|

市场调查报告书

商品编码

1404499

资料中心的液浸冷却 -市场占有率分析、产业趋势与统计、2024-2029 年成长预测Immersion Cooling in Data Centers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

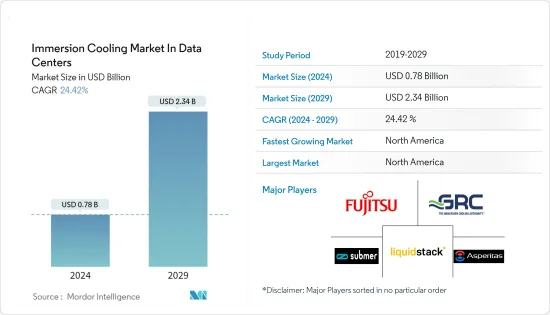

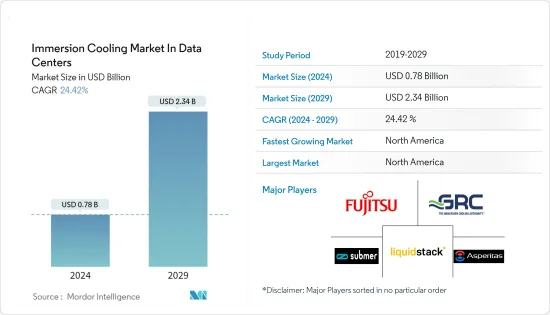

资料中心液浸冷却市场预计将从2024年的7.8亿美元成长到2029年的23.4亿美元,预测期间(2024-2029年)复合年增长率为24.42%。

根据许多行业估计,冷却成本约占资料中心能耗的 40%,因此解决高密度电力消耗将推动市场发展。浸没式冷却可以将资料中心的能源使用量减少 60% 以上,一些系统称它可以减少多达 95%。对于许多资料中心来说,这每年可以节省数百万美元。

最近资料中心建设的激增主要集中在以最小的延迟向高流量区域提供服务,而资料中心营运商正在寻求从合适的环境扩展到复杂的城市设施。我被迫这样做。因此,对克服传统空气和液体冷却的环境和空间限制的伺服器冷却技术的需求不断增长。对显着减少资料中心实体占地面积同时支援高密度操作的解决方案的需求正在推动对液浸冷却的需求。

印度和中国等新兴经济体拥有先进的IT基础设施发展,可能会积极推动资料中心需求。随着云端模型的采用,对资料中心的需求可能会增加,这为 IT 产业带来成本和营运优势。 NTT Ltd. 的一项调查显示,超过一半 (52%) 的受访者表示云端将为他们组织的业务运作带来最重大的变化。因此,资料中心冷却的需求预计会增加,从而导致根据最终用户的喜好采用液体冷却方法。

随着巨量资料和人工智慧的使用越来越多,组织面临资料处理的挑战。例如,在美国,由于认知能力需求不断成长,IBM公司新建了四个资料资料中心。这可能会增加这些资料中心冷却技术的使用率。

浸入式冷却是透过介电液体冷却资料中心最有效的方法之一。高投资和更高的技术资本支出是限制市场成长的唯一因素。

COVID-19 大流行的爆发给多个经济体的各个部门带来了进一步的压力。这已将焦点转移到数位经济。资料中心面临的新压力是巨大的。随着越来越多的员工在家工作,视讯通话和 VPN 的使用正在增加。医疗保健相关人员越来越多地使用远端医疗应用程式来治疗患者。中国最大的云端处理供应商阿里云正在投资数十亿美元建设下一代资料中心,以支援「疫情后世界」的数位转型需求。

资料中心液浸冷却市场趋势

对高密度功耗的反应正在推动市场

- 富含 GPU 的系统基于 2U ThinkSystem SR670 机架伺服器,每台伺服器最多具有四个双宽 GPU。紧凑型半机架 24U 系统可容纳多达四台联想伺服器,功耗不到 5kW。同时,中型版本在全尺寸46kW机架中最多可容纳16台伺服器,并且可以根据需要添加任意数量的机架进行扩充。两个系统均由Schneider的 EcoStruxure IT 进行监控。

- 向资料中心销售即插即用浸入式冷却模组的荷兰新兴企业Asperitas 表示,在能量吸收方面,浸入式冷却将所有电气元件浸入辩证液体中,因此仅IT 一项就可以将您的能源足迹减少10 % 45%。它还强调,在相同体积和温度下,合适的介电液体吸收的热能比空气多约 1,500 倍。

- 资料中心在添加更多刀片伺服器和储存设备以提高效能时,需要更多的电力并产生更多的热量。平均散热量超过30-50kW/伺服器机架。因此,全球范围内对用于高效热量和设备管理的冷却和温度控管解决方案的投资正在增加。去年 3 月,AMAX 的 HPC 和 AI 解决方案集团发布了 ServMaxAE-2484L,这是一款具有单相浸没式冷却功能的新型 2U 4 节点密度优化伺服器。

- 此伺服器经过认证,可将伺服器功耗降低高达 20%,同时在此外形尺寸中提供最高的 CPU 运算密度,从而提高电源使用效率 (PUE)。 2U 4节点密度优化伺服器专注于解决位置、电力可得性和成本等限制,满足HPC和AI工作负载等日益严苛的运算需求。

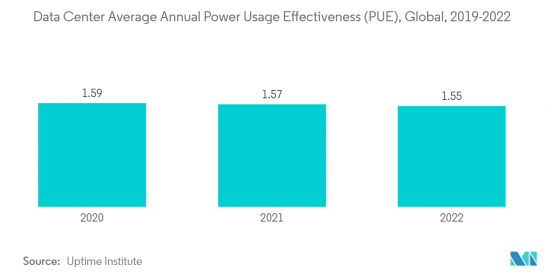

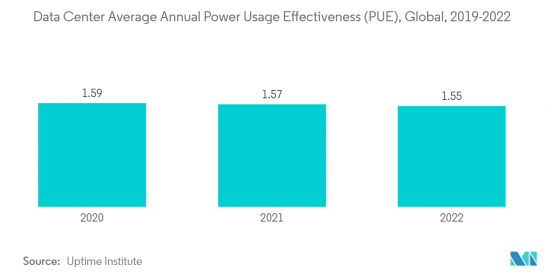

- 根据 Uptime Institute 进行的一项研究,最大的资料中心 IT 和资料中心经理的年度电力使用效率 (PUE) 比率为 1.55。资料中心营运商努力使 PUE 比率尽可能接近 1,许多来自超大规模和主机代管供应商的现代资料中心比使用旧技术的资料中心更有效率。

北美可望创最大市场规模

- 北美是一个快速采用新技术的国家。资料中心投资者越来越多地投资于浸入式和片下冷却解决方案。全球 5G 网路的出现推动了边缘资料中心的重要性,美国是最早采用该技术的国家之一。许多美国业者已开始投资这些中心,包括 EdgePresence、EdgeMicro 和 American Towers。

- 此外,思科系统公司报告称,美国的行动资料流量逐年显着增长,从 2028 年的每月 21.49Exabyte(EB) 增长到 2017 年的每月 2028 艾字节。这导致了 6.7EB资料Exabyte。据爱立信称,到 2030 年,资料流量预计将增加两倍。因此,分散式云端正在实用化,因为它们可以确保轻鬆连接这种规模所需的低延迟和宽频宽度。

- 根据能源技术领域的数据,由于多种因素的影响,美国资料中心的能源使用量预计将小幅增长,从 2014 年到去年增长超过 4%。根据目前趋势估计,美国资料中心预计 2022 年将消耗约 1.9 吉瓦。

- 在美国,个人和企业的网路使用量正在迅速增加。该国是最大的资料中心营运市场,并且由于最终用户资料消耗的增加而持续增长。物联网的日益普及是美国超大型资料中心市场的关键驱动力,导致设施扩展以支援企业用户和消费者产生的Exabyte资料。

- 包括微软在内的几家美国公司正在研究在其资料中心实施浸入式冷却。两相液浸冷却的生产引入正值风冷资料晶片技术的可靠进展大幅放缓之际,这是我们长期计划的下一步。微软已经研究了液浸作为一些高效能运算应用(包括人工智慧)的冷却解决方案。研究表明,两相浸入式冷却可以将任何给定伺服器的功耗降低 5% 到 15%。

资料中心浸入式冷却产业概述

研究市场的竞争程度很高,预计在预测期内将进一步加剧。市场上的竞争正在采取联盟和收购等策略来加强其产品供应并获得永续的竞争优势。 Fujitsu Limited、Green Revolution Cooling Inc.、Submer Technologies SL、Liquid Stack Inc.和Asperitas Company是主要的市场参与企业。

2022 年 9 月,陶氏推出 DOWSIL 浸入式冷却技术。 DOWSIL 浸入式冷却技术是一种永续解决方案,针对超大规模云端和企业资料中心冷却进行了最佳化。 DOWSIL 浸入式冷却技术为高速、大容量通讯时代快速成长的资料中心提供了突破性的温度控管和永续性方法。

2022 年 2 月,InfraPrime 和 Iceotope Technology Ltd. 建立了合作伙伴关係,以消除和减少净零 Powershell 站点在资料中心生命週期中的消费量。这将最大限度地发挥和支持循环业务的潜力,永续的经济成长和有弹性的未来。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 竞争程度

- 替代品的威胁

- 评估 COVID-19 对产业的影响

- 产业供应链分析

- 氟化液体供应商/製造商

- 浸入式冷却浴设备供应商

- 资料中心供应商

第五章市场动态

- 市场驱动因素

- 超大规模资料中心的增加

- 应对高密度功耗

- 市场抑制因素

- 资金投入大

第 6 章 技术概览

- 资料中心冷却的演变

- 能耗和计算密度指标以及关键考虑因素

- 流体、处理器、GPU、机架和基础设施供应商的细分

第七章市场区隔

- 按类型

- 单相浸没式冷却系统

- 两相浸没式冷却系统

- 透过冷却剂

- 矿物油

- 去离子水

- 氟碳液

- 合成液

- 按用途

- 高效能运算

- 边缘运算

- 人工智慧

- 加密货币挖矿

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第八章竞争形势

- 公司简介

- Fujitsu Limited

- Green Revolution Cooling Inc.

- Submer Technologies SL

- Liquid Stack Inc.

- Asperitas Company

- LiquidCool Solutions

- Midas Green Technologies

- Iceotope Technologies Ltd.

- Wiwynn Corporation

- DCX Ltd.

- DUG Technology

第九章投资分析

第10章市场的未来

The Immersion Cooling Market in Data Centers Industry is expected to grow from USD 0.78 billion in 2024 to USD 2.34 billion by 2029, at a CAGR of 24.42% during the forecast period (2024-2029).

Dealing with high-density power consumption drives the market, as many industry estimates put cooling costs at around 40% of the data center's energy consumption. The immersion cooling is able to reduce the data center's energy usage by over 60%, with some systems stating it could be as much as a 95% reduction. For many data centers, this provides millions of dollars in savings annually.

The recent surge in data center construction activities, majorly targeted toward serving high-traffic zones with minimum latency, forced data center operators to expand beyond a suitable environment into complex urban facilities. This increased the demand for server cooling technology that involves the environmental and space constraints that traditional air and liquid cooling practices pose. The increasing need for solutions may significantly reduce the data center's physical footprint and simultaneously accommodate high-density operations, bolstering the demand for immersion cooling.

Growing developments in IT infrastructure in emerging economies, such as India, China, and other countries, is likely to boost the demand for data centers positively. The demand for data centers is likely to increase due to the adoption of the cloud model, which has cost and operational benefits for the IT industry. According to a study by NTT Ltd, over half of the respondents (52%) mentioned that the cloud would have the most transformational impact on their organization's business operations. Hence, the demand for the cooling of data centers is expected to increase, leading to the implementation of liquid cooling methods based on end-user preferences.

The growing use of Big Data, AI, to name a few, has led organizations to face a data-crunch challenge. For instance, the rising demand for cognitive capabilities in the United States led IBM Corporation to build four new cloud data centers. This is likely to encourage the utilization of cooling technologies in these data centers.

Immersion cooling is one of the most effective ways to cool data centers through dielectric liquids. High investment with more significant technological CAPEX has been the only restraint hindering the market's growth.

The outbreak of the COVID-19 pandemic posed additional stress on multiple economies across various sectors. This shifted the focus toward a digital economy. The new load on data centers is serious. More employees are working from home, increasing video calls and VPN usage. Allied health professionals have ramped up the use of telehealth applications to treat patients. China's top cloud computing provider, Alibaba Cloud, invests billions in building next-generation data centers to support digital transformation needs in a "post-pandemic world."

Data Center Immersion Cooling Market Trends

Dealing with High-density Power Consumption Driving the Market

- The GPU-rich system is based on a 2U ThinkSystem SR670 rack server, which includes up to four double-width GPUs per server. A small half-rack 24U system includes up to four Lenovo servers and uses less than 5 kW. At the same time, the medium-sized version includes up to 16 of the servers in full-sized 46 kW racks and can be scaled up by including as many of those racks as needed. Both systems are monitored with Schneider's EcoStruxure IT.

- On the energy absorption front, liquid immersion cooling submerges all electrical components in a dialectic liquid, thus reducing the energy footprint of IT alone by between 10% and 45%, as per Asperitas, a Dutch startup selling plug-and-play liquid immersion cooling modules to data centers. It further highlighted that suitable dielectric liquids absorb approximately 1,500 times more heat energy than air with the same volumes and temperatures.

- As organizations are observed to be adding blade servers and storage devices to improve their performance, data centers are demanding more electricity and producing high heat. On average, the heat dissipation exceeds the 30 kW-50 kW/server rack. Thus, allied investments in cooling and heat management solutions for efficient heat and equipment management are increasing globally. In March last year, AMAX's HPC and AI Solutions Group announced a new 2U 4-Node density optimized server, ServMaxAE-2484L, for single-phase liquid immersion cooling.

- The server is recognized to improve Power Usage Effectiveness (PUE) by reducing server power usage by up to 20% amid the highest CPU compute density in its form factor. The 2U 4-Node density optimized server focuses on solving constraints such as location, the availability and cost of power, and the handling of increasingly demanding computing requirements, such as HPC and AI workloads.

- According to a survey conducted by Uptime Institute, at the largest data center, IT and data center management reported an annual power use effectiveness (PUE) ratio of 1.55. Data center operators strive to achieve a PUE ratio as near to one as feasible, with many of the newest data centers from hyperscale and colocation providers delivering higher efficiency than those using older technology.

North America is Expected to Register the Largest Market

- North America is an early adopter of newer technologies. Datacenter investors are increasingly investing in liquid immersion and direct-to-chip cooling solutions. The importance of edge data centers has been aided by the emergence of 5G networks worldwide, and the United States is among the earliest adopters of the technology. Many operators in the United States, such as EdgePresence, EdgeMicro, and American Towers, started investing in these centers.

- Moreover, the mobile data traffic in the United States increased considerably over the years, from 21.49 exabytes (EB) 2028 of data traffic in 2017 to 6.7 EB exabytes per month of data traffic by this year, as reported by Cisco Systems. According to Ericsson, this data traffic is expected to triple by 2030. Thus, the distributed cloud that may secure the low latency and high bandwidth required to connect such scale easily is coming into action.

- Due to multiple factors, energy use in US data centers is expected to grow slightly, increasing by more than 4% from 2014 to last year, according to the Energy Technology Area. Based on current trend estimates, the US data centers were projected to consume approximately 1.9 gigawatts in 2022.

- The United States is witnessing massive growth in internet usage by people and businesses. The country is the largest market in data center operations, and it continues to grow due to the higher data consumption by end-users. The growing popularity of the IoT is a significant driver for the US hyper-scale data center market, leading to additional facilities supporting exabytes of data generated by business users and consumers.

- Multiple US-based companies, like Microsoft, are researching immersion cooling deployment in data centers. The production environment deployment of two-phase immersion cooling is the next step in Microsoft's long-term plan to keep up with demand for faster, more robust data center computers when reliable advances in air-cooled computer chip technology considerably slowed. Microsoft researched liquid immersion as a cooling solution for several high-performance computing applications, such as AI. The investigation revealed that two-phase immersion cooling reduced power consumption for any given server by 5% to 15%.

Data Center Immersion Cooling Industry Overview

The degree of competition in the market studied is high and is expected to increase over the forecast period. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage. Fujitsu Limited, Green Revolution Cooling Inc., Submer Technologies SL, Liquid Stack Inc., and Asperitas Company are some of the key market players.

In September 2022, Dow announced DOWSIL Immersion Cooling Technology, which is an optimized and sustainable solution for cooling hyperscale cloud and enterprise data centers. DOWSIL Immersion Cooling Technology offers a revolutionary approach to thermal management and sustainability for fast-growing data centers in an era of high-speed, high-volume communications.

In February 2022, InfraPrime and Iceotope Technology Ltd entered a partnership to eliminate and reduce water consumption for Net Zero PowerShell Sites throughout the data center life cycle. It would help leverage and boost the full potential of circular businesses for sustainable economic growth and a resilient future.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Degree of Competition

- 4.2.5 Threat of Substitute Products

- 4.3 Assessment of the Impact of COVID-19 on the Industry

- 4.4 Industry Supply Chain Analysis

- 4.5 Fluorine-based Liquid Suppliers/Manufacturers

- 4.6 Immersion Cooling Bath Equipment Vendors

- 4.7 Data Center Vendors

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in the Number of Hyper-scale Data Centers

- 5.1.2 Dealing with High-density Power Consumption

- 5.2 Market Restraint

- 5.2.1 High Investment with Greater Capital Expenditure

6 TECHNOLOGY SNAPSHOT

- 6.1 Evolution of Data Center Cooling

- 6.2 Energy Consumption and Computing Density Metrics, and Key Considerations

- 6.3 Teardown of Fluid, Processor, GPUs, Racks, and Infrastructure Providers

7 MARKET SEGMENTATION

- 7.1 By Type

- 7.1.1 Single-Phase Immersion Cooling System

- 7.1.2 Two-Phase Immersion Cooling System

- 7.2 By Cooling Fluid

- 7.2.1 Mineral Oil

- 7.2.2 Deionized Water

- 7.2.3 Fluorocarbon-Based Fluids

- 7.2.4 Synthetic Fluids

- 7.3 By Application

- 7.3.1 High-performance Computing

- 7.3.2 Edge Computing

- 7.3.3 Artificial Intelligence

- 7.3.4 Cryptocurrency Mining

- 7.3.5 Other Applications

- 7.4 By Geography

- 7.4.1 North America

- 7.4.2 Europe

- 7.4.3 Asia Pacific

- 7.4.4 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Fujitsu Limited

- 8.1.2 Green Revolution Cooling Inc.

- 8.1.3 Submer Technologies SL

- 8.1.4 Liquid Stack Inc.

- 8.1.5 Asperitas Company

- 8.1.6 LiquidCool Solutions

- 8.1.7 Midas Green Technologies

- 8.1.8 Iceotope Technologies Ltd.

- 8.1.9 Wiwynn Corporation

- 8.1.10 DCX Ltd.

- 8.1.11 DUG Technology