|

市场调查报告书

商品编码

1642132

固定无线存取:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Fixed Wireless Access - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

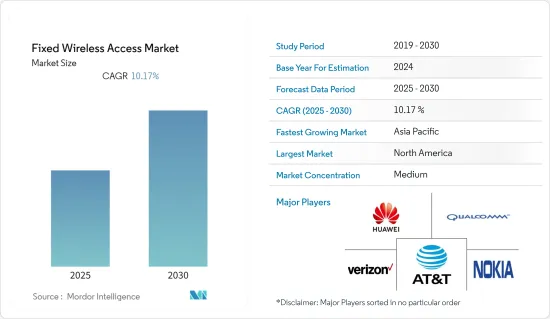

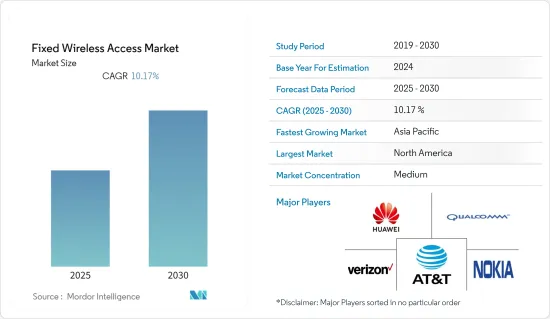

预测期内,固定无线接取市场预计将以 10.17% 的复合年增长率成长。

主要亮点

- 连网型设备的兴起推动了家庭网路连线的需求。此外,穿戴式技术在新兴国家正在不断改进,增加了对无线宽频连线的需求。

- 此外,过去十年来无线宽频技术的稳定发展与电气及电子工程师学会(IEEE) 制定的标准的进步保持同步。这些标准正在进行现代化改造,以提高最大速度和传输容量方面的网路吞吐量。这些升级鼓励了市场参与者进行创新,满足了客户对更高频宽和更快网路速度的需求,从而显着促进了市场成长。

- 此外,由于资料量越来越大以及连接设备数量不断增加,消费者对更快互联网连接的需求也刺激了对高效连接固定无线接入的需求。此外,预计在预测期内,连网装置数量的增加以及使用智慧设备的智慧家庭的日益关注和采用将推动市场需求。此外,全球范围内越来越多地采用智慧家庭架构,例如远端存取、语音控制和无缝连接,进一步推动了所调查市场的需求。

- 此外,随着 5G 网路的推出,预计亚太地区的新兴国家将在研究期间推动固定无线存取市场的发展。根据爱立信的行动报告,预计年终5G用户数将达到10亿人。今年,我们预计智慧型 5G 设备的数量将增加,且功能更加强大。五年后,5G用户数预计将超过50亿,而固定无线接取(FWA)连线数预计将达到约3亿,其中5G约占FWA连线的80%。

- 然而,一些国家对频谱分配的依赖性不断增加以及与毫米波技术相关的成本和环境挑战等方面可能会在预测期内抑制市场成长。

- 在 COVID-19 危机期间,固定无线存取 (FWA) 解决方案可能会见证对光纤宽频网路的需求和供应的增加。这是由于全球有条件的员工突然大规模采用远距在家工作在家工作所致。据固定无线网路品质监控和优化平台 Preseem 称,业务时段的需求成长尤为明显。

固定无线接取市场趋势

住宅市场预计将占最大份额

- 由于家庭和个人宽频连线的增加,住宅应用领域预计将见证最高的普及率。 FWA(固定无线接取)使用无线行动网路技术而非固网提供家庭网路连线。随着网路和行动用户的普及率不断提高,对连续资料来源和网路的需求逐年增加。

- 5G固定无线存取是住宅客户的理想选择,因为它以有竞争力的价格提供速度,并且没有安装问题。此外,在许多新兴国家,建造固定宽频基础设施在经济上不可行。

- 根据思科最新的视觉网路指数报告,智慧家庭预计将成为未来几年物联网连接成长的主要驱动力之一。该公司预测,今年的设备连接数量将达到 285 亿,其中约 50% 将是 IoT/M2M(机器对机器)。

- 此外,各大公司正在推出服务来扩大其客户覆盖范围,尤其是家庭和个人用户。例如,诺基亚和 Ooredoo 于去年 6 月在阿曼推出了超高速、可靠的 4G 和 5G 固定无线 (FWA) 存取。最初预计将有 15,000 家企业和家庭连接到该网路。此外,城市地区的 3,000 户家庭将配备诺基亚 FastMile 5G FWA。

- 据物管称,用于控制和连接目的的智慧家庭物联网 (IoT) 设备的总数预计在未来一年将会增加。预计到年终将有近 2.84 亿台设备投入使用。因此,随着智慧家庭物联网 (IoT) 设备的整体兴起,预计市场将在整个预测期内展现出各种有利可图的成长机会。

北美占据市场主导地位

- 预计预测期内北美将占据全球固定无线接取市场的最大份额。美国对高速网路连线的需求正在激增,这推动企业投资固定无线连线。固定无线连接的部署不仅可以提供高速互联网,而且还有助于为服务不足地区的用户提供服务。

- 固定无线解决方案中使用的小型基地台更靠近最终用户,这对于物联网来说具有天然优势。小型基地台的广泛部署将把设备连接到通讯网络,并帮助营运商成功建构物联网。

- 过去两年来,北美对固定无线宽频技术的兴趣和投资显着增加。美国偏远和农村地区仍有约 30% 的家庭无法享受高速宽频连接,但固定无线宽频正在成为缩小这一差距的关键技术。目前,约有 2,000 家无线网路服务供应商为全美 50 个美国的小城镇和农村地区的 400 多万家庭提供固定无线宽频服务。

- 将 Wi-Fi 与小型基地台结合,可为无缝资讯服务提供经济高效的容量和额外的覆盖范围。这种整合优势最终可以转化为收益的增加和总拥有成本 (TCO) 的节省。

- 此外,作为其主要成长策略的一部分,各市场参与者正致力于推出多种 5G 服务。例如,2023 年 1 月,T-Mobile US 与思科合作宣布推出可扩展、分散式、全国性的云端原生融合核心闸道。新的融合核心网关将简化 T-Mobile 的运营,使该非运营商能够更灵活地转移资源来推出 5G 家庭互联网等服务。

固定无线接取产业概况

固定无线接入市场较为分散,全球各地的重要解决方案供应商都在不断努力争取市场吸引力。公司正在建立策略伙伴关係和联盟,筹集资金推出新的解决方案,并改善现有的解决方案以提高市场知名度。让我们来看看一些最近的市场发展趋势。

2023 年 2 月,诺基亚和中国联通网路通讯集团有限公司 (CUC) 宣布,他们将扩大合作,在现有网路上试用基于诺基亚整合多接取网关的 5G 固定无线存取 (FWA) 解决方案。这将是在中国市场的首次尝试。透过固定和行动网路的无缝结合,CUC 将能够扩展其网路频宽并为消费者提供额外的网路服务。

2022 年 10 月,诺基亚宣布 NBN 已选择它为其固定无线网路升级提供 5G 固定无线存取 (FWA) mmWave 用户端设备 (CPE)。该计划将为澳洲区域、半乡村和偏远地区的数千个家庭和企业带来更快的通讯。诺基亚的用户端设备 (CPE) 是全球首个支援高频「mmWave」频段的设备,可在无线基地台七公里半径范围内提供Gigabit速度。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 技术简介

- FWA 采用的关键推动因素分析

- 知名供应商的主要倡议

- 关键业务考量与假设

- FWA、FTTH 和 FTTdp 的比较分析

- 分析农村、半都市区和都市区的主要经营模式和使用案例

- COVID-19 对固定无线接取市场的影响评估

第五章 市场动态

- 市场驱动因素

- 对采用先进技术的高速资料连接的需求日益增加

- 透过 5G 产业各相关人员之间的策略合作来促进应用

- 市场挑战

- 对某些国家频率分配的依赖

- 毫米波技术的成本与环境挑战

- 市场机会

第六章 市场细分

- 按类型

- 硬体

- 消费者场所设备 (CPE)

- 接入单元(毫微微蜂窝和微微型基地台)

- 按服务

- 硬体

- 按应用

- 住宅

- 商业的

- 产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争格局

- 公司简介

- Huawei Technologies Co. Limited

- Nokia Corporation

- Qualcomm Technologies

- AT & T, Inc.

- Verizon Communications, Inc.

- Airspan Networks Inc.

- Siklu Communication Limited

- Arqiva(UK)

- Telefonaktiebolaget LM Ericsson

- Samsung Electronics Co. Ltd

第八章投资分析

第九章:市场的未来

The Fixed Wireless Access Market is expected to register a CAGR of 10.17% during the forecast period.

Key Highlights

- The demand for internet connectivity among households has increased with the growth in connected devices. Additionally, wearable technology has improved in various emerging economies, contributing to the need for better wireless broadband connectivity.

- Additionally, the steady evolution of wireless broadband technology over the past decade keeps pace with advances in standards set by the Institute of Electrical and Electronics Engineers (IEEE). These standards are modernized to improve the network throughput regarding maximum speed and transmission capability. These upgrades have given the companies in the market the means to strive for innovation and successfully satisfy the customers' demand for higher bandwidth and faster internet, driving the market's growth significantly.

- Also, the increasing demand for faster internet connectivity among consumers, owing to the data size becoming more prominent and the rise in the number of devices connected to the device, is spurring the demand for fixed wireless access with effective connectivity. Further, the increase in the number of connected devices and increasing focus and implementation of smart homes using smart devices are expected to fuel the market demand during the forecast period. Moreover, the growing adoption of smart home architecture worldwide, including remote access, voice control, and seamless connectivity, further drives the demand in the market studied.

- Furthermore, with the 5G network launch, the emerging economies in the Asia-Pacific region are expected to propel the market for fixed wireless access during the study period. According to the Ericsson Mobility Report, 5G subscriptions are expected to reach 1 billion by the end of the year. More smart 5G devices with additional capabilities are expected this year. In five years, the 5G subscriptions are anticipated to surpass 5 billion, and Fixed Wireless Access (FWA) connections will reach around 300 million, where 5G will account for about 80 % of FWA connections.

- However, aspects like the rising dependence on Spectrum Allocation in Some Countries and Cost and Environmental Challenges Associated with Millimeter-wave Technology might be some factors that can restrain the market's growth throughout the forecasted period.

- Amid the COVID-19 crisis, fixed wireless access (FWA) solutions would likely witness increased demand and fill in fiber broadband networks. This results from a sudden and widespread explosion in telecommuting by employees worldwide who can work from home. According to Preseem, a quality monitoring and optimization platform for fixed wireless networks, the increased demand is especially significant during business hours.

Fixed Wireless Access Market Trends

Residential Segment Expected to Depict the Maximum Application

- The household application segment is expected to depict the maximum adoption due to growing broadband connectivity in households or for individuals. Fix6ed Wireless Access, or FWA, provides home internet access using wireless mobile network technology rather than fixed lines. Due to the increasing internet and mobile penetration amongst users, the need for a continuous source of data and the internet has been increasing over the years.

- 5G fixed wireless access is an ideal alternative for residential customers as users get speeds at a competitive price with no installation issues. Also, building fixed broadband infrastructure in many developing countries is not economically viable.

- According to Cisco's latest Visual Networking Index Report, smart homes are expected to be one of the primary drivers for the growth of IoT connectivity during the next few years. The company expects around 50% of the 28.5 billion device connections predicted by this year to be IoT/machine-to-machine (M2M).

- Moreover, major companies are introducing their services to expand their reach to customers, especially for households or individual users. For instance, in June last year, Nokia and Ooredoo introduced super-fast and reliable 4G and 5G fixed wireless (FWA) access throughout Oman. The scope of work would initially witness 15,000 businesses and homes connected. In addition, 3,000 homes in city centers would get Nokia FastMile 5G FWA.

- As per property management, the total number of smart home IoT (Internet of Things) devices utilized for control and connectivity purposes was anticipated to rise in the upcoming year. Nearly 284 million devices are predicted to be in use by the end of the following year. Hence, with the rise in the overall smart home IoT (Internet of Things) devices, the market is expected to witness various lucrative growth opportunities throughout the forecast period.

North America to Dominate the Market

- North America is expected to hold the most significant global fixed wireless access market share during the forecast period. In the United States, the demand for high-speed internet connections is increasing rapidly, owing to which companies are rigorously investing in fixed wireless connections. Deploying fixed wireless connections not only offers high-speed internet but also helps users in unserved areas to avail of the service.

- Small cells used in fixed wireless solutions are deployed close to end-users; therefore, they have natural advantages in the Internet of Things. Extensive small cell deployments connect devices to communication networks, helping operators build a successful Internet of Things.

- North America witnessed a significant increase in interest and investment in fixed wireless broadband technology in the last two years. Though approximately 30% of US households in remote and rural communities still lack access to a high-speed broadband connection, fixed wireless broadband is emerging as a key technology to bridge this gap. About 2,000 wireless internet service providers currently provide fixed wireless broadband services to more than 4 million residences in small towns and rural communities in all 50 US states.

- Integrating Wi-Fi with small cells can offer cost-effective capacity and additional coverage for seamless data services. Benefits from such integration may eventually lead to increases in revenue and savings in the total cost of ownership (TCO).

- Moreover, various market players are well involved in launching multiple 5G offerings as a part of their crucial growth strategy. For instance, in January 2023, T-Mobile US announced its collaboration with Cisco to launch a scalable and distributed nationwide cloud native converged core gateway. The new converged core gateway also simplifies operations for T-Mobile, allowing the Un-carrier to shift resources with better agility and roll out services like 5G home internet.

Fixed Wireless Access Industry Overview

The fixed wireless access market is fragmented due to the presence of significant solution providers across the globe who are incessantly working towards gaining more market traction. The companies are entering into strategic partnerships and alliances, raising funds to introduce new solutions, and improvising on the existing ones to increase market visibility. Some of the recent developments in the market are

In February 2023, Nokia and China United Network Communication Group Co. (CUC) announced today that they are expanding their collaboration by trialing a 5G fixed wireless access (FWA) solution based on Nokia's integrated Multi-Access Gateway in an existing network. This is the first test of its kind in the Chinese market. CUC will be able to grow network bandwidth and provide additional internet services to its consumers in the future by smoothly combining fixed and mobile networks.

In October 2022, Nokia declared that NBN had selected it to supply 5G fixed wireless access (FWA) mmWave Customer Premises Equipment (CPE) for NBN's fixed wireless network upgrade. The program would help deliver faster speeds to thousands of homes and businesses across regional, semi-rural, and remote Australia. In a world-first, the customer premise equipment (CPE) provided by Nokia supports high frequency 'mmWave' bands, capable of Gigabit speeds for premises within a 7 km radius of a radio base station.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.4.1 Analysis of Key Enablers for the Adoption of FWA

- 4.4.2 Key Initiatives Undertaken by Notable Vendors

- 4.4.3 Key Business Considerations and Pre-requisites

- 4.4.4 Comparative Analysis of FWA With FTTH and FTTdp

- 4.4.5 Analysis of Key Business Models and Use Cases in Rural, Semi-urban, and Urban Areas

- 4.5 Assessment of COVID-19 impact on the Fixed Wireless Access Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for High-speed Data Connectivity Through Advanced Technologies

- 5.1.2 Strategic Collaborations Between Various Stakeholders in the 5G Industry to Drive Adoption

- 5.2 Market Challenges

- 5.2.1 Dependence on Spectrum Allocation in Some Countries

- 5.2.2 Cost and Environmental Challenges Associated with Millimeter-wave Technology

- 5.3 Market Opportunities

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware

- 6.1.1.1 Consumer Premise Equipment (CPE)

- 6.1.1.2 Access units (Femto & Picocells)

- 6.1.2 Services

- 6.1.1 Hardware

- 6.2 By Application

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Huawei Technologies Co. Limited

- 7.1.2 Nokia Corporation

- 7.1.3 Qualcomm Technologies

- 7.1.4 AT & T, Inc.

- 7.1.5 Verizon Communications, Inc.

- 7.1.6 Airspan Networks Inc.

- 7.1.7 Siklu Communication Limited

- 7.1.8 Arqiva (UK)

- 7.1.9 Telefonaktiebolaget LM Ericsson

- 7.1.10 Samsung Electronics Co. Ltd