|

市场调查报告书

商品编码

1404440

医疗保健供应链管理 -市场占有率分析、产业趋势与统计、2024-2029 年成长预测Healthcare Supply Chain Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

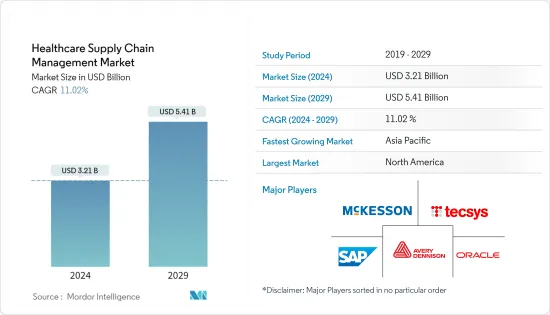

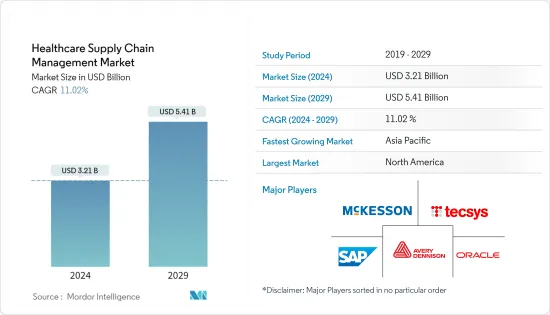

医疗保健供应链管理市场规模预计到 2024 年将达到 32.1 亿美元,到 2029 年将达到 54.1 亿美元,在预测期内(2024-2029 年)复合年增长率为 11.02%。

COVID-19 对医疗保健供应链管理产生了重大影响,因为世界上多个国家报告在大流行早期阶段药品和手术器械的原料药短缺。然而,COVID-19 大流行产生了对药品无缝追踪和追溯的需求,从而促进了大流行后期的市场成长。

例如,根据 2022 年 3 月发表在爱思唯尔公共卫生紧急事件集上的报导,COVID-19 大流行以前所未有的速度和规模影响了全球供应链。报导称,疫情过后,供需缺口进一步扩大。目前,多家公司正在医疗保健领域开发创新的供应链管理解决方案,用于追踪药品,因此,调查市场预计在预测期内将成长。

推动市场成长的关键因素是医疗保健提供者加强降低成本和提高供应链质量,以及对高品质库存管理系统的需求不断增长。

各种医疗保健供应链管理软体应用程式提供的优势导致需求不断增长,预计将推动市场成长。例如,根据 2022 年 11 月《沙乌地阿拉伯製药杂誌》发表的报导,库存和供应链管理主要专注于提高生产力、降低成本和管理所需的供应品,以便提供更好的患者照护。我们专注于接收和分配准时。

有效的供应链管理依赖于组织和追踪库存、采购、订购和付款工作流程。最近,供应链管理在医疗保健机构中的使用增加。医疗保健组织计划、购买、管理、处理、追踪和运输库存,例如药品、医疗保健设备和用品。因此,库存管理至关重要,预计将在预测期内推动供应链管理市场的成长。

此外,市场参与企业之间越来越多地推出和结盟,以扩大医疗保健供应链管理解决方案,预计这将在预测期内推动市场成长。例如,2022 年 2 月,艾利丹尼森 Smartrac 推出了适用于製药应用的 AD Minidose U9 RAIN RFID嵌体,为医疗保健、製药和实验室资产管理释放了庞大的 RFID 价值。同样在 2021 年 8 月,法国 Tageos 推出了适用于医疗保健和製药应用的 EOS~202 U9 RAIN RFID嵌体。

此外,据报道,最近各政府机构越来越多地采用供应链管理解决方案,预计这也将在预测期内对市场成长做出重大贡献。例如,2022年1月,阿联酋卫生署推出了一款配备AR的药物包,带有二维码,可以无纸化地获取药物相关资讯。患者只需扫描药盒上的二维码即可读取药品资讯。

因此,由于库存管理解决方案的优势、市场参与企业不断推出产品以及政府组织越来越多地采用供应链管理,预计所研究的市场将在分析期间呈现成长。然而,由于供应链管理软体的实施成本较高,预计市场成长将受到限制。

医疗保健供应链管理市场趋势

预计云端基础的细分市场将在预测期内实现强劲成长

云端基础的供应链解决方案提供网路、储存和容量,以弹性的基于使用的模型运行,允许快速更新和适应。扩大规模(或缩小规模)、适应新的市场环境、与新的合作伙伴建立联繫以及添加新的供应商都是潜在的用途。

由于活性化和云端基础的解决方案的进步,预计该行业将在预测期内增长。例如,根据国家生物技术资讯中心2022年8月发表的报导,在香港和美国进行的研究表明,云端基础的区块链的技术永续性可以提高医疗保健供应链的效率。它可以与人工智慧(AI)结合进行管理。因此,此类研究将推动云端基础的医疗保健供应链管理业务的发展。

此外,各种医疗保健组织越来越多地采用云端基础的供应链解决方案,预计也将在预测期内推动该细分市场的成长。例如,2022年10月,总部位于印第安纳州的卫理公会医院与云端解决方案公司Infor合作开发了一款云端基础的医疗保健应用程序,该应用程式可以标准化财务、人力资源、供应链和营运等各领域的关键流程。 。预计此类合作伙伴关係将在预测期内扩大云端基础的解决方案市场。

此外,先进的云端基础的供应链管理软体的推出预计将推动市场成长。例如,2022 年 5 月,Jump Technologies 与电子健康记录(EMR)、企业资源规划 (ERP) 或调度系统集成,记录医院使用的产品的批号、序号和有效期。推出了云端基础的名为JumpStock 的软体解决方案可增强移动扫描解决方案以提高合规性,从而使医院能够节省物资囤积、医生偏好差异和缺货成本Ta。

因此,由于云端基础的供应链管理的高采用率以及市场参与企业的推出和合作伙伴关係的增加,预计该行业将在预测期内扩大。

预计北美将在预测期内占据主要市场占有率

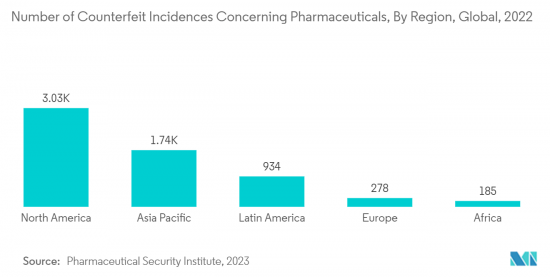

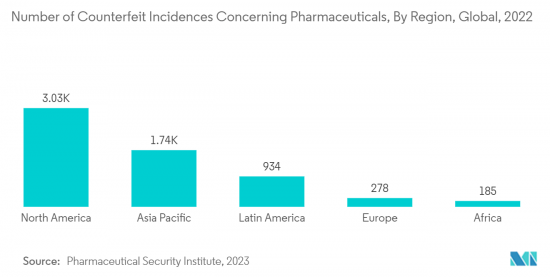

北美面临不合格药品和假药、严格的法律规范、药品和医疗保健器械的 GS1 和唯一器械标识 (UDI) 的引入,再加上大型製造地。预计将占主要因素预测期内的市占率。例如,2022年7月,美国食品药物管理局(FDA)发布了独特设备识别系统的最终指南,以正确识别在美国销售的医疗设备的製造、分销和患者使用等方面的指导方针和政策。因此,此类国家政府指南和建议的可用性预计将在预测期内推动该地区对供应链管理的需求。

此外,市场参与企业越来越多地采用各种业务策略,例如在该地区建立联盟、合作伙伴关係和产品发布,也有助于市场扩张。例如,2022年10月,总部位于魁北克的供应链管理软体公司Tecsys Inc.宣布推出其端到端Elite医疗保健供应链执行平台的新功能「Elite Healthcare Receiving」。这项新功能是医院住院应用程序,它将住院和交付流程无缝整合到医疗保健系统的供应链业务中。因此,增加简化医疗机构供应链业务的新功能预计将在预测期内促进市场成长。

医疗保健供应链管理产业概览

医疗保健供应链管理市场是一个快速成长的市场,本质上竞争适度。目前的市场占有率主要由少数专门提供医疗保健领域服务解决方案的医疗科技公司主导。主要市场参与企业包括 SAP AG Group、Oracle Corporation、McKesson Corporation、Avery Dennison Corporation、Tecsys Inc.、Ochsner Health System 和 Providence Health & Services。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 医疗保健提供者加大力度降低成本并提高供应链质量

- 对高品质库存管理系统的需求不断增长

- 市场抑制因素

- 引进供应链管理软体成本高

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(以金额为准的市场规模 - 百万美元)

- 按成分

- 软体应用

- 供应商管理软体

- 库存管理软体

- 其他软体应用程式

- 硬体

- 扫码机

- RFID

- 其他硬体

- 软体应用

- 按交货方式

- 本地

- 云端基础

- 按最终用户

- 医疗服务提供方

- 保健品製造商

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 其他亚太地区

- 中东/非洲

- 海湾合作委员会国家

- 南非

- 其他中东/非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章竞争形势

- 公司简介

- Advocate Healthcare

- Ascension Health

- Avery Dennison Corporation

- Tecsys Inc.

- Mckesson Corporation

- Oracle Corporatipon

- Providence Health & Services

- SAP AG Group

- Spectrum Health

- Ochsner Health System

- Aspen Technology Inc

- Infor

第七章 市场机会及未来趋势

The Healthcare Supply Chain Management Market size is estimated at USD 3.21 billion in 2024, and is expected to reach USD 5.41 billion by 2029, growing at a CAGR of 11.02% during the forecast period (2024-2029).

COVID-19 significantly impacted healthcare supply chain management as several countries worldwide reported that active pharmaceutical ingredients were in short supply of drugs and surgical equipment during the early phase of the pandemic. However, the COVID-19 pandemic created a need for the seamless tracking and tracing of pharmaceutical items, which boosted the market growth in the later phase of the pandemic.

For instance, according to an article published in Elsevier Public Health Emergency Collection in March 2022, the COVID-19 pandemic has impacted global supply chains at an unprecedented speed and scale. As per the article, gaps between supply and demand increased post-pandemic. Various companies are currently developing innovative supply chain management solutions in the healthcare segment for tracking pharmaceuticals, due to which the studied market is expected to grow during the forecast period.

The major factors driving the market growth are increasing efforts of healthcare providers to reduce cost and improve the quality of the supply chain and rising demand for the quality inventory management system.

The advantages offered by various healthcare supply chain management software applications are leading to their rising demand, which is expected to boost market growth. For instance, according to an article published in Saudi Pharmaceutical Journal in November 2022, in order to deliver better patient care, inventory and supply chain management primarily focuses on increasing productivity, reducing costs, and receiving and distributing the required supplies on time.

Workflow organization and tracking of inventory, purchases, orders, and payments depend on effective supply chain management. The use of supply chain management in healthcare settings has increased recently. Healthcare institutions are responsible for planning, purchasing, managing, handling, tracking, and transporting stock such as medications, medical equipment, and supplies. Therefore, inventory management is crucial and is expected to propel the supply chain management market growth during the forecast period.

Furthermore, the rising launches and partnerships among the market players to expand the healthcare supply chain management solutions are expected to propel the market growth during the forecast period. For instance, in February 2022, Avery Dennison Smartrac launched its AD Minidose U9 RAIN RFID inlay for pharmaceutical applications, unlocking critical RFID value for healthcare, pharmacies, and laboratory asset management. Also, in August 2021, Tageos, a French-headquartered company, launched its EOS-202 U9 RAIN RFID inlay for healthcare and pharmaceutical applications.

Additionally, the growing adoption of supply chain management solutions by various government bodies has been reported in recent times, which is also expected to significantly contribute to the market growth during the forecast period. For instance, in January 2022, the United Arab Emirates' Ministry of Health launched AR-powered drug packs with a QR code for paperless access to drug-related information. It will help patients to read drug information by simply scanning a QR code on the medicine box.

Therefore, owing to the advantages of inventory management solutions, rising launches by market players, and increasing adoption of supply chain management by government organizations, the studied market is anticipated to witness growth over the analysis period. However, the high cost of implementation of supply chain management software is expected to restrain market growth.

Healthcare Supply Chain Management Market Trends

Cloud based Segment is Expected to Register a Significant Growth Over the Forecast Period

The network, storage, and capacity provided by cloud-based supply chain solutions operate on a flexible, usage-based model that allows for faster updates and adaptations. Scaling up (or down), adapting to new market conditions, connecting with new partners, and adding new suppliers are all potential uses.

The segment is expected to grow during the forecast period owing to the rising research studies and advancements in cloud-based solutions. For instance, according to an article published in August 2022 by the National Center of Biotechnology Information, a study conducted in Hong Kong and the United States mentioned that the technical sustainability of cloud-based blockchain could be combined with artificial intelligence (AI) for efficient healthcare supply chain management. Therefore, such research studies boost the developments in cloud-based healthcare supply chain management operations.

Additionally, the rising adoption of cloud-based supply chain solutions by various healthcare organizations is also expected to boost segment growth during the forecast period. For instance, in October 2022, Indiana-based Methodist Hospitals partnered with cloud solutions company Infor to create a cloud-based healthcare application that will allow the health system to standardize key processes in various areas, such as finance, human resources, supply chain, and operations. Such partnerships are expected to expand the cloud-based solution market during the forecast period.

Furthermore, the launch of advanced cloud-based supply chain management software is expected to propel market growth. For instance, in May 2022, Jump Technologies launched a cloud-based software solution called JumpStock that integrates with the electronic medical record (EMR), enterprise resource planning (ERP), or scheduling systems and enhances its mobile scanning solution to improve compliance for recording lot and serial numbers, as well as expiration dates of product used in hospitals, allowing hospitals to save money on supply hoarding, physician preference variances, and stock-outs.

Therefore, owing to the high adoption of cloud-based supply chain management and rising launches and partnerships by market players, the segment is expected to propel during the forecast period.

North America is Expected to Hold a Significant Market Share Over The Forecast Period

North America is anticipated to hold the major share of the market over the forecast period owing to the increasing risks from substandard and falsified drugs and stringent regulatory frameworks, and mandatory implementation of GS1 and Unique Device Identification (UDI) on pharmaceutical drugs and medical devices, coupled with the presence of large manufacturing hubs. For instance, in July 2022, the Food and Drug Administration (FDA) published the final guidelines and policies regarding the unique device identification system to adequately identify medical devices sold in the United States from manufacturing through distribution to patient use. Therefore, the availability of such national government guidelines and recommendations is expected to propel the demand for supply chain management in the region during the forecast period.

Furthermore, the increasing adoption of various business strategies by the market players, such as collaborations, partnerships, and product launches in the region, is also contributing to the market expansion. For instance, in October 2022, Tecsys Inc., a Quebec-based supply chain management software company, launched a new feature, Elite Healthcare Receiving, in its end-to-end Elite Healthcare supply chain execution platform. The new feature is a hospital receiving application that seamlessly integrates receiving and delivery processes into a health system's supply chain operations. Therefore, the addition of new features to simplify the supply chain operations in healthcare organizations is projected to augment the market growth over the forecast period.

Healthcare Supply Chain Management Industry Overview

The healthcare supply chain management market is a fast-growing market and moderately competitive in nature. The current market share is majorly controlled by a few medical technology companies that have expertise in providing service solutions in the healthcare domain. Some of the key market players are SAP AG Group, Oracle Corporation, McKesson Corporation, Avery Dennison Corporation, Tecsys Inc., Ochsner Health System, and Providence Health & Services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Efforts of Healthcare Providers to Reduce Cost and Improve the Quality of Supply Chain

- 4.2.2 Rising Demand of the Quality Inventory Management System

- 4.3 Market Restraints

- 4.3.1 High Cost of Implementation of Supply Chain Management Software

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Component

- 5.1.1 Software Application

- 5.1.1.1 Supplier Management Software

- 5.1.1.2 Inventory Management Software

- 5.1.1.3 Other Software Applications

- 5.1.2 Hardware Type

- 5.1.2.1 Barcode Scanners

- 5.1.2.2 RFID

- 5.1.2.3 Other Hardware Types

- 5.1.1 Software Application

- 5.2 By Delivery Mode

- 5.2.1 On-premise

- 5.2.2 Cloud based

- 5.3 By End User

- 5.3.1 Healthcare Providers

- 5.3.2 Healthcare Manufacturers

- 5.3.3 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Advocate Healthcare

- 6.1.2 Ascension Health

- 6.1.3 Avery Dennison Corporation

- 6.1.4 Tecsys Inc.

- 6.1.5 Mckesson Corporation

- 6.1.6 Oracle Corporatipon

- 6.1.7 Providence Health & Services

- 6.1.8 SAP AG Group

- 6.1.9 Spectrum Health

- 6.1.10 Ochsner Health System

- 6.1.11 Aspen Technology Inc

- 6.1.12 Infor