|

市场调查报告书

商品编码

1405371

杯盖:市场占有率分析、产业趋势/统计、成长预测,2024-2029 年Cups And Lids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

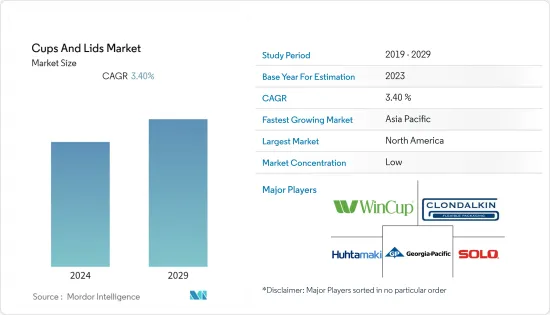

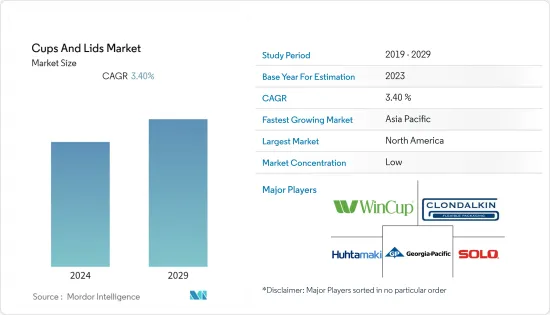

2024年,杯盖市场规模为171.6亿美元,预计到2029年将达到202.9亿美元,在预测期内(2024-2029年)复合年增长率为3.4%。

主要亮点

- 由于人口显着成长,茶、咖啡和无酒精饮品消费量的增加是推动全球杯盖需求的主要因素之一。快速成长的食品和饮料 (F&B) 行业以及快餐店 (QSR) 中越来越多地订购一次性包装以最大程度地减少各种食品和饮料溢出风险的情况已得到调查,这对市场产生了积极影响。在特殊场合举行社交聚会的新趋势也推动了世界对一次性盘子、杯子、盖子和其他容器的需求。

- 近年来,由于咖啡、奶昔等特色饮料的需求不断增加,包装产业对杯盖的需求迅速增长。市场成长的重要力量包括杯盖产品的特性,例如轻盈、光滑的捲边,可在表面上舒适安全地使用、卡扣配合、易于拆卸、防漏应用和成本效益。

- 消费者经常寻求方便且功能性的饮料,例如即饮咖啡、茶和能量饮料,这些饮料可以随时随地轻鬆饮用。因此,具有功能性和实用性且相对健康和天然的非酒精饮料可以吸引忙碌的消费者。品牌可以透过在新产品配方中利用电解质、维生素、矿物质和其他天然成分的天然、增强能量的特性来瞄准疲惫的消费者。

- 都市化的加快意味着越来越多的消费者会花大量时间远离家乡,无论是参加社交聚会、旅行、享受美好天气还是参加体育赛事。最近,2022 年 11 月,来自世界各地的超过 140 万球迷前往卡达观看 2022 年 FIFA 世界杯。卡达在 FIFA 世界杯总合为超过 100 万游客铺设了红地毯,并计划到 2030 年每年吸引 600 万游客。

- 此外,各国对塑胶的禁令阻碍了市场成长,而纸张的可回收性是推动杯盖市场成长的关键因素之一。因为杯子是纸做的,所以可以无限期回收。符合环保法规製造,用户无需担心浪费,且有包装成本优势。供应商可以透过他们的产品为永续性目标做出贡献。

- 此外,俄罗斯和乌克兰之间的战争导致多个国家受到经济制裁,大宗商品价格急剧上升,供应链中断,影响了许多全球市场。战争导致 300 多家西方主要公司撤离,包括乌克兰和俄罗斯的包装和生产设施大规模关闭。此外,由于战争何时结束尚不明朗,有些企业一开始不愿停工、缩小经营规模或关门。

杯盖市场趋势

食品饮料板块实现显着成长

- 杯盖市场最重要的成长动力之一是全球食品和饮料行业的成长,原因是行动消费者数量的增加以及即食食品和饮料的日益普及。此外,该部门还得到人口和人均收入成长以及生活方式改变等其他因素的补充。

- 外食是重要的终端用户产业,拥有很大的杯盖市场占有率。线上食品配送服务的成长增加了对食品杯和份量杯的需求。

- 预计在预测期内,快餐店业务将在全球大幅扩张。市场扩张的主要因素是消费者偏好的变化和员工数量的增加。即使在购物中心,也有超过三分之一的顾客是来用餐而不是购物的。大多数速食店都使用一次性杯子盛装热饮和冷饮。结果,世界各地对杯子的需求激增。

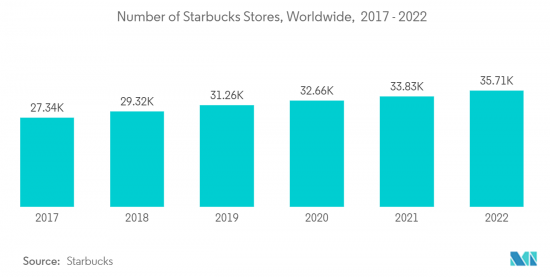

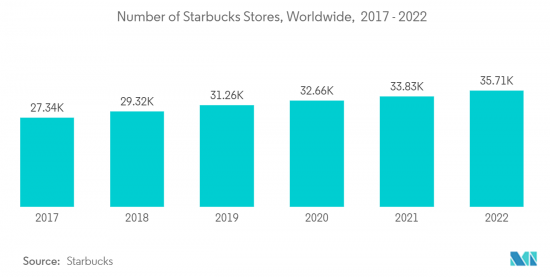

- 由于对外带用餐和速食食品正在世界各地扩张门市。例如,星巴克是一家在创新杯盖上提供咖啡并写有顾客姓名的领先公司,近年来不断增加门市数量,到 2022 年全球门市数量将达到 35,711 家。

预计北美将占据最大的市场占有率

- 北美市场的成长是由消费者食品和饮料趋势推动的,这些趋势青睐更小包装以方便单份消费,并日益关注特色饮料。此外,人们生活方式的快速演变、饮食习惯的改变以及对方便的单剂量包装的需求不断增加也促进了该地区的市场成长。

- 美国咖啡文化的发展,受到了星巴克等深受年轻人欢迎的连锁店的广泛存在的影响。他们是该饮料的最大消费者。随着咖啡文化在美国的发展,对咖啡杯和咖啡盖的需求不断增加。

- 为了满足咖啡文化的需求和普及,星巴克也抓住了机会,增加了在美国的门市数量,根据星巴克资料,公司经营门市从2021年的8,947家增加到2020年的8,941家。到2022年,门市数量已增加至9,265家。由于需求增加而导致的基础设施扩张趋势正在推动未来几年杯盖市场的成长。

杯盖行业概况

杯盖市场竞争激烈,有许多大大小小的公司向国内和国际市场供应产品。市场上的主要参与者正在采取产品创新和併购等策略来增加其市场供应并在市场形势中保持竞争力。该市场的主要企业包括 Reynolds Consumer Products、Huhtamaki Oyj、Greiner Holding AG 和 Solo Cup Operating Corporation。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 食品和饮料行业正在经历显着的成长。

- 快餐数量的增加促进了市场成长

- 市场抑制因素

- 有关塑胶使用的各种规定

第六章市场区隔

- 按材质

- 塑胶

- 纸

- 形式

- 其他的

- 副产品

- 饮水杯

- 包装杯/其他(份量杯/食品杯)

- 盖

- 最终用户产业

- 食品与饮品

- 餐饮服务

- 零售/其他

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 法国

- 德国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 南非

- 沙乌地阿拉伯

- 其他中东/非洲

- 北美洲

第七章竞争形势

- 公司简介

- Georgia-Pacific LLC

- Clondalkin Group Holdings

- Greiner Holding AG

- Huhtamaki Oyj

- Printpack Inc.

- Solo Cup Operating Corporation

- WinCup Inc.

- Graphic Packaging International LLC

- Mondi Group

- Airlite Plastics Company

- Reynolds Consumer Products

- Michael Procos SA

- BioPak UK

- Paper Cup Company

- Greiner AG

- ECO Products Europe

- Brendos Ltd

- Berry Global

- Dart Container

第八章投资分析

第9章市场的未来

The Cups & Lids Market is valued at USD 17.16 billion in 2024 and is expected to grow at a CAGR of 3.4 % during the forecast period (2024-2029) to become USD 20.29 billion by 2029.

Key Highlights

- The rise in tea, coffee, and soft drinks consumption on account of a considerable increase in the population is one of the key factors catalyzing the demand for cups and lids globally. The burgeoning food and beverage (F&B) industry and the escalating order for disposable packaging in quick service restaurants (QSRs) to minimize the risk of leakage and spillage of different food products and beverages are influencing the market studied positively. The emerging trend of social gatherings on special occasions also drives the worldwide need for disposable plates, cups, lids, and other containers.

- Due to the increased demand for specialty drinks, e.g. coffee and milkshakes, there has been a sharp increase in demand for cups and lids within the packaging sector over these past years. Significant forces to market growth include the characteristics of cup and lid products such as lightweight, smooth rolled rims that are comfortable and secure for use on a pleasant and safe surface, snap fit, easy removal, leak-resistant applications, and cost-effectiveness.

- Consumers frequently grab convenient and functional drinks, such as RTD coffee and tea, energy drinks, and other beverages that can be consumed whenever and wherever they need a boost. As such, non-alcoholic drinks that offer functional and practical benefits that are relatively healthy and natural can appeal to busy consumers. Leveraging the natural, energy-boosting characteristics of electrolytes, vitamins, minerals, and other natural ingredients in new product formulations can help brands target tired consumers.

- The rise in urbanisation has led to an increasing number of consumers spending considerable time away from their homes, visiting and travelling into social venues, enjoying the weather or attending sporting events. As a result, when consumers are on the move, they drink more.Recently, in November 2022, more than 1.4 Million fans from across the globe visited Qatar for the FIFA World Cup 2022. Qatar rolled out the red carpet for a total of one million plus visitors for the FIFA World Cup and aims to attract up to 6 million a year by 2030.

- Moreover, the ban on plastic in various nations somehow hinders the growth of the market but the recyclability of paper is one of the key factors driving the growth of the paper cup and lids market. These cups can be recycled indefinitely because they are made of paper. Manufactured per environmental regulations, users benefit from the cost advantages of packaging while eliminating disposal concerns. It helps the vendors contribute to the sustainability goals through their products.

- Additionally, the war between Russia and Ukraine has led to economic sanctions on multiple countries, a surge in commodity prices, and supply chain disruptions, affecting many global markets. The war has caused over 300 major Western companies' evacuation, including the widespread closures of packaging and production facilities in Ukraine and Russia. Uncertainty over when it will end has also led to some companies initially being reluctant to suspend activities, either scaling or shutting down operations.

Cups And Lids Market Trends

Food and Beverage Segment to Witness Significant Growth

- One of the most important drivers for the growth of the Cups & Lids Market is due to the growth of the food and beverage sector worldwide due to an increasing number of consumers on the go and rising adoption of ready-to-eat foods and drinks. In addition, the sector has been supplemented by other factors such as increasing population and per capita income along with changing lifestyles.

- The food service industry is a prominent end-user industry with a significant market share in cups and lids. The growth of online food delivery services augmented the demand for food cups and portion cups.

- The quick-service restaurant business is expected to expand significantly globally during the forecast period. Market expansion is primarily driven by changing consumer preferences and an increase in the number of employees. Even at malls, more than one-third of patrons come for the food, not the shopping. Most quick-service restaurants use disposable paper cups for hot and cold beverages. Therefore, there is a rapid demand for cups across the globe.

- Major fast-food chains like KFC, Domino, Starbucks, Pizzahut, and Mcdonald's are expanding their stores worldwide due to the huge demand on the go meal and ready-to-eat food. For instance, Starbucks which is a major player in serving coffee with its innovative cups and lids with writing customers' names on them, has continuously increased the number of stores last consecutive years and it has reached 35,711 stores worldwide in the year 2022

North America is Expected to Hold the Largest Market Share

- The market growth in North America is driven by food trends from consumers, who are fond of convenient and smaller packaging for single-serving consumptions as well as a growing focus on specialty beverages. Furthermore, the rapid evolution of people's lifestyles, changes in eating habits, and growing demand for single-serve convenient packaging are some other factors contributing to market growth in this region.

- The development of American coffee culture has been influenced by the widespread presence of chains like Starbucks, which is popular with young people. They're the largest consumers of that drink. The demand for coffee cups and lids is increasing in the United States because of its growing coffee culture.

- According to the Starbucks data, to cater to the demand and popularity of coffee culture Starbucks also took up the opportunity by increasing the number of stores in the United States, the company operated stores reached 9,265 stores in the year 2022 which has increased from 8,947 stores in 2021 and 8,941 stores in 2020. This trend of expanding infrastructure due to upward trends of demand has made the market for cups and lids up for the coming years.

Cups And Lids Industry Overview

The cups and lids market is highly competitive due to the presence of many large and small players in the market, supplying their products in the domestic and international markets. Major players in the market are adopting strategies like product innovation and mergers and acquisitions to increase their market offerings and stay competitive in the market landscape. Some of the major players in the market are Reynolds Consumer Products, Huhtamaki Oyj, Greiner Holding AG, and Solo Cup Operating Corporation, among others.

- November 2022 - Huhtamaki, a packaging supplier for the food and consumer goods industries, introduced paperboard cups with moisture-resistant inner and exterior lining to the United States yogurt market at PACK EXPO International.

- September 2022 - Huhtamaki and StoraEnso launched a paper cup recycling initiative. The Cup Collective program aims to recycle used paper cups on an industrial scale and provide consumers and businesses convenient access to used paper cups, which can then be renewed into valuable recycled raw material.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Food and Beverage Segment to Witness Significant Growth

- 5.1.2 Growing Number of QSR Aids to Market Growth

- 5.2 Market Restraints

- 5.2.1 Various Regulations Pertaining to Plastic Usage

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastic

- 6.1.2 Paper

- 6.1.3 Foam

- 6.1.4 Other Materials

- 6.2 By Product

- 6.2.1 Drinking Cups

- 6.2.2 Packaging Cups and Other Cups (Portion Cups and Food Cups)

- 6.2.3 Lids

- 6.3 By End-User Vertical

- 6.3.1 Food and Beverage

- 6.3.2 Foodservices

- 6.3.3 Retail and Other End User Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United kingdom

- 6.4.2.2 France

- 6.4.2.3 Germany

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East & Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 South Africa

- 6.4.5.3 Saudi Arabia

- 6.4.5.4 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Georgia-Pacific LLC

- 7.1.2 Clondalkin Group Holdings

- 7.1.3 Greiner Holding AG

- 7.1.4 Huhtamaki Oyj

- 7.1.5 Printpack Inc.

- 7.1.6 Solo Cup Operating Corporation

- 7.1.7 WinCup Inc.

- 7.1.8 Graphic Packaging International LLC

- 7.1.9 Mondi Group

- 7.1.10 Airlite Plastics Company

- 7.1.11 Reynolds Consumer Products

- 7.1.12 Michael Procos SA

- 7.1.13 BioPak UK

- 7.1.14 Paper Cup Company

- 7.1.15 Greiner AG

- 7.1.16 ECO Products Europe

- 7.1.17 Brendos Ltd

- 7.1.18 Berry Global

- 7.1.19 Dart Container