|

市场调查报告书

商品编码

1404484

保险科技:市场占有率分析、产业趋势/统计、成长预测,2024-2029Insurtech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

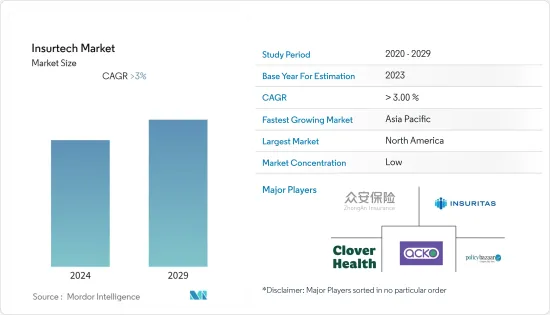

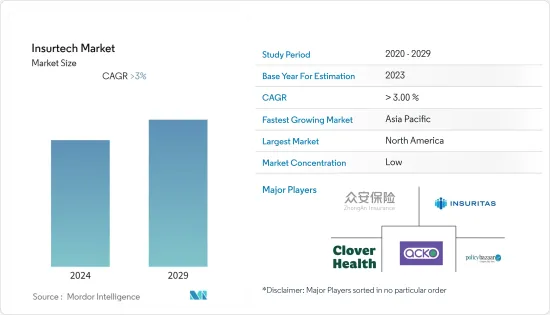

本财年全球保险科技市场营收预计将超过 55 亿美元,预测期内复合年增长率将超过 3%。

由于保险申请流程的简化、与客户的沟通的改善以及实施自动化的能力等因素,全球保险科技市场预计在预测期内将显着增长。由于与一般产物保险、车辆保险等其他保险业相比,保险科技的采用率显着提高,预计健康保险市场将在未来几年呈现最高成长率。在产物保险业,柠檬水和众安等公司占据了保险科技市场的主要份额。产业的独特之处在于创新和独特的解决方案,以改善保险价值链,吸引来自世界各地的传统参与者和投资者的资金。

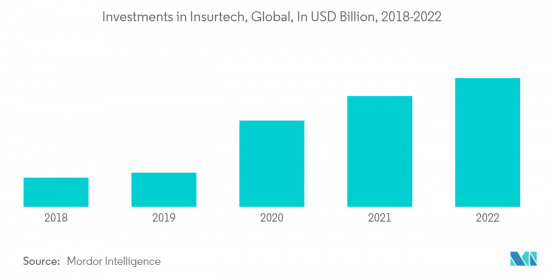

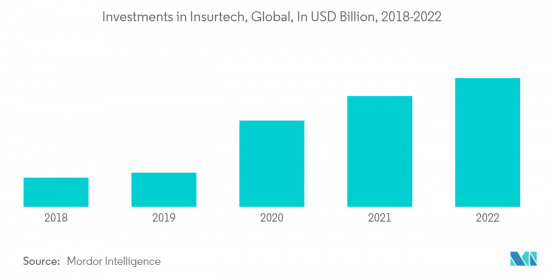

保险领域对人工智慧、机器学习和区块链技术等技术进步的日益偏好,导致过去几年交易数量持续增加。保险科技公司透过开发新产品推动保险市场创新的能力将有助于保险公司回应动态的客户需求。

在新冠肺炎 (COVID-19) 疫情期间,由于封锁规定,对技术的需求增加,保险科技市场出现显着成长。自 COVID-19 以来,市场在创新的推动下经历了适度成长。

保险科技市场趋势

技术进步驱动市场

数位技术正在推动市场。这些技术用于了解客户需求并根据不断变化的客户需求增强服务产品。市场参与者有很大机会透过数位化现有业务来在短期内获取价值,但除非他们同时利用数位技术进行创新和建立新业务,否则他们就有被抛在后面的风险。看来确实会如此。数位化和无所不在的资料通讯使企业能够创建全球供应链。随着人工智慧和网路安全的引入,该公司正在赢得新合约并扩大其影响范围。例如,2021年,Metromile宣布推出比特币付款解决方案,允许他们使用加密货币接受保险费并支付保险索赔。

BFSI 细分市场占据主导地位

BFSI 细分市场占据主导地位,2022 年占全球收益的 20.0% 以上。 BFSI 公司广泛采用保险科技解决方案来提高业务效率。 BFSI 领域连接设备的增加导致了大量资料的产生。此外,保险公司发现利用这些资料可以让他们提供更好的服务、优化成本、获得洞察并增加收益。同时,全球智慧型手机普及的不断提高预计也将推动 BFSI 产业对保险科技解决方案的需求。

保险科技市场概况

全球保险科技市场较为分散,有大量小型企业满足寿险和非寿险产业的需求。本报告概述了在所研究市场中运营的主要国际参与者。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 市场范围

第二章调查方法

第三章执行摘要

第四章市场洞察与动态

- 市场概况

- 市场驱动因素

- 数位化正在推动市场

- 市场抑制因素

- 资料安全和隐私问题抑制市场

- 市场机会

- 新的创新为新进入者创造了机会

- 产业吸引力波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 对保险科技成长週期融资的见解

- 洞察塑造市场的法规结构

- 对塑造市场的技术进步的见解

- COVID-19 对市场的影响

第五章市场区隔

- 按类型

- 车

- 商业

- 健康

- 住宅

- 专业

- 旅行

- 其他的

- 按最终用户

- 车

- BFSI

- 政府

- 卫生保健

- 製造业

- 零售

- 运输

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 亚太地区

- 印度

- 中国

- 澳洲

- 其他亚太地区

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 北美洲

第六章竞争形势

- 市场集中度概况

- 公司简介

- Banc Insurance Agency Inc(Insuritas)

- Policy Bazaar

- ZhongAn Online Property & Casualty Insurance Co. Ltd.

- Clover Health Insurance

- Acko General Insurance Limited

- Moonshot-Internet

- Sureify

- Lemonade

- Oscar Health

- Anorak

- BDEO

- Earnix

- Planck

- ThingCo

- Tractable

- Bima

- Metromile

- Collective Health*

第七章 市场趋势

第 8 章 免责声明,关于出版商

The global insurtech market has generated a revenue of over USD 5.5 billion in the current year and is anticipated to register a CAGR of more than 3% for the forecast period.

The global insurtech market is expected to grow significantly during the forecast period, owing to the factors such as simplification of the claims process, improved communication with the client, and the capabilities to implement automation. The health insurance market is expected to have the highest growth rate in the upcoming years as the adoption of Insurtech is significantly higher compared to that of other insurance sectors, such as property and casualty, vehicle, and others. Under the Property and casualty insurance industry, companies such as Lemonade and Zhong An hold the major share of the insurtech market. The differentiating factors about the industry are their innovations and unique solutions to improve the insurance value chain that are attracting funds from legacy players and investors worldwide.

The number of deals made has risen continuously during the past few years, owing to the increased preference for technological advancements, such as artificial intelligence, machine learning, and blockchain technology in the insurance sector. The capability of the Insurtech companies to drive innovation in the insurance market by developing new products will help insurance companies meet dynamic customer requirements.

During COVID-19, the necessity of technology rose, and the insurtech market experienced significant growth due to lockdown restrictions. Post-COVID-19, the market is experiencing gradual growth with innovations.

Insurtech Market Trends

Technological Advancements are Driving the Market

Digital technology is driving the market. These technologies are used to understand customer needs and also to enhance their offerings based on the changing customer needs. There is a significant opportunity for the market players to capture value in the short term by digitizing their current business; they will get left behind if they fail simultaneously to use digital technology to innovate and build new businesses. Digitization and ubiquitous data communications have enabled companies to build global supply chains. With the adoption of Artificial intelligence and cyber security, companies are tapping new contracts and expanding their reach to people. For instance, in 2021, Metromile Inc. announced to implementation of Bitcoin Payment Solutions to accept premiums and pay claims in cryptocurrency.

BFSI Segment Dominating the Market

The BFSI segment dominated the market and accounted for more than 20.0% share of the global revenue in 2022. BFSI businesses are widely adopting insurtech solutions for improving business efficiency. The increase in the number of connected devices in the BFSI sector is leading to the generation of a huge amount of data. Moreover, insurance companies have realized that they can use such data to deliver better services, optimize costs, gain insights, and boost revenues. At the same time, the growing penetration of smartphones worldwide is also expected to drive the demand for insurtech solutions across the BFSI sector.

Insurtech Market Overview

The global insurtech market is fragmented due to the presence of a large number of small players that cater to the needs of life and non-life insurance sectors. The report includes an overview of the major international players operating in the market studied. Currently, some of the notable players based on their growth potential and industry significance are Banc Insurance Agency Inc. (Insuritas), Policy Bazaar, ZhongAn Online Property & Casualty Insurance Co. Ltd., Clover Health Insurance, and Acko General Insurance Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Market

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Digitalization is Driving the Market

- 4.3 Market Restraints

- 4.3.1 Data Security and Privacy Concerns are Restraining the Market

- 4.4 Market Opportunities

- 4.4.1 New Innovations will Create Opportunities to New Entrants

- 4.5 Industry Attractiveness: Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights on Financial Infusions into the Insurtech Growth Cycle

- 4.7 Insights on Regulatory Framework Shaping the Market

- 4.8 Insights on Technological Advancements Shaping the Market

- 4.9 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Auto

- 5.1.2 Business

- 5.1.3 Health

- 5.1.4 Home

- 5.1.5 Specialty

- 5.1.6 Travel

- 5.1.7 Other Types

- 5.2 By End-User

- 5.2.1 Automotive

- 5.2.2 BFSI

- 5.2.3 Government

- 5.2.4 Healthcare

- 5.2.5 Manufacturing

- 5.2.6 Retail

- 5.2.7 Transportation

- 5.2.8 Other End-Users

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 Rest of Europe

- 5.3.3 South America

- 5.3.3.1 Brazil

- 5.3.3.2 Argentina

- 5.3.3.3 Rest of South America

- 5.3.4 Asia-Pacific

- 5.3.4.1 India

- 5.3.4.2 China

- 5.3.4.3 Australia

- 5.3.4.4 Rest of Asia-Pacific

- 5.3.5 Middle East & Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Banc Insurance Agency Inc (Insuritas)

- 6.2.2 Policy Bazaar

- 6.2.3 ZhongAn Online Property & Casualty Insurance Co. Ltd.

- 6.2.4 Clover Health Insurance

- 6.2.5 Acko General Insurance Limited

- 6.2.6 Moonshot-Internet

- 6.2.7 Sureify

- 6.2.8 Lemonade

- 6.2.9 Oscar Health

- 6.2.10 Anorak

- 6.2.11 BDEO

- 6.2.12 Earnix

- 6.2.13 Planck

- 6.2.14 ThingCo

- 6.2.15 Tractable

- 6.2.16 Bima

- 6.2.17 Metromile

- 6.2.18 Collective Health*