|

市场调查报告书

商品编码

1404509

资料中心机架 PDU:市场占有率分析、产业趋势与统计、成长预测,2024-2029 年Data Center Rack PDU - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

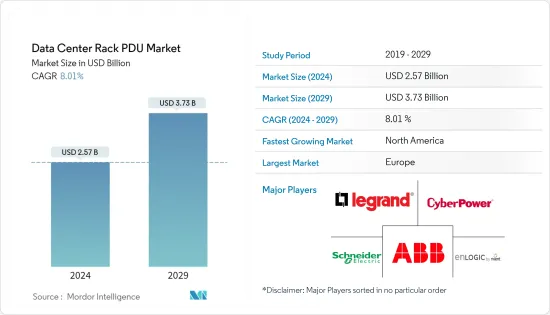

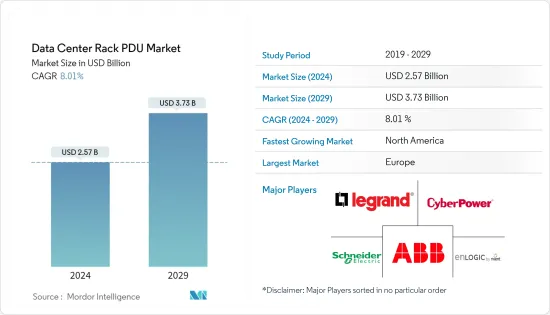

资料中心机架PDU市场规模预计到2024年为25.7亿美元,预计到2029年将达到37.3亿美元,在预测期内(2024-2029年)复合年增长率为8.01%,预计将会成长。

主要亮点

- 由于资料中心对高效电源管理解决方案的需求不断增加,资料中心机架 PDU 市场正在不断扩大。随着云端运算、数位化和资料驱动应用的快速发展,资料中心需要一致且扩充性的配电来支援营运。资料中心机架 PDU 提供远端管理、即时监控和高效利用电源资源,以实现最佳效能并减少停机时间。

- 此外,对永续性、能源效率和降低成本的日益关注进一步推动了先进机架 PDU 的采用,这些 PDU 能够在现代资料中心基础设施中实现有效的用电监控和分配。

- 此外,随着资料中心温度升高,对冷却系统的需求也会增加,从而减少与冷却设备相关的额外成本。然而,随着资料中心建筑室内温度的升高,排气温度也不断上升。因此,必须使用高环境温度规格的PDU,以防止设备因过热而故障。在此背景下,对高耐热规格配电板的需求不断增加,预计资料中心机架配电板市场将在整个预测期内成长。

- 硬体成本、基础设施价格和设备税使资料中心的营运成本相对较高。这限制了那些希望吸收建立资料中心的更高成本的高资源公司的市场成长。此外,缺乏适当的监管合规性将影响市场并大大延迟公司之间主机代管的采用。缺乏监管合规预计将成为未来五年市场成长的主要挑战。

- 由于 COVID-19大流行,建议个人留在家中作为预防措施。多家公司遵循在家工作政策,以保护员工并服务客户。这导致数位流量的增加和线上通讯服务的使用增加。在不确定时期,资料中心对于保护和维护安全的数位基础设施至关重要。这场危机将人们的注意力转移到了改善与资料中心相关的数位基础设施的重要性上,并为市场成长铺平了道路。这对资料中心机架PDU市场产生了正面影响。

资料中心机架PDU市场趋势

主机代管细分市场占据主要市场占有率

- 资料中心数量的增加,尤其主机代管资料中心数量的增加,对资料中心机架PDU市场产生正面影响。随着越来越多的公司选择託管IT基础设施主机代管利用成本节约、扩充性和共用资源,对支援这些设施的机架 PDU 的需求可能会增加。

- 几十年来,机架配电单元 (PDU) 一直是资料中心配电架构中不可或缺的一部分。在主机代管环境中,这些 PDU 为最终用户提供了多种优势,包括提高 IT 设备的营运效率、增强监控和安全性。

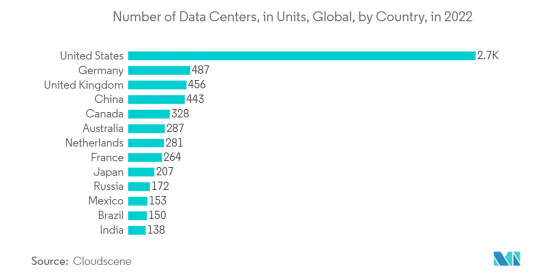

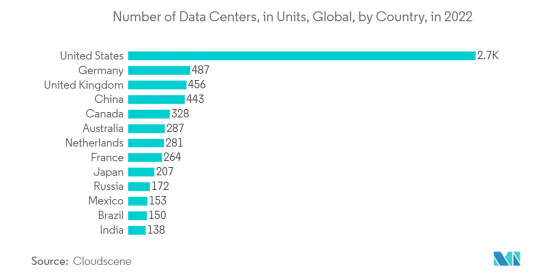

- 根据Cloudscene统计,截至2022年1月,美国有2,701个资料中心,德国有487个。就资料中心数量而言,英国以456个国家排名第三,中国以443个国家紧追在后。如此庞大的资料中心数量预计将导致PDU设备的成长。

- 过去十年来,主机代管业务取得了显着的发展,而资料中心在这项发展中发挥了核心作用。主机代管资料中心无需初期成本即可解决储存问题,这使其成为对许多小型企业和超大规模企业有吸引力的解决方案。

- 减少整体 IT 支出的需求、对可扩展资料中心的需求增加以及资料中心复杂性的增加是主机代管业务成长的关键驱动力。

- 主机代管中心越来越多地部署智慧型配电单元(PDU),它能够从机架和设备层面监控和管理电力资料,以确保所有IT设备的供电。这是因为最终客户需要监控他们的能力。

- 主机代管资料中心营运商也越来越多地部署资料中心基础设施管理 (DCIM) 软体,以与这些智慧型PDU 结合监控和追踪电力资料。该系统允许最终用户即时监控电力使用情况,并允许他们设定警报阈值来控制电力使用。这些技术进步正在推动所研究市场的需求。

预计北美地区将出现显着成长

- 该国正在迅速采用新技术。资料中心投资者越来越多地寻找新地点。随着全球5G网路的发展,美国日益重视边缘资料中心。许多美国营运商已开始投资这些设施,包括 EdgePresence、EdgeMicro 和 American Towers。

- 据Cisco称,随着时间的推移,美国的行动资料流量资料增加,从 2017 年的每月 1.26Exabyte增加到 2022 年的每月 7.75Exabyte。据爱立信称,到 2030 年,这一资料流预计将增加两倍。要方便地连结这样的规模,必须确保低延迟和高频宽的要求。结果,分散式云开始运作。这刺激了日本资料中心对机架 PDU 的需求。

- 此外,在美国,个人和组织对网路的使用正在迅速增加。该国是最大的资料中心营运市场,并且由于最终用户资料消耗的增加而持续增长。物联网的兴起极大地激发了美国超大型资料中心市场的活力,推动了新设施的建设,以处理消费者和商业用户产生的Exabyte资料。

- 由于对高效资料资料的需求不断增长、努力提供环保资料中心解决方案以及该地区功率密度的显着增加,加拿大也在不断扩展和提供资料中心基础设施解决方案。我来了。这为资料中心机架 PDU 市场创造了庞大的商机。

- 资料中心机架PDU市场的成长与各市场参与者对资料中心推出和资料中心扩张国家的投资直接相关。资料中心机架PDU市场预计未来将大幅成长。此外,农业、製造业和城市等不同行业越来越多地使用物联网平台,这正在津贴不断增加的资料消耗,并刺激加拿大资料中心的需求。此类新兴市场的开拓预计也将在预测期内促进市场成长。

资料中心机架PDU产业概述

资料中心机架PDU市场的特点是产品多样化、整合缓慢。然而,施耐德电机、Enlogic、罗格朗、Cyber Power Systems、ABB集团等知名厂商是各地区受欢迎的资料中心机架PDU供应商。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

- 主要市场调查结果

- 分析师对当前市场情势的评论

- 全球领先的主机主机代管和超大规模热点

第四章市场动态与洞察

- 市场概况

- 市场驱动因素

- 超大规模直流投资持续推动智慧 PDU 安装的需求

- 产业指令和SDDC 对电力可用性的要求

- 边缘资料中心的需求

- 市场挑战

- 生命週期更新速度快于资料中心生命週期

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间敌对关係的强度

- 替代品的威胁

- 市场机会

- 加大资料中心建设力度

- 资料中心 PDU 的连续演变

- 主要 PDU 基础设施细分领域分析 - 机架式、落地式、母线槽式

第五章市场区隔

- 按结构分

- 智慧型PDU

- 传统/基本 PDU

- 按用途

- 主机代管

- 企业

- 云端基础

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 东南亚

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第六章竞争形势

- 公司简介

- Schneider Electric SE

- Enlogic by nVent

- Legrand

- Cyber Power Systems

- ABB Ltd

- Aten International Co. Ltd

- Vertiv Group Corp.

- Eaton

- Conteg Spol. SRO

- Rittal GmbH & Co. KG

第七章 投资分析

第八章 市场未来展望

The Data Center Rack PDU Market size is estimated at USD 2.57 billion in 2024, and is expected to reach USD 3.73 billion by 2029, growing at a CAGR of 8.01% during the forecast period (2024-2029).

Key Highlights

- The data center rack PDU market is increasing due to the rising demand for efficient power management solutions in data centers. With the rapid development of cloud computing, digitalization, and data-driven applications, data centers need consistent and scalable power distribution to support their operations. Data center rack PDUs offer remote management, real-time monitoring, and efficient utilization of power resources that ensure optimal performance and lower downtime.

- Additionally, the increasing focus on sustainability, energy efficiency, and cost savings further drives the adoption of advanced rack PDUs, which enable effective power usage monitoring and distribution in modern data center infrastructures.

- Further, the need for cooling systems increases with rising temperatures in data centers, which lowers additional costs related to equipment cooling. However, the exhaust temperature is also growing along with the indoor temperature in data center buildings. Therefore, it is essential to use PDUs with high ambient temperature specifications to prevent equipment failures brought on by overheating. These previously mentioned elements have increased demand for high-rated power distribution units, which is anticipated to drive the growth of the data center rack power distribution unit market throughout the forecast period.

- Hardware costs, infrastructure prices, and taxes over equipment have been amounting to relatively expensive data center running costs. This has limited the market's growth to highly-resourced firms to absorb higher costs with the data center setups. Further, a lack of proper regulatory compliance will affect the market and greatly slow down the adoption of colocation among companies. Lack of regulatory compliance is expected to be a major challenge for the market's growth over the next five years.

- Due to the COVID-19 pandemic, individuals were advised to stay home as a preventive measure. Several companies followed work-from-home policies to protect their employees and serve their clients. This led to increased digital traffic and usage of online communication services. Data centers were crucial in safeguarding and maintaining secure digital infrastructure during that uncertain time. This crisis shifted the focus towards the importance of improved digital infrastructure coupled with data centers, thereby paving the way for the market's growth. This impacted the data center rack PDU market positively.

Data Center Rack PDU Market Trends

Colocation Segment Holds Significant Market Share

- The growth in the number of data centers, especially colocation data centers, positively impacts the data center rack PDU market. As more businesses choose to colocate their IT infrastructure to take advantage of cost savings, scalability, and shared resources, the demand for rack PDUs to support these facilities will likely increase.

- For decades, rack power distribution units (PDUs) have been an integral part of power distribution architectures in data centers. In the colocation environment, these PDUs provide the end customers with several benefits, such as enhanced operational efficiency, increased monitoring, and security of their IT equipment.

- According to Cloudscene, as of January 2022, there were 2,701 data centers in the United States and 487 in Germany. The United Kingdom ranked third among countries in the number of data centers, with 456, while China recorded 443. Such a huge number of data centers is expected to create growth for PDU equipment.

- The colocation business has evolved significantly over the past ten years, with the role of the data center being central to that evolutionary process. Since its inception, colocation data centers have been an attractive solution to many small-scale and hyperscale players equally, as it allows organizations to address their storage issues without substantial upfront costs.

- The need to reduce the overall IT expenditure, the rising requirement for scalable data centers, and the growing data center complexities are the major drivers for the growth of the colocation business.

- Intelligent power distribution units (PDUs) that possess the ability to monitor and manage power data from the rack and device level are increasingly being deployed in the colocation centers, owing to the end customers' need to monitor the capability of PDUs to ensure the availability of power to all their IT equipment.

- Operators of colocation data centers are also increasingly deploying data center infrastructure management (DCIM) software to pair with these intelligent PDUs to monitor and track power data. This system also enables the end customers to monitor their power usage in real time and provides the ability to establish alarm thresholds to control the usage of power. Such advancements in technology are driving the demand for the market studied.

North America is Expected to Register Significant Growth

- Newer technologies are quickly adopted in the country. Investors in data centers are increasingly finding new locations. The worldwide development of 5G networks, of which the United States is one of the early adopters, has boosted the significance of edge data centers. Many American operators, including EdgePresence, EdgeMicro, and American Towers, have begun making investments in these facilities.

- According to Cisco Systems, the amount of mobile data traffic in the United States has grown significantly over time, from 1.26 exabytes of data traffic per month in 2017 to 7.75 exabytes per month by 2022. This data flow is anticipated to triple by 2030, according to Ericsson. In order to link such scale conveniently, low latency and high bandwidth requirements must be secured. As a result, the distributed cloud is starting to operate. Which has fueled the demand for data center rack PDUs in the country.

- Furthermore, Internet usage by individuals and organizations is rapidly increasing in the United States. The nation is the largest market for data center operations, and it is still expanding as a result of increased end-user data consumption. The market for US hyper-scale data centers is being significantly fueled by the rising IoT, which is encouraging the construction of new facilities to handle the exabytes of data generated by consumers and commercial users.

- Canada is also constantly expanding and offering more data center infrastructure solutions due to rising demand for efficient data centers, initiatives to provide environmentally friendly data center solutions, and a significant increase in power density in the region. Which has created significant opportunities for the data center rack PDU market.

- The growth of the data center rack PDU market is directly related to the launch of data centers and various market players investing in the data center expansion country. The data center rack PDU market is anticipated to flourish. Additionally, Augmented use of IoT platforms by variable sectors, such as agriculture, manufacturing, and cities, has subsidized the increasing data consumption, which has activated the demand for data centers in Canada. Such developments are also expected to aid the growth of the studied market during the forecast period.

Data Center Rack PDU Industry Overview

The data center rack PDU market features moderate consolidation with a diverse range of products available. However, prominent vendors such as Schneider Electric, Enlogic, Legrand, Cyber Power Systems, and ABB Group, among others, are highly preferred providers of data center rack PDUs across various regions.

In June 2023, the Kanpur Metro chose ABB India's Electrification solutions for ensuring safe, reliable, and high-quality power distribution. ABB's cutting-edge technology plays a pivotal role in ensuring a seamless and comfortable commuting experience for passengers. ABB India's contribution to the Indian Microsystems includes providing electrification solutions to 13 metro rail projects across India.

In May 2023, Legrand introduced the industry's next generation of intelligent rack PDUs, the PRO4X and PX4. These innovative products combine the best hardware and software technologies from previous Raritan and Server Technology rack PDUs while introducing groundbreaking features and top-tier hardware for enhanced visibility and security. Notably, they are the first rack PDUs to estimate total harmonic distortion at both the device and cabinet levels, offering data center operators precise and comprehensive internalized power quality monitoring, including waveform capture capabilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

- 3.1 Key Market Findings

- 3.2 Analyst Commentary on the Current Market Scenario

- 3.3 Key Colocation and Hyperscale Hotspots Worldwide

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Investments in Hyperscale DCs Continues to Spur Demand for Smart PDU Installations

- 4.2.2 Industry Mandates Related to Power Availability and Demand for Software-Defined Data Centers

- 4.2.3 Demand for Edge Data Centers

- 4.3 Market Challenges

- 4.3.1 Faster Refresh Life Cycle than Data Center Profitable Life Expectancy

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Intensity of Competitive Rivalry

- 4.4.5 Threat of Substitutes

- 4.5 Market Opportunities

- 4.5.1 Rise in Data Center Construction

- 4.6 Evolution of Data Center PDUs Along a Continuum

- 4.7 Analysis of the Major PDU Infrastructure Segments - Rack, Floor-based, and Busways

5 MARKET SEGMENTATION

- 5.1 By Construction

- 5.1.1 Smart PDU

- 5.1.2 Traditional/Basic PDU

- 5.2 By Application

- 5.2.1 Colocation

- 5.2.2 Enterprise

- 5.2.3 Cloud-Based

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Southeast Asia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Schneider Electric SE

- 6.1.2 Enlogic by nVent

- 6.1.3 Legrand

- 6.1.4 Cyber Power Systems

- 6.1.5 ABB Ltd

- 6.1.6 Aten International Co. Ltd

- 6.1.7 Vertiv Group Corp.

- 6.1.8 Eaton

- 6.1.9 Conteg Spol. S R O

- 6.1.10 Rittal GmbH & Co. KG