|

市场调查报告书

商品编码

1404467

街道照明/道路照明:市场占有率分析、产业趋势/统计、2024年至2029年成长预测Street And Roadway Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

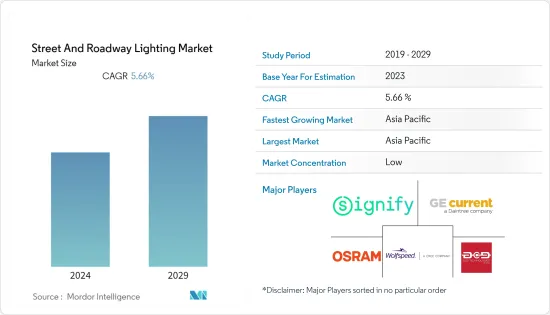

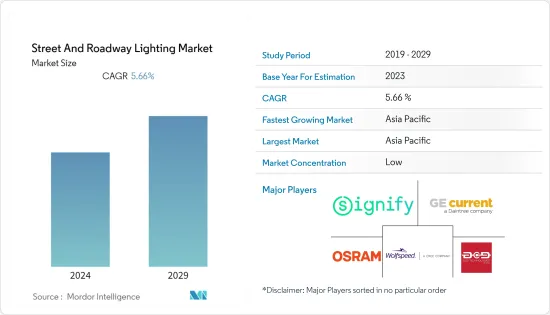

上年度路灯市场规模为94.4亿美元,预计未来五年将达130.9亿美元,复合年增长率为5.66%。

随着交通基础设施变得更加复杂,越来越需要加强道路和车道的照明,确保交通畅通和道路上人员的安全,同时保持成本效益。Masu。

主要亮点

- 道路照明对于提供符合道路照明标准设计标准的节能照明系统至关重要。为道路提供充足且均匀的照明,以确保驾驶者和行人的安全。由于道路照明系统智慧型解决方案的需求不断增加,道路照明和车道照明市场正在加速发展。

- 在能见度很重要的繁忙道路和高速公路上,道路照明被认为是重要的安全功能。根据 CED Engineering 的说法,适当的照明可以减少约 30% 的夜间碰撞事故,从而提高驾驶员、乘客和行人的安全性。

- 街道照明极为重要,因为它可以提高行人的安全性和能见度。 LED 路灯解决方案比传统路灯消费量更少的能源,减少碳排放,帮助城市变得更环保。此类照明系统还可与智慧技术整合,以降低成本、节省能源并提高公共照明基础设施的适应性、弹性和效率。因此,世界各地的城市越来越多地用 LED 取代旧的、效率较低的照明灯具。

- 此外,由于新兴国家能源效率的提高以及街道照明系统中的无线技术,街道照明和道路照明市场在未来几年可能会成长。然而,需要广泛接受的开放标准以及快速增加的产品测试成本可能会在不久的将来对街道照明市场的扩张构成进一步的障碍。除此之外,缺乏适合所有智慧路灯并适合城市采用的单一网路选项也是一个重大挑战。

- 此外,COVID-19 大流行导致全球封锁,迫使製造设施关闭,并严格限制社会流动。这影响了 LED 製造设施的一般运作。全球供应链中断、金属和电线杆短缺以及物流相关服务导致街道和道路照明产量下降,这些都是全球 LED 照明市场受到影响的其他征兆。所有这些因素都可能导致市场小幅下滑。

街道照明和道路照明市场的趋势

LED照明领域呈现显着成长

- LED 照明透过提高整体能见度提供稳定的光线,为道路和高速公路位置提供额外的安全性。它还可以与光电管、运动感测器和定时器结合,提供照明控制系统以实现高效使用。

- LED 照明越来越受欢迎,以获得当地能源效率的好处。根据美国能源局,经过能源之星认证的 LED 灯泡比传统白炽灯泡的能耗减少 90%,并且在其使用寿命内可为您节省 80 美元以上的能源成本。由于政府法规支持节能照明,美国许多企业都在采用 LED 照明。

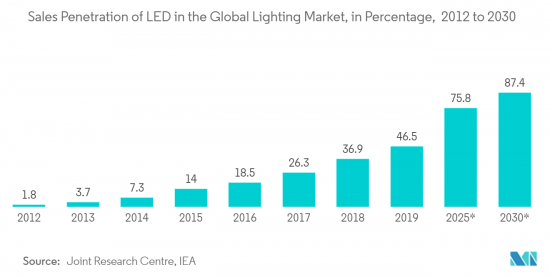

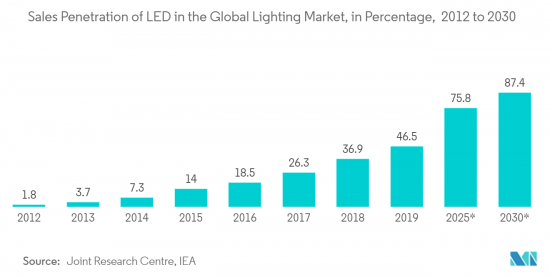

- 国际能源总署(IEA)估计,道路照明占全球照明总量的4%,改用LED照明平均可节省50%的能源成本,导致全球整体能源成本达1,600亿美元。预计可减少 5.55 亿吨二氧化碳排放。此外,根据 IEA 的数据,到 2030 年,LED普及预计将占全球照明市场的 87.4%。

- 此外,随着世界各地许多政府正在製定鼓励 LED 采用的法规,政府措施正在推动市场成长。例如,在印度,SLNP(国家路灯计画)等政府产业(一项以 LED 取代 2,100 万盏路灯的倡议)正在进一步促进市场成长。

- 此外,LED 照明应用提供全频谱的色彩,有助于改善户外空间、桥樑、道路和建筑物的美感。例如,2022年8月,匹兹堡政府在该市的三座姊妹桥上安装了LED照明。该项目将从 9 月的 Rachel Carson 大桥开始,在连接匹兹堡市中心和北岸的三座桥樑上安装 601,440 盏彩色 LED 灯。计划预计将于年终完工。

北美占据主要市场占有率

- 随着智慧城市计画的兴起,北美将主导街道照明和道路照明市场。此外,政府加大力度在高速公路和道路应用中采用 LED 技术将支持该地区街道照明和道路照明市场在预测期内的成长。

- 影响该地区照明市场的关键因素之一是联网街道照明的投资。街道照明计画已经使该地区的众多社区受益。例如,2022 年 9 月,美国政府历史性的 1.2 兆美元基础设施投资和就业法案将使 Signify 和 Upciti 能够帮助美国和加拿大的城市和公共付加照明基础设施以外的附加价值。我有机会帮助您获得那里。

- 自 2023 年 3 月起,拉雷多的 12,000 盏路灯将转换为LED灯,使拉雷多成为德克萨斯州第一个完成此类转换的城市。此外,达拉斯市官员正在考虑在 2022 年 3 月之前大量改用 LED 路灯。达拉斯市约有 15,000 盏路灯,其中近一半是 LED 灯。

- 据美国能源部称,2020年至2035年美国对LED照明的需求预计将增加,特别是户外使用。到 2025 年,预计 93% 的户外照明将是 LED 照明,使其成为所有行业中最受欢迎的类型,主要与路灯相关。

- 此外,为了使该市的街道照明更加节能,阿拉巴马市议会于 2022 年 2 月核准了与 NORESCO Energy Services 达成的 470 万美元的成本削减协议。全市范围内安装 LED 照明的工作已经开始。 Blountsville 和 Alabama Power 也于 2022 年 4 月签署了新的 LED 路灯合约。由于该镇的成本将分摊到三年内,因此价格可能会更低。这项节能策略预计每月将为该市节省 128 美元。这些倡议预计将增加该地区对 LED 照明的需求。

道路照明产业概况

街道照明和道路照明市场高度分散且竞争激烈,世界各地有许多区域和国际参与企业。主要参与企业包括 Signify、OSRAM 和 Cree。

2023年6月,印度政府核准在德里公共工程部(PWD)管理的所有道路上安装9万盏智慧路灯。政府强调加强中央监控系统,确保路灯不间断运作。

2023 年 2 月,门罗市议会宣布核准一项动议,向东南密西根市政委员会 (SEMCOG) 提交津贴请求,将城市周围的路灯改造成发光二极体(LED) 灯。一旦核准,这笔赠款预计将涵盖该市高达 80% 的改造资本成本。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 对街道照明系统智慧型解决方案的需求不断增长

- 智慧城市基础设施的采用率不断提高

- 市场抑制因素

- 引进智慧照明成本高昂

第六章市场区隔

- 照明类型

- 传统照明

- 智慧照明

- 光源

- LED

- 萤光

- 高强度放电灯泡

- 奉献

- 硬体

- 照明和灯泡

- 照明设备

- 控制系统

- 软体和服务

- 硬体

- 电力

- 50W以下

- 50~150W

- 150W以上

- 目的

- 高速公路

- 路

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章竞争形势

- GE Current

- Cree Inc.(Wolfspeed Inc.)

- Signify Holding

- OSRAM Licht AG

- DCD Technologies ME FZCO

- Hubbell Inc

- Zumbotel Group(Thorn Lighting)

- LED roadway lighting Ltd

- Acuity Brands, Inc.

- Syska LED Lights Pvt. Ltd.

第八章投资分析

第九章 市场机会及未来趋势

The Street and Roadway Lighting Market was valued at USD 9.44 billion in the previous year and is expected to register a CAGR of 5.66 percent, reaching USD 13.09 billion by the next five years. The increasing complexities of transportation infrastructure have increased the need for enhanced illumination on streets and roadways to ensure smooth traffic flow and people's safety on the streets while remaining cost-effective.

Key Highlights

- Street and roadway lighting is essential for providing an energy-efficient lighting system that is suitable as per the standard design criteria for roadway lighting. It provides adequate and uniform lighting on the roads for both motorists' and pedestrians' safety. The market for street and roadway lighting is accelerating due to the growing demand for intelligent solutions in street lighting systems.

- Roadway lighting is regarded as an essential safety feature for busy streets and highways where clear visibility is critical. According to CED Engineering, adequate lighting can reduce nighttime collisions by about 30 percent, enhancing the safety of drivers, riders, and pedestrians.

- Street lighting is crucial because it increases pedestrian safety and visibility. Owing to their lower energy consumption compared to conventional street lamps, LED street lighting solutions can help cities become more environmentally friendly by reducing their carbon footprint. In order to reduce costs, conserve energy, and improve the adaptability, flexibility, and efficiency of public lighting infrastructure, such lighting systems can also be integrated with smart technologies. As a result, cities all over are switching out older, inefficient fixtures with LEDs.

- Additionally, in the upcoming years, the street and roadway lighting market may grow due to improvements in energy efficiency in developing nations and wireless technology for street lighting systems. However, the need for widely accepted open standards and the rapidly rising costs of product testing could pose additional obstacles to the market's expansion for street and roadway lighting in the near future. In addition to this, the unavailability of a single networking option that works best for all smart street lights and is suitable for a city to adopt is also a significant challenge.

- Furthermore, the COVID-19 pandemic scenario resulted in a global lockdown, which resulted in the closure of manufacturing facilities and severe restrictions on social movement. This impacted the general operations of LED manufacturing facilities. The disruption of the global supply chain, the lack of metals and poles, and the logistics-related services that led to the low production of street and roadway lighting were additional signs of the global impact on the LED lighting market. All of these elements could cause a slight decline in the market.

Street and Roadway Lighting Market Trends

LED Lights Segment to Exhibit Significant Growth

- LED lights provide consistent light by improving overall visibility and providing added security for street and highway locations. They can also be paired with photocells, motion sensors, and timers to offer a lighting control system for efficient usage.

- LED lighting is becoming increasingly common to reap the benefits of energy efficiency in the area. According to the U.S. Department of Energy, an Energy Star-certified LED light bulb can utilize up to 90 percent less energy compared to traditional incandescent bulbs while saving more than USD 80 in power costs throughout its lifetime. Due to government regulations supporting energy-efficient lighting, many businesses in the U.S. are implementing LED lighting.

- The International Energy Agency (IEA) estimated that road lighting accounts for 4 percent of total global light, and a switch to LED lights can save an average of 50 percent in energy costs, which results in global savings of USD 160 billion in energy costs, and 555 million tons of CO2. Further, according to IEA, the LED penetration rate is expected to be 87.4 percent of the global lighting market by 2030.

- Moreover, government initiatives are fueling market growth, as many governments worldwide are structuring regulations for encouraging LED adoption. For instance, in India, the government's industry, such as SLNP (Street Light National Program), an initiative to replace 21 million streetlights with LED, further contributes to the market growth.

- Additionally, LED lighting applications provide color across the entire spectrum and thus help improve the aesthetics of outdoor spaces, bridges, roads, and buildings. For instance, in August 2022, the Government of Pittsburgh installed LED lights on three of the city's sister bridges. The installation of 601,440 colored LED lights across the three bridges that connect Downtown Pittsburgh to the North Shore will begin in September with the Rachel Carson Bridge. The project is anticipated to be finished by the end of 2023.

North America to Witness the Significant Market Share

- The rise in smart city initiatives will cause North America to dominate the street and roadway lighting market. Additionally, expanding government initiatives to adopt LED technology for highway and roadway applications will support the growth of the region's street and roadway lighting market over the forecast period.

- One of the key factors influencing the area's lighting market is investments in connected streetlights. Street and road lighting initiatives have already benefited numerous communities across the region. For instance, in September 2022, with the US government's historic USD 1.2 trillion Infrastructure Investment and Jobs Act, Signify and Upciti took the opportunity to aid cities and utilities across the United States and Canada get added value, well beyond illumination from their lighting infrastructure.

- 12,000 streetlights in the City of Laredo were converted to LED lamps as of March 2023, making Laredo the first City in the state of Texas to accomplish such a conversion, according to officials. Additionally, Dallas city officials discussed significantly switching to LED streetlights in March 2022. The City owns about 15,000 streetlights in Dallas, nearly half of which are LEDs.

- The demand for LED lights is expected to increase in the United States between 2020 and 2035, particularly for outdoor uses, according to the Department of Energy. By 2025, 93 percent of outdoor lighting installations are expected to be LED lighting, making it the most popular type across all industries, primarily for connected street lights.

- Furthermore, to make the City's streetlights more energy-efficient, the Alabama City Council approved a USD 4.7 million cost-saving agreement with NORESCO Energy Services in February 2022. Work started on installing LED lights all over the City. The Town of Blountsville and Alabama Power also signed a new LED streetlights contract in April 2022. The price will likely be reduced because the town's expenses will be dispersed over three years. The City will save an estimated USD 128 per month with the power savings strategy. These developments are anticipated to increase the region's demand for LED lighting.

Street and Roadway Lighting Industry Overview

The street and roadway lighting market is fragmented and highly competitive owing to the presence of many regional and international players across the globe. Some of the significant players are Signify, OSRAM, and Cree, among others.

In June 2023, The Government of India approved the installation of 90,000 smart street lights on all the roads maintained by the Public Works Department (PWD) in Delhi to eliminate dark spots and bolster women's security. The government stressed a robust central monitoring system for ensuring the uninterrupted functioning of the lights.

In February 2023, The Monroe City Council announced the approval of a motion to submit a grant request to the Southeast Michigan Council of Governments (SEMCOG) to convert street lights around the city to light-emitting diode (LED) lamps. After approval, the grant is expected to cover up to 80 percent of the capital costs the city would incur in the conversion.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Intelligent Solutions in Street Lighting Systems

- 5.1.2 Increasing Adoption of Smart City Infrastructure

- 5.2 Market Restraints

- 5.2.1 High Installation Cost of Smart Lighting

6 MARKET SEGMENTATION

- 6.1 Lighting Type

- 6.1.1 Conventional Lighting

- 6.1.2 Smart Lighting

- 6.2 Light Source

- 6.2.1 LEDs

- 6.2.2 Fluorescent Lamps

- 6.2.3 High-intensity Discharge Lamps

- 6.3 Offering

- 6.3.1 Hardware

- 6.3.1.1 Lights and Bulbs

- 6.3.1.2 Luminaires

- 6.3.1.3 Control Systems

- 6.3.2 Software and Services

- 6.3.1 Hardware

- 6.4 Power

- 6.4.1 Below 50W

- 6.4.2 Between 50W - 150W

- 6.4.3 More Than 150W

- 6.5 Application

- 6.5.1 Highways

- 6.5.2 Street and Roadways

- 6.6 Geography

- 6.6.1 North Ameroca

- 6.6.2 Europe

- 6.6.3 Asia-Pacific

- 6.6.4 Latin America

- 6.6.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 GE Current

- 7.1.1 Cree Inc. (Wolfspeed Inc.)

- 7.1.2 Signify Holding

- 7.1.3 OSRAM Licht AG

- 7.1.4 DCD Technologies ME FZCO

- 7.1.5 Hubbell Inc

- 7.1.6 Zumbotel Group (Thorn Lighting)

- 7.1.7 LED roadway lighting Ltd

- 7.1.8 Acuity Brands, Inc.

- 7.1.9 Syska LED Lights Pvt. Ltd.