|

市场调查报告书

商品编码

1405351

智慧汽车 -市场占有率分析、产业趋势与统计、2024年至2029年成长预测Smart Motors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

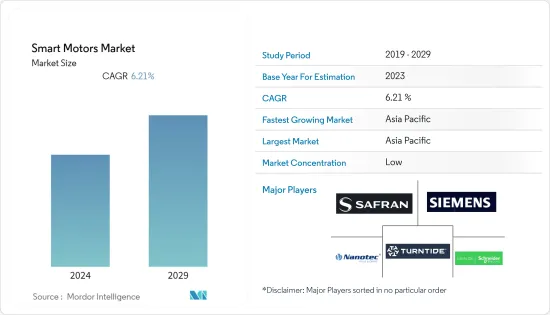

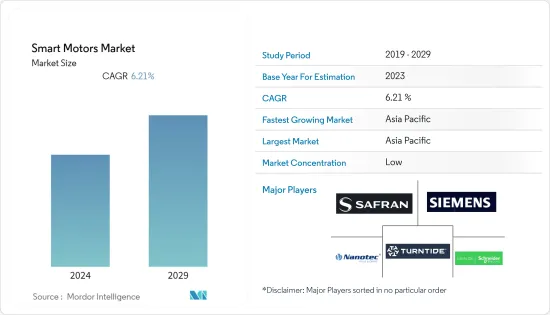

上一年智慧马达市场规模为27.59亿美元,预计在预测期内将达到38.34亿美元,复合年增长率为6.21%。

马达可以与智慧型马达控制和先进的通讯功能相结合,以提高性能和运行效率。智慧马达可实现预测性机器诊断,从而优化流程并减少停机时间。与传统电动马达相比,这些电动马达具有更高的能源效率、性能、可靠性和维护能力,使其成为商业和工业应用的理想选择。

主要亮点

- 全球对透过提高能源效率来节省能源成本的兴趣日益浓厚,正在推动智慧马达在各种能源集中产业中的采用,包括工业製造、汽车、消费性电子产品、石油和天然气、航太和国防以及采矿。支持你。此外,欧盟(EU)和美国环保署(EPA)等监管机构对碳排放的严格监管是预测期内推动智慧马达市场需求的关键因素之一。

- 例如,根据美国环境资讯署 (EIA) 的数据,全球工业能源消费量预计将从 2020 年的 241.10 兆英国热单位增加到 2050 年的 361.4 兆英国热单位。此外,到2021年,工业部门将占美国终端能源消耗总量的35%和能源消耗总量的33%。根据 IEA 的数据,到 2022 年,工业部门将占全球能源消耗的 37%(166 EJ)。

- 先进的控制能力是工业领域使用的先进机器人和自动化解决方案所需的关键功能,随着各产业向自动化产业转型,对智慧马达的需求将会不断增加。除了机器人和自动化设备等因素和解决方案有助于提高生产效率和产能,同时减少生产时间外,劳动力短缺、人事费用上升以及对节能解决方案的需求也是促成因素。其他因素,是推动产业选择这些解决方案的关键因素。

- COVID-19大流行对市场的影响是巨大的,包括多个国家政府实施的遏制措施,对工业部门的成长产生了重大影响。结果,所研究的市场经历了放缓,尤其是在早期阶段。然而,随着主要终端用户产业满载恢復运营,智慧马达的需求预计将在后疫情时期成长。

智慧马达市场趋势

石油和天然气领域占主要市场占有率

- 在当前市场情势下,油气产业面临经营绩效、营业成本(TCO)、能源效率以及上下游流程安全等多重问题。透过不仅生产石油和天然气,而且在其营运中使用石油和天然气,石油和天然气产业可以显着减少其影响。

- 随着传统碳氢化合物能源的枯竭,在更脆弱和具有挑战性的环境中生产能源变得越来越复杂。由于强调能源效率,石油和天然气产业正在以前所未有的速度采用智慧马达系统。石油和天然气产业致力于确保石油和天然气的可用性,同时以具成本效益的方式解决能源安全和环境问题。

- 石油和天然气公司正在使用运动控制系统来改进流程,其中许多系统都采用智慧马达。此外,石油和气体纯化使用低压运动控制中心进行集中控制。这增加了所研究领域对智慧马达的需求。

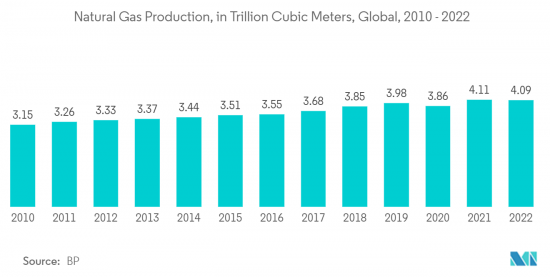

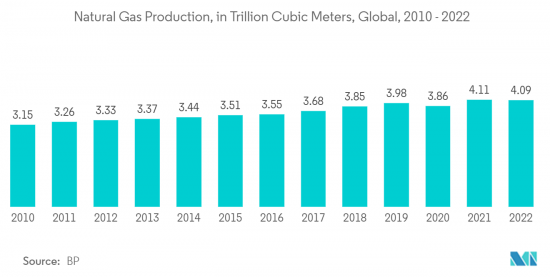

- 根据英国石油公司(BP)预测,2022年全球天然气产量将达到约4.9兆立方米,2021年将达到4.1兆立方米。沙乌地阿美也表示,2022年原油产量为1,150万桶/日,高于2021年的922万桶/日。

- 此外,根据OPEC的预测,2022年全球原油需求(包括生质燃料)预计将达到9,957万桶/日,2023年将增至1,0189万桶/日。预测期内石油和天然气需求的增加可能会促进智慧马达的普及。此外,预计石油和天然气生产活动的增加将显着推动所研究市场的成长。

亚太地区预计将占据主要市场占有率

- 亚太地区是研究市场最重要的市场之一。由于该地区各个最终用户行业越来越多地采用自动化,该地区为所研究的市场供应商提供了巨大的成长潜力。该地区的能源挑战也增加了低压电气设备的采用,激励许多公司开发节能且紧凑的电气设备和装置,进一步推动智慧马达的成长。

- 此外,「印度製造」计画等措施使印度成为世界地图上的製造地,并使印度经济得到全球认可。印度製造宣传活动正在支援印度多个新推出的工业机器人。特别是,印度的工业自动化领域正在透过将製造的数位和物理方面相结合来实现最佳性能而发生革命性的变化。此外,对实现零废弃物生产和缩短时间的关注正在加速市场成长。

- 工业 4.0 带来的製造业大规模转变以及物联网的接受,透过技术推进生产以实现更大的产能和产量,正在推动市场对智慧马达的需求。其他推动优势,例如最小化维护要求和改进的过程控制,也推动了采用。

- 中国政府启动了一项五年计划,到 2022 年在中国工业领域扩大智慧製造和机器人流程自动化 (RPA)。成立了由16个国家资助的工业板组,以快速推动製造业走向未来并推广电动马达的使用。此外,透过加强机器人、人工智慧(AI)和云端资料技术的研究能力,中国正致力于开发提供更大自主权并支援工业领域进一步成长的技术。

- 我国长期以来专注于发展高端製造业、电力工程、油气产业,推广使用国产中低压变频器。例如,中国政府雄心勃勃的「中国製造2025」倡议部分受到德国工业4.0的启发,旨在提高中国製造业的竞争。

- 此外,在过去的几十年里,中国经历了令人瞩目的成长,特别是在工业领域,并被广泛认为是世界製造中心。许多拥有各种製造和製程设备的行业的存在正在推动该地区对智慧马达的需求。此外,最近透过更多采用自动化和其他先进技术来实现区域产业转型的努力推动了所研究的市场需求。

智慧马达产业概况

智慧型马达市场高度分散,主要参与者包括 Safran Electrical &Power、Siemens AG、Natec Electronic GmbH &Co.KG、Turntide Technologies Inc. 和 Schneider Electric SE。市场参与企业正在采取联盟和收购等策略来加强其产品阵容并获得永续的竞争优势。

2023年6月,赛峰电气与电力公司宣布在法国尼奥尔和英国皮特斯通安装4条专用ENGINeUS电动马达的自动化生产线。从 2026 年开始,这款大批量生产型号每年将生产 1,000 台发动机,以满足蓬勃发展的电动和混合动力航空市场的需求。

2023年2月,日本电产株式会社宣布拟以150亿日圆(约105.4亿美元)现金收购义大利工具机公司PAMA。这将是日本电产株式会社在2021年进军工具机业务企业合併。日本电产株式会社将先前专注于国内市场的工具机销售管道扩展到海外市场,将其定位为继电动车(EV)驱动系统之后的成长支柱。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 评估主要宏观经济趋势的影响

第五章市场动态

- 市场驱动因素

- 在提高设备效率的同时减少资本投资变得越来越重要

- 更好地整合 IIoT 服务,以实现预测性维护、更好的机器控制等服务

- 市场抑制因素

- 采用率低

- 与替代 VFD 解决方案相关的高转换成本

第六章市场区隔

- 按成分

- 变速驱动器

- 引擎

- 按用途

- 工业的

- 商业的

- 车

- 航太/国防

- 油和气

- 金属/矿业

- 用水和污水

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章竞争形势

- 公司简介

- Safran Electrical & Power

- Siemens AG

- Nanotec Electronic GmbH & Co. KG

- Turntide Technologies Inc.

- Schneider Electric SE

- Fuji Electric Co. Ltd

- Nidec Motion Control(Nidec Corporation)

- Moog Inc.

- Dunkermotoren GmbH(Ametek Inc.)

- Shanghai Moons'Electric Co. Ltd

第八章投资分析

第9章市场的未来

The smart motors market was valued at USD 2.759 billion the previous year and is expected to register a CAGR of 6.21%, reaching USD 3.834 billion over the forecast period. Motors can be combined with intelligent motor controls and advanced communication capabilities to improve performance and operational efficiencies. Smart motors allow predictive machine diagnosis, thus, resulting in reduced downtime through process optimization. These motors provide energy efficiency, improved performance, reliability, and maintenance capabilities compared to traditional electric motors, making them an ideal choice for commercial and industrial applications.

Key Highlights

- The rising global concern about saving energy costs by improving energy efficiency has been driving the adoption of smart motors in various high energy-intensive industries such as industrial manufacturing, automotive, consumer electronics, oil & gas, aerospace & defense, and mining, among others. Furthermore, growing stringent regulations regarding carbon emissions by regulatory agencies such as the European Union and the US Environmental Protection Agency (EPA) are among the key factors projected to fuel the market demand for smart motors during the forecast period.

- For instance, according to the United States Environmental Information Agency (EIA), global industrial energy consumption is estimated to grow from 241.10 quadrillion British thermal units in 2020 to 361.4 quadrillion British thermal units by 2050. Moreover, in 2021, the industrial sector accounted for 35% of total US end-use energy consumption and 33% of total US energy consumption. According to IEA, the industrial sector accounted for 37% (166 EJ) of global energy use in 2022.

- As advanced control features are crucial features required in advanced robotics and automation solutions used in the industrial sector, the demand for smart motors is increasing, with industries across various sectors transitioning to automated industries. Apart from the factors and solutions such as robotics and automated equipment help industries drive production efficiency and capacity while reducing production time, labor shortage, rising labor cost, and the growing demand for energy-efficient solutions are other major factors encouraging the industries to opt for such solutions.

- A notable impact of the global outbreak of COVID-19 was observed on the market as various containment measures taken by governments across multiple countries, such as the implementation of lockdown, significantly impacted the growth of the industrial sector. As a result, a slowdown was witnessed in the studied market, especially during the initial phase. However, with significant end-user industries resuming operations at total capacity, the demand for smart motors is anticipated to grow in the post-covid period.

Smart Motors Market Trends

Oil and Gas Segment Holds Major Market Share

- In the current market scenario, oil and gas industries face multiple issues related to business performance, the total cost of operation (TCO), energy efficiency, and safety in upstream and downstream processes. In addition to producing oil and gas, the industry also uses oil and gas in its operations, and this can significantly reduce the industry's impact.

- As traditional hydrocarbon energy resources are depleted, energy production from ever more sensitive and difficult environments is becoming increasingly complex. Smart motor systems are observing an unprecedented adoption rate by the oil and gas industry as it focuses efforts on energy efficiency. The industry strives to ensure the availability of oil and gas while addressing energy security and environmental concerns cost-effectively.

- Oil and gas companies use motion control systems to improve their processes, and many of these systems employ smart motors. Further, low voltage-motion control centers are being used in the oil and gas refineries for centralized control. This augments the demand for smart motors in the studied segment.

- According to BP (British Petroleum) company, global natural gas production amounted to approximately 4.09 trillion cubic meters and 4.10 trillion cubic meters in 2022 and 2021. Further, according to Aramco, its crude oil production volume of 11.5 million barrels per day in 2022 increased from 9.22 million barrels per day in 2021.

- Furthermore, according to OPEC, the global demand for crude oil (including biofuels) in 2022 amounted to 99.57 million barrels per day, and it is projected to increase to 101.89 million barrels per day in 2023. The rising demand for oil and gas during the forecast period would boost the penetration of smart motors. Further, the increase in oil and gas production activities is anticipated to drive the growth of the studied market significantly.

Asia Pacific is Expected to Hold Significant Market Share

- Asia-Pacific is one of the most significant markets for the market studied. The region offers massive growth potential to the studied market vendors, owing to the growing adoption of automation across the various end-user industries in the region. The energy concern in the region is also increasing the adoption of low-voltage electrical equipment and motivating many firms to develop energy-efficient and compact electrical equipment and devices, further driving the smart motor growth.

- Further, initiatives like the 'Make in India' program places India on the world map as a manufacturing hub and give global recognition to the Indian economy. The Make in India campaign has bolstered multiple new launches in industrial robots in the country. Notably, India's industrial automation sector has been revolutionized by the combination of digital and physical aspects of manufacturing to deliver optimum performance. Further, the focus on achieving zero waste production and a shorter time to acquire the market has augmented the growth of the market.

- The massive shifts in manufacturing due to Industry 4.0 and the acceptance of IoT to advance production, with technologies to achieve greater production capacity and output, have propelled the demand for smart motors in the market. Also, the additional drive benefits, such as minimized maintenance requirements and improved process control, fuels adoption.

- The Chinese government launched a five-year plan to increase smart manufacturing and robotic process automation (RPA) in the country's industrial sector in 2022. A group of sixteen state-funded industry committees was formed to rapidly push the manufacturing industry into the future, driving the usage of electric motors. Furthermore, by strengthening robotics, artificial intelligence (AI), and cloud data technology research capabilities, the country focuses on developing technologies that can provide it greater autonomy and help the industrial sector grow further.

- Over the years, China has been focusing on high-end manufacturing industries, power utilities, and oil & gas industries, boosting the usage of both low and medium-voltage drives in the country. For instance, the Chinese government's ambitious 'Made in China 2025' initiative, partially inspired by Germany for Industry 4.0, aims to boost the country's competitiveness in the manufacturing sector.

- Furthermore, during the past few decades, China has witnessed remarkable growth, especially in the industrial segment, and is widely regarded as the global manufacturing hub. The presence of many industries wherein a wide variety of manufacturing/process equipment is used drives the demand for smart motors in the region. Furthermore, recent initiatives to transform the local industry through a higher adoption of automation and other advanced technologies will drive the studied market demand.

Smart Motors Industry Overview

The smart motors market is highly fragmented, with the presence of major players like Safran Electrical & Power, Siemens AG, Nanotec Electronic GmbH & Co. KG, Turntide Technologies Inc., and Schneider Electric SE. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In June 2023, Safran Electrical & Power announced the installation of four automation production lines specifically for its ENGINeUS electric motors at its sites in Niort, France, and Pitstone, and Great Britain. This high-volume production model will enable 1,000 motors to be manufactured per year from 2026 to serve the booming electric and hybrid aviation markets.

In February 2023, Nidec Corporation announced its intention to acquire the Italian machine tool company PAMA for JPY 15 billion (~USD 10.54 billion) in cash. As the company enters the machine tool business in 2021, this is the first time Nidec has initiated an overseas corporate merger and acquisition (M&A). Nidec intends to expand its previously domestic-focused machine tool sales channel into international markets, positioning it as a growth pillar after electric vehicle (EV) drive systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Degree of Competition

- 4.4 An Assessment of the Impact of Key Macroeconomic Trends

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Emphasis on Reducing Capex With Gaining Effectiveness of the Equipment

- 5.1.2 Growing Integration of IIoT Services for Enabling Services Such as Predictive Maintenance, Superior Machine Control

- 5.2 Market Restraints

- 5.2.1 Low Rate of Implementation

- 5.2.2 High Switching Cost Along with Alternate VFD Solutions

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Variable Speed Drive

- 6.1.2 Motor

- 6.2 By Application

- 6.2.1 Industrial

- 6.2.2 Commercial

- 6.2.3 Automotive

- 6.2.4 Aerospace and Defense

- 6.2.5 Oil and Gas

- 6.2.6 Metal and Mining

- 6.2.7 Water and Wastewater

- 6.2.8 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Safran Electrical & Power

- 7.1.2 Siemens AG

- 7.1.3 Nanotec Electronic GmbH & Co. KG

- 7.1.4 Turntide Technologies Inc.

- 7.1.5 Schneider Electric SE

- 7.1.6 Fuji Electric Co. Ltd

- 7.1.7 Nidec Motion Control (Nidec Corporation)

- 7.1.8 Moog Inc.

- 7.1.9 Dunkermotoren GmbH (Ametek Inc.)

- 7.1.10 Shanghai Moons' Electric Co. Ltd