|

市场调查报告书

商品编码

1404457

相机模组-市场占有率分析、产业趋势/统计、2024年至2029年成长预测Camera Module - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

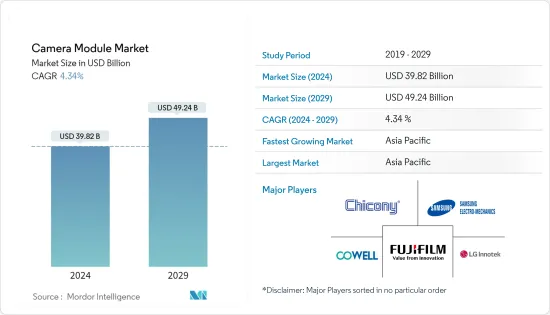

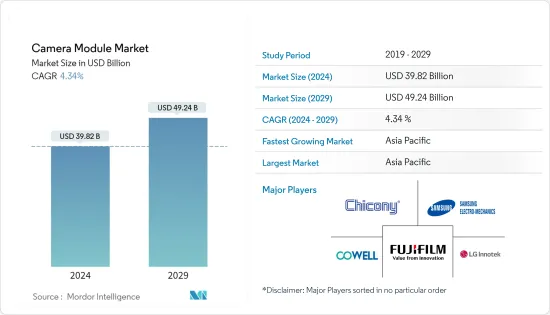

相机模组市场规模预计到2024年为398.2亿美元,预计到2029年将达到492.4亿美元,在预测期内(2024-2029年)复合年增长率为4.34%。

主要亮点

- 相机模组是从智慧型手机、汽车、智慧家电等设备拍摄照片和影片的产品。作为视讯输入设备,广泛应用于视讯会议、安防系统、即时监控等领域。它由影像感测器、红外线截止滤光片、致动器(AF/OIS)、镜头组、镜头卡口等组成。模组组装将所有这些组件组合到一个模组中。

- ADAS 市场越来越多地采用自动驾驶和自动驾驶汽车,这是一个关键的成长要素。例如,根据英特尔的预测,到2030年,全球汽车销售量预计将达到1.014亿辆以上,而自动驾驶汽车预计到2030年将占汽车註册量的12%左右。

- 世界各地建设活动的增加为广泛使用摄影机的安全系统的结合提供了有利可图的机会。根据挪威统计局的数据,挪威住宅量从 2022 年 4 月的 1,929 套增加到 5 月的 2,777 套。此外,2022年1月,挪威斯塔万格市向瑞典建设公司Skanska支付8,550万美元(7.5亿挪威克朗)开发新城区。 LervikQuarter开发计划将建在斯塔万格Storhaug区。占地 26,000平方公尺的场地将包括一个停车场、一所小学、一所幼儿园、办公室、一家杂货店和一个多功能厅。

- 全球恐怖攻击和有组织犯罪数量不断增加、IP摄影机的采用不断增加、基于物联网的安全系统的采用不断增加等正在推动主要在住宅和商业机构中对安全摄影机的需求。例如,根据英国国家统计局的数据,2021/22年度的犯罪率为每1000人129人,使得英格兰东北部的克利夫兰成为英格兰和威尔斯所有警区中犯罪率最高的地区。 。

- 轻便型相机模组是一个复杂的系统,涉及许多不同的学科、技术和流程。由于 CCM 子组件製造商的活动重迭,CCM 供应链变得越来越复杂。实现强大的 CCM 技术面临的挑战进一步增加了市场生态系统的复杂性,并对技术的发展提出了挑战。

- 此外,相机模组的高成本和维护等管理费用等挑战对市场开拓构成挑战,特别是在消费者对价格高度敏感的新兴国家和欠发达地区。

相机模组市场趋势

行动区隔市场占据显着的市场占有率份额

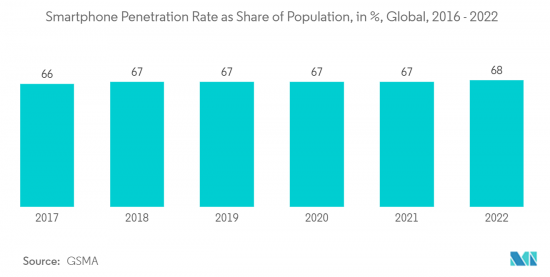

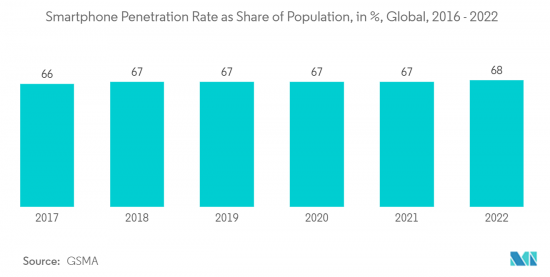

- 技术开拓和预算落后的新兴经济体智慧型手机销售成长,推动了相机模组市场的发展。爱立信预计,到2022年终,智慧型手机用户数量预计将达到66亿部,约占所有行动电话用户的79%。预计到 2028 年,合约数量将达到 78 亿份,约占所有行动电话合约的 84%。

- 此外,根据 GSMA 的数据,到 2025 年,北美智慧型手机用户预计将达到 3.28 亿。此外,到 2025 年,该地区的行动电话用户普及(86%) 和网路普及(80%) 可能会增加。此外,到 2025 年,欧洲预计将拥有最高的网路普及(82%) 和智慧型手机普及(88%)。所有这些因素都对所研究市场的成长做出了积极贡献。

- 由于各种智慧型手机对提高相机解析度的需求不断增加,多家製造商正在推出新的感光元件和相机模组。例如,2023 年 1 月,三星发布了最新的 2 亿像素 (MP) 影像感测器 ISOCELL HP2,该感测器具有改进的像素技术和全阱容量,可改善高阶智慧型手机中的行动影像。这款新感光元件采用 1/1.3 吋光学格式,拥有 2 亿个 0.6 微米像素,这是 108MP 智慧型手机主相机常用的感光元件尺寸。

- 此外,大多数智慧型手机现在使用 CMOS(互补型金属氧化物半导体)影像感测器而不是 CCD(电荷耦合元件)。 CMOS 的功耗比 CCD 低,非常适合行动装置。同样在 2022 年 11 月,CMOS 影像感测器供应商 SmartSens Technology 发布了 SC520XS,这是一款用于高阶智慧型手机相机的 0.7 微米像素、52MP CMOS 影像感测器。

- 此外,智慧型手机供应商正在开拓先进的行动电话镜头,这也推动了相机模组市场的发展。例如,2022 年 7 月,小米宣布在其新款旗舰智慧型手机 Mi 12S Ultra 上配备加大的相机感光元件。它配备了一个对于智慧型手机来说比较巨大的新功能,那就是1吋的相机感应器。

亚太地区主导市场

- 电子製造商、半导体製造商和汽车製造商的广泛存在以及消费者购买力的不断增强正在推动亚太地区紧凑型相机模组市场的成长。该地区智慧型手机的普及和智慧监控系统的变化,推动了紧凑型相机模组的推出,以支持蓬勃发展的消费性电子製造业。

- 例如,根据 GSMA 的数据,亚太地区的智慧型手机订阅率预计到 2030 年将达到 94%,而 2022 年将达到 76%。此外,预计独立行动电话用户数也将从2022年的17.3亿大幅增加到2030年的21.1亿。所有这些因素结合起来,为亚太研究市场的成长创造了良好的前景。

- 该地区消费电子产业的快速成长也有助于为市场创造积极的成长前景,因为相机模组越来越多地整合到各个领域的消费性电子设备中。中国已经拥有世界上最大的家用电子电器产业之一。此外,据IBEF称,印度家用电器和家用电子电器产业预计到2021年将达到98.4亿美元,到2025年将增加一倍多,达到211.8亿美元。

- 此外,由于自动化和工业机器人解决方案将相机模组用于各种目的,预计该地区的自动化将在预测期内扩大相机模组市场。例如,「中国製造2025」等中国政府计画正在促进工厂自动化的研发和技术投资。 「中国倡议」旨在扩大自动化设备的国内生产,因为大多数自动化设备都是从其他国家进口的。

- 该地区的医疗保健行业也大量采用数位化。因此,作为理想的解决方案,预计将推动下一代一次性内视镜的市场需求调查。据 IBEF 称,医疗保健已成为印度最大的行业之一。在收入增加、健康意识提高、文明病和保险覆盖率增加的推动下,该国的医疗保健市场预计到 2022 年将达到 3,720 亿美元。因此,对医疗设备的需求不断增加,也增加了对此类设备中使用的相机模组的需求。

相机模组产业概况

随着不断增长的需求吸引新参与企业,相机模组市场正在进入碎片化阶段。随着相机模组行业知名製造商的不断增加,预计竞争公司之间的敌对关係将在预测期内加剧。 Cowell E Holdings Inc.、富士软片公司、索尼公司等市场老牌企业对整体市场有相当大的影响力。

2023 年 5 月,夏普发布了配备 1 吋徕卡影像感测器的 Aquos R8 Pro。它配备了带有 Summicron 镜头的 47.2MP 1 英寸SONYIMX989 主摄像头,以及焦距为 19mm 的 50.3MP 1/1.55 英寸摄像头。此外,它还配备了 4,570mAh 电池和高通 Snapdragon 8 Gen 2 晶片组、LPDDR5x RAM 和 UFS 4.0 储存。

2023年4月,三星马达宣布将发表2亿像素相机模组,防手震功能提升一倍以上。该公司还希望以其捕捉高品质照片和影片的专有技术瞄准市场。本产品的防手震角度为3.0度,是传统产品防手震角度1.5度的两倍。在目前市场上具有OIS功能的智慧型手机中,这是全球最高的之一。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- 评估 COVID-19 对产业的影响

- 价格走势分析

- 超小型相机模组的动态

- 适用于各种应用的相机模组尺寸的演变

- 每个供应商提供的解析度和产品映射

- 解析度与成本分析

第五章市场动态

- 市场驱动因素

- 增加汽车 ADAS(进阶驾驶辅助系统)的市场驱动力

- 家庭和商业机构越来越多地使用保全摄影机

- 市场抑制因素

- 复杂的製造和供应链挑战

- 科技演进趋势

- 按组件分類的技术进步

- 每个最终产品的平均摄影机数量 - 智慧型手机与轻型车辆

汽车/行动电话相机的演变

第六章市场区隔

- 按成分

- 影像感测器

- 镜片

- 相机模组组装

- VCM 供应商(AF 和 OIS)

- 按用途

- 移动的

- 家用电器(不含手机)

- 车

- 医疗保健

- 安全

- 工业的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第七章供应商市场占有率分析

- 相机模组厂商市场占有率

- 影像感测器(CIS)供应商排名

- 镜头组厂商排名

第八章竞争形势

- 公司简介

- Chicony Electronics Co. Ltd.

- Cowell E Holdings Inc.

- Fujifilm Corporation

- LG Innotek Co. Ltd.

- LuxVisions Innovation Limited(Lite-On Technology Corporation)

- Primax Electronics Ltd.

- Samsung Electro-Mechanics Co. Ltd.

- Sharp Corporation

- Sony Group Corporation

- STMicroelectronics NV

- Sunny Optical Technology(Group)Company Limited

- ams OSRM AG

- On Semiconductor(Semiconductor Components Industries LLC)

- OFILM Group Co. Ltd.

- OmniVision Technologies Inc.

第九章投资分析

第十章市场机会与未来成长

The Camera Module Market size is estimated at USD 39.82 billion in 2024, and is expected to reach USD 49.24 billion by 2029, growing at a CAGR of 4.34% during the forecast period (2024-2029).

Key Highlights

- A camera module is a product that takes photos and videos from devices like smartphones, automobiles, smart home appliances, etc. It is widely used in video conferencing, security systems, and real-time monitoring as a video input device. It comprises image sensors, an IR-cut filter, an actuator (AF/OIS), a lens set, a lens mount, etc. Module assembly brings all these components together into a module.

- The ADAS market's increasing adoption of self-driving or autonomous vehicles is a primary growth factor. For instance, according to Intel, global car sales are expected to reach over 101.4 million units in 2030, and autonomous vehicles are expected to account for about 12% of car registrations by 2030.

- The increasing construction activities globally provide lucrative opportunities for incorporating security systems wherein cameras are widely used. According to Statistics Norway, Housing Starts in Norway increased to 2,777 units in May from 1,929 units in April of 2022. Furthermore, in January 2022, the Norwegian municipality of Stavanger gave Swedish construction company Skanska a USD 85.5 million (NOK 750 million) contract to develop a new municipal town center. The Storhaug neighborhood of Stavanger is expected to receive the LervikQuarter development project. The 26,000 m2 structure would have parking places, a primary school, a kindergarten, offices, a grocery shop, a multipurpose hall, and other amenities.

- The rising number of terrorist attacks and organized crimes globally, expanding adoption of IP cameras, and rising adoption of IoT-based security systems are primarily driving the demand for security cameras in residential and commercial establishments. For instance, according to the Office for National Statistics (UK), in 2021/22, with a crime rate of 129 per 1,000 people, Cleveland, in Northeast England, had the highest crime rate of all the police force areas in England and Wales.

- Compact camera modules are complex systems involving various disciplines, technologies, and processes. The supply chain of CCMs is witnessing complexities against the backdrop of overlaps between the activities of CCM's sub-component manufacturing companies. Challenges in realizing robust CCM technology further add to the complexity of the market's ecosystem, thereby creating challenges for the evolution of the technology.

- Furthermore, factors such as the higher cost of camera modules and overhead costs such as maintenance also challenge the studied market's growth, especially in developing or underdeveloped regions, wherein consumer price sensitivity is higher.

Camera Module Market Trends

Mobile Segment to Hold a Notable Market Share

- The growing sales of smartphones across economies with slower technological developments and budgets have propelled the market for camera modules. According to Ericsson, at the end of 2022, 6.6 billion smartphone subscriptions were estimated, accounting for about 79% of all mobile phone subscriptions. This is expected to reach 7.8 billion in 2028, accounting for around 84% of all mobile subscriptions.

- Moreover, according to GSMA, smartphone subscribers in North America are anticipated to reach 328 million by 2025. Additionally, by 2025, the region may also witness an increase in mobile phone subscriber penetration rates (86%) and the Internet (80%). Furthermore, by 2025, Europe is estimated to register the highest internet penetration rate (82%) and smartphones (88%). All these factors contribute positively to the studied market's growth.

- The increasing demand to improve cameras' resolution across smartphones of all ranges has enabled several manufacturers to launch new sensors and camera modules. For instance, in January 2023, Samsung introduced its latest 200-megapixel (MP) image sensor, the ISOCELL HP2, with improved pixel technology and full-well capacity to improve mobile images in premium smartphones. The new sensor packs 200 million 0.6-micrometer pixels in a 1/1.3" optical format, a sensor size commonly used in 108MP main smartphone cameras, enabling consumers to experience even higher resolutions in the latest high-end smartphones without larger camera bumps in their devices.

- Moreover, currently, most smartphones use CMOS (Complementary Metal-Oxide Semiconductor) image sensors instead of CCD (Charge-Coupled Device). CMOS uses less power than CCD, which makes it highly suitable for mobile devices. Also, in November 2022, SmartSens Technology, a CMOS image sensor supplier, introduced SC520XS, a 0.7-micron pixel, 52-MP CMOS Image Sensor for high-end smartphone cameras.

- Further, smartphone vendors are developing advanced cameras in their mobile phones, which drives the camera module market. For instance, in July 2022, Xiaomi announced an extended camera sensor in its new Mi 12S Ultra flagship smartphone. It comes with a huge new feature: a 1-inch camera sensor, which is relatively giant for a smartphone.

Asia-Pacific to Dominate the Market

- The widespread presence of electronics, semiconductor, and automobile manufacturing companies, as well as an increase in consumers' purchasing power of the population, is fueling the growth of the compact camera modules market in the Asia-Pacific. The region has witnessed a change in smartphone adoption and smart surveillance systems, thus propelling the deployment of compact camera modules to cater to a booming consumer electronics manufacturing sector.

- For instance, according to GSMA, smartphone subscription in the Asia-Pacific region is anticipated to reach 94% by 2030, compared to 76% in 2022. Furthermore, unique mobile subscribers are also anticipated to grow significantly, from 1.73 billion in 2022 to 2.11 billion in 2030. All these factors together create a favorable outlook for the growth of the studied market in the Asia Pacific region.

- The region's rapidly growing consumer electronics industry also helps create a positive growth scenario for the market as camera modules are increasingly being integrated into consumer electronic devices for different segments. China already has one of the largest consumer electrical industries in the world. Moreover, according to IBEF, the Indian appliances and consumer electronics industry reached USD 9.84 billion in 2021 and is estimated to more than double to reach USD 21.18 billion by 2025.

- Further, automation in the region is expected to augment the camera module market during the forecast period as automation and industrial robotic solutions uses camera module for various purposes. For instance, the Chinese government's programs, such as the Made in China 2025 plan, promote R&D in factory automation and technology investments. As most of the automation equipment is imported from other countries, the 'Made in China' initiative aims to expand the country's domestic production of automation equipment.

- The healthcare sector in the region has also shown a significant adoption of digitization. Hence, it is expected to drive the demand for the market studied as an ideal solution for next-generation single-use endoscopes. Healthcare has emerged as one of the largest sectors in India, according to IBEF. The healthcare market in the country is expected to reach USD 372 billion by 2022, driven by increasing income, better health awareness, lifestyle diseases, and growing access to insurance. Thus, the growing demand for medical devices also augments the demand for camera modules for use in many such devices.

Camera Module Industry Overview

The camera module market is moving towards a fragmented stage as the growing demand is attracting new players to enter the market. The growing presence of prominent manufacturers in the camera module industry is expected to intensify competitive rivalry during the forecast period. Market incumbents, such as Cowell E Holdings Inc., Fujifilm Corporation, and Sony Corporation, considerably influence the overall market.

In May 2023, Sharp introduced the Aquos R8 Pro, which features a 1" Leica image sensor. It has a 47.2MP 1-inch Sony IMX989 primary camera with a Summicron lens as opposed to a 50.3MP 1/1.55-inch camera with a 19 mm focal length equivalent. Additionally, they are fueled by a 4,570 mAh battery and a Qualcomm Snapdragon 8 Gen 2 chipset with LPDDR5x RAM and UFS 4.0 storage.

In April 2023, Samsung Electro-Mechanics announced that it would release a 200-megapixel-class camera module with improved image stabilization features that are more than twice as good. The company also wants to target the market with unique technologies for taking high-quality photos and videos. This product's 3.0-degree image stabilization angle is twice as good as the existing products' 1.5-degree stabilization angle. Among the smartphones with OIS features currently on the market, it offers the highest level globally.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

- 4.5 Price Trend Analysis

- 4.6 Ultra Small Camera Module Dynamics

- 4.6.1 Evolution of Camera Module Size Across Various Applications

- 4.6.2 Product Mapping with Resolutions Offered by Various Vendors

- 4.6.3 Resolution Vs. Cost Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Market Demand for Advanced Driver Assistance Systems in Vehicles

- 5.1.2 Increased Use of Security Cameras in Households and Commercial Establishments

- 5.2 Market Restraints

- 5.2.1 Complicated Manufacturing and Supply Chain Challenges

- 5.3 Technology Evolution Trends

- 5.3.1 Component-wise Technological Advancements

- 5.3.2 Average Number of Cameras Per End-product - Smartphones Vs. Light

Vehicles / Camera Evolution in a Mobile Phone

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Image Sensor

- 6.1.2 Lens

- 6.1.3 Camera Module Assembly

- 6.1.4 VCM Suppliers (AF and OIS)

- 6.2 By Application

- 6.2.1 Mobile

- 6.2.2 Consumer Electronics (Excl. Mobile)

- 6.2.3 Automotive

- 6.2.4 Healthcare

- 6.2.5 Security

- 6.2.6 Industrial

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 VENDOR MARKET SHARE ANALYSIS

- 7.1 Camera Module Vendor Market Share

- 7.2 Image Sensor (CIS) Vendor Ranking

- 7.3 Lens Set Vendor Ranking

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Chicony Electronics Co. Ltd.

- 8.1.2 Cowell E Holdings Inc.

- 8.1.3 Fujifilm Corporation

- 8.1.4 LG Innotek Co. Ltd.

- 8.1.5 LuxVisions Innovation Limited (Lite-On Technology Corporation)

- 8.1.6 Primax Electronics Ltd.

- 8.1.7 Samsung Electro-Mechanics Co. Ltd.

- 8.1.8 Sharp Corporation

- 8.1.9 Sony Group Corporation

- 8.1.10 STMicroelectronics NV

- 8.1.11 Sunny Optical Technology (Group) Company Limited

- 8.1.12 ams OSRM AG

- 8.1.13 On Semiconductor (Semiconductor Components Industries LLC)

- 8.1.14 OFILM Group Co. Ltd.

- 8.1.15 OmniVision Technologies Inc.