|

市场调查报告书

商品编码

1404468

隔热涂料:市场占有率分析、产业趋势与统计、2024-2029 年成长预测Thermal Barrier Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

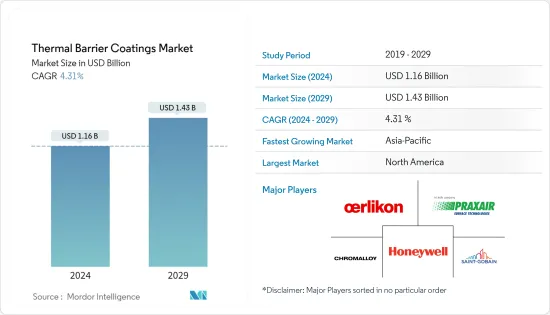

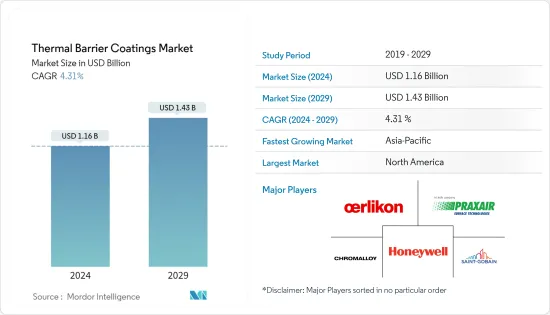

预计 2024 年隔热障涂料市场规模为 11.6 亿美元,预计 2029 年将达到 14.3 亿美元,在预测期内(2024-2029 年)复合年增长率为 4.31%。

由于不利的宏观经济和这些涂料主要最终用户的营运限制,COVID-19 对 2020 年市场产生了负面影响,压低了这段时期的需求。不过,目前预计市场将达到疫情前水平,并有望稳定成长。

主要亮点

- 从燃煤发电向天然气发电的转变以及航太领域不断增长的需求预计将推动隔热障涂料市场的需求。

- 另一方面,原物料价格波动预计将抑制市场需求。

- 在预测期内,各种最终用户市场的技术进步可能会为所研究的市场带来新的成长途径。

- 北美主导着世界市场。然而,预计亚太地区在预测期内将呈现最高成长率。

隔热障涂层市场趋势

航太领域占市场主导地位

- 隔热障涂层通常用于保护镍基高温合金免受熔化以及航空涡轮机与冷气流结合的热循环的影响。

- 隔热障涂层将允许的气体温度提高到高温合金的熔点以上。它可以降低叶片合金的温度,并保护其免受热气体引起的氧化和热腐蚀,从而提高涡轮机的性能、寿命和效率。

- 不断增长的机持有和不断增加的国防支出导致世界各地的飞机产量增加,从而对 TBC 等用于保护发动机和涡轮机的被覆剂产生了巨大的需求。

- 根据航空维修店协会发布的资料,全球飞机持有预计在未来十年将快速成长。预计这一数字将从 2023 年的 28,000 人增加到 2032 年的 38,100 人。

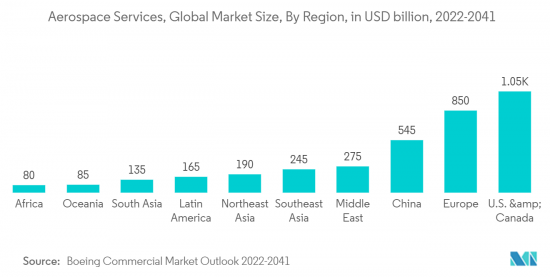

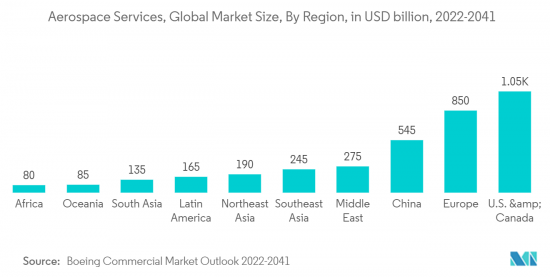

- 根据波音《2022-2041年商业展望》,全球航太服务业预计将达到3.6兆美元以上,其中美国和加拿大占近30%的市场份额。欧洲紧随其后,占 23.5%,这可能会推动未来几年研究市场的需求。

- 此外,根据波音《2022-2041年商业展望》,到2041年,中国将交付约8,485架新飞机,市场服务价值将达到5,450亿美元。因此,它正在推动市场的成长。

- 总体而言,航太工业隔热障涂料市场预计将逐步復苏,并在整个预测期内实现稳定成长。

北美市场占据主导地位

- 由于航太、汽车、电力、石油和天然气等各个最终用户产业的强劲需求,北美地区在隔热涂料市场占据主导地位。

- 此外,美国在市场研究中占最大份额。除美国外,加拿大和墨西哥在隔热障涂料市场中占有很大份额。

- 向法国、中国和德国等国家的航太零件出口强劲,加上美国强劲的消费支出,推动了航太业的製造业活动。这可能会给市场带来正面的动力。

- 在北美,波音《2022-2041年商业展望》预计,到2041年,新飞机交付总量将达到9,310架,市场服务价值将达到1.45兆美元。

- 根据OICA的数据,2022年北美汽车产量将为17,756,263辆,比2021年产量16,190,835辆增加10%。此外,在北美,2022年美国产量超过1,006万台。

- 北美地区主要国家继续受到半导体微晶片短缺和供应链进一步中断的影响。例如,根据美国汽车经销商协会 (NADA) 的数据,2022 年年轻型汽车销量是自 2011 年以来最低的一年。与2021年轻型汽车销量相比,年减8.2%。

- 因此,预计所有上述因素都将在预测期内对该地区隔热障涂料市场的需求产生重大影响。

隔热障涂层产业概况

隔热障涂层市场分散。该市场的主要企业包括(排名不分先后)霍尼韦尔国际公司、OC Oerlikon Management AG、Praxair ST Technology, Inc.、Chromalloy Gas Turbine LLC 和 Saint-Gobain。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 航太领域需求增加

- 发电对燃气涡轮机的依赖日益增加

- 其他司机

- 抑制因素

- 原物料价格不稳定

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 产品

- 金属(黏合层)

- 陶瓷(面漆)

- 金属间化合物

- 其他产品(金属玻璃复合材料)

- 最终用户产业

- 车

- 航太

- 发电厂

- 油和气

- 其他最终用户产业(船舶、铁路)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章竞争形势

- 併购、合资、联盟、协议

- 市场占有率分析(%)**/市场排名分析

- 主要企业策略

- 公司简介

- A&A Thermal Spray Coatings

- Chromalloy Gas Turbine LLC

- CTS, Inc.

- Hayden Corp.

- Honeywell International Inc.

- KECO Coatings

- Metallic Bonds, Ltd.

- Northwest Mettech Corp.

- OC Oerlikon Management AG

- Praxair ST Technology, Inc.

- Saint-Gobain

- Tech Line Coatings LLC

- ZIRCOTEC

第七章 市场机会及未来趋势

- 最终用户市场的技术进步

- 其他机会

The Thermal Barrier Coatings Market size is estimated at USD 1.16 billion in 2024, and is expected to reach USD 1.43 billion by 2029, growing at a CAGR of 4.31% during the forecast period (2024-2029).

COVID-19 negatively impacted the market in 2020 due to the unfavorable macroeconomics and operational restrictions across major end users of these coatings pushed back the demand during this period. However, the market is now estimated to reach pre-pandemic levels and is expected to grow steadily.

Key Highlights

- The shift from coal to natural gas-fired power generation and increasing demand from the aerospace sector is expected to drive demand for the thermal barrier coatings market.

- On the flip side, volatile raw material prices are expected to restrain demand in the market studied.

- The technological advancements in various end-user markets will likely provide new growth avenues for the market studied during the forecast period.

- North America dominated the global market. However, Asia-Pacific will likely witness the highest growth rate during the forecast period.

Thermal Barrier Coatings Market Trends

Aerospace Sector to Dominate the Market

- Thermal barrier coatings are commonly used to protect nickel-based superalloys from melting and thermal cycling in aviation turbines combined with cool airflow.

- Thermal barrier coatings increase the allowable gas temperature above the superalloy melting point. They reduce the temperature of the blade alloy and protect against oxidation and hot corrosion from high-temperature gas, thus, increasing turbine performance, life expectancy, and efficiency.

- The increasing aircraft fleet and the rising defense expenditure increased aircraft production worldwide, creating immense demand for coatings like TBCs to protect engines and turbines.

- According to the data released by the Aeronautical repair station association, the global aircraft fleet is expected to expand rapidly in the coming decade. It is expected to reach 38,100 aircraft by 2032 from 28,000 in 2023.

- According to the Boeing Commercial Outlook 2022-2041, the worldwide aerospace services industry is predicted to reach over USD 3.6 trillion, with the United States and Canada accounting for almost 30% of the market. Europe follows it with 23.5%, which will likely boost the demand for the studied market in the coming years.

- Furthermore, according to the Boeing Commercial Outlook 2022-2041, in China, around 8,485 new deliveries will be made by 2041 with a market service value of USD 545 billion. Thus, boosting the market growth.

- Overall, the market for thermal barrier coatings in the aerospace industry is expected to recover gradually through the forecast period and grow consistently.

North American Region to Dominate the Market

- The North American region is dominating the thermal barrier coatings market, owing to the significant demand from various end-user industries such as aerospace, automotive, power, and oil and gas.

- Moreover, the United States includes the largest share of the market studied. Besides the United States, Canada and Mexico contain a sizeable share of the market for thermal barrier coatings.

- Strong exports of aerospace components to countries such as France, China, and Germany, along with robust consumer spending in the United States, are driving the manufacturing activities in the aerospace industry. It can induce positive momentum for the market.

- In North America, according to the Boeing Commercial Outlook 2022-2041, the total deliveries of new airplanes will account for 9,310 units by 2041, with a market service value of USD 1,045 billion.

- According to the OICA, automotive production in North America in 2022 accounted for 17,756,263 units, an increase of 10% compared to the production in 2021, which was reported to be 16,190,835 units. Additionally, in North America, Over 10.06 million vehicles manufactured in 2022 were produced in the United States.

- Major countries in the North American region continued to get affected by the semiconductor microchip shortage and additional supply chain disruptions. For instance, According to the National Automobile Dealers Association (NADA), Light vehicle sales in 2022 recorded the lowest full-year sales in 2022 since 2011. They experienced an 8.2% annual decline compared to light vehicle sales in 2021.

- Hence, all the factors above are expected to significantly impact the demand for the thermal barrier coatings market in the region over the forecast period.

Thermal Barrier Coatings Industry Overview

The thermal barrier coatings market is fragmented in nature. Some of the major players in the market include Honeywell International Inc., OC Oerlikon Management AG, Praxair ST Technology, Inc., Chromalloy Gas Turbine LLC, and Saint-Gobain, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Aerospace Sector

- 4.1.2 Growing Dependence on Gas-Fired Turbines for Power Generation

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Volatile Raw Material Prices

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product

- 5.1.1 Metal (Bond Coat)

- 5.1.2 Ceramic (Top Coat)

- 5.1.3 Intermetallic

- 5.1.4 Other Products (Metal Glass Composites)

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Aerospace

- 5.2.3 Power Plants

- 5.2.4 Oil and Gas

- 5.2.5 Other End-user Industries (Marine and Railways)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%)**/ Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 A&A Thermal Spray Coatings

- 6.4.2 Chromalloy Gas Turbine LLC

- 6.4.3 CTS, Inc.

- 6.4.4 Hayden Corp.

- 6.4.5 Honeywell International Inc.

- 6.4.6 KECO Coatings

- 6.4.7 Metallic Bonds, Ltd.

- 6.4.8 Northwest Mettech Corp.

- 6.4.9 OC Oerlikon Management AG

- 6.4.10 Praxair S.T. Technology, Inc.

- 6.4.11 Saint-Gobain

- 6.4.12 Tech Line Coatings LLC

- 6.4.13 ZIRCOTEC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Technological Advancements in the End-user Market

- 7.2 Other Opportunities