|

市场调查报告书

商品编码

1405089

雷射清洗:市场占有率分析、产业趋势与统计、2024-2029 年成长预测Laser Cleaning - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

雷射清洗市场规模预计将从2024年的7.8亿美元成长到2029年的15亿美元,预测期内复合年增长率为14.61%。

主要亮点

- 雷射清洗已成为各行业的重要阶段/过程。雷射清洗主要应用于製造业,随着复杂生产的增加,其硬体技术也经历了多次升级。

- 传统上用于后续工业流程的表面处理,工业4.0带来的变化需要自动化清洗流程。此外,喷砂系统会产生大量废弃物并损坏脆弱的表面,化学溶剂的使用会产生潜在危险的蒸气和废液。这些问题催生了基于雷射技术的表面清洁解决方案。

- 雷射清洗相对于这些传统方法的潜在优势正在推动其清洗。此外,雷射清洗可以准确、精确地清洗半导体,推动其在电子产业的采用。

- 对可靠性的要求不断提高,以及免清洗程序导致的电子元件错误增加,迫使电子製造业重新关注清洗。清洁行业提供了多种选择来确定理想的清洁方法,推动了雷射清洁市场的成长。

- 雷射清洁设备的高价格和缺乏技术专业知识是市场成长的挑战。 95%的雷射清洁设备的价格在每台75万印度卢比(9153.43美元)到550万印度卢比(67125.13美元)之间。

- 在 COVID-19 期间,雷射清洁受细菌感染的表面已成为一种非常有效的程序,因为雷射的热效应用于对錶面进行消毒。虽然雷射通常是脉衝雷射器,但必须仔细选择波长、脉衝能量和重复频率。预计这些趋势将对所研究市场的成长做出积极贡献。

雷射清洗市场趋势

汽车产业实现显着成长

- 雷射清洁可以去除所有污染物,而不仅仅是可见污染物。在汽车中使用雷射清洁的关键范例包括汽车生产或维护中的腐蚀去除、涂层去除、选择性面漆去除以及氧化物处理。

- 雷射清洗可以恢復高价值汽车的所有原件和良好的表面状况。具有轻微腐蚀的优质汽车很难买到,尤其是当它们老化时。据 Adapt Laser Systems 称,通用汽车、丰田和米其林等汽车製造商与该组织合作开发雷射技术,包括清洁技术。

- 除此之外,电动车需求的显着增长和雷射清洗机的实际引入将在预测期内进一步推动需求。雷射清洁每秒使用数千个脉衝来吸收和去除杂质。这主要有利于需要连接实践或预先焊接过程的汽车零件。透过在黏合或加工之前去除污染物,公司可以改善将电池和电动车零件固定在一起的化学反应,并延长其产品的使用寿命。涂层去除、射出成型模具加工、后处理和轮胎模具清洗都是雷射清洗的可能应用。

- 使用雷射系统清洁电池组件使生产商能够快速、安全地工作,同时将烧蚀过程控制在 1-3 微米的材料去除水平。这有助于保持基材层完好无损,从而比未清洗区域产生更好的连接,并大大提高了随着时间和里程的推移的黏合稳定性。雷射消熔透过改善电池单元和键合线之间的导电性,彻底改变了电动车(EV) 电池的清洗方式。大多数製造商采用常见的脉衝光纤雷射透过传统的光纤传输来清洁电动车电池。这是一项伟大的多用途技术,但它不仅适用于电动车产业。

- 例如,电动车产量的增加预计将推动所研究的市场。例如,2022年2月,特斯拉计划在中国建造第二座电动车(EV)工厂,以满足中国国内和出口市场不断增长的需求。短期内,特斯拉计画在上海临港自贸区目前的生产基地附近设计第二家工厂,将其在中国的产能提高到每年至少100万辆。

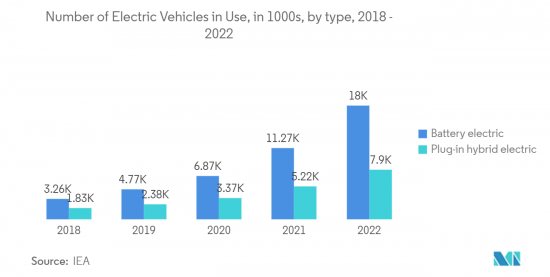

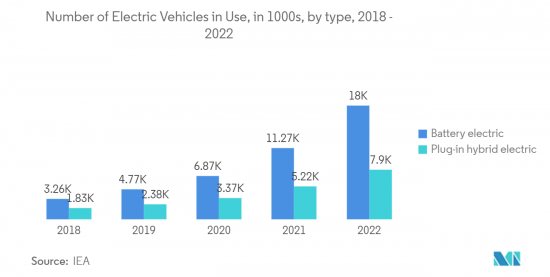

- 根据 IEA 的数据,到 2022 年,全球将有约 2,590 万辆电动车运作。同年所有电动车在插电式电动车中的份额约为69.5%。

- 此外,2022 年 5 月,丰田集团宣布计划在印度投资 480 亿印度卢比(6.24 亿美元)用于生产电动车零件。此外,印度最初对电动车的兴趣和接触来自国家电动车任务计划,该计划旨在快速引进和生产混合动力汽车以及 EVsFAME I 和 II。政府宣布从现在到2022年将总共花费14亿美元用于FAME第二阶段。这种汽车扩张可能会进一步刺激研究市场的成长。

亚太地区可望成为快速成长的市场

- 中国在环境保护方面越来越严格,公民也越来越关注保护自己免受污染。尤其是传统清洗产业存在的污染问题,已成为雷射清洗解决方案需求的主要原因。

- 而且,以雷射作为重要支撑技术,中国的製造工艺正在上升到更高的水平,国家战略「工业4.0」和「中国製造2025」也已蓄势待成熟。

- 在这个市场中,用于材料加工的雷射器的性能有望提高,日本工业领域有前景的雷射加工应用数量正在增加。此外,为了正确使用雷射,基于雷射科学的雷射加工技术的先进性和系统化、高品质製造的生产技术以及雷射研究人员和工程师数量的增加正在取得进展。

- 此外,随着超过 70% 的印度都市区购买更多的家庭清洁产品,市场正在见证创造更健康家居的创新。例如,2022年2月,Dyson推出了印度首款采用雷射检测技术的吸尘器。此吸尘器设计用于检测小至 10 毫米的灰尘。 Dyson V12 Detect Slim 是一款新型无线吸尘器,配备晶粒电机,可产生高达 150 瓦的强大吸力。 5阶段过滤系统可捕捉 99.9% 的 0.3 微米灰尘。

- 由于韩国汽车需求量大,因此需要确保焊接前后最高水平处理的雷射清洗机,从而产生无需经过涂层工艺即可完全涂层的牢固连接。由于危险化学品和废弃物的使用以及去除氧化剂污染、射出成型模具消毒、耐腐蚀和黏结剂製备等其他应用,对雷射清洗机的需求不断增加。据KAIDA称,2022年韩国销售了约851,000辆汽油动力汽车。其次最受欢迎的燃料类型是柴油,其次是混合动力汽车,位居第三。同年电动车及混合动力汽车销量较上年大幅成长。

- 2022年2月,韩国电池製造商三星SDI开始使用雷射设备清洗方形电池罐。在方形电池中,正极、负极和隔膜等材料沉淀在金属容器中。这些部件在插入罐头之前会形成果冻。雷射在果冻卷插入后立即启动,但在用盖子密封罐口之前。

- 其他亚太地区包括澳洲、泰国和印尼等亚洲国家,预计这些国家的研究市场在预测期内将显着成长。

雷射清洗行业概况

雷射清洁市场分散,有许多地区和国际参与企业。由于市场分散,参与企业之间的竞争非常激烈,各种新参与企业都在投资该市场。济南新天科技(XT Laser)、通快集团、Laser Photonics Corporation、Laserax Inc.和Adapt Laser Systems是该市场的重要参与企业。市场参与企业正在采取合作伙伴关係、创新和收购等策略来加强其产品供应并获得永续的竞争优势。

- 2022 年 5 月 - Laser Photonics Corp. 推出 CleanTech3000-CTH 雷射清洁系统。 CleanTech3000-CTH雷射清洗系统是一款手持式雷射清洗设备,可在喷漆前去除最难去除的腐蚀并提高黏合。该系统包括一个整合式冷却器,尺寸与 2000-CTH 相同,2000-CTH 是以前商业行业中效率最高的系统。 Laser Photonics CleanTech 手持式系列中的「粗加工」雷射已透过引入 3KW 雷射喷射器进行了扩展,如 Laser Photonics 清洁雷射选择指南中所述。

- 2022 年 4 月 - Laser Photonics Corp. 是一家用于雷射清洁的高科技雷射系统供应商,宣布升级其现有产品线。所有产品线都在取得进步,包括 IV 级到 I 级雷射喷砂柜、自动雷射清洁设备和机器人应用。此外,2022年5月,Laser Photonics Corp.宣布推出CleanTech3000-CTH雷射清洁系统(3KW)。

- 2022 年 3 月 - IPG Photonics 不断升级其雷射清洁产品组合,推出手持式雷射焊接和清洁产品线中的第三款产品 LightWELDXR。与先前的 LightWELD 型号相比,这款新产品扩展了手持式雷射焊接和清洁功能,可容纳更多的材料和板材厚度。这是透过产生较小的光点尺寸并提供超过 6 倍的能量密度来实现的。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 宏观经济走势对市场的影响

第五章市场动态

- 市场驱动因素

- 与传统方法相比,采用雷射清洁

- 电子元件越来越采用小型化

- 市场抑制因素

- 高成本且缺乏专业工程师

第六章市场区隔

- 按输出范围

- 高的

- 期间~

- 低的

- 按最终用户产业

- 基础设施

- 车

- 航太/飞机

- 工业的

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章竞争形势

- 公司简介

- Jinan Xintian Technology Co., Ltd(XT Laser)

- TRUMPF Group

- Laser Photonics Corporation

- Laserax Inc.

- Adapt Laser Systems

- Clean-Lasersysteme GmbH

- P-Laser

- IPG Photonics Corporation

- Scantech Laser Pvt. Ltd

- Anilox Roll Cleaning Systems

- HGLaser Engineering Co. Ltd

- Coherent Corp.

第八章投资分析

第9章市场的未来

The Laser Cleaning Market size is expected to grow from USD 0.78 billion in 2024 to USD 1.5 billion by 2029, at a CAGR of 14.61% during the forecast period.

Key Highlights

- Laser cleaning has become a vital phase/process in various industries. Adopted mainly in manufacturing, laser cleaning has witnessed multiple upgrades to the hardware technology as sophisticated production is on the rise.

- Conventionally being used to prepare surfaces for subsequent industrial processes, automated cleaning processes are required to adhere to changes brought in by Industry 4.0. Also, abrasive blasting systems create substantial waste and damage delicate surfaces, and the use of chemical solvents causes potentially hazardous vapors and liquid waste products. Such issues led to the adoption of laser technology-based solutions for surface cleaning.

- The potentially high benefits of laser cleaning over these conventional approaches have been driving the adoption of laser cleaning. Further, laser cleaning provides accurate and precise cleaning of semiconductors, driving their adoption in the electronics industry.

- The increased demand for reliability and the increasing number of errors in electronic components created by no-clean procedures compelled the electronics manufacturing industry to refocus on cleaning. The cleaning industry provides a wide range of options for determining the ideal cleaning method, driving the growth of the laser cleaning market.

- The high price of laser cleaning equipment and lack of technical expertise poses a challenge to the market's growth. The price of 95% of laser cleaning machines is between INR 750,000 (USD 9153.43) and INR 5,500,000 (USD 67125.13) per piece.

- During the COVID-19 period, laser cleaning of bacteria-infected surfaces emerged as a highly effective procedure as the thermal effects of the laser was used to disinfect the surface.Various studies have been conducted to determine the efficacy of multiple types of lasers in cleaning bacteria-infested surfaces. The lasers are usually pulsed, but the wavelength, pulse energy, and repetition rate must be carefully selected. Such trends are expected to contribute positively to the studied market's growth.

Laser Cleaning Market Trends

Automotive Sector to Witness Major Growth

- Laser cleaning removes all contaminants, not just those that are visible. The significant instances where I used laser cleaning in automotive include corrosion removal, coating removal, topcoat select removal, oxide treatment in automotive production or maintenance, etc.

- Laser cleaning can restore a high-value vehicle that has all its original parts and is in good condition on the surface. Great cars with minor corrosion are tough to obtain, especially as they age. According to Adapt Laser Systems, automotive manufacturers such as GM, Toyota, Michelin, and others have partnered with the organization for laser technologies, including cleaning.

- Adding to this, the significant growth in the demand for electric vehicles and the actual deployment of laser cleaning machines is further analyzed to boost the demand during the forecast period. Thousands of pulses per second are used in laser cleaning to absorb and eliminate impurities. This mainly benefits automotive parts that require bonding practice and pre-weld processes. Companies can improve the chemical characteristics that hold the battery or electric car parts together and extend the product's lifespan by eliminating pollutants before bonding or treating them. Coating removal, injection mold treatment, post-weld treatment, and tire mold cleaning are all possible applications for laser cleaning.

- Cleaning battery components with a laser system enables producers to work fast and safely while managing the ablation process down to 1 to 3-micron levels of material removal. This keeps the substrate layer intact easier, resulting in connections far superior to non-cleaned areas and significantly improved bond stability over time and miles. Laser ablation is a game-changing electric vehicle (EV) battery cleaning method because it improves conductivity between the battery cell and the bonding wire. Most manufacturers employ a typical pulsed fiber laser to clean EV batteries with conventional optical delivery. This is a terrific multi-purpose technique but does not exclusively cater to the EV industry.

- For instance, the rise in the production of EVs is expected to propel the Market studied. For example, in February 2022, Tesla planned to build a second electric vehicle (EV) facility in China to help it keep up with increasing demand locally and in export markets. In the short term, Tesla plans to increase capability in China to at least 1 million cars per year, with a second plant designed near its current production in Shanghai's Lingangfree trade zone.

- According to IEA, roughly 25.9 million electric vehicles were operating worldwide in 2022. All-electric cars accounted for about 69.5% of plug-in electric vehicles that year.

- Further, in May 2022, Toyota Group revealed plans to invest INR 48 billion (USD 624 million) in India to manufacture electric vehicle components. In addition, The first interest and exposure for electric mobility in India was driven by the National Electric Mobility Mission Plan, which is aimed at faster adoption and production of hybrids and EVsFAME I and II. The government has announced an expenditure totalling USD 1.4 billion between now and 2022, in the second phase of FAME. The study market growth can be further stimulated by such an expansion of motor vehicles.

Asia Pacific is Expected to be the Fastest Growing Market

- China has become more stringent in the field of environment protection and citizens are increasingly concerned with protecting themselves from pollution. A growing number of issues, in particular pollution problems that are a major reason for the demand for laser cleaning solutions, can be observed in the Traditional Cleaning Industry.

- Moreover, China's manufacturing processing is rising to a higher level, with lasers as the significant supporting technology and significantly becoming ready and mature due to the country's national strategies "Industry 4.0" and "Made in China 2025., which are expected to bring increased opportunities for various vendors offering laser cleaning systems.

- The market is expected to witness an increased performance of lasers for materials processing, and the number of promising laser treatment applications is growing in Japan's industrial domains. Furthermore, to correctly employ lasers, laser processing technology is being created based on laser science for enhancement and systematization, production technology for manufacturing high-quality items, and an increase in the number of laser researchers and engineers.

- Further, the market sees innovations to help create healthier homes as over 70% of people in urban India buy more home-cleaning products. For instance, in February 2022, Dyson announced India's first vacuum cleaner with laser detection technology. The vacuum cleaner is designed to detect concealed particles as small as 10 millimeters. The Dyson V12 Detect Slim is a new cordless vacuum cleaner with a hyperdymium motor that generates up to 150 air watts of intense suction. Its five-stage filtration system collects 99.9% of dust particles as small as 0.3 microns.

- The necessity for laser cleaning machines to ensure the highest possible prewelding and postwelding treatment results in a growing and strong connection, which can be sufficiently coated without being subjected to any coating process, due to significant automotive demand in South Korea Increased demand for laser cleaning machines has been observed due to the use of harmful chemicals or wastes and other uses such as removal of contamination by oxidising agents, injection mold disinfection, corrosion resistance and Bond preparation. According to KAIDA, in 2022, around 851 thousand gasoline vehicles were sold in South Korea. The next popular fuel type was diesel, followed by hybrid cars in third place. That year, the sales of electric or hybrid vehicles noticed a large increase compared to the last year.

- In February 2022, Samsung SDI, a South Korean battery manufacturer, started cleaning prismatic battery cans with laser equipment. Materials, including cathode, anode, and separators, are deposited in a metal container in prismatic batteries. Before being inserted into the can, these components are formed into a jelly roll. The laser begins immediately after the jelly roll is inserted and before the can's opening is sealed with a cap.

- Other Asian countries, such as Australia, Thailand, and Indonesia, which are expected to grow significantly in the studied market during the forecast period, are included in the rest of the Asia Pacific segment.

Laser Cleaning Industry Overview

The laser cleaning market is fragmented due to many regional and international players. Due to the fragmented nature of the Market, the competition amongst the players is high, and various new players are also investing in this Market. Jinan Xintian Technology Co., Ltd (XT Laser), TRUMPF Group, Laser Photonics Corporation, Laserax Inc., and Adapt Laser Systems are critical players in the Market. Players in the Market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- May 2022 - Laser Photonics Corp. launched the CleanTech3000-CTH laser cleaning system. The CleanTech3000-CTH laser cleaning system is a handheld laser cleaning equipment capable of removing the most challenging corrosion and improving adhesion before painting. This system includes an integrated chiller and is the same size as the 2000-CTH, which was formerly the most efficient for the commercial industry. The Laser Photonics CleanTech Handheld series of "Roughing" lasers was expanded by introducing the 3KW laser blaster, as stated in the Laser Photonics Cleaning Laser selection guide.

- April 2022 - Laser Photonics Corp., a provider of high-tech laser systems for laser cleaning, announced the upgrades to the existing product line. Advancements are being made to the entire product line, which includes everything from Class IV to Class I laser blaster cabinets, automatic laser cleaning equipment, and robotic applications. Also, in May 2022, Laser Photonics Corp. announced the launch of the CleanTech3000-CTH laser cleaning system (3KW).

- March 2022 - IPG Photonics constantly upgraded its laser cleaning portfolio; the company launched LightWELDXR, the third product offering within its handheld laser welding and cleaning product line. The new product provides an extended range of handheld laser welding and cleaning capabilities to address more materials and thicknesses than previous LightWELDmodels. This is done by producing a much smaller spot size and delivering more than six times the energy density.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Adoption of Laser Cleaning over Traditional Approach

- 5.1.2 Increasing Adoption of Miniaturization in Electronic Components

- 5.2 Market Restraints

- 5.2.1 High Cost and Lack of Technical Expertise

6 MARKET SEGMENTATION

- 6.1 By Power Range

- 6.1.1 High

- 6.1.2 Medium

- 6.1.3 Low

- 6.2 By End-user Industry

- 6.2.1 Infrastructure

- 6.2.2 Automotive

- 6.2.3 Aerospace and Aircraft

- 6.2.4 Industrial

- 6.2.5 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of the Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Jinan Xintian Technology Co., Ltd (XT Laser)

- 7.1.2 TRUMPF Group

- 7.1.3 Laser Photonics Corporation

- 7.1.4 Laserax Inc.

- 7.1.5 Adapt Laser Systems

- 7.1.6 Clean -Lasersysteme GmbH

- 7.1.7 P-Laser

- 7.1.8 IPG Photonics Corporation

- 7.1.9 Scantech Laser Pvt. Ltd

- 7.1.10 Anilox Roll Cleaning Systems

- 7.1.11 HGLaser Engineering Co. Ltd

- 7.1.12 Coherent Corp.