|

市场调查报告书

商品编码

1852114

电子鼻:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030)Electronic Nose - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

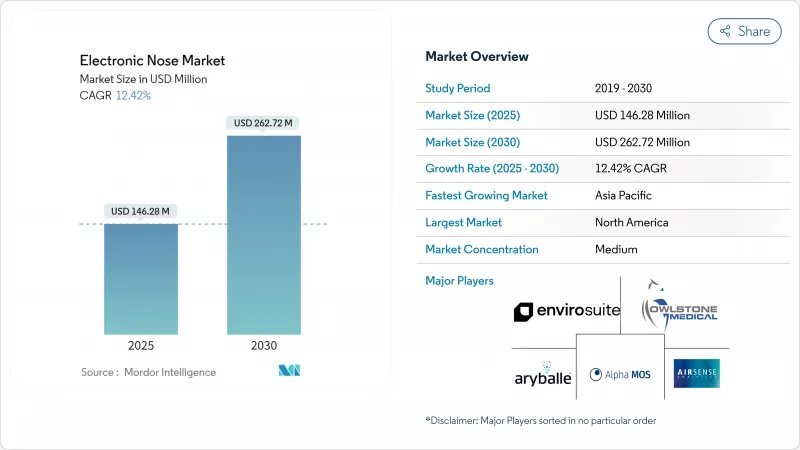

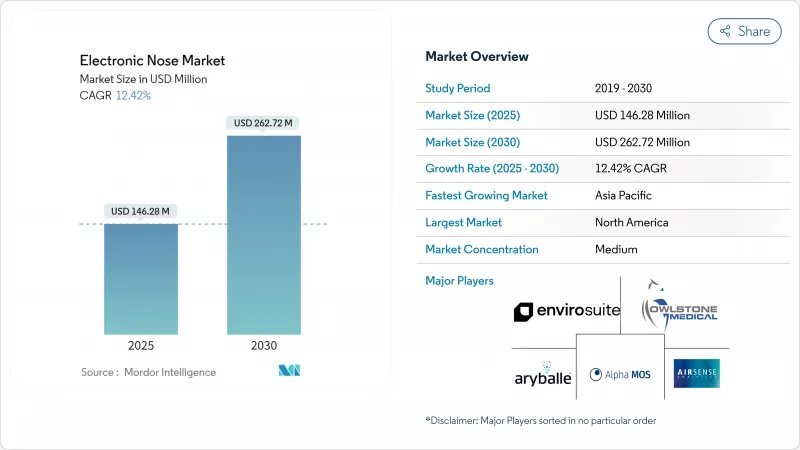

预计到 2025 年,电子鼻市场规模将达到 1.4628 亿美元,到 2030 年将达到 2.6272 亿美元,在此期间的复合年增长率为 12.42%。

微型化的MEMS感测器阵列、神经型态人工智慧演算法以及在医疗保健、食品安全和环境监测领域日益广泛的应用,正推动着电子鼻技术的强劲发展。高速气味检测技术如今已能与哺乳动物的嗅觉相媲美,反应时间仅需毫秒级,使其成为即时诊断的可行技术。在有利于呼吸诊断的法规结构的推动下,北美地区到2024年将占据电子鼻市场30.5%的份额。同时,亚太地区预计将以14.0%的复合年增长率成长,这主要得益于製造业和农业领域对品管的需求。按终端用户划分,食品饮料行业将占销售额的35.3%,而医疗保健行业的复合年增长率将达到13.6%,这主要得益于已验证的基于呼吸的疾病检测方法。

全球电子鼻市场趋势与洞察

MEMS感测器阵列的快速小型化和成本降低

以微机电系统(MEMS)为基础的电子鼻系统如今体积仅相当于一张信用卡,同时仍能维持95%以上的侦测精度。自2022年起,中国、韩国和台湾地区半导体封装标准化和晶圆製造产能的扩张,已使单位成本降低了40%至60%。三氧化钨奈米棒加热器可将辨识时间缩短至0.5至1秒,远超过传统平台10至30秒的辨识时间。占空比控制策略可将功耗降低至250 ℃下的160µW,从而拓展了电池供电和穿戴式装置的应用情境。这降低了准入门槛,使电子鼻市场能够渗透到消费性电子、远端医疗和智慧家庭生态系统。

将神经形态人工智慧整合到即时模式辨识中

基于哺乳动物嗅球模型的脉衝神经网路在1毫瓦专用积体电路(ASIC)上实现了超过97%的分类准确率,延迟低于16毫秒。大规模语言模型扩展将化学特征与上下文元元资料融合,从而增强了对重迭挥发性有机化合物(VOC)特征的选择性。边缘部署减少了云端流量,这对于矿业和加工厂的危险气体警报至关重要。线上主动学习循环可有效抑制感测器漂移,无需手动重新校准即可维持90%以上的长期准确率。这些突破性进展为下一代自主气味分析仪在国防、医疗保健和工业安全领域的应用奠定了基础。

恶劣环境下的感测器漂移和校准复杂性

金属氧化物感测器在湿度和温度波动下会产生显着的基准漂移,需要每季重新校准,从而增加运行成本。七年的现场研究表明,炼油厂烟囱和掩埋的感测器性能会劣化,需要更换。小波分解和机器学习校准可在一年内实现 100% 的识别率,但需要嵌入式电脑能力,并增加组件成本。单类漂移方法可将校准样本减少 70%,但仍依赖受控的训练週期。对于需要 24/7运作的产业,例如石油化学加工,这种维护负担成为推广应用的一大障碍。

细分市场分析

预计到2030年,医疗保健产业将以13.6%的复合年增长率成长。呼吸检测肿瘤筛检和气喘监测设备的需求将持续成长,美国和德国有利的报销试点计画也将推动这一成长。食品饮料产业仍然是最大的垂直领域,电子鼻被用于检测肉类新鲜度、葡萄酒氧化程度和乳製品掺假。电子鼻的应用范围正从加工厂扩展到速食店,并将云端仪錶板整合到日常产品审核中。

到2025年,军事、国防和国防安全保障将占总收入的9.1%,这主要得益于北约和亚太地区国防现代化对有毒气体检测的需求。废弃物处理公司正在部署气味感测器,以符合欧盟成员国的掩埋排放法规。工业安全和暖通空调公司正在将感测器阵列整合到通风系统中,用于全天候监测二氧化碳和挥发性有机化合物(VOC),以减少有关建筑物环境污染的申诉。整体而言,医疗保健产业将维持较高的复合年增长率,并从2030年起超越食品和饮料产业的销售额。

区域分析

北美占据电子鼻市场30.5%的份额,这主要得益于美国国立卫生研究院(NIH)的津贴以及美国食品药物管理局(FDA)对呼吸诊断技术的早期批准。国防支出和国防安全保障部门在化学威胁检测方面的支出进一步刺激了市场需求。产学合作,包括与史丹佛大学和麻省理工学院(MIT)的合作,正在加速新产品的研发。

亚太地区预计将以14.0%的复合年增长率成为成长最快的地区,这主要得益于中国、日本和印度食品供应链和智慧工厂的数位化转型。台湾和韩国的半导体製造中心为MEMS晶粒提供了经济高效的晶圆厂,从而降低了区域平均售价。深圳和班加罗尔的本土新兴企业正在利用边缘人工智慧技术,为咖哩新鲜度、米酒品质和城市空气污染等应用场景客製化低成本模组。

在欧洲,EN 13725:2022 标准对气味排放进行监管,要求对工业设施进行持续监测。该地区的农产品出口商正在将电子鼻纳入其生物安全通讯协定,以保护与中东和亚洲的贸易。在南美洲和中东及北非地区,电子鼻系统的需求分别由农产品出口检验和石油天然气中的甲烷检测所驱动,但基数较低。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- MEMS感测器阵列的快速小型化和成本降低

- 将神经型态人工智慧整合到即时模式辨识中

- 农产品出口国加强生物安全监管

- 基于挥发性有机化合物(VOC)的疾病诊断技术获得快速监管核准

- 气味即服务平台产生持续收入

- 借助边缘到云端分析降低整体拥有成本

- 市场限制

- 恶劣环境下的感测器漂移和校准复杂性

- 呼吸切片检查健康记录中的资料隐私问题

- 缺乏全球统一的气味排放标准

- 携带式电子鼻设备的电池寿命有限

- 产业供应链分析

- 监管环境

- 技术展望

- 宏观经济因素如何影响市场

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 最终用户

- 军事/国防

- 卫生保健

- 食品/饮料

- 废弃物管理(环境监测)

- 工业安全与暖通空调

- 透过感测器技术

- 金属氧化物半导体(MOS)

- 石英晶体共振器(QCM)

- 场非对称离子移动率谱(FAIMS)

- 导电聚合物

- 光学和光电离

- 透过使用

- 疾病诊断(呼吸分析)

- 品管和保质期预测

- 有害气体检测

- 室内空气品质监测

- 研究与学术测试

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲国家

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Alpha MOS SA

- Electronic Sensor Technology Inc.

- Plasmion GmbH

- Envirosuite Ltd.

- The eNose Company BV

- Airsense Analytics GmbH

- Sensigent LLC

- Common Invent BV

- E-Nose Pty Ltd.

- Owlstone Medical Ltd.

- Smart Nanotubes Technologies GmbH

- Scentroid Inc.

- Oizom Instruments Pvt Ltd.(Odosense)

第七章 市场机会与未来展望

The electronic nose market size is valued at USD 146.28 million in 2025 and is forecast to reach USD 262.72 million by 2030, expanding at a 12.42% CAGR over the period.

Strong momentum arises from miniaturized MEMS sensor arrays, neuromorphic AI algorithms, and increasing deployment across healthcare, food safety, and environmental monitoring. High-speed odor detection now matches mammalian olfaction with millisecond response times, making the technology viable for real-time diagnostics. North America holds a 30.5% electronic nose market share in 2024 on the back of supportive regulatory frameworks for breath diagnostics. Meanwhile, the Asia-Pacific is the fastest-growing region at 14.0% CAGR, fueled by quality control demands in manufacturing and agriculture. Across end-user verticals, food and beverage commands 35.3% revenue while healthcare shows the highest 13.6% CAGR, driven by validated breath-based disease tests.

Global Electronic Nose Market Trends and Insights

Rapid Miniaturization and Cost Decline of MEMS Sensor Arrays

MEMS-based systems now fit on credit-card footprints while maintaining >95% detection accuracy. Standardized semiconductor packaging and expanded wafer fabs in China, South Korea, and Taiwan have shaved 40-60% off unit costs since 2022. Tungsten-trioxide nanorod heaters enable 0.5-1 s identification, far outpacing legacy 10-30 s platforms.Duty-cycling strategies cut power draw to 160 µW at 250 °C, opening battery-operated and wearable use cases. The net result: entry barriers fall and the electronic nose market penetrates consumer electronics, telehealth, and smart-home ecosystems.

Integration of Neuromorphic AI for Real-Time Pattern Recognition

Spiking neural networks modeled on the mammalian olfactory bulb accomplish >97% classification accuracy with <16 ms latency on 1 mW ASICs. Large-language-model extensions fuse chemical signatures with contextual metadata, sharpening selectivity for overlapping VOC profiles. Edge implementations trim cloud traffic, critical for hazardous-gas alerts in mining and process plants. Online active-learning loops counter sensor drift, keeping long-term accuracy above 90% without manual recalibration. These breakthroughs underpin the next wave of autonomous odor-analysis devices across defense, healthcare, and industrial safety.

Sensor Drift and Calibration Complexity in Harsh Environments

Metal-oxide sensors exhibit pronounced baseline drift under humidity and temperature swings, forcing quarterly recalibration that inflates operating costs. Seven-year field studies confirm performance erosion necessitating sensor replacement in refinery stacks and landfills. Wavelet-decomposition and machine-learning compensation reach 100% identification over one-year horizons but demand embedded computing power, raising the bill of materials. While one-class drift schemes cut calibration samples by 70%, they still rely on controlled training cycles. Industries requiring 24/7 uptime, such as petrochemical processing, view these maintenance burdens as adoption barriers.

Other drivers and restraints analyzed in the detailed report include:

- Heightened Bio-security Mandates in Agri-Exporting Nations

- VOC-Based Disease Diagnostics Gaining Regulatory Fast-Track

- Data-Privacy Concerns for Breath-Biopsy Health Records

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Healthcare is projected to post a 13.6% CAGR through 2030. Breath-based oncology screening and asthma-monitoring devices drive demand, supported by favorable reimbursement pilots in the United States and Germany. Food and beverage remains the largest vertical, leveraging e-noses for meat freshness, wine oxidation, and dairy adulteration checks. Adoption spreads from processing plants to quick-service restaurants, integrating cloud dashboards for daily product audits.

Military, defense, and homeland security made up 9.1% revenue in 2025, propelled by toxic-gas detection requirements within NATO and Asia-Pacific defense modernization. Waste-management operators deploy odor sensors to comply with landfill emission caps in EU member states. Industrial safety and HVAC companies embed arrays in ventilation systems for 24/7 CO2 and VOC tracking, reducing sick-building complaints. Overall, healthcare's elevated CAGR positions it to eclipse food and beverage revenue post-2030.

The Electronic Nose Market Report is Segmented by End-User Vertical (Military and Defense, Healthcare, Food and Beverage, and More), Sensor Technology (Metal-Oxide Semiconductor, Quartz Crystal Microbalance, and More), Application (Disease Diagnosis, Quality Control and Shelf-Life Prediction, and More), and Geography (North America, South America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 30.5% of the electronic nose market, underpinned by NIH grants and early FDA clearances for breath diagnostics. Defense and homeland-security spending on chemical-threat detection further stimulates demand. Academic-industry collaborations at institutions such as Stanford and MIT accelerate new-product pipelines.

Asia-Pacific is projected to clock the fastest 14.0% CAGR as China, Japan, and India digitize food-supply chains and smart-factory lines. Semiconductor manufacturing hubs in Taiwan and South Korea offer cost-effective fabs for MEMS die, lowering regional ASPs. Local start-ups in Shenzhen and Bengaluru use edge AI to tailor low-cost modules for curry freshness, rice-wine quality, and urban air pollution use cases.

Europe is sustained by EN 13725:2022 odor-emission enforcement that obliges industrial sites to deploy continuous monitoring. The region's agri-exporters integrate e-noses in bio-security protocols to protect trade with the Middle East and Asia. In South America and the Middle East, and Africa, the demand for electronic nose is driven by agricultural export inspection and oil-and-gas methane detection respectively, albeit from a lower base.

- Alpha MOS SA

- Electronic Sensor Technology Inc.

- Plasmion GmbH

- Envirosuite Ltd.

- The eNose Company BV

- Airsense Analytics GmbH

- Sensigent LLC

- Common Invent BV

- E-Nose Pty Ltd.

- Owlstone Medical Ltd.

- Smart Nanotubes Technologies GmbH

- Scentroid Inc.

- Oizom Instruments Pvt Ltd. (Odosense)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid miniaturisation and cost decline of MEMS sensor arrays

- 4.2.2 Integration of neuromorphic AI for real-time pattern recognition

- 4.2.3 Heightened bio-security mandates in agri-exporting nations

- 4.2.4 VOC-based disease diagnostics gaining regulatory fast-track

- 4.2.5 Odour-as-a-service platforms unlocking recurring revenue

- 4.2.6 Edge-to-cloud analytics lowering total cost of ownership

- 4.3 Market Restraints

- 4.3.1 Sensor drift and calibration complexity in harsh environments

- 4.3.2 Data-privacy concerns for breath-biopsy health records

- 4.3.3 Absence of harmonised global odour emission standards

- 4.3.4 Limited battery life in portable e-nose devices

- 4.4 Industry Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors on the Market

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By End-user Vertical

- 5.1.1 Military and Defence

- 5.1.2 Healthcare

- 5.1.3 Food and Beverage

- 5.1.4 Waste Management (Environmental Monitoring)

- 5.1.5 Industrial Safety and HVAC

- 5.2 By Sensor Technology

- 5.2.1 Metal-Oxide Semiconductor (MOS)

- 5.2.2 Quartz Crystal Microbalance (QCM)

- 5.2.3 Field Asymmetric Ion Mobility Spectrometry (FAIMS)

- 5.2.4 Conducting Polymer

- 5.2.5 Optical and Photo-Ionisation

- 5.3 By Application

- 5.3.1 Disease Diagnosis (Breath Analysis)

- 5.3.2 Quality Control and Shelf-life Prediction

- 5.3.3 Hazardous Gas Detection

- 5.3.4 Indoor Air Quality Monitoring

- 5.3.5 Research and Academic Testing

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 South-East Asia

- 5.4.4.6 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Egypt

- 5.4.5.2.3 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Alpha MOS SA

- 6.4.2 Electronic Sensor Technology Inc.

- 6.4.3 Plasmion GmbH

- 6.4.4 Envirosuite Ltd.

- 6.4.5 The eNose Company BV

- 6.4.6 Airsense Analytics GmbH

- 6.4.7 Sensigent LLC

- 6.4.8 Common Invent BV

- 6.4.9 E-Nose Pty Ltd.

- 6.4.10 Owlstone Medical Ltd.

- 6.4.11 Smart Nanotubes Technologies GmbH

- 6.4.12 Scentroid Inc.

- 6.4.13 Oizom Instruments Pvt Ltd. (Odosense)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment