|

市场调查报告书

商品编码

1405370

视讯管理服务:市场占有率分析、产业趋势与统计、2024-2029 年成长预测Video Managed Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

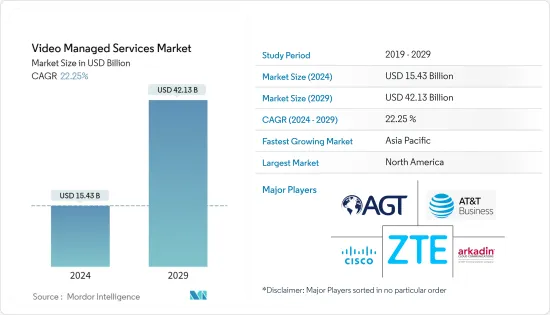

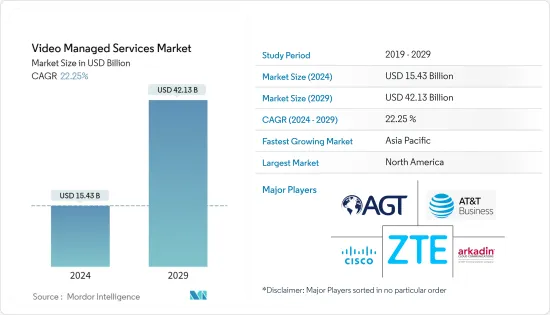

视讯管理服务市场规模预计到 2024 年为 154.3 亿美元,预计到 2029 年将达到 421.3 亿美元,在预测期内(2024-2029 年)复合年增长率为 22.25%。

託管服务使中小型企业能够提高业务效率并降低营运成本,使他们能够专注于自己的核心竞争力。託管服务可实现最佳资源分配和利用,提高整体盈利和业务效率。可扩展的基础设施和託管服务模型使组织更容易采用新技术。预计这些变数将在未来的预测期内推动市场成长。

主要亮点

- 託管视讯会议服务市场成长的关键驱动力之一是注重基本功能和提高效率。为了提高业务效率,企业正在专注于业务流程的核心,并透过管理服务和资讯科技外包来接手IT业务。我们使用託管服务提供者来满足我们的 IT 需求,包括应用程式和基础架构管理。这有助于公司透过将员工的技能和资源用于核心业务来实现其目标和愿景。

- 视讯託管服务产业促进视讯託管服务市场成长的主要趋势之一是託管服务的自动化程度不断提高。视讯管理服务的自动化大大提高了业务流程的效率。透过管理复杂的IT基础设施和简化营运工作流程来增强您的业务能力。企业中託管基础设施服务的自动化改善了作业流程,同时降低了成本。整合众多的组织部门与职能,消除重复的 IT 流程。

- BYOD、巨量资料分析、人工智慧和机器学习环境是大型企业依赖影片MSP 的关键驱动因素,因为它们专注于在数位转型时代增强业务。大型企业选择整合服务供应商,尤其是大型 MSP 的託管服务。这些供应商提供更好的技术支援、减少停机时间、强大的安全性以及先进的网路和技术解决方案,这些解决方案对于这些公司维持不间断的业务流程至关重要。

- 託管服务提供者面临的最大问题之一是网路安全。网路犯罪分子的目标是当今威胁生态系统中的小型和大型企业。较大的公司可能拥有更多的财务资源,但他们也有更多的资金用于先进防御、远端监控和网路安全解决方案,这使得它们更难以被攻破。同时,小型企业往往缺乏网路安全工具和保障措施。此外,安全问题可能会损害小型和大型企业的成功。因此,视讯 MSP 必须将网路安全作为其客户的首要任务。

- 新冠疫情后在家工作趋势的持续预计将推动所研究的市场。根据 Zippia 的 2022 年调查,到 2022 年,26% 的美国员工将进行远距工作。到 2025 年,将有 3,620 万美国员工远距工作。

视讯管理服务市场趋势

软体部门推动成长

- 託管服务提供者 (MSP) 依靠许多专用的工具来集中客户资讯。为了管理客户的网络,MSP 主要依靠 RMM 软体、PSA 软体、防毒软体和安全软体以及復原和备份软体。

- MSP 软体旨在透过自动化在客户设备上执行的任务来减少重复性任务和人为错误。此外,託管服务提供者需要专注于促进日常 IT 流程、提高用户满意度、提供更高品质的服务并降低营运成本的核心功能。这些是自订MSP 软体的一些优点。

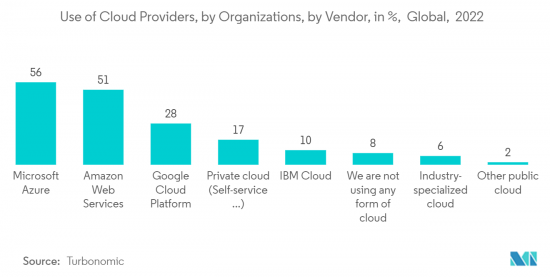

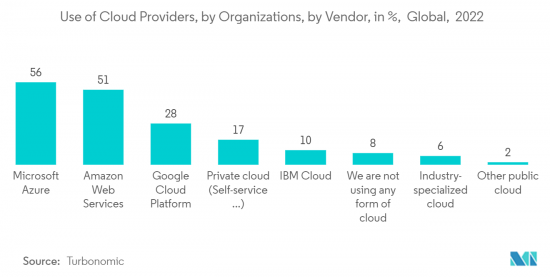

- 此外,人们日益认识到节省成本和资源的重要性,也推动了采用云端基础的解决方案和按需安全服务的需求。公司正在意识到透过将资料移至云端而不是建置和维护新的资料储存来节省成本和资源的重要性。由于其多重优势,云端平台和生态系统有望成为未来几年数位创新快速成长的关键跳板。

- 此外,实施公有云服务会在组织外部引入一层信任,这对于云端基础设施安全至关重要。然而,随着云端解决方案的使用越来越多,企业实施影片託管服务变得越来越容易。随着 Google Drive、Dropbox 和 Microsoft Azure 等云端服务成为业务流程的一部分,必须解决敏感资料失去控制等安全性问题。

北美预计将占据很大份额

- 美国小型企业发展管理局报告称,2022年美国小型企业数量将达到3,320万家,99.99%的企业将位于美国。 2022年美国小型企业数量的成长反映稳定成长,较与前一年同期比较成长2.2%,较2017年至2022年成长12.2%。

- 事实上,以任何标准衡量,签订管理服务协议并让来自各个领域的专家填补整个 IT 部门的空缺都更具成本效益。根据 CompTIA 研究,近一半使用 MSP 的公司将其年度 IT 成本降低了高达 25%。内部网路支援技术人员的年薪可能超过 10 万美元,如果考虑到社会福利、培训、设备、额外报酬和其他成本,则几乎翻了两番。透过与 MSP 合作,企业只需支付固定的月费即可获得所需的 IT 服务,同时免除这些成本。

- 据Cisco称,资料的增加和设备的成长正在增加网路的压力。预计该地区的这一趋势将在预测期内推动託管网路服务的发展。

- 此外,该地区OTT平台的成长也为市场带来了巨大的成长机会。例如,2023 年第二季度,Netflix 在加拿大和美国的付费串流订阅用户达到 7,557 万,高于上一季的 7,440 万。

- 特别是,视讯会议託管服务市场正在不断扩大,不仅包括视讯点播 (VOD) 的视讯工作流程和管理,还包括直接面向消费者的即时视讯 (D2C) 和 OTT (OTT) 内容。随着该地区越来越多的内容提供者认识到外包的好处,预计该业务将继续成长。

影片管理服务产业概述

随着全球参与者不断创新其服务以向用户提供具有成本效益的服务,视讯管理服务市场变得碎片化,为市场上的竞争对手提供了高度竞争优势。拥有重要市场份额的领先公司正致力于扩大海外基本客群,并利用策略合作倡议来提高市场占有率和盈利。主要参与者包括 Arkadin Cloud Communications、AGT(Applied Global Technologies)和Cisco。

- 2023 年 5 月 - NTT 宣布 SPEKTRA 成为 NTT 託管网路解决方案的下一代全球服务平台。该平台利用 NTT 的管理服务经验、专业知识和广泛的技术力,为客户提供网路转型的直接途径。

- 2023 年 1 月 - PV Lumens LLP 是一家快速成长的安全、保全、连接和生产力解决方案销售商,宣布与视讯管理系统领导者 Digifort 合作,在印度提供其监控解决方案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- BYOD(自备设备)简介

- 透过减少不必要的时间来提高生产力

- 市场抑制因素

- 初始投资和实施成本高

第六章市场区隔

- 按类型

- 软体

- 硬体

- 按公司规模

- 大公司

- 中小企业

- 按用途

- 公司间交易

- 企业与个人

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争形势

- 公司简介

- Arkadin Cloud Communications(NTT Communications)

- Applied Global Technologies

- Cisco Systems, Inc.

- ZTE Enterprise

- AT&T Business

- Polycom, Inc.

- BT Conferencing, Inc.

- Telus Communications

- Dimension Data

- AVI-SPL Inc.

- Vega Global

- Macro Technologies Inc.

第八章投资分析

第九章 市场机会及未来趋势

The Video Managed Services Market size is estimated at USD 15.43 billion in 2024, and is expected to reach USD 42.13 billion by 2029, growing at a CAGR of 22.25% during the forecast period (2024-2029).

SMEs will be able to concentrate only on this their core competencies through managed services improving operational efficiency and cutting operating costs. Managed services give optimal resource allocation and utilization, which improves overall profitability and operational efficiency. New technologies are more easily adopted by organizations thanks to a number ofScalable Infrastructures and Management Services Models. In the coming forecast period, these variables are expected to fuel market growth.

Key Highlights

- The requirement to focus on fundamental capabilities and increase efficiency is one of the main drivers for this market growth in managed videoconferencing services. In order to increase operating efficiency, businesses are focusing on the core of their business processes and taking over IT operations through Management Services and Information Technology Outsourcing. They use a managed service provider to handle IT-related needs like application and infrastructure management. This is assisting businesses in achieving their goal and vision by directing employee skills and resources toward their core business.

- One of the important video-managed services industry trends contributing to video-managed services market growth is more automation in managed services. The automation of video-managed services greatly improves business process efficiencies. It assists businesses in managing complicated IT infrastructures and streamlining operational workflow. Automation of managed infrastructure services in enterprises improves operational procedures while decreasing costs. It integrates numerous organizational divisions and functions and eliminates the need for repetitive IT processes.

- BYOD, Big data analytics, AI, and ML Environments are the major drivers for large enterprises to rely on video MSPs as they focus on stepping up their operations in the digital transformation era. Large enterprises opt for managed services from integrated service providers, especially large MSPs. These providers offer better technology support, lower downtime, robust security, and advanced network and technology solutions, vital for such enterprises to maintain uninterrupted business processes.

- One of the biggest problems facing managed service providers is cybersecurity. Cybercriminals target both small and large businesses in the threat ecosystem of today. Larger businesses may have more financial resources, but they are more difficult to compromise because they also have more money to spend on advanced defenses, remote monitoring, and cybersecurity solutions. On the other hand, smaller firms frequently lack cybersecurity tools and safeguards. Furthermore, security problems can ruin the success of both small and large businesses equally. As a result, video MSPs must provide cybersecurity top priority to their customers.

- The continuation of the work-from-home trend in the post-COVID scenario is expected to drive the studied market. According to the Zippia survey 2022, as of 2022, 26% of US employees worked remotely.By 2025, 36.2 million American employees are likely to work remotely.

Video Managed Services Market Trends

Software Segment to Witness the Growth

- Managed service providers (MSPs) are relying on a number of specialized tools tailored to manage all their client's information in one place. In order to manage their client's network, they have primarily relied on RMM software, PSA software, the antivirus and safety software as well as recovery and backup software.

- MSP software is designed to reduce repetitive work and human error through the automation of tasks carried out by clients' devices. In addition, there is a need for the management service providers to concentrate on core capabilities that facilitate everyday IT processes, increase user satisfaction, provide better quality of services and lower operating costs. These are a few of the benefits you'll find in your custom MSP software.

- In addition, the demand for cloud based solutions and the adoption of on demand security services is driven by the growing realization of the importance of saving money and resources are moving Instead of building and maintaining new data storage, data is transferred to the cloud which is why enterprises are increasingly realizing the importance of saving money and resources by moving data to the cloud. Due to multiple benefits, cloud platforms and ecosystems are expected to be key launching points for a rapid growth in Digital Innovation over the coming years.

- Furthermore, the deployment of public cloud services introduces a layer of trust outside an organisation which is crucial in terms of security for Cloud Infrastructures. Nevertheless, the adoption of video managed services practices by businesses is made considerably easier as a consequence of increasing use of cloud solutions. Enterprises must address security concerns, such as the loss of control over confidential data, because more people are moving towards cloud services like Google Drive, Dropbox and Microsoft Azure among other tools becoming a part of their business processes.

North America is Expected to Hold Major Share

- The American Small Business Administration Office for Advocacy reports that the number of US small businesses in 2022 will be 33.2 million, and In the country accounting for almost all 99,99 percent of companies. With a 2.2% increase over the previous year and 12.2% during the period from 2017 to 2022, the increase in the number of small businesses in the US in 2022 reflects steady growth.

- It is more cost effective to enter into a management service agreement, filling an entire IT department with various subject-matter specialists by practically any standard. According to a CompTIA survey, about half of all businesses using MSPs cut their annual IT costs by up to 25%. In-house network support technicians can earn over USD 100,000 per year, and when firms factor in benefits, training, equipment, supplemental compensation, and other costs, that amount can almost quadruple. By working with an MSP, firms can get necessary IT services for a fixed monthly charge while being relieved of those expenses.

- According to Cisco Systems, the growth of data and devices is increasing the network burden, and In this way, 95% of network changes are carried out on a manual basis which increases operating costs by between 2 and 3 times the value of the network. This trend in the region is expected to drive the managed network services over the forecast period.

- Moreover, growth in OTT platforms in the region also offers considerable growth opportnuities for the market. For instance, Netflix reported 75.57 million paid streaming subscribers across Canada and the United States in the second quarter of 2023, up from 74.4 million in the previous quarter.

- Particularly, the video conferencing managed services market is expected to continue growing as more content providers in the region realize the advantages of outsourcing video workflows or management for both video on demand (VOD) as well as live video direct-to-consumer (D2C) OTT (over-the-top) content.

Video Managed Services Industry Overview

The video-managed services market is fragmented as the global players are innovating their services to provide cost-benefit offers to the users, which gives a high rivalry to the market competitors. Major players with a prominent share in the market are focusing on expanding their customer base across foreign countries by leveraging strategic collaborative initiatives to increase their market share and profitability. Key players are Arkadin Cloud Communications, AGT (Applied Global Technologies), Cisco Systems, Inc., etc.

- May 2023 - NTT introduced SPEKTRA as the next generation of its global services platform for NTT Managed Networks solutions. The Platform is equipped with the company's management services experience, expertise and extensive technological capacity to provide customers with a direct path into network transformation.

- January 2023 - PV Lumens LLP, a rapidly growing distributor of safety, security, connectivity, and productivity solutions, announced a partnership with Digifort, a leader in video management systems, to offer their surveillance solutions in India.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Adoption of BYOD (Bring Your Own Device)

- 5.1.2 Higher Productivity Rate by Reducing Unnecessary Hours

- 5.2 Market Restraints

- 5.2.1 High Initial Investments and Installation Costs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Software

- 6.1.2 Hardware

- 6.2 By Enterprise Size

- 6.2.1 Large Enterprise

- 6.2.2 Small & Medium Enterprise

- 6.3 By Applications

- 6.3.1 Business to Business

- 6.3.2 Business to Consumer

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Arkadin Cloud Communications ( NTT Communications)

- 7.1.2 Applied Global Technologies

- 7.1.3 Cisco Systems, Inc.

- 7.1.4 ZTE Enterprise

- 7.1.5 AT&T Business

- 7.1.6 Polycom, Inc.

- 7.1.7 BT Conferencing, Inc.

- 7.1.8 Telus Communications

- 7.1.9 Dimension Data

- 7.1.10 AVI-SPL Inc.

- 7.1.11 Vega Global

- 7.1.12 Macro Technologies Inc.