|

市场调查报告书

商品编码

1404560

图形处理单元 (GPU) -市场占有率分析、产业趋势与统计、2024-2029 年成长预测Graphics Processing Unit (GPU) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

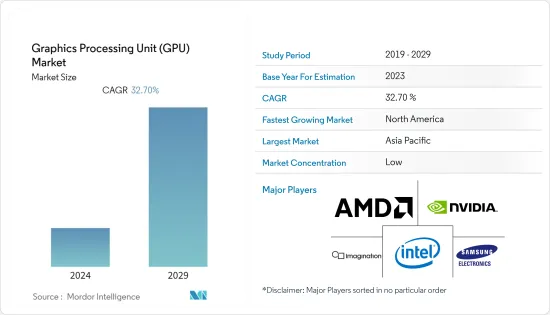

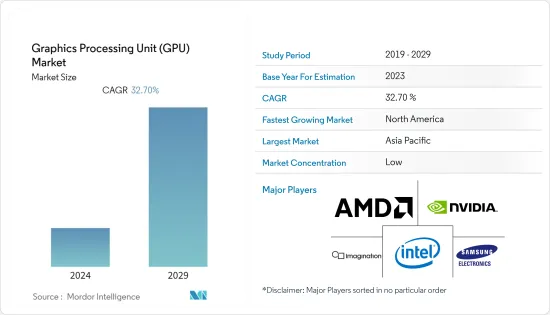

上年度图形处理单元(GPU)市值为379亿美元,预计未来五年复合年增长率为32.70%,达2069.5亿美元。

近年来,高阶个人电脑设备和游戏机的需求激增。投资图形附加板对微处理公司来说是有利的,因为 GPU 是成品的关键组件。

主要亮点

- 个人电脑(PC)和笔记型电脑等运算产品在全球的高普及,以及游戏产业投资的增加,是近年来推动研究市场成长的关键因素。在预测期内,对高阶图形和运算应用程式的需求不断增长,人工智慧等技术的扩展以及即时分析的趋势,主要扩大了 GPU 技术的范围。

- 游戏产业是 GPU 市场的主要动力之一。全球游戏产业投资的增加和游戏开发的进步也推动了图形的成长。即时刺激器等功能需要较高的图形效能。此外,游戏开发商主要透过开发与现实世界场景相符的高图形游戏来利用其竞争优势。这些功能还需要先进的显示卡。

- 对 AR、VR 和 AI 等先进技术不断增长的需求进一步推动了对 GPU 的需求。因为这些技术需要快速分析,而 GPU 是理想的选择。 AI晶片在效能和能源效率方面优于GPU。然而,GPU 对于高效能运算仍然至关重要。除了AI之外,GPU还拥有扎实的通用运算能力。

- 製造 GPU,尤其是单一 GPU 晶片成本高昂,并且需要高阶机器。儘管原材料具有成本效益,但公司需要大量初始投资来建造测试和製造实验室。例如,英特尔推出了高效能消费性图形解决方案Intel Arc。 Arc品牌涵盖多代硬体、软体和服务,首款基于Xe HPG架构的独立GPU(Alchemist)已于今年第一季交付给OEM。

- COVID-19阶段透过扰乱供应链对该行业产生影响。然而,市场报告指出某些细分市场的消费者需求增加,主要支持 GPU 技术的成长。今年 4 月,Nvidia 表示,研究人员使用配备 NVIDIA GPU 的超级电脑发现了 25 个哈伯资料趋势。 NVIDIA GPU 的高效能运算被用来分析灼热的大气层,以便更好地了解所有行星。

图形处理单元 (GPU) 市场趋势

伺服器应用领域预计将占据主要市场占有率

- 由于各个最终用户细分市场采用云端普及,伺服器细分市场正经历显着成长。例如,在日本,着名电信业者之一的 KDDI 与 NVIDIA 合作,为其客户提供 GeForce Now 游戏串流服务。据报道,KDDI 正在与 NVIDIA 合作,透过低延迟宽频和 5G 网路向日本游戏玩家提供 PC 游戏。 KDDI 将在东京的新资料中心安装 NVIDIA RTX 游戏伺服器。

- 此外,GPUaaS 可用于多种目的,包括训练多语言人工智慧语音引擎和识别与糖尿病相关的失明的早期指标。现代 GPUaaS 为传统通用处理器提供了一种有吸引力的替代方案,具有可变定价且无资本支出,使其成为获得机器学习系统所需速度的一种方式。

- 此外,印度市场也有大量供应商投资。例如,宏碁在印度推出了新型 NVIDIA Tesla GPU 驱动的伺服器。该伺服器最多可託管八个 NVIDIA Tesla V100 32GB SXM2 GPU 加速器。 GPU 对包含一个用于高速互连的 PCIe(週边组件互连)插槽。

- 高效能运算 (HPC) 的技术进步也可能为 GPU 供应商带来机会。例如,2022 年 4 月,NVIDIA 表示研究人员使用配备 NVIDIA GPU 的超级电脑发现了 25 个哈伯资料趋势。 NVIDIA GPU 的高效能运算被用来分析我们炎热的大气层,以便更好地了解所有行星。根据 Steam 统计,截至 2022 年 8 月,91.22% 的受访者正在使用 DirectX 12 GPU 显示卡。

亚太地区预计将占据主要市场占有率

- 在中国,风华GPU在广泛普及方面取得了重要的里程碑。这款GPU是芯东科技和芯动科技于去年11月发表的。该GPU于2022年3月检验,运作稳定,同芯UOS作业系统效能优异。

- 同心UOS是中国重要的作业系统,因为它是主导政府创建的,其效能优于Windows。基于 Debian Linux 构建,并经过调整以与现代本土硬体配合使用。因此,风华 GPU 认证是重要的一步,同时也为兆芯 CPU 和 GPU 等中国设计的半导体装置提供支援。

- 2022 年 4 月,Moore Threads 宣布推出适用于 PC 桌上型电脑和工作站的 MTT S60 以及适用于伺服器的 MTT S2000。两者均基于基于 MUSA 的 12nm GPU。转向人工智慧,基于MUSA的显示卡可以支援各种流行的人工智慧框架,包括视觉处理、音讯处理和自然语言处理。

- 此外,许多公司正在与政府支持的中国新兴企业和研究机构合作或投资。这也称为间接渗透中国市场。商汤科技是一家总部位于中国的热门人工智慧Start-Ups,拥有 700 家客户和合作伙伴,其中包括麻省理工学院 (MIT) 和高通。

- 该公司在短时间内取得了成功,估值已达45亿美元。商汤科技能够如此迅速发展的原因之一是政府的支持以及对中国庞大资料库的直接存取。该公司也与中国政府合作实施「中国製造2025」。该公司还透露了超过 160 petaflops 的总运算能力,这是透过分布在 12 个 GPU丛集集中的 15,000 个 GPU 上的 5,400 万个 GPU 核心实现的。

- 中国游戏产业的成长主要得益于加强投入加强GPU技术研发能力。国内公司开发的独立游戏继续主导中国市场的销售。

图形处理单元 (GPU) 产业概览

图形处理单元 (GPU) 市场由英特尔公司、Advanced Micro Devices Inc.、Nvidia 公司、Imagination Technologies Group 和三星电子等主要企业瓜分。市场参与企业正在采取联盟和收购等策略来加强其产品供应并获得永续的竞争优势。

- 2023 年 5 月 - 联发科技与 NVIDIA 合作,为下一代软体定义车辆提供一整套汽车AI 座舱解决方案。透过此次合作,联发科将开发整合全新 NVIDIA AGPU 小晶片以及 NVIDIA 人工智慧和图形 IP 的汽车SoC。

- 2022 年 8 月:英特尔资料中心 GPU Flex 系列 Arctic Sound-M 宣布推出智慧视觉云端。 Flex 系列 GPU 旨在满足智慧型视觉云端工作负载的要求,提供 5 倍的媒体转码吞吐量效能和多达 68 个同步云端游戏串流。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- 宏观经济走势对市场的影响

第五章市场动态

- 市场驱动因素

- 游戏图形的演变

- 拓展AR、VR、AI的应用

- 市场抑制因素

- 初始投资高

第六章市场区隔

- 按类型

- 独立GPU

- 整合GPU

- 按用途

- 桌面

- 行动电脑

- 工作站

- 伺服器/资料中心

- 汽车/自动驾驶汽车

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章竞争形势

- 公司简介

- Intel Corporation

- Advanced Micro Devices Inc.

- Nvidia Corporation

- Imagination Technologies Group

- Samsung Electronics Co. Ltd

- Arm Limted(soft Bank Group)

- EVGA Corporation

- SAPPHIRE Technology Limited

- Qualcomm Technologies Inc.

第八章 供应商市场占有率

第九章投资分析

第十章投资分析市场的未来

The Graphics Processing Unit (GPU) Market was valued at USD 37.9 billion the previous year and is expected to grow at a CAGR of 32.70%, reaching USD 206.95 billion by the next five years. The demand for high-end personal computing devices and gaming console effects has surged in recent years. Hence, investing in a graphics add-in board is helpful for micro-processing companies, as GPU forms a vital component of the finished product.

Key Highlights

- The high adoption of computing products, such as personal computers (PC) or laptops, globally and the increasing investment in the gaming industry have been major factors driving the studied market's growth in recent years. The growing demand for high graphics and computing applications and the expansion of technologies, like AI, along with the trend of real-time analysis, are mainly expanding the scope of GPU technology over the forecast period.

- The gaming industry is one of the significant driving forces for the GPU market. The growing investment in the global gaming sector and advancement in game development also fuel graphics growth. Features like real-time stimulators demand high graphics. Additionally, game developers mainly leverage competitive advantage by developing high-graphics games that match real-world scenarios. These features also require advanced graphics boards.

- The growing demand for advanced technologies, like AR, VR, and AI, is further fueling the GPU demand, as these technologies require high-speed analysis, for which GPU is an ideal option. AI chips have surpassed GPUs in performance and energy efficiency. However, GPUs are still an indispensable part of high-performance computing. Apart from AI, GPUs also have a solid general-purpose computing capability.

- GPU manufacturing, especially the standalone GPU chip, is costlier and requires high-end machines. Although the raw material is cost-effective, the companies need a high initial investment to build the lab for testing and manufacturing. For instance, Intel announced Intel Arc for consumer high-performance graphics solutions. The Arc brand would encompass hardware, software, and services over multiple generations of hardware, with the first discrete GPU (Alchemist) based on the Xe HPG microarchitecture delivered to OEMs in Q1 of the current year.

- COVID-19 impacted the industry by disrupting the supply chain in the initial phase. However, the market has reported increased consumer demand in a particular segment, mainly supporting GPU technology growth. In April this year, Nvidia stated that researchers discovered trends in Hubble data on 25 of them using a supercomputer with NVIDIA GPUs. To increase the understanding of all planets, high-performance computing is used with NVIDIA GPUs to analyze the torrid atmospheres.

Graphics Processing Unit (GPU) Market Trends

Servers Application Segment is Expected to Hold Significant Market Share

- The server segment is witnessing significant growth owing to the proliferation of the cloud in various end-user sectors. For instance, in Japan, KDDI, one of the prominent telecom companies, partnered with NVIDIA to offer GeForce Now game-streaming service to customers. KDDI reportedly partnered with NVIDIA to deliver PC games over low-latency broadband and a 5G network to gamers in Japan. It would place NVIDIA's RTX gaming servers in a new data center in Tokyo.

- Additionally, GPUaaS may be utilized for various purposes, including training multilingual AI speech engines and identifying early indicators of diabetes-related blindness. Modern GPUaaS, which provides a compelling alternative to traditional general-purpose processors with variable pricing and no CAPEX, is one way to achieve the speed required for machine learning systems.

- Moreover, the Indian market is also witnessing investment by many vendors. For instance, Acer launched new NVIDIA Tesla GPU-powered servers in India. The server can host up to eight NVIDIA Tesla V100 32GB SXM2 GPU accelerators. GPU pair includes one Peripheral Component Interconnect (PCIe) slot for high-speed interconnect.

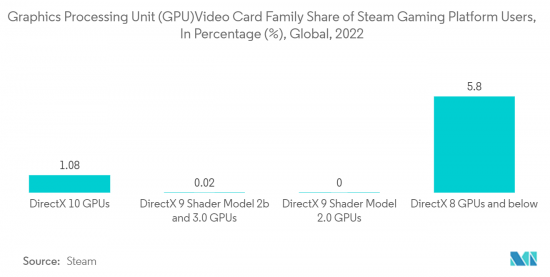

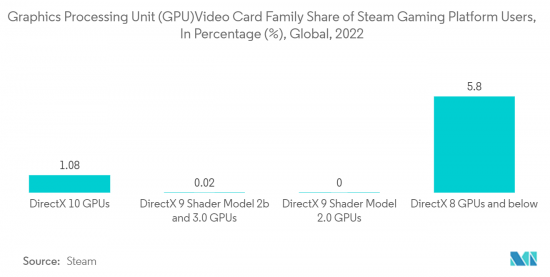

- Technological advancement in high-performing computing (HPC) may also develop an opportunity for GPU vendors. For instance, in April 2022, Nvidia stated that researchers discovered trends in Hubble data on 25 of them using a supercomputer with NVIDIA GPUs. To increase the understanding of all planets, high-performance computing is used with NVIDIA GPUs to analyze the torrid atmospheres. According to Steam, 91.22 percent of respondents used a DirectX 12 GPU graphics card as of August 2022.

Asia Pacific is Expected to Hold Significant Market Share

- In China, the Fenghua GPU achieved a significant milestone in terms of broad adoption. The GPU was announced in November last year by Xindong Technology and Innosilicon. The GPU was validated in March 2022 for stable operation and excellent Tongxin UOS operating system performance.

- Tongxin UOS is a significant operating system in China because it was created as a government-led effort to usurp Windows. It is built on Debian Linux and has been tweaked to work with the newest homemade hardware. As a result, alongside the development of support for Chinese-designed semiconductor devices such as Zhaoxin CPUs and GPUs, the Fenghua GPU certification represents a significant step.

- In April 2022, Moore Threads announced MTT S60 for PC desktops and workstations and the MTT S2000 for servers. Both are based on MUSA-based 12nm GPUs. Moving on to AI, MUSA-based graphics cards can support a variety of common AI frameworks, including those for visual processing, audio processing, natural language processing, and more.

- Many companies are also partnering or investing in Chinese start-ups or research laboratories, which are getting government support. This is also known as indirect penetration in the Chinese market. China-based popular AI start-up SenseTime has a portfolio of 700 clients and partners, including the Massachusetts Institute of Technology (MIT), and Qualcomm, among others.

- The company has become successful in very little time and has a valuation of USD 4.5 billion. One of the reasons SenseTime has been able to grow so quickly is that it has government support and direct access to China's vast databases. The company is also working with the Chinese government on Made in China in 2025. The company also revealed that its aggregate computing power is more than 160 petaflops, achieved with 54,000,000 GPU cores across 15,000 GPUs within 12 GPU clusters.

- The growth in the Chinese gaming industry is mainly due to increasing investment in enhancing R&D capability for GPU technology. Independent games developed by domestic firms have continued to dominate market sales in China.

Graphics Processing Unit (GPU) Industry Overview

The Graphics Processing Unit market is fragmented with the presence of major players like Intel Corporation, Advanced Micro Devices Inc., Nvidia Corporation, Imagination Technologies Group, and Samsung Electronics Co. Ltd. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- May 2023 - MediaTek partnered with NVIDIA to deliver a complete range of in-vehicle AI cabin solutions for the next generation of software-defined vehicles. MediaTek would develop automotive SoCs through this collaboration, integrating a new NVIDIA GPU chiplet with NVIDIA AI and graphics IP.

- August 2022: Intel Data Centre GPU Flex Series Arctic Sound-M was introduced for the Intelligent Visual Cloud. Flex Series GPU is designed to meet the requirements for intelligent visual cloud workloads, with 5x media transcode throughput performance and up to 68 simultaneous cloud gaming streams.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macro Economic trends on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Evolving Graphics in Games

- 5.1.2 Growing Applications of AR, VR, and AI

- 5.2 Market Restraints

- 5.2.1 High Initial Investments

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Discrete GPUs

- 6.1.2 Integrated GPUs

- 6.2 By Applications

- 6.2.1 Desktop

- 6.2.2 Mobile PC

- 6.2.3 Workstation

- 6.2.4 Server/Datacenter

- 6.2.5 Automotive/Self-driving Vehicles

- 6.2.6 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 Advanced Micro Devices Inc.

- 7.1.3 Nvidia Corporation

- 7.1.4 Imagination Technologies Group

- 7.1.5 Samsung Electronics Co. Ltd

- 7.1.6 Arm Limted (soft Bank Group)

- 7.1.7 EVGA Corporation

- 7.1.8 SAPPHIRE Technology Limited

- 7.1.9 Qualcomm Technologies Inc.