most cars worldwide.

Over the long term, increasing investments in R&D by major industry players and a rise in sales of electric and hybrid vehicles, as well as rising demand for connectivity features in automobiles, will create demand in the automotive wiring harness industry with a surge in sales of automotive wiring harness systems.

The Asia-Pacific region is expected to dominate the market during the forecast period. With the upliftment of lockdown and restrictions, the increased demand for vehicles is expected to be observed, which is anticipated to further aid in the growth of the automotive wiring harness market across the region. Moreover, various initiatives have been undertaken by different governments worldwide to promote the adoption of electric vehicles.

Automotive Wiring Harness Market Trends

Electric Vehicles are Expected to Drive the Market Growth

Electric vehicles are fast becoming a mainstream part of the automotive industry. They help vehicle owners cut down the operating costs of their vehicles and governments to achieve a clean environment and energy independence along with reduced emission of pollutants and other greenhouse gases as lower oil imports. The increasing environmental concerns and favorable government initiatives are the major factors driving the adoption of electromobility worldwide.

Electric car markets experienced significant growth in 2022, as sales surpassed the 10 million mark. By that year, 14% of all cars sold were electric, representing a five-fold increase from 2020, when less than 5% of new vehicles were electric, and a 55% rise from 2021, when around 9% of new cars purchased were electric.

China once again dominated global electric car sales, accounting for around 60%. With more than half of all-electric cars internationally on the roads located in China, the country has already surpassed its 2025 target for new energy vehicle sales. In Europe, the 2nd greatest market, electric car sales enhanced by over 15 % in 2022, meaning that over one in any five vehicles sold was electric. Electric car sales in the United States doubled by 55 % in 2022, arriving at a sales disclose of 8 %.

With this increasing adoption of electric vehicles worldwide, some wire and cable manufacturers are investing heavily in increasing their production capacity to cater to the rising demands. For instance

In September 2022, Yazaki Corporation opened its fourth manufacturing facility in Morocco at Kenitra near Rabat with an investment of USD 30 million.

With the aforementioned trends and developments, the rising demand for electric vehicles will propel demand in the wiring harness market during the foreseeable future.

Asia-Pacific Region is Expected to Dominate the Target Market

The Asia-Pacific region is expected to have a majority share in the automotive wiring harness market. Rising disposable income and an increase in GDP in the Asia Pacific are driving the market. Ease of manufacturing auto parts, vehicle sales, and growing government regulations improving electric vehicles adoption and robust expansion adopted by OEMs and suppliers in the region to accommodate rising demand from the automotive industry across the Asia-Pacific region is expected to create a positive outlook for market growth during the forecast period.

Growing government regulations improving electric vehicle adoption and robust expansion adopted by OEMs and suppliers in the region to accommodate rising demand from the automotive industry in China are expected to create a positive outlook for market growth. For instance,

- The Chinese market caught up during the first half of 2022. BEVs and PHEVs made up 19% and 5% of the total number of new passenger car registrations that were electric vehicles. This represents an 8% point increase over the market share from the previous year and is four times higher than it will be in 2020. As a result, two years before the target year of 2025, China has already surpassed the 20% EV share target set forth in the 14th Five-Year Plan Energy Saving and Emission Reduction Work Plan.

Other important countries in the region are India and South Korea. India is a lucrative market for automotive wiring harness market manufacturing companies as the government has allowed 100% foreign equity investment in the automobile sector. Additionally, the number of new vehicle registrations per year is increasing in India, serving as a positive growth environment for automotive wiring harness manufacturing companies. India is also home to Motjrson Sumi Ltd, a major manufacturer of automotive wiring harness systems.

As traditional wiring methods are not suitable for upgrading features offered by automakers, the automobile wire harness is growing steadily. Also, installing such wire harness systems enhances the vehicle's fuel efficiency and complies with Indian government fuel usage and emissions laws. Owing to these factors, the sector is expected to grow at a reasonable rate, enhancing the demand in the automotive wiring harness market during the forecast period.

Automotive Wiring Harness Industry Overview

The Automotive Wiring Harness Market is highly consolidated, with global and very few local players dominating the market. Some of the major players in the market are Sumitomo Corporation, Aptiv Plc, Yazaki Corporation, Motherson Group, Leoni AG, and Lear Corporation. The market concentration can be considered to be medium-level competitive.

Different wiring harness manufacturers are prominent in other control systems of vehicles. Leoni AG group specializes in wires, wiring systems, and optical fibers for the automotive market. Leoni generates about 45% of its sales only in the EMEA region. To gain a considerable edge over other players in the market, many companies are forming partnerships to bring the latest features to their products and expand their production capacities.

For instance, in June 2022, Yazaki Corporation announced to set up a pilot production facility in Guatemala at Ayutla in the San Marcos Department. The plant will likely be set up at an investment of USD 10 million, will employ 1,000 people, and is expected to be operational by January 2023.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Automotive Production

- 4.1.2 Growing Demand For Advanced Safety Features

- 4.2 Market Restraints

- 4.2.1 Fluctuating Raw Material Prices

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Value in USD)

- 5.1 By Application Type

- 5.1.1 Ignition System

- 5.1.2 Charging System

- 5.1.3 Drivetrain and Powertrain System

- 5.1.4 Infotainment System and Dashboard

- 5.1.5 Vehicle Control and Safety Systems

- 5.1.6 Body and Cabin Wiring Harness

- 5.2 By Wire Type

- 5.2.1 Copper

- 5.2.2 Aluminum

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 LEONI AG

- 6.2.2 Yazaki Corporation

- 6.2.3 Aptiv PLC

- 6.2.4 Sumitomo Electric Industries Ltd.

- 6.2.5 Lear Corporation

- 6.2.6 Motherson Sumi Systems Ltd.

- 6.2.7 Furukawa Electric Co. Ltd.

- 6.2.8 Fujikura Ltd.

- 6.2.9 Coroplast Fritz Muller GmbH & Co.

- 6.2.10 Jiangsu Kyungshin Electronic Co. Ltd.

- 6.2.11 Nexans

- 6.2.12 THB Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Adoption Of Connected Vehicles