|

市场调查报告书

商品编码

1404483

乙醛酸-2024年至2029年市场占有率分析、产业趋势与统计、成长预测Glyoxylic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

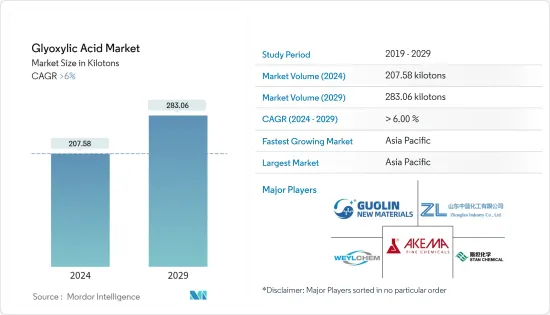

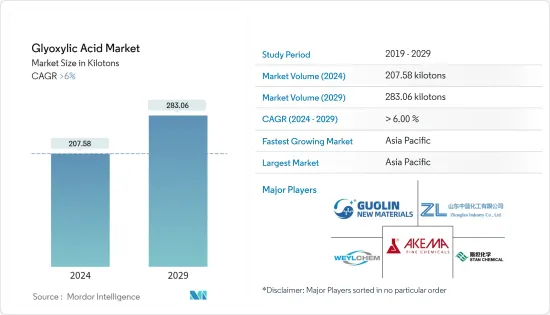

预计2024年乙醛酸市场规模为207.58千吨,预计2029年将达到283.06千吨,在预测期(2024-2029年)复合年增长率超过6%。

COVID-19 的爆发对 2020 年的市场产生了负面影响,导致世界各地的营运关闭、製造活动和供应链中断以及生产停顿。目前市场正从疫情中恢復。预计2022年市场将达到疫情前水准并持续稳定成长。

主要亮点

- 乙醛酸广泛用作个人护理和化妆品行业的中和剂,预计将推动市场成长。

- 另一方面,有关乙醛酸生产过程中排放控制和废弃物处理挑战的环境法规预计将在预测期内抑制市场成长。

- 此外,乙醛酸在製药领域使用方面不断进步的技术进步可能会在未来为全球市场创造利润丰厚的成长机会。

- 亚太地区主导全球市场,中国、印度和日本等国家是最大的消费者。

乙醛酸市场趋势

个人护理和化妆品行业的需求增加

- 近年来,由于个人护理行业的需求,对乙醛酸的需求量很大。

- 乙醛酸广泛用作个人护理行业的中和剂。应用领域包括直髮产品,如洗髮精、乳液和润髮乳。

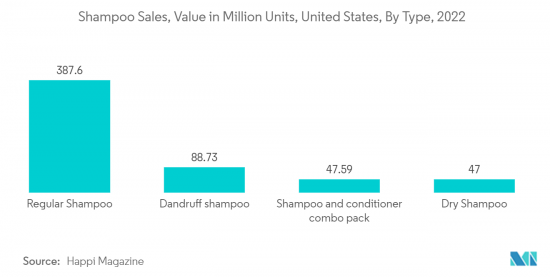

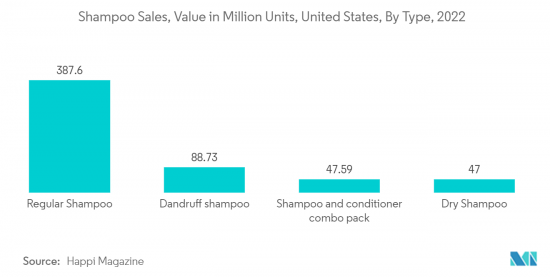

- 根据 Happi 杂誌报导,普通洗髮精将在美国销量最多,到 2022 年销量约为 3.88 亿瓶,其次是去屑洗髮精以及洗髮精和润髮乳组合装。因此,洗髮精消费量的增加可能会支持市场成长。

- 此外,由于各种消费者的高需求,全球化妆品产业正在快速成长。消费者对个人保健产品益处的认识不断提高,导致化妆品和个人保健产品的使用量增加。

- 此外,人们可支配收入和购买力的增加进一步导致对化妆品和个人护理产品的需求成长,推动市场成长。

- 根据国际贸易管理局 (ITA) 的数据,中国是全球第二大个人保健产品市场,预计到 2025 年将接近 800 亿美元。这是因为消费者日益成熟和中阶,人口持续成长也是推动个人照护和护肤品需求的因素。

- 因此,考虑到上述因素,预计预测期内乙醛酸的需求将大幅增加。

亚太地区主导市场

- 由于个人护理和化妆品、药品和农业化学品等终端用户的需求不断增长,亚太地区已成为乙醛酸市场的主要市场。

- 中国、印度和日本是亚太地区乙醛酸的主要消费国。化妆品和个人护理品是该地区成长最快的行业之一。

- 人口持续成长也是推动个人照护需求的因素之一。此外,农业活动活性化导致农药消费量增加也刺激了受访市场的需求。

- 根据印度投资局预测,印度个人护理和卫生用品市场预计2022年将达到150.5亿美元,2026年将达到173.4亿美元。因此,预测期内的市场成长显着。

- 此外,乙醛酸也用作生产维生素、抗组织胺药物和抗生素等药物化合物的关键中间体。由于收入增加、健康意识增强和高龄化,中国医疗产业正在经历快速成长。该国生产学名药、治疗药物、原料药和中药。

- 为了开拓医疗产业,中国政府正在实施「健康中国2030」策略,目标是到2030年将市场规模增加到2.4兆美元。

- 此外,2023年8月,中国国务院发布了旨在改善外商投资营商环境的24条指导意见,重点关注中国医疗和生物製药产业的发展。

- 因此,由于上述趋势,亚太地区预计将在预测期内主导乙醛酸市场。

乙醛酸产业概况

乙醛酸市场部分整合。主要企业(排名不分先后)包括Akema Srl、中兰实业、新疆国林新材料、WeylChem International GmbH、STAN Chemical等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 农化领域需求增加

- 扩大个人护理和化妆品行业的应用

- 其他司机

- 抑制因素

- 关于排放和废弃物处理的严格规定

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模(基于数量))

- 最终用户

- 个人护理和化妆品

- 药品

- 农药

- 香料工业

- 其他(食品和饮料等)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Akema Srl

- Zhonglan Industry Co.,Ltd.

- STAN Chemical Co., Ltd

- Xinjiang Guolin New Materials Co., Ltd

- Haihang Industry

- Hubei Hongyuan Pharmaceutical Technology Co., Ltd

- JIAXING ZHONGHUA CHEMICAL Co., Ltd

- WeylChem International GmbH

- Amzole India Pvt. Ltd

- Ensince Industry Co., Ltd.

第七章 市场机会及未来趋势

- 扩大製药领域的技术进步

- 其他机会

The Glyoxylic Acid Market size is estimated at 207.58 kilotons in 2024, and is expected to reach 283.06 kilotons by 2029, growing at a CAGR of greater than 6% during the forecast period (2024-2029).

The COVID-19 outbreak caused nationwide lockdowns around the world, disruption in manufacturing activities and supply chains, and production halts, all of which had a negative impact on the market in 2020. Currently, the market has recovered from the pandemic. The market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

Key Highlights

- Glyoxylic Acid is widely used as a neutralizing agent in the personal care and cosmetic industry, which is expected to fuel market growth.

- On the flip side, environmental regulation regarding emission control and waste disposal challenges generated during the manufacturing of glyoxylic acid is anticipated to restrain the growth of the market over the forecast period.

- Further, the growing technological advancements concerning the use of glyoxylic acid in the pharmaceutical sector are likely to create lucrative growth opportunities for the global market in the future.

- The Asia-Pacific region dominated the market around the world, with countries like China, India, and Japan being the biggest consumers.

Glyoxylic Acid Market Trends

Increasing demand from Personal Care and Cosmetics Sector

- The demand for glyoxylic acid has gained a lot of significance in the past few years from the personal care segment.

- Glyoxylic acid is widely used as a neutralizing agent in the personal care industry. Some of the areas of application include hair straightening products such as shampoos, lotions, conditioners, etc.

- According to Happi Magazine, in the United States, the shampoo unit sales were highest for regular shampoo, generating sales of about 388 million units in 2022, followed by dandruff shampoo and shampoo and conditioner combo packs. Thus, the growing consumption of shampoo is likely to boost the market growth.

- Further, the global cosmetic industry has been growing rapidly due to high demand from various consumers. Increasing awareness about the benefits of personal care products among customers is resulting in higher usage of cosmetics and personal care products as they protect skin from harmful UV rays, besides providing other benefits.

- Moreover, growing disposable incomes and the purchasing power of the population are further leading to the growth in demand for cosmetics and personal care products, thereby fueling the market's growth.

- China is the world's second-largest personal care products market, and as per the International Trade Administration (ITA), it is projected to be worth nearly USD 80 billion by 2025. This is due to increasingly sophisticated consumers and a large middle-class section of people and continuous growth in population is another factor fueling the demand for personal care and skin care products, which in turn is anticipated to boost the market growth.

- Therefore, considering the aforementioned factors, the demand for glyoxylic acid is expected to increase significantly during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is the major market for the glyoxylic acid market owing to the rising demand from end-users such as personal care and cosmetics, pharmaceuticals, and agrochemicals.

- Countries such as China, India, Japan, etc., are the major consumers of glyoxylic acid across the Asia-Pacific region. Cosmetics and personal care are one of the fastest-growing sectors in the region.

- Continuous growth in population is another factor fueling the demand for personal care. Additionally increasing the consumption of agrochemicals in the country with the increasing agriculture activities is boosting the demand of the market studied.

- According to Invest India, the market for personal care and hygiene in India is worth USD 15.05 billion in 2022 and is forecasted to reach USD 17.34 billion in 2026. Thus driving the market growth significantly during the forecast period.

- Further, glyoxylic acid is also used as a key intermediate in the manufacturing of pharmaceutical compounds, such as vitamins, antihistamines, and antibiotics. China's healthcare industry is experiencing rapid growth, driven by rising incomes, increasing health awareness, and an aging population. The country produces generics, therapeutic medicines, active pharmaceutical ingredients, and traditional Chinese medicine.

- The government of China has implemented the "Healthy China 2030" initiative, for developing the healthcare industry, which aims for the market to reach a value of USD 2.4 trillion by 2030.

- Furthermore, in August 2023, China's State Council released a 24-point list of guidelines aiming to improve the business environment for foreign investment which focuses on advancing Chinese healthcare and biopharma sectors.

- Therefore, owing to the aforementioned trends, the Asia-Pacific region is expected to dominate the glyoxylic acid market during the forecast period.

Glyoxylic Acid Industry Overview

The glyoxylic acid market is partially consolidated in nature. The major players (not in any particular order) include Akema S.r.l., Zhonglan Industry Co.,Ltd. Xinjiang Guolin New Materials Co., Ltd, WeylChem International GmbH, and STAN Chemical Co., Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Agrochemicals Sector

- 4.1.2 Growing Applications from Personal Care and Cosmetic Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Regulation Regarding Emission Control and Waste Disposal

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 End-user

- 5.1.1 Personal Care and Cosmetics

- 5.1.2 Pharmaceuticals

- 5.1.3 Agrochemicals

- 5.1.4 Flavour Industry

- 5.1.5 Others (Food and Beverage, etc.)

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akema S.r.l.

- 6.4.2 Zhonglan Industry Co.,Ltd.

- 6.4.3 STAN Chemical Co., Ltd

- 6.4.4 Xinjiang Guolin New Materials Co., Ltd

- 6.4.5 Haihang Industry

- 6.4.6 Hubei Hongyuan Pharmaceutical Technology Co., Ltd

- 6.4.7 JIAXING ZHONGHUA CHEMICAL Co., Ltd

- 6.4.8 WeylChem International GmbH

- 6.4.9 Amzole India Pvt. Ltd

- 6.4.10 Ensince Industry Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Technological Advancements in Pharmaceutical Sector

- 7.2 Other Opportunities