|

市场调查报告书

商品编码

1404507

行动应用测试服务 (MATS) -市场占有率分析、产业趋势与统计、2024-2029 年成长预测Mobile Application Testing Services (MATS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

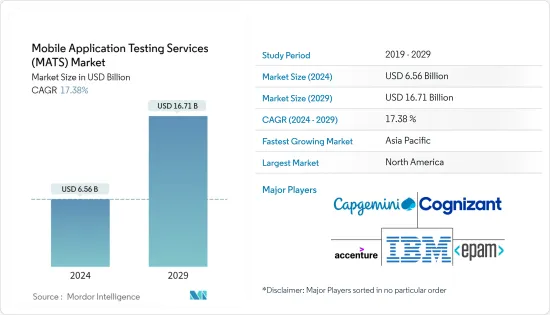

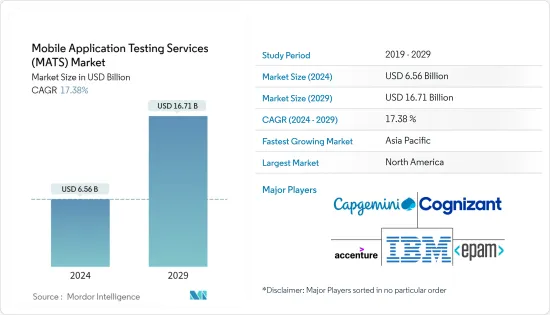

行动应用测试服务市场规模预计到 2024 年为 65.6 亿美元,预计到 2029 年将达到 167.1 亿美元,在预测期内(2024-2029 年)复合年增长率为 17.38%。

行动设备生态系统包括各种硬体、软体和网路配置。此外,新技术和浏览器的不断出现,以及作业系统版本的不断发布,使得品质保证策略和测试变得疲惫不堪且极具挑战性。市场上不同类型和代次的行动电话的存在也对需求产生重大影响。应用程式必须以最佳水平运行和执行。

主要亮点

- 相关应用程式商店中应用开发程式开发商之间的竞争正在影响市场。对 App Store 评论的直接、透明的回馈正在增加对优质行动应用程式和改善用户体验的需求。

- 在策略合作中,很少有参与企业专注于提高知名度和拓展新市场。例如,下一代测试自动化解决方案的领先开发人员Applitools在去年的品质工程报告中宣布与Capgemini SA集团旗下的Sogeti就人工智慧现状建立合作伙伴关係。 Applitools 使用 VisualAI 和 Ultrafast Test Cloud 提供新一代测试自动化平台。

- 使用 MAT 服务的关键因素包括更快的上市时间、更低的预算、品质保证材料的可得性以及对使用者体验设计的重视。过去十年,行动应用商店生态系统中与应用品质和用户体验相关的测量工具市场大幅成长。

- 开发人员在精实和敏捷的开发方法下不断开发新功能和增量即用型软体。中小型企业正在寻求利用与行动装置相关的庞大商机。

- 需要针对与「物联网」应用程式相关的使用者问题和挑战进行测试。例如,您无法将物联网装置连接到行动应用程式。感测器不发送资料,应用程式未安装在设备上,并且应用程式总是崩溃。

- COVID-19大流行迫使行动应用程式测试团队变得更加分散,为企业带来了新的、越来越远端的工作规范。它涉及企业不断评估和发布高品质的数位体验,同时管理时间和空间上分散的团队。

行动应用测试服务 (MATS) 市场趋势

对混合行动应用测试服务的需求不断增长

- 对混合应用程式测试服务不断增长的需求反映了混合行动应用程式在不断扩展的行动环境中的普及。混合应用程式结合了本机应用程式和 Web 应用程式的元素,并且由于其多功能性和满足不同业务需求的能力而变得流行。

- 混合应用程式设计为在多个平台上运行,例如 iOS、Android 和 Web 浏览器。测试服务的需求源自于确保不同作业系统和装置上功能和效能的一致性。

- 除此之外,由于大幅节省成本和缩短开发时间,对混合应用的需求正在增加。与本机应用程式需要单独的 iOS 和 Android 程式码库不同,混合应用程式使用可以在多个平台上运行的单一程式码库。这意味着开发人员只需为混合应用程式编写一次程式码,从而使开发更加高效且更具成本效益。许多开发人员按小时收费,因此混合应用程式的更快开发时间意味着更低的成本。

- 扩展混合应用程式比扩展本机应用程式更容易。通用码库可以更新和改进,确保所有平台的一致性。这就是为什么我们的测试服务专注于使用者体验测试,以确保您的混合应用程式提供无缝且使用者友好的体验,无论您使用什么平台或装置。

亚太地区可望成为快速成长的市场

- 该地区的 IT 市场越来越多地采用行动应用程式测试解决方案。此外,行动应用程式测试有助于建立可在各种平台上存取和扩展的应用程式。行动应用程式测试是透过测试功能、一致性和可用性来建立应用程式软体的过程。这包括自动和手动测试。

- 亚太地区的行动电话使用量正在迅速增加。该地区的消费者越来越多地使用行动电话作为购买他们喜爱的品牌的即时方式。塑造行动生态系统的主要趋势包括 5G 货币化、生成式人工智慧的兴起、向循环性的转变、规模和效率的整合以及金融科技。

- 由于对线上游戏、云端和支援 5G 的身临其境型应用程式的浓厚兴趣等因素,该地区成熟的行动市场预计将成长。在其他地方,对行动资料和金融应用服务的需求不断增长已成为该地区市场的主要收益成长要素。

- 越来越多的用户正在采用线上钱包功能,预计这将推动电子商务管道的使用。许多公司采用先进的测试流程来交付不太可能损害安全性的应用程式。这些都是推动该市场成长的关键因素。

行动应用测试服务 (MATS) 产业概述

行动应用测试服务市场高度分散,多个参与企业争夺市场占有率。就市场占有率而言,由于最终用户行业的选择多种多样,没有任何一个市场参与企业能够占据主导地位。然而,市场参与企业更愿意透过差异化服务来区别于技术创新和技术快速开拓。

- 2023年6月SmartBear发表了Swagger开放原始码工具,支援最新版本的Open API规格OAS 3.1。 OAS 是一种供应商中立且开放的 HTTP API说明格式,被世界各地组织的开发团队广泛使用。 Swagger 已发展成为最受欢迎的 API 开发开放原始码工具之一,对 OAS、AsyncAPI、JSON Schema 等提供丰富的支援。

- 2023 年 1 月 Cigniti Technologies 与 LambdaTest 合作,加速全球企业的数位化保障和数位转型之旅。此次合作将使 Cigniti 能够利用 LambdaTest 的创新 HyperExecute 平台,在 DevOps (CI/CD) 生命週期的各个阶段为客户提供安全、可扩展且富有洞察力的测试编配。透过此次合作,Cigniti 和 LambdaTest 将为客户提供智慧测试编配平台,帮助他们快速运行端到端自动化测试,从而使跨产业和地理的上市时间得以缩短。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介

第五章市场动态

- 市场驱动因素

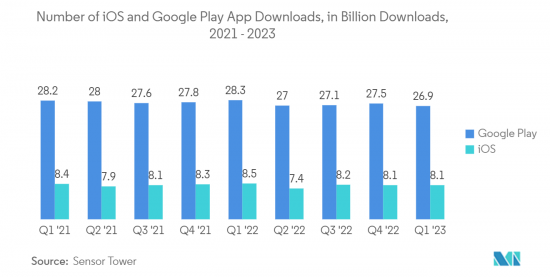

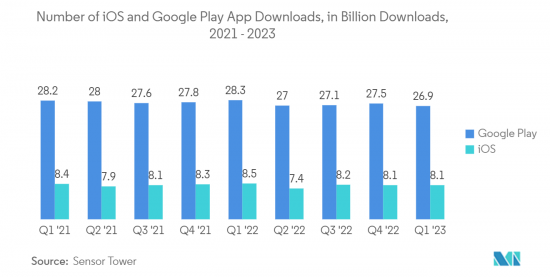

- 智慧型手机的普及推动市场成长

- 人工智慧和人工神经网路等扩展技术的存在

- 市场抑制因素

- 基础建设需要大量资金投入

第六章市场区隔

- 应用程式类型

- 本国的

- 网路

- 混合

- 最终用户产业

- 游戏

- BFSI

- 医疗保健

- 零售

- 旅游/旅游

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第七章竞争形势

- 公司简介

- Accenture PLC

- Capgemini SE

- Cognizant Technology Solutions

- EPAM Systems Inc.

- IBM Corporation

- Wipro Ltd

- Tata Consultancy Services Limited

- AQM Software Testing Lab

- Cigniti Technologies Ltd

- Amazon Web Services Inc.

- Sauce Labs Inc.

第八章投资分析

第九章 市场机会及未来趋势

The Mobile Application Testing Services Market size is estimated at USD 6.56 billion in 2024, and is expected to reach USD 16.71 billion by 2029, growing at a CAGR of 17.38% during the forecast period (2024-2029).

There are a variety of hardware, software, and network configurations within the mobile device ecosystem. Furthermore, the task itself is tiring and presents exceptional challenges regarding quality assurance strategy and testing due to the continuous availability of new technologies and browsers and the release of operating system versions. Demand has been significantly influenced by the availability of various types and generations of cell phones on the market. The applications should work and run at the optimal level.

Key Highlights

- The competition between application developers across relevant app stores is influencing the market. Direct and transparent feedback on reviews in the App Store has generated increased demand for high-quality mobile applications and an enhanced user experience.

- In strategic collaboration, few players focus their attention on becoming visible and expanding into new markets. For example, Applitools, a leading developer of following-generation test automation solutions, announced a partnership with Sogeti, a Capgemini Group company, on the state of artificial intelligence in the quality engineering report last year. Applitools uses VisualAI and Ultrafast Test Cloud to provide a next-generation test automation platform.

- The major factors considered for using MAT services are reduced time to market, lower budget and availability of quality assurance materials, and an emphasis on user experience design. Over the last ten years, there has been a marked rise in the market for measurement tools related to application quality and user experience on Mobile App Store ecosystems.

- Developers constantly develop new features and increments of ready-to-use software under a lean and agile development approach. Small businesses were trying to take advantage of the huge business opportunities associated with cellular devices.

- The user problems and challenges associated with the Internet of Things apps require testing. For instance, an Internet of Things device cannot be connected to a mobile application. The sensor doesn't send data, the application isn't installed on your device, and you always get an app crash.

- With the COVID-19 pandemic, mobile application testing teams have become more distributed, leaving enterprises with a new and growing remote working standard. It is for enterprises to continuously evaluate and publish high-quality digital experiences while simultaneously managing teams that are separate from one another by time and space.

Mobile Application Testing Services (MATS) Market Trends

Growing Demand of Hybrid Mobile Application Testing Services

- The rising demand for hybrid application testing services reflects the growing prevalence of hybrid mobile applications in the ever-expanding mobile landscape. Hybrid applications, which combine elements of both native and web applications, have gained popularity due to their versatility and ability to address diverse business requirements.

- Hybrid applications are designed to run on multiple platforms, such as iOS, Android, and web browsers. The demand for testing services arises from ensuring consistent functionality and performance across various operating systems and devices.

- In addition to this, there has been an increasing demand of hybrid apps as it provides substantial cost savings and faster development times. In contrast to native apps, which require separate codebases for iOS and Android, hybrid apps use a single codebase that can run on multiple platforms. This means that developers only need to write code once for a hybrid app, making development more efficient and cost-effective. Because many developers charge by the hour, the shorter development time for hybrid apps means lower costs.

- Scaling a hybrid app is more straightforward than scaling native apps. Updates and improvements can be made to the common codebase, ensuring consistency across all platforms. This simplifies maintenance and provides a smoother user experience. hence, testing services focus on UX testing to ensure that hybrid applications deliver a seamless and user-friendly experience, regardless of the platform or device used.

Asia Pacific Expected to be Fastest Growing Market

- The adoption of mobile application testing solutions is increasing in IT markets in the region. Furthermore, mobile application testing facilitates building applications that are accessible and scalable across various platforms. It is a process to build application software by testing its functionality, consistency, and usability. This can be done by automation and manual testing.

- Mobile phone usage across the Asia Pacific is booming. Consumers in the region increasingly use their phones as an immediate method to shop with their favorite brands. Key tendencies shaping the mobile ecosystem include 5G monetization, the rise of generative AI, the shift to circularity, consolidation to drive scale and efficiency, and fintech.

- The market is expected to grow in the future owing to factors such as, in mature mobile markets in the region, there is strong interest in online gaming, cloud, and 5G-enabled immersive applications. Elsewhere, growing demand for mobile data and financial application services has emerged as crucial revenue growth drivers for the market in the region.

- A rising number of users are adopting online wallet features, which, in turn, is expected to boost the utilization of e-commerce channels. Many enterprises are adopting advanced testing processes to deliver apps with a low possibility of security breaches. These are some of the key driving factors of growth for the market.

Mobile Application Testing Services (MATS) Industry Overview

The mobile application testing services market is highly fragmented and comprises multiple players vying for market share. About market shares, as various choices are available for the end user industry, no market player can have a dominant position. Nevertheless, market players prefer to distinguish themselves from innovation and rapid technological developments by differentiating their services.

- June 2023: SmartBear released Swagger open-source tooling support for the latest version of the Open API Specification, OAS 3.1. A vendor-neutral, open description format for HTTP APIs, the OAS is widely used by development teams at organizations worldwide. Millions of developers use Swagger, which has evolved into one of the most popular open-source tools for API development, with rich support for the OAS, AsyncAPI, JSON Schema, and more.

- January 2023: Cigniti Technologies Partners with LambdaTest to accelerate the digital assurance and digital transformation Journeys of global Companies; the partnership allows Cigniti to tap into LambdaTest's innovative HyperExecute platform that provides secure, scalable, and insightful test orchestration for customers at different points in their DevOps (CI/CD) lifecycle. Through this collaboration, Cigniti and LambdaTest provide their customers with a smart test orchestration platform that helps clients run end-to-end automation tests at blazing-fast speeds, enabling faster time-to-market across industries and geographies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Smartphones Drives the Market Growth

- 5.1.2 Presence of Augmenting Technology, such as AI, ANN, and Others

- 5.2 Market Restraints

- 5.2.1 Significant Infrastructure Requires Huge Capital Investment

6 MARKET SEGMENTATION

- 6.1 Application Type

- 6.1.1 Native

- 6.1.2 Web

- 6.1.3 Hybrid

- 6.2 End-User Industry

- 6.2.1 Gaming

- 6.2.2 BFSI

- 6.2.3 Healthcare

- 6.2.4 Retail

- 6.2.5 Travel and Tourism

- 6.2.6 Other End-User Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Accenture PLC

- 7.1.2 Capgemini SE

- 7.1.3 Cognizant Technology Solutions

- 7.1.4 EPAM Systems Inc.

- 7.1.5 IBM Corporation

- 7.1.6 Wipro Ltd

- 7.1.7 Tata Consultancy Services Limited

- 7.1.8 AQM Software Testing Lab

- 7.1.9 Cigniti Technologies Ltd

- 7.1.10 Amazon Web Services Inc.

- 7.1.11 Sauce Labs Inc.