|

市场调查报告书

商品编码

1404529

数位双胞胎:市场占有率分析、产业趋势/统计、成长预测,2024-2029Digital Twin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

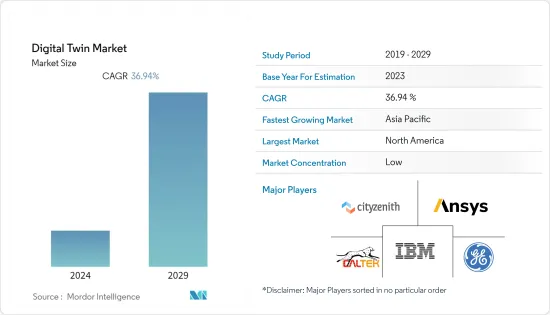

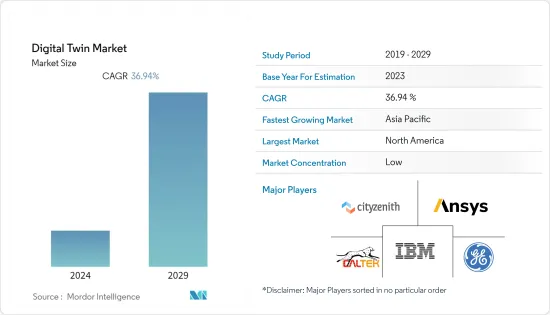

本财年数数位双胞胎市场规模预计为 190.9 亿美元,预计在预测期内以 36.94% 的复合年增长率增长,五年内达到 919.2 亿美元。

预计将转变技术孪生解决方案,以简化製造流程,并提供各种创新方法来降低成本、优化维护、监控资产、减少停机时间、创建新的关联产品等。数位双胞胎模型虽然很常见,但正在迅速进入製造业和其他行业。物联网和云端基础的平台等技术是增加这些解决方案采用的主要驱动力。

主要亮点

- 数位双胞胎将巨量资料、物联网、机器学习 (ML) 和人工智慧 (AI) 融入工业 4.0。数位双胞胎主要用于工业IoT(IIoT)、工程和製造业务领域。在物联网广泛使用的世界中,数位双胞胎变得更有效率且可供企业使用。製造商预测,大约 40% 的物联网参与者将整合模拟平台、系统和功能来开发数位双胞胎。

- 资料双胞胎也准备改变公司对现场产品和设备进行预防性保养的方式。这些机器中嵌入的感测器即时向数位双胞胎发送效能资讯,以主动识别和修復故障,并制定满足个别客户要求的服务和维护计划。

- 为了规避3D列印中的这些困难,我们使用孪生技术来模拟整个生产过程。此技术可让您查看 3D 模型中发生扭曲的位置,以便进行修正。结果是一个经过全面优化的新模型,以弥补其差异并为您提供最佳的列印效果。

- 低度开发国家使用的遗留系统预计将严重阻碍市场成长。这些旧有系统大多已经开发出来,但主要是为了在没有连接的情况下运作而设计和建构的。无法采用提供即时资料的先进感测器技术限制了先进技术的采用。

- 由于 COVID-19 的爆发,数位双胞胎等工业 4.0 技术的采用率加快,促进了市场成长。世界各国政府也正在探索部署不同智慧城市解决方案以提高城市弹性的可能性。例如,新加坡政府认识到加速跨产业数位化的重要性。预计这些因素将推动对这些解决方案的需求。

数位双胞胎市场趋势

物联网和云端基础平台的成长将推动市场

- 数位双胞胎解决方案预计将改变生产流程,并提供降低成本、优化维护和资产管理、减少停机时间以及创建新连网型产品的新方法。数位双胞胎并不新鲜,但它们正在迅速进入製造业和工业领域。物联网和云端基础的平台等新兴技术是这些解决方案快速普及的主要驱动力。

- 主要云端供应商最近推出了重要的数位双胞胎功能。在建筑和建筑管理方面,微软发布了数位双胞胎本体。在物流和製造领域,Google推出了数位双胞胎服务。为了简化工厂、工业设备、车辆等的数位双胞胎,Amazon Web Services 推出了物联网 TwinMaker 和 FleetWise。 Nvidia 也推出了元宇宙 ,这是一项为其合作伙伴网路中的工程师提供的专案订阅服务。

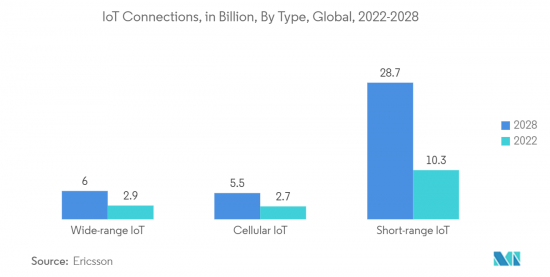

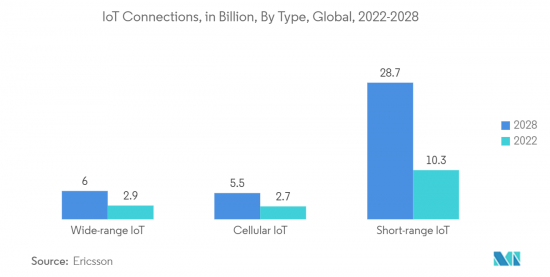

- 此外,物联网和数位数位双胞胎正在改变数位世界和生物世界互动的方式,因为物联网越来越多地透过与物理世界几乎相同的数位双胞胎来连接和存取物理世界的智慧。此外,新的应用程式、商业模式和设备成本下降刺激了物联网的采用,从而增加了世界各地互连设备和端点的数量。物联网巨头NB-IoT和Cat-M1继续在全球部署。

- 物联网的应用无所不在,从工业应用到紧急服务、大众交通工具、公共、城市照明和智慧城市应用。市政当局正在转向由物联网支援的无线通讯,以降低成本、提高效率并减少资源。

北美占据主要市场占有率

- 美国的现代製造设施依靠新技术和创新以更低的成本生产优质的产品。美国计划成为物联网、巨量资料、DevOps 和行动性等普及技术的早期采用者,将数位双胞胎整合到流程中以简化和利用更先进的见解。

- 儘管製造业已开始采用数位双胞胎技术,但建设业仍是依赖技术创新的主要二维产业。 3D 视觉数位双胞胎技术使现场专家能够从现场存取计划的每个细节,直至 Google 街景。

- 加拿大的製造业、建设业和汽车业正在大力采用数位双胞胎技术。为了衡量这些实体资产的性能并确定改进措施以获得更好的结果,这些领域的组织正在使用数位双胞胎技术。

- 例如,2022 年 11 月,AECO 创新实验室与四家加拿大机构合作进行了一个名为「用于建筑环境中监管流程自动化的人工智慧数位双胞胎」的计划。该计划将支持架构、工程和建设产业以及公共部门相关部门的创新和数位转型。该计划将探索如何使用新想法、数位工具和技术来改善和转变核准流程。我们还将探讨加拿大监管机构如何利用 BIM 和数数位双胞胎来更好地理解他们的决策。

数位双胞胎产业概述

数位双胞胎市场被 ANSYS Inc.、Cal-Tek SRL、Cityzenith Inc.、General Electric Company 和 IBM Corporation 等主要企业瓜分。市场参与者正在采取联盟和收购等策略来增强其服务产品并获得永续的竞争优势。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 物联网和云端基础平台的成长

- 3D列印技术在製造业的快速采用

- 降低计划成本的目标

- 市场挑战

- 欠发达国家基础设施不足与资料安全相关问题

第六章市场区隔

- 按用途

- 製造业

- 能源/电力

- 航太

- 油和气

- 车

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 其他地区

- 北美洲

第七章竞争形势

- 公司简介

- ANSYS Inc.

- Cal-Tek SRL

- Cityzenith Inc.

- General Electric Company

- IBM Corporation

- Lanner Group Limited(Royal Haskoning DHV)

- Mevea Ltd

- Microsoft Corporation

- Rescale Inc.

- SAP SE

第八章投资分析

第9章市场的未来

The Digital Twin Market size is estimated at USD 19.09 billion in the current year. It is expected to reach USD 91.92 billion in five years, registering a CAGR of 36.94% during the forecast period.

To simplify the manufacturing process and offer a variety of innovative approaches for cutting costs, optimizing maintenance, monitoring assets, reducing downtime, and creating new linked products, technological twin solutions are expected to be transformed. The digital twin model, although familiar, has been entering manufacturing and other industries fast. Technologies such as IoT and cloud-based platforms have been significant drivers for the increased adoption of these solutions.

Key Highlights

- Digital twins incorporate big data, the Internet of Things (IoT), machine learning (ML), and artificial intelligence (AI) in Industry 4.0. They are predominantly used in the Industrial Internet of Things (IIoT), engineering, and manufacturing business space. In a world where the Internet of Things is used widely, digital twins have become more efficient and accessible to businesses. The manufacturers have estimated that around 40 % of the Internet of Things players are expected to integrate simulation platforms, systems, and capabilities for developing digital twins.

- The way companies deliver preventive maintenance for products and equipment in the field is also undergoing a transformation timed to be driven by data twins. To identify and fix malfunctions before they occur and set up service and maintenance plans to satisfy individual customer requirements, sensors incorporated in these machines have been transmitting performance information in real-time into a Digital Twin.

- To avoid these difficulties with 3D printing, the whole production process has been simulated using twinning technology. This technology can tell if there will be distortions and where they may occur in a 3D model, so it is possible to correct them. This can result in new models that are fully optimized to compensate for the discrepancies and obtain the best possible printing results.

- The market's growth is expected to be significantly hampered by the presence of traditional systems used in underdeveloped countries. Most of these legacy systems had already been developed but were primarily designed and built to function without connectivity. They cannot incorporate advanced sensor technology that offers real-time data, limiting the adoption of advanced technologies.

- The adoption rate of Industry 4.0 technologies, e.g., digital twins, is accelerating due to the COVID-19 pandemic and contributing to market growth. Governments worldwide have also explored the possibility of deploying a different smart city solution to improve urban resilience. For instance, the Singapore government recognized the importance of accelerating digitalization across industries. These factors are expected to drive the demand for these solutions.

Digital Twin Market Trends

Growth in IoT and Cloud-based Platforms to Drive the Market

- The Digital Twin solutions are expected to transform production processes and offer new ways to lower costs, optimize maintenance and asset management, reduce downtime, and create new connected products. Even though it's not new, digital twins are rapidly starting to enter the production and industrial sectors. Emerging technologies like the Internet of Things and cloud-based platforms are significant drivers for the rapid adoption of these solutions.

- All the leading cloud providers have recently implemented a significant digital twin capability. In construction and building management, Microsoft has released a digital twin ontology. In logistics and manufacturing, Google has launched a digital twin service. To simplify the digital twins of factories, industry equipment, and fleet vehicles, Amazon Web Services has launched Internet of Things TwinMaker and FleetWise. In addition, Nvidia has launched a metaverse for engineers on its partner network as an ad hoc subscription service.

- In addition, it is anticipated that the interaction of digital and biological worlds will change due to the IoT and digital twins as the Internet of Things is increasingly connecting and accessing intelligence in a physical world through digital twins almost identical to their physical counterparts. Additionally, the adoption of the Internet of Things is being stimulated by new applications, business models, and declining costs for equipment, resulting in a growing number of interconnected devices and endpoints worldwide. The massive IoT technologies NB-IoT and Cat-M1 continue to be rolled out globally.

- IoT is used everywhere, from industrial applications to emergency services, public transportation, public safety, city lighting, and smart city applications. Municipalities are moving to wireless communications offered by IoT due to low cost, greater efficiency, and resource reduction.

North America Holds Major Market Share

- Modern manufacturing facilities in the United States rely on new technologies and innovations to produce superior-quality products at low costs. The US industry plans to integrate digital twins into their processes to simplify and leverage more advanced insight, thanks to the early adoption of increasingly popular technologies such as IoT, Big Data, DevOps, or Mobility.

- The construction sector continues to be a major 2D industry relying on technology innovation, even though the manufacturing sector has begun adopting digital twin technologies. With 3D visual digital twin technology, off-site experts can access on-site views into the nitty-gritty of projects taking off where Google Street View ends.

- The Canadian manufacturing, construction, and automotive industries have adopted significant digital twin technologies. To measure the performance of such Physical Assets and identify where improvements could be made to achieve more favorable results, organizations within those sectors are using Digital Twin Technology.

- For instance, in November 2022, the project, AI-enabled Digital Twins for Automation of Regulatory Processes in the Built Environment, was carried out in collaboration with four Canadian institutions nationwide by AECO Innovation Lab. The project supports innovation and Digital Transformation of the Architecture, Engineering, and Construction industries and related sectors within the public sector. This project examines how new ideas, digital tools, and technology can be used to improve and transform the approval process. In addition, it examines how Canada's regulators could use BIM and Digital twins to understand their decisions better.

Digital Twin Industry Overview

The digital twin market is fragmented with major players like ANSYS Inc., Cal-Tek SRL, Cityzenith Inc., General Electric Company, and IBM Corporation. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their service offerings and gain sustainable competitive advantage.

In June 2023, Mevea announced delivering digital twins, simulation software, and training simulators to Siemens. Siemens integrates these solutions within its open and modular SIMOCRANE Remote Control Systems (RCOS) to remotely control all relevant crane types like STS, Cantilever ARMG, end loading ASC, and RTG. The digital twins are used in crane automation, software testing & development, and operator training.

In March 2023, ANSYS Inc. and L&T Technology Services Limited signed an MOU to establish the LTTS-Ansys Center of Excellence (CoE) for Digital Twin. The center will support LTTS in demonstrating industry use cases, developing future-facing solutions, and enabling its customers to optimize design, manufacturing, and supply chain processes. Ansys' Twin Builder solution will further allow LTTS to expand its market share in digital twin areas.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in IoT and Cloud-based Platforms

- 5.1.2 Surge in Adoption of 3D Printing Technology in the Manufacturing Industry

- 5.1.3 Objective to Reduce Project Cost

- 5.2 Market Challenges

- 5.2.1 Inadequate Infrastructure in Under-developed Countries and Data Security-related Concerns

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Manufacturing

- 6.1.2 Energy and Power

- 6.1.3 Aerospace

- 6.1.4 Oil and Gas

- 6.1.5 Automobile

- 6.1.6 Others Applications

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 Rest of Asia Pacific

- 6.2.4 Rest of the World

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ANSYS Inc.

- 7.1.2 Cal-Tek SRL

- 7.1.3 Cityzenith Inc.

- 7.1.4 General Electric Company

- 7.1.5 IBM Corporation

- 7.1.6 Lanner Group Limited (Royal Haskoning DHV)

- 7.1.7 Mevea Ltd

- 7.1.8 Microsoft Corporation

- 7.1.9 Rescale Inc.

- 7.1.10 SAP SE