|

市场调查报告书

商品编码

1405349

密度计 -市场占有率分析、产业趋势/统计、2024-2029 年成长预测Density Meter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

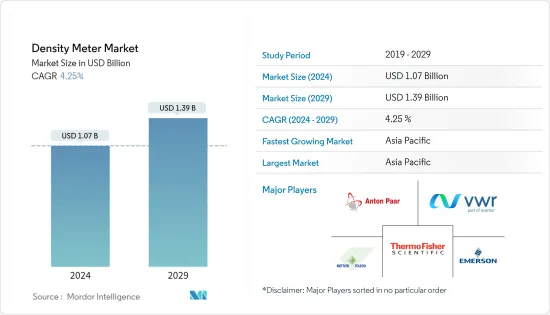

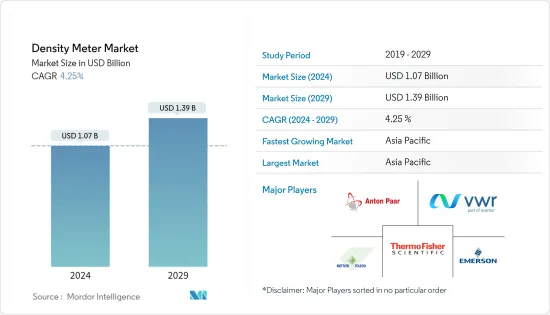

密度计市场规模预计到2024年为10.7亿美元,预计到2029年将达到13.9亿美元,在预测期内(2024-2029年)复合年增长率为4.25%,预计。

密度计市场的成长是由智慧工厂的开拓以及对精确测量各种生产过程中使用的流体密度的需求不断增长所推动的。美国和欧洲国家严格的政府排放控制法规也推动了市场的成长。

主要亮点

- 涵盖整个生产过程的全面品质保证对于任何工业活动都是至关重要的。密度测量很常用,特别是在化学、製药、石化以及食品和饮料行业。密度测量允许製造商根据多种因素分析原材料、半成品、最终产品和製造过程。

- 例如,在化工厂中,出于多种原因,在一般散装化学品、特种化学品和专有产品中使用密度计。酸、碱、溶剂、树脂、浆料、聚合物、合成橡胶等用密度计测量。此外,也测量纯化学品和溶液。

- 快速工业化以及水处理技术的进步也对液体密度计的需求起到了至关重要的作用。用水和污水行业的高成长率和技术创新创造了对易于维护和操作的实验室设备的需求。为此,超音波液体密度计的需求量大幅增加。此外,密度计在塑胶和橡胶产业的日益普及也创造了成长机会。

- COVID-19大流行以及由此产生的全球封锁法规影响了工业活动,并扰乱了世界各地的製造业务和供应链。在这种情况下,全球多个产业收益和利润大幅下降,大量员工和工人下岗,整个工业生产活动遭受损失。然而,随着 COVID-19 的爆发,受访市场中的多个最终用户行业受到营运减少和工厂临时关闭的影响。

密度计市场趋势

石油和天然气产业占主要市场占有率

- 石油和天然气是一个广泛的行业,涵盖许多流程和应用。它大致分为勘探、开采、生产、加工、分销和运输等基本类别。大多数应用涉及监测各种目的运输的石油和天然气的密度。

- 石油和天然气产业是密度计最大的最终用户之一。在石油和天然气行业,密度计用于下游测量生产前精製样品的精製和表征。密度计也用于各种应用领域,包括油轮和铁路车辆装货场、多产品管道中的产品识别、生产过程中的产品品管控制以及飞机用油应用中的品质测量。

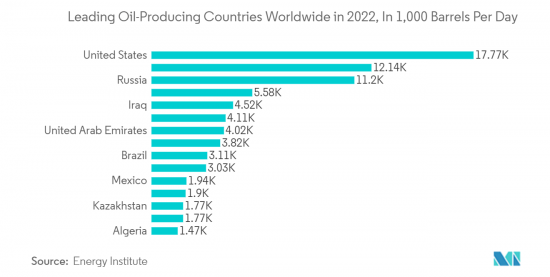

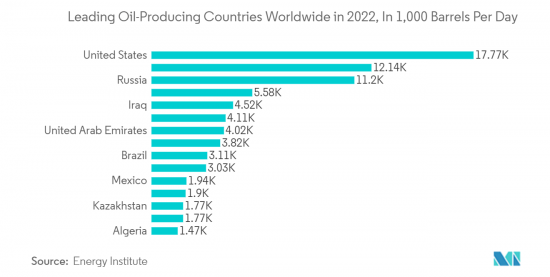

- 随着工业化程度的提高和对能源资源的需求的增加,石油和天然气产业正在不断扩大。例如,根据国际能源总署(IEA)的数据,亚太地区是消费量最高的地区。光是中国就占世界天然气需求的三分之二。

- 此外,製程工业依靠技术设备来保持整个原材料的均匀性和质量,而密度计则发挥重要作用。石油和天然气生产行业将被迫加快生产率,导致对包括密度计在内的机械和测试设备的需求增加,这将推动市场成长。

- 石油和天然气产业是密度计的主要最终用户之一。市场主要需求来自下游油气产业。工厂和精製等下游设施在生产前测量样品的纯度,以确保操作安全和效率。

- 市场正在经历多种产品创新。 2022年5月,Flexim推出FLUXUS H831。这种防爆、非侵入式仪表可以测量石油和天然气行业的工作密度、基线密度和许多其他变数。

亚太地区实现显着成长

- 亚太地区工业化程度很高,是密度计的潜在市场之一。过程自动化产业也有望利用亚太地区的各种机会。由于其政治和全球改革,预计印度将在未来几年为流程自动化产业提供更多机会。

- 据印度品牌股权基金会称,2022 年 5 月,ONGC 宣布计划在 22-25 财年投资 40 亿美元,以加大在印度的探勘活动。到 2045 年,印度的石油需求预计将翻一番,达到每天 1,100 万桶。

- 到 2050 年,亚太地区石油产品需求预计将增加至 3,880 万桶/日。石油产品需求的增加是由于该地区的快速发展,特别是印度、中国、印尼和日本等国家。

- 2010年天然气消费量量约5,752亿立方米,2022年将增加至9,183亿立方米,占全球天然气消费量的22.7%。同样,该地区的石油消费量为每天 27,963,000 桶。 2021年,产量将达到约35,806,000桶/日,使亚太地区成为全球最大的石油产品消费国。

- 此外,由于亚太地区食品和饮料和製药公司数量不断增加,以及他们致力于扩大亚太地区不同地区的业务和製造单位,预计密度计的需求将大幅增加。此外,政府在用水和污水处理行业的主导对于开拓亚太密度计市场至关重要。

密度计行业概况

全球密度计市场竞争激烈。市场高度集中,参与企业规模各异。所有主要公司都占有重要的市场份额,并致力于扩大消费群。市场主要企业包括:ABB Ltd、Azbil Corporation、Endress+Hausar AG、艾默生电气公司、东芝公司、霍尼韦尔国际公司、KROHNE Messtechnik GmbH、Anton Paar GmbH Mettler-Toledo International Inc.VWR International (Avantor) Berthold Technologies GmbH &Co.KG Emerson Electric Co.Red Meters LLC Schmidt+Haensch GmbH &Co.、Thermo Fisher Scientific 等。公司正在透过建立多个合作伙伴关係和投资新产品推出来增加市场占有率,以在预测期内赢得竞争。

Modulyzer Flavor and Fragrance 由安东帕于 2023 年 2 月开发,是一种新型分析系统,结合了密度计、旋光计和屈光,透过自动化选件在一个测量週期内提供有关香精香料行业物质的全面资讯.品管领域的使用者可以受益于节省成本的功能,例如每次测量仅需要 10 ml 样品,并且能够在测量后收集和重复使用样品。此外,透过与安东帕实验室执行软体 AP Connect 集成,您可以直接从桌上型电脑收集、检视和分类测量资料。

2022 年 3 月,数位密度计现已应用于製药业,用于品管、研究和开发。 Thermo Fisher 和 Symphogen 扩大了合作范围,以改善支持新癌症治疗方法发现和开发的资料工作流程。两家公司将共同为生物製药发现和开发实验室提供创新工具和简化的工作流程,以有效表征复杂的治疗性蛋白质。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- COVID-19 对密度计市场的影响

第五章市场动态

- 市场驱动因素

- 扩大工业化

- 关于食品品质和安全的严格规定

- 市场挑战

- 密度测量设备的精度与成本权衡

第六章市场区隔

- 按类型

- 桌面式

- 模组化的

- 便携的

- 按用途

- 科里奥利

- 核能

- 超音波

- 微波

- 重力式

- 按最终用户产业

- 用水和污水

- 化学

- 采矿/金属加工

- 食品和饮料

- 医疗和製药

- 电子产品

- 油和气

- 其他最终用户产业(电力/公共产业、研究)

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章竞争形势

- 公司简介

- Anton Paar GmbH

- Mettler-Toledo International Inc.

- VWR International(Avantor)

- Berthold Technologies GmbH & Co.KG

- Emerson Electric Co.

- Red Meters LLC

- Schmidt+Haensch GmbH & Co.

- Thermo Fisher Scientific

- RUDOLPH RESEARCH ANALYTICAL

- Rhosonics Analytical BV

- KRUSS Optronic GmbH

- Ametek Inc.

- Yokogawa Electric Corporation

- Koehler Instrument

- Toshiba Infrastructure Systems & Solutions Corporation

第八章投资分析

第9章市场的未来

The Density Meter Market size is estimated at USD 1.07 billion in 2024, and is expected to reach USD 1.39 billion by 2029, growing at a CAGR of 4.25% during the forecast period (2024-2029).

The growth of the density meter market can be attributed to smart factories' development and the increased demand to accurately measure the density of the fluids used in or during various production processes. Also, the stringent government regulations in the United States and European countries to regulate emissions drive market growth.

Key Highlights

- A comprehensive quality assurance covering the entire production process is essential in any industrial operation. Density measurements are commonly used for this purpose, especially in the chemical, pharmaceutical, petrochemical, and food & beverage industries. They allow the manufacturer to analyze raw materials, semi-finished and finished products, and the manufacturing steps regarding several factors.

- For instance, in chemical plants, a density meter is used for many reasons for the common bulk chemicals and the specialty and proprietary products. Acids, caustics, solvents, resins, slurries, polymers, elastomers, and more are measured using a density meter. Furthermore, pure chemicals and solutions are also measured.

- Also, rapid industrialization, in line with the technological advancement in water treatment technology, plays an essential role in the demand for liquid density meters. High growth and innovation in the water and wastewater industry create the need for a simple laboratory device to maintain and operate. Because of this, the demand for ultrasonic liquid density meters increased significantly. Further, growing applications of density meters in the plastics and rubber industry create growth opportunities.

- The COVID-19 pandemic and associated lockdown restrictions worldwide affected industrial activities that witnessed a disruption in manufacturing operations and supply chains worldwide. Under these circumstances, multiple industries worldwide saw a massive decline in revenue and profits, leading to many employees and workers being laid off, resulting in an overall loss to industrial production activities. However, with the onset of COVID-19, multiple end-user industries in the market studied were affected by reduced operations, temporary factory closures, etc.

Density Meter Market Trends

Oil and Gas Industry to Hold Significant Market Share

- Oil and gas is a wide-ranging industry encompassing many processes and applications. Some of these might be roughly grouped into basic categories: exploration, extraction, production, processing, distribution, and transportation. Most applications include monitoring the density of oil and gases transported for various purposes.

- The oil and gas sector is one of the largest end-users of density meters. In the oil and gas industry, density meters are utilized in downstream processes, wherein purification and assessment of the purified sample are measured before manufacturing. Also, the dense meter is used in various application sectors such as tanker truck and railcar loading stations, product identification on multi-product pipelines, product quality control in the production process, and mass measurement in aircraft refueling applications.

- The oil and gas industry is expanding with the growth of industrialization and the demand for energy resources. For instance, according to the International Energy Agency, the Asia-Pacific region was the highest importer and consumer of natural gas. China alone accounted for two-thirds of the demand for natural gas globally.

- Moreover, the process industries depend on technical equipment to maintain uniformity and quality throughout the crude material, wherein the density meter plays an important role. The transition would force the oil and gas production sector to accelerate the production rate, increasing demand for machinery and testing equipment, including density meters, thereby driving the market's growth.

- The oil and gas sector is one of the key end users of density meters. The primary market demand comes from the downstream sector of oil and gas. The purity of the sample is measured before manufacturing to ensure operational safety and efficiency in downstream facilities, such as plants and refineries.

- The market is witnessing multiple product innovations. In May 2022, Flexim launched FLUXUS H831. This explosion-proof and non-intrusive meter can determine operational density, density at base conditions, and many other variables in the oil and gas industry.

Asia-Pacific to Witness Significant Growth

- The increasing industrialization in Asia-Pacific makes the region one of the potential markets for density meters. The process automation industry is also expected to avail of various opportunities in Asia-Pacific. India is expected to provide more opportunities for the process automation industry in the coming years because of its political and global reformation.

- According to the India Brand Equity Foundation, in May 2022, ONGC announced plans to invest USD 4 billion from FY22-25 to increase its exploration efforts in India. The oil demand in India is projected to register a 2 times growth to reach 11 million barrels per day by 2045.

- The Asia-Pacific's oil product demand by 2050 is expected to rise to 38.8 million b/d. The increased demand for oil products can be ascribed to the rapid development in the region, particularly in countries such as India, China, Indonesia, and Japan.

- The natural gas consumption was around 575.2 billion cubic meters in 2010, which rose to 918.3 billion cubic meters in 2022-totaling a 22.7% share of global natural gas consumption. Similarly, oil consumption in the region was 27,963 thousand barrels daily. In 2021, it was around 35,806 thousand barrels daily, making the Asia Pacific region the biggest consumer of oil products globally.

- Further, owing to the increase in the number of food & beverage and pharmaceutical companies in Asia-Pacific and the focus on expanding the operations & manufacturing units across different parts of Asia-Pacific, the demand for density meters is predicted to grow substantially. Moreover, the water and wastewater treatment industry's government initiative is vital in developing the density meter market across the Asia-Pacific region.

Density Meter Industry Overview

The global density meter market is very competitive. The market is highly concentrated due to the presence of various small and large players. All the major players account for a large share of the market and are focusing on expanding their consumer base across the world. Some of the significant players in the market are ABB Ltd, Azbil Corporation, Endress+Hausar AG, Emerson Electric Corporation, Toshiba Corporation, Honeywell International Inc., KROHNE Messtechnik GmbH, Anton Paar GmbH Mettler-Toledo International Inc. VWR International (Avantor) Berthold Technologies GmbH & Co.KG Emerson Electric Co. Red Meters LLC Schmidt + Haensch GmbH & Co. Thermo Fisher Scientific, and many more. The companies are increasing the market share by forming multiple partnerships and investing in introducing new products to earn a competitive edge during the forecast period.

In February 2023, Modulyzer Flavour and Fragrance is a new analytical system developed by Anton Paar that combines density meters, polarimeters, and refractometers with an automated option to provide comprehensive information - in a single measurement cycle - on substances in the flavor and fragrance industry. Users in the quality control field can benefit from cost-reduction opportunities due to a variety of features, such as the requirement for only 10 ml sample per measurement and the ability to recover and reuse samples after a measurement. Additionally, the system can be integrated with AP Connect - Anton Paar's lab execution software - to enable the collection, review, and categorization of measurement data directly from a desktop computer.

In March 2022, digital density meters were used in the pharmaceutical industries for quality control, research, and development. Thermo Fisher and Symphogen have extended the collaboration involving improved data workflow, which supports the discovery and development of new cancer treatments. The companies provide biopharmaceutical discovery and development laboratories with innovative tools and streamlined workflows to characterize complex therapeutic proteins efficiently.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Density Meter Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Expansion in Industrialization

- 5.1.2 Stringent Regulations with Regard to Food Quality and Safety

- 5.2 Market Challenges

- 5.2.1 Tradeoff Between the Accuracy and Cost of the Density Meter Equipment

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Benchtop

- 6.1.2 Module

- 6.1.3 Portable

- 6.2 By Application

- 6.2.1 Coriolis

- 6.2.2 Nuclear

- 6.2.3 Ultrasonic

- 6.2.4 Microwave

- 6.2.5 Gravitic

- 6.3 By End-user Industry

- 6.3.1 Water and Wastewater

- 6.3.2 Chemicals

- 6.3.3 Mining and Metal Processing

- 6.3.4 Food and Beverage

- 6.3.5 Healthcare and Pharmaceuticals

- 6.3.6 Electronics

- 6.3.7 Oil and Gas

- 6.3.8 Other End-user Industries (Power and Utilities, Research)

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Anton Paar GmbH

- 7.1.2 Mettler-Toledo International Inc.

- 7.1.3 VWR International (Avantor)

- 7.1.4 Berthold Technologies GmbH & Co.KG

- 7.1.5 Emerson Electric Co.

- 7.1.6 Red Meters LLC

- 7.1.7 Schmidt + Haensch GmbH & Co.

- 7.1.8 Thermo Fisher Scientific

- 7.1.9 RUDOLPH RESEARCH ANALYTICAL

- 7.1.10 Rhosonics Analytical BV

- 7.1.11 KRUSS Optronic GmbH

- 7.1.12 Ametek Inc.

- 7.1.13 Yokogawa Electric Corporation

- 7.1.14 Koehler Instrument

- 7.1.15 Toshiba Infrastructure Systems & Solutions Corporation

![密度计市场:趋势、机遇、竞争分析 [2023-2028]](/sample/img/cover/42/1300033.png)