|

市场调查报告书

商品编码

1405345

汽车标籤:市场占有率分析、产业趋势/统计、成长预测,2024-2029Automotive Labels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

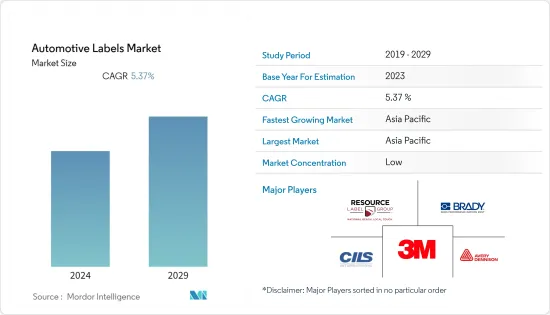

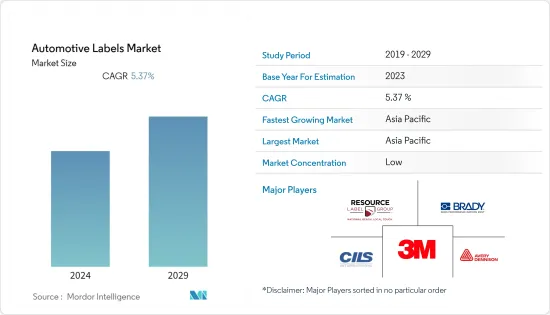

上年度汽车标籤市场规模为74.1亿美元,预计在预测期内将达到101.1亿美元,复合年增长率为5.37%。

主要亮点

- 汽车产业对车辆的需求不断增长,以及对用于汽车零件识别、资讯和安全的无线射频识别 (RFID) 和条码等标籤的需求预计将推动市场发展。由于所有最终用户行业的包装和标籤市场的成长,汽车标籤行业正在显着扩张。

- 汽车标籤通常由徽章和标籤组成,例如条码、报价和车辆识别号码 (VIN) 标籤,显示零件资讯、公司名称或标誌、价格、技术资讯和其他重要详细资讯。预计推动市场成长的其他因素包括对 RFID 和条码等智慧标籤的需求不断增加,对环保标籤製造方法的需求不断增加等。

- 汽车标籤在小客车中的使用不断增加是推动市场成长的主要因素之一。此外,汽车製造设备投资的增加和小客车产量的增加是拉动汽车标籤市场需求的主要因素。由于几乎每个行业的技术发展,汽车标籤市场也在不断扩大。对自动驾驶平台产生的数百万张照片和影片进行正确分类至关重要。

- 汽车行业有许多标籤要求,从清洁用品和汽车製造商到一级方程式赛车和大众交通工具。该行业几乎在汽车的每个区域都使用标籤,包括外装和引擎。汽车标籤可用于该领域的启动马达、电缆、泵浦、马达、引擎管理系统等。

- 随着汽车标籤市场的不断成长,全球对油墨成分的法令遵循也变得更加严格。因此,选择与这些市场相容且与潜在设计油墨不同的成分对于配方设计师来说是一项复杂而艰鉅的挑战。这加上各国生产成本的上升,预计将阻碍市场成长。

- 汽车标籤製造商在应对眼前的危机并寻找新的 COVID-19 后工作方式时,应保护其营运和供应链。但标籤是必需品供应链的一部分。此外,它也是传递资讯的重要工具。此外,汽车标籤市场领先于产业技术变革。自动驾驶平台会产生数十亿张图像和影片,必须以最高精度进行标记。

汽车标籤市场趋势

条码细分市场占据主要市场占有率份额

- 条码标籤提供了一种快速储存和搜寻资料的方法。条码标籤以线条和数字的形式包含公司和产品详细资讯。条码标籤还可用于管理库存并透过提供可追溯性来减少召回负担。汽车标籤条码常见于引擎、车门和仪表板等零件上。

- 二维条码是汽车零件标籤最常用的条码类型之一。标籤在汽车零件製造商的供应链中发挥重要作用。它确保产品的准确交付,提供关键的条码和其他资讯,并加速货物的流动。从客户特定需求和新兴市场卖家品牌要求到进出口控制和海关审核,标籤是劳力密集且成本高昂的。

- 另一方面,3D 扫描器可产生条码的 3D 扫描。此扫描可以从任何方向读取。 3D 条码扫描器通常用于汽车组装和製造等工业应用。

- 多家製造商提供各种汽车条码标籤。例如,Metalcraft 生产多种用途的塑胶条码标籤。可用于挡风玻璃、电缆、电线、仪表板等。我们还有砸道机标籤、金属化标籤等等。

- 汽车零件和汽车库存标籤在汽车和汽车零件的生产中非常重要。汽车製造商使用条码追踪仓库中的产品并检查第三方物流(3PL) 供应商的库存。他们还使用条码(带有印刷条码)来识别具有各种其他资讯(例如序号、日期和型号)的零件。

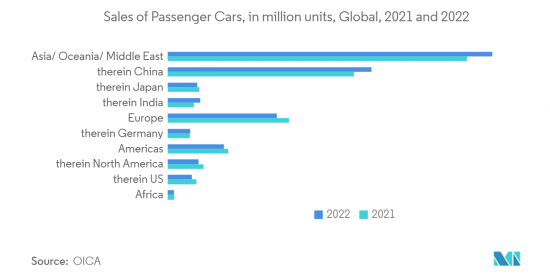

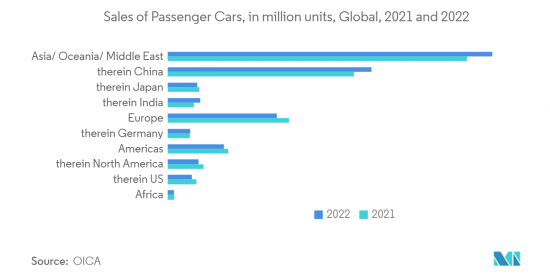

- 条码印表机和扫描器可以列印这些条码并建立要套用至产品的标籤。这有助于追踪库存并最大限度地减少错误或丢失重要资讯的风险。据OICA称,今年轻型汽车销量预计将成长4.73%。总体而言,汽车行业的成长预计将有助于市场成长。

亚太地区预计将主导市场

- 亚太地区占据主要市场占有率,预计在预测期内将成长最快。艾利丹尼森等公司正在增加该地区新兴企业的数量,以发展标籤和包装行业并提高创新能力,这是推动市场成长的关键因素。

- 汽车售后服务市场的成长得益于多种因素,包括汽车产销量的增加以及中国汽车零件产业的扩张。此外,由于以客户为中心的客製化和二手车市场的增加,预计引擎售后服务市场在预测期内将出现强劲增长。在售后服务领域,标籤用于更换零件、提供维护和维修服务、确保安全、遵守法律规章。随着市场的扩大,对引擎标籤和其他汽车标籤的需求预计也会增加。

- 印度汽车工业在宏观经济扩张和技术发展中发挥重要作用,成为衡量经济实力的良好指标。在印度,中产阶级不断壮大,人口年轻化,两轮车市场在保有量方面占据主导地位。希望开拓区域市场的公司的兴趣增加也支持了该行业的成长。结果,生产的汽车数量不断增加。随着汽车产业的持续成长,对包括标籤在内的汽车零件的需求预计也会增加。

- 日本政府承认无线射频识别(RFID)是一项得到大量财政投资支持的创新技术,日本强大的生产基地将在未来几年的RFID应用中主导作用。我们保证这一点。 RFID 技术的重大进步可以在政府支持的基础上实现。这可能会导致更先进、更有效的 RFID 适合在汽车领域使用。

- 根据日本汽车工业协会的数据,2022 年日本汽车製造商在日本境外的生产设施生产了约 1,696 万辆汽车,高于去年的 1,646 万辆。将生产扩大到日本以外地区是这家日本汽车製造商全球扩大策略的体现。随着汽车製造商在海外市场建立更强大的影响力,他们可能需要专门的标籤来适应不同地区和语言的独特要求,进一步推动汽车标籤市场的需求。

汽车标籤产业概况

由于 3M 公司、艾利丹尼森公司、Resource Label Group 和 HB Fuller 公司等几家大公司的存在,该市场呈现碎片化。以大型企业的参与为特征的不断变化的行业形势正在加剧努力捕捉新机会的公司之间的竞争。同时,中小企业也处于成长轨道,并希望利用市场巨大的成长潜力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 汽车产业对 RFID 标籤的需求不断增长

- 提高对标籤法律规章的遵守

- 市场抑制因素

- 小型製造商的製造成本增加

第六章市场区隔

- 透过识别技术

- 条码

- QR 图码

- 无线射频识别标籤

- 其他的

- 按类型

- 品牌推广

- 货物追踪

- 警告/安全

- 资产标籤

- 其他类型(轮胎标籤、耐候标籤)

- 按用途

- 室内使用

- 外装使用

- 引擎应用

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章竞争形势

- 公司简介

- 3M Company

- Avery Dennison Corporation

- Resource Label Group LLC

- CILS International

- Brady Worldwide Inc.

- Asean Pack

- Polyonics Inc.

- Imagetek Labels

- Weber Packaging Solutions

- Advantage Label & Packaging Inc.

- Label-Aid Systems Inc.

- Clarion Safety Systems

第八章投资分析

第9章市场的未来

The automotive labels market was valued at USD 7.41 billion the previous year and is expected to register a CAGR of 5.37%, reaching USD 10.11 billion over the forecast period.

Key Highlights

- The increasing need for vehicles from the automotive industry and the requirement for labels like radio-frequency identification (RFID) and bar codes for the automotive part's identification, information, and safety are anticipated to drive the market. Due to the growth of the packaging and labeling markets across all end-user industries, the automotive labels industry is expanding significantly.

- Automotive labels typically consist of badging and labels, such as barcode, estimate, and vehicle identification number (VIN) labels, that display component information, a company's name and logo, price, technical information, and other important details. Additional factors anticipated to fuel market growth include the increased demand for smart labels, such as RFID and barcodes, and the rising demand for eco-friendly label production methods.

- The increasing utilization of automotive labels in passenger cars is one of the key factors driving the market growth. Moreover, the increasing investments in automobile manufacturing facilities and rising passenger car production are key factors fostering the market demand for automotive labels. The market for automotive labels market is also expanding due to technical developments occurring in almost every industry. It's important to properly categorize the millions of photos and videos that autonomous driving platforms produce.

- The automotive industry has many labeling requirements, from cleaning supplies and car producers to Formula 1 and public transportation. There are labels used in this industry in almost every area of a car, including the exterior and the engine. In this sector, automotive labeling may be used on starting motors, cables, pumps, motors, and engine management systems, among other things.

- As the market for automotive labels continues to grow, so too are the global compliance regulations for ink components. As a result, it has become complex and challenging for formulators to select ingredients to meet such a market and are different from the elements that could be a design ink. This and rising production costs in various countries are expected to hinder the market's growth.

- Automotive label manufacturers are expected to protect their operations and supply chain from meeting the impending crisis and finding new ways of working post-COVID-19. However, the labels are part of the supply chains of necessities. Additionally, they serve as a critical tool for conveying information. Furthermore, the automotive labels market is in advance with technological changes in the industry. Autonomous driving platforms generate hundreds of millions of images and videos to be labeled with the highest levels of accuracy.

Automotive Labels Market Trends

Barcode Segment to Hold Major Market Share

- Barcode labels provide a fast way to store and retrieve data. Barcode labels contain company and product details in line and number formats. Barcode labels can also be used to manage inventory and reduce the recall burden by providing traceability. Automotive barcodes on automotive labels can be found on parts of engines, doors, dashboards, and more.

- The 2D barcode is one of the most common types of barcode used to label car parts. Labeling plays a critical role in the supply chain of a car part manufacturer. It guarantees a product's accurate delivery, provides important barcodes and other information, and accelerates the movement of goods; from customer-specific needs and branding requirements for distributors in emerging markets to import and export controls and customs audits, labeling can be labor-intensive and expensive.

- On the other hand, 3D scanners generate a 3D scan of the bar code. This scan can be read from any direction. 3D barcode scanners are commonly used in industrial applications such as automotive assembly and manufacturing.

- Several manufacturers provide a wide range of automotive barcode labels. For instance, Metalcraft, Inc. manufactures plastic barcode labels that come in various applications. They can be used on windshields, cables, wires, dashboards, etc. Also, there are tamper-evident and metalized labels, many others.

- Car parts and automotive inventory labeling are important in producing cars and car parts. Car manufacturers use barcodes to keep track of products in their warehouses and to check inventory from their third-party logistics (3PL) suppliers. They also use barcodes (with printed barcodes) to identify parts with a wide range of other information, including serial numbers, dates, and models.

- Barcode printers or scanners can print these barcodes to produce the label applied to a product. This helps track inventory and minimizes the risk of mistakes or missing important information. According to OICA, the sales of light vehicles are expected to increase by 4.73% this year. Overall, the growing automotive industry is expected to aid the market's growth.

Asia-Pacific Expected to Dominate the Market

- The Asia-Pacific region holds a major market share and is expected to witness the highest growth over the forecast period. The growing number of startups in the region by companies like Avery Dennison to grow the labels and packaging industry and boost its innovation abilities is a significant factor aiding the market's growth.

- The automotive after-sales market's growth is attributed to various factors, including increased vehicle production and sales in China and the expansion of the automotive components industry. Additionally, the market for engine after-sales is projected to experience a robust growth rate over the forecast period, driven by an increase in customer-centric customization and the market for used cars. Within the after-sales segment, labels are utilized to replace parts, provide maintenance and repair services, ensure safety, and adhere to regulations. As the market continues to expand, there is likely to be a corresponding increase in the demand for engine and other automotive labels.

- As the Indian automotive industry plays a major role in both macroeconomic expansion and technological development, it has been an excellent indicator of how well the economy is doing. Due to the growing middle class and a large proportion of India's young population, the two-wheeler segment dominates the market in terms of volume. The sector's growth is also supported by increased interest by businesses to explore regional markets. This has resulted in an increase in the production of vehicles. As the automotive industry continues to grow, the demand for automotive parts, including labels, is also expected to increase.

- The Japanese government recognizes radio-frequency identification (RFID) as an innovative technology supported by major financial investment to ensure that the strong production base in Japan will play a leading role in RFID applications over the coming years. Significant advances in RFID technology can be achieved based on government support. This could lead to more advanced and effective RFID, which would be better suited for use in the automotive sector.

- According to the Japan Automobile Manufacturers Association Inc., in 2022, Japanese automakers manufactured around 16.96 million vehicles at production facilities outside of Japan, increasing from 16.46 million in the previous year. Expanding production outside Japan indicates a global expansion strategy by Japanese automakers. As they establish a stronger presence in foreign markets, they may require specialized labels to cater to the unique requirements of different regions and languages, further driving demand in the automotive labels market.

Automotive Labels Industry Overview

The market exhibits fragmentation due to the presence of several major players, including 3M Company, Avery Dennison Corporation, Resource Label Group, H.B. Fuller Company, and more. This evolving industry landscape, characterized by the involvement of these major players, has intensified competition among companies striving to seize emerging opportunities. Simultaneously, smaller firms are on a growth trajectory, seeking to harness the market's substantial growth potential.

In June 2023, Avery Dennison Corporation announced a strategic collaboration with Emerald Technology Ventures focused on Industrial, Sustainable, and New Packaging Materials Technologies. This collaboration represents a significant step towards advancing Avery Dennison's innovation and sustainability objectives.

Furthermore, in October 2022, Resource Label Group bolstered its presence in the Midwest and reinforced its leadership in the label and packaging industry by acquiring Deco Flexible Packaging, a Chicago-based company. This acquisition marked the twenty-fourth addition to Resource Label Group's expanding portfolio.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand From the Automotive Industry for RFID Labels

- 5.1.2 Increasing Compliance With Label Laws

- 5.2 Market Restraints

- 5.2.1 Cost of Manufacturing Greater for Small Manufacturers

6 MARKET SEGMENTATION

- 6.1 By Identification Technology

- 6.1.1 Barcode

- 6.1.2 QR Code

- 6.1.3 RFID Tags

- 6.1.4 Other Identification Technologies

- 6.2 By Type

- 6.2.1 Branding

- 6.2.2 Track & Trace

- 6.2.3 Warning & Safety

- 6.2.4 Asset Labels

- 6.2.5 Other Types (Tire Labels, Weatherproof Labels)

- 6.3 By Application

- 6.3.1 Interior Applications

- 6.3.2 Exterior Applications

- 6.3.3 Engine Applications

- 6.3.4 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Spain

- 6.4.2.5 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 3M Company

- 7.1.2 Avery Dennison Corporation

- 7.1.3 Resource Label Group LLC

- 7.1.4 CILS International

- 7.1.5 Brady Worldwide Inc.

- 7.1.6 Asean Pack

- 7.1.7 Polyonics Inc.

- 7.1.8 Imagetek Labels

- 7.1.9 Weber Packaging Solutions

- 7.1.10 Advantage Label & Packaging Inc.

- 7.1.11 Label-Aid Systems Inc.

- 7.1.12 Clarion Safety Systems