|

市场调查报告书

商品编码

1405375

硫酸软骨素:市场占有率分析、产业趋势与统计、2024年至2029年成长预测Chondroitin Sulfate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

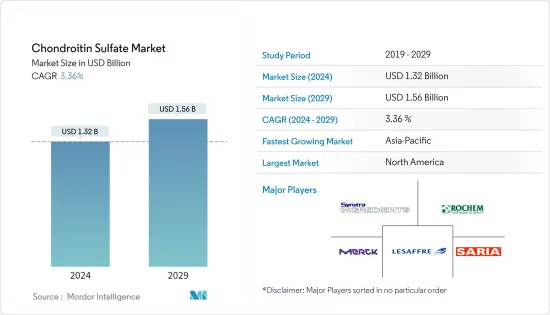

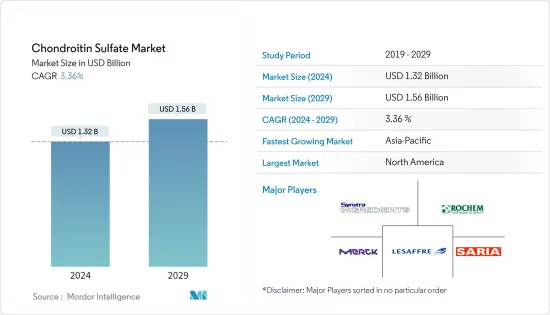

硫酸软骨素市场规模预计到 2024 年为 13.2 亿美元,预计到 2029 年将达到 15.6 亿美元,在预测期内(2024-2029 年)复合年增长率为 3.36%。

COVID-19 大流行扰乱了硫酸软骨素的供应链,使公司难以获得製造该产品所需的原材料。例如,BioMed Central 2023年4月发表的一篇论文发现,COVID-19大流行加剧了最弱势儿童的营养不良,并增加了食品和营养原料药的数量,包括硫酸软骨素原料药原料药的供应链系统被扰乱。因此,疫情导致硫酸软骨素原料药短缺,进而导致价格上涨,导致企业生产和销售含硫酸软骨素的产品变得困难。

另一方面,COVID-19大流行激发了对硫酸软骨素潜在抗病毒特性的研究,预计硫酸软骨素将在预测期内推动市场成长。例如,Virus Journal 于 2022 年 2 月发表的一项研究强调了高度硫酸化的Glico(GAG) 衍生物(包括硫酸软骨素 (CS))对包括 SARS-CoV-2 在内的冠状病毒的潜在抗病毒作用。因此,从整体情况来看,由于供应链中断和随后的价格上涨导致硫酸软骨素原料药短缺,COVID-19大流行在阶段对市场产生了重大影响。然而,在 SARS-CoV-2 感染后,对硫酸软骨素潜在抗病毒特性的研究增多,并探索其在新适应症中的应用,刺激了该领域的研究和投资。

预测期内促进硫酸软骨素市场成长的关键因素包括通常用硫酸软骨素治疗的骨关节炎病例数量的增加、硫酸软骨素在各个领域的应用增加等。例如,根据世界卫生组织(WHO)2023年7月发布的资料,约73%的骨关节炎患者年龄超过55岁,其中60%是女性。

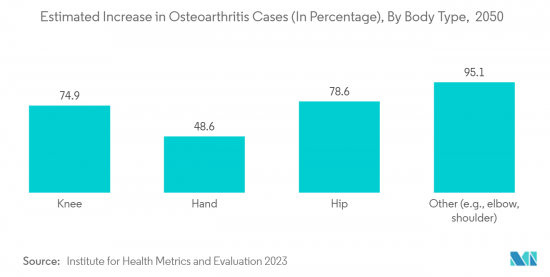

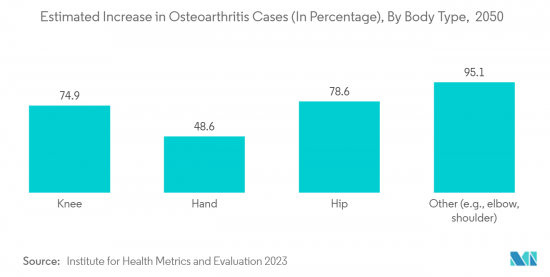

此外,膝盖和手部骨关节炎的盛行率上升,加上高龄化和肥胖症的增加,预计也将在预测期内推动市场成长。例如,健康指标与评估研究所(IHME)2023年8月发布的资料预测,到年终,全球将有约10亿人患有骨关节炎,这主要是由于肥胖病例的增加。此外,根据世界卫生组织(WHO)2023年7月发布的资料,约73%的骨关节炎患者年龄超过55岁,其中60%是女性。因此,高龄化人口中骨关节炎的高盛行率预计将推动预测期内的市场成长。因此,高龄化人口中骨关节炎的高盛行率预计将推动预测期内的市场成长。

随着世界人口高龄化,骨关节炎等与关节相关的健康问题变得越来越普遍。随着越来越多的老年人寻求维持运动功能和控制关节不适的方法,硫酸软骨素作为关节健康补充品的需求预计将会成长。例如,欧盟(EU)的老年人口正在快速成长。例如,世界经济论坛2022年9月发表的报导预测,到2100年,欧盟有30%以上的人口将超过65岁。因此,世界不同地区老年人口的快速成长预计将在预测期内推动市场成长。

主要市场参与者发展硫酸软骨素製药业的行动预计将促进市场成长。例如,2022年3月,Livisto在埃及推出了用于治疗狗和猫骨软骨病的营养补充食品 DC。 HYALUTIDINDC 是一种由透明质酸和硫酸软骨素组成的高度偏好的口服溶液。

因此,骨关节炎盛行率的增加和市场参与者的策略活动预计将在预测期内推动市场成长。然而,硫酸软骨素的副作用是阻碍市场成长的主要因素。

硫酸软骨素市场趋势

预计药品在预测期内将出现强劲成长

药用级硫酸软骨素经常被证明可以减轻骨关节炎患者的疼痛并增强其功能。硫酸软骨素常与盐酸盐葡萄糖胺、硫酸葡萄糖胺、抗坏血酸锰、N-乙酰葡萄糖胺等其他物质合併使用,用于治疗胃酸逆流、间质性膀胱炎、大骨节病、乳癌,用于治疗胆固醇、摄护腺癌等。运动肌肉疼痛、干癣等。硫酸软骨素也可口服治疗心臟病、爱滋病毒/爱滋病、心臟病、骨质疏鬆症和关节痛。

对于骨关节炎不适,硫酸软骨素软膏与硫酸盐葡萄糖胺、鲨鱼软骨和樟脑合併使用。此外,骨关节炎患者数量的增加预计将推动研究目标市场的扩大。例如,根据美国疾病管制与预防中心 (CDC) 2021 年 9 月发布的资料,有症状的膝骨关节炎患者的平均终生风险接近 50%。此外,根据关节炎基金会统计,到2022年,美洲将有超过3250万人患有膝骨关节炎,5到15年间,美洲将有超过3250万人患有前膝骨关节炎。十字韧带( ACL) 损伤。近一半的人受到影响。预测表明,到 2040 年,将有 7800 万美国人患有骨关节炎。因此,硫酸软骨素具有多种医疗应用,随着骨关节炎盛行率的增加,相应的市场预计将急剧发展。

此外,药物製剂中硫酸软骨素应用的扩大和采用的增加也有望促进市场成长。例如,2023年7月,工业在日本对胃肠外科领域的手术防粘连剂SI-449(主要成分为交联硫酸软骨素的粉末型防粘连剂)进行了重大试验,并宣布取得了良好的成果。

因此,由于骨关节炎负担的增加以及市场上新产品的推出等因素,预计该细分市场将显着成长。

预计北美将在预测期内占据主要市场占有率

由于关节炎盛行率上升和硫酸软骨素应用范围扩大等因素,预计北美地区在预测期内将显着增长。此外,该国市场参与者的策略活动也有望促进市场成长。

骨关节炎是一种慢性疾病,特别影响膝关节、髋关节、肩关节和手腕关节,而整形外科疾病的盛行率不断增加是由于硫酸软骨素等药物的使用,这些药物作用于疼痛并损伤关节软骨。创造对减缓退化的有效疗法的需求。这创造了对硫酸软骨素的需求并促进了市场成长。例如,根据疾病预防控制中心2023年6月发布的统计数据,到2040年,估计有7,840万人(25.9%)18岁及以上的美国成年人将被医生诊断为关节炎。因此,整形外科疾病负担的增加预计将创造对硫酸软骨素的需求并促进市场成长。

老年人口的成长和整形外科疾病的高盛行率预计将在预测期内提高市场成长率。例如,根据联合国人口基金发布的2022年统计数据,到2022年,加拿大约19%的人口将达到65岁或以上。因此,不断增加的老年人口发生肌肉骨骼损伤的风险更高,增加了对硫酸软骨素产品的需求并推动市场成长。

此外,最近在兽医领域推出的专注于促进伴侣动物骨骼健康的产品可能会促进市场成长。例如,总部位于美国的优质狗补充品品牌Dogsnob 于2021 年3 月推出,旨在支持幼犬、成年犬和老年犬的运动表现、缓解疼痛、维持骨骼强度以及促进心臟健康。我们推出了「Mobility 」含有硫酸软骨素的管理软咀嚼片。预计增加对硫酸软骨素和製造配方区域的需求的产品推出将在预测期内推动市场成长。

因此,骨质疏鬆症和关节炎等整形外科疾病负担的增加,以及知名企业在该国推出的产品,预计将导致主要企业之间的竞争加剧。这种竞争可以带来产品供应的改进、新的进步和价格竞争力。

硫酸软骨素产业概况

由于存在多家在全球和区域运营的公司,硫酸软骨素市场本质上是分散的。主要市场参与者包括 Lesaffre (Gnosis SpA)、Merck KGaA (Sigma-Aldrich Inc.)、SARIA International GmbH (Bioiberica SAU) 和 Rochem International Inc.。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 骨关节炎盛行率增加

- 扩大硫酸软骨素的用途

- 市场抑制因素

- 硫酸软骨素的副作用

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(市场规模)

- 按来源

- 猪

- 鲨鱼

- 牛

- 人造的

- 其他的

- 按用途

- 药品

- 化妆品

- 动物用药品

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 亚太地区其他地区

- 中东/非洲

- 海湾合作委员会成员国

- 南非

- 中东和非洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章竞争形势

- 公司简介

- SARIA International GmbH(Bioiberica SAU)

- Rochem International Inc.

- Lesaffre(Gnosis SpA)

- BASIC NUTRITION

- BeiJing Geyuantianrun Bio-tech Co. Ltd

- Merck KGaA(Sigma-Aldrich Inc.)

- Synutra Inc.

- Summit Nutritionals International

- Beloor Bayir

- Chongqing Aoli Biopharmaceutical Co. Ltd

- TSI Group Ltd

第七章 市场机会及未来趋势

The Chondroitin Sulfate Market size is estimated at USD 1.32 billion in 2024, and is expected to reach USD 1.56 billion by 2029, growing at a CAGR of 3.36% during the forecast period (2024-2029).

The COVID-19 pandemic disrupted the chondroitin sulfate supply chain, making it difficult for companies to obtain the raw materials they needed to make the product. For instance, according to the article published by BioMed Central in April 2023, the COVID-19 pandemic led to an increase in malnutrition among the most vulnerable children and disrupted food and nutritional API supply chain systems, including chondroitin sulfate APIs. Thus, the pandemic led to shortages of chondroitin sulfate API, which, in turn, led to increased prices, thereby making it difficult for companies to produce and sell chondroitin sulfate-containing products.

Furthermore, the COVID-19 pandemic led to increased research studies on the potential antiviral properties of chondroitin sulfate, which is projected to drive market growth during the forecast period. For instance, a research study published by the Viruses Journal in February 2022 investigated the potential antiviral effects of high-sulfated glycosaminoglycan (GAG) derivatives, including chondroitin sulfate (CS), against coronaviruses, including SARS-CoV-2. Therefore, looking at the overall scenario, the COVID-19 pandemic substantially impacted the market in its initial phases, owing to supply chain disruptions leading to Chondroitin sulfate API shortages and subsequently increased prices. However, increased research into the potential antiviral properties of Chondroitin sulfate and the exploration of its use in new indications after SARS-CoV-2 infection has driven research and investment in this area.

The significant factors contributing to the growth of the chondroitin sulfate market over the forecast period include the rising occurrence of osteoarthritis cases, which are usually treated with chondroitin sulfate, and the increasing applications of chondroitin sulfate in various sectors. For instance, according to the data released by the World Health Organization (WHO) in July 2023, about 73% of people living with osteoarthritis are older than 55 years, and 60% are female.

In addition, the rising prevalence of osteoarthritis of knees and hands coupled with the increasing aging population and obesity is also projected to drive market growth during the forecast period. For instance, according to the data published by the Institute for Health Metrics and Evaluation (IHME) in August 2023, approximately 1 billion people worldwide are projected to suffer from osteoarthritis by the end of 2050, primarily due to the rising obesity cases. Moreover, according to the data released by the World Health Organization (WHO) in July 2023, about 73% of people living with osteoarthritis are older than 55 years, and 60% are female. Therefore, the high prevalence of osteoarthritis in the aging population is projected to drive market growth during the forecast period. Therefore, the high prevalence of osteoarthritis in the aging population is projected to drive market growth during the forecast period.

With an aging global population, joint-related health issues like osteoarthritis are more prevalent. The demand for Chondroitin sulfate as a supplement for joint health is expected to rise as more elderly individuals seek ways to maintain mobility and manage joint discomfort. For instance, the geriatric population in the European Union (EU) is increasing at a rapid pace. For instance, as per the article published by the World Economic Forum in September 2022, more than 30% of the EU population is expected to be 65 or older by 2100. Therefore, the surging geriatric population in different regions of the world is projected to drive market growth during the forecast period.

Actions by key market players to develop the pharmaceutical segment of chondroitin sulfate are expected to boost market growth. For instance, in March 2022, Livisto launched HYALUTIDIN DC, a nutraceutical product for osteochondrosis in dogs and cats in Egypt. HyalutidinDC is an oral solution composed of hyaluronic acid and chondroitin sulfate with high palatability.

Therefore, the increasing incidence of osteoarthritis and strategic activities by market players are anticipated to drive market growth during the forecast period. However, the adverse effects of chondroitin sulfate are a major factor hindering market growth.

Chondroitin Sulfate Market Trends

The Pharmaceutical Segment is Expected to Witness Significant Growth During the Forecast Period

In patients with osteoarthritis, pharmaceutical-grade chondroitin sulfate has frequently been shown to lessen pain and enhance function. It is frequently combined with other substances, such as glucosamine hydrochloride, glucosamine sulfate, manganese ascorbate, and N-acetylglucosamine. It is used in medications to treat acid reflux, interstitial cystitis, Kashin-Beck illness, breast cancer, high cholesterol, muscle soreness after exercise, and psoriasis. Chondroitin sulfate is also taken orally for heart attack, HIV/AIDS, heart disease, osteoporosis, and joint pain.

For osteoarthritis discomfort, chondroitin sulfate ointments can be used with glucosamine sulfate, shark cartilage, and camphor. Additionally, the growing number of people with osteoarthritis is anticipated to aid in the expansion of the market studied. For instance, according to the data published in September 2021 by the Centers for Disease Control and Prevention (CDC), a person's average lifetime risk for symptomatic osteoarthritis of the knee was almost 50%. Furthermore, according to the statistics of the Arthritis Foundation, in 2022, more than 32.5 million people in the Americas will have osteoarthritis, which will impact nearly half the knees with anterior cruciate ligament (ACL) injuries during a five- to fifteen-year period. According to projections, 78 million Americans will develop osteoarthritis by 2040. Therefore, there are many different medical uses for chondroitin sulfate, and the corresponding market is anticipated to develop dramatically as incidences of osteoarthritis rise.

Moreover, the growing application of chondroitin sulfate and the increasing adoption in pharmaceutical formulations are expected to contribute to the market growth. For instance, in July 2023, Seikagaku Corporation announced that favorable results were obtained in a pivotal study in Japan for SI-449 (SI-449 is a powdered adhesion barrier whose main ingredient is cross-linked chondroitin sulfate), a surgical adhesion barrier in the field of gastroenterological surgery.

Therefore, the segment studied is expected to grow significantly owing to factors such as the increasing burden of osteoarthritis and new product launches in the market.

North America is Expected to Hold a Significant Market Share Over the Forecast Period

North America is expected to witness significant growth during the forecast period due to factors such as the rise in the prevalence of arthritis and the growing application of chondroitin sulfate. In addition, strategic activities by the market players in the country are also expected to boost market growth.

Osteoarthritis is a chronic disease that affects the knee, hip, shoulder, and hand joints in particular, and the growing prevalence of orthopedic diseases is expected to create the demand for effective treatments, such as chondroitin sulfate, which acts both on the pain and on the slowing down of the degeneration of the articular cartilage. This creates the demand for chondroitin sulfate and boosts the market growth. For instance, according to the statistics released by the CDC in June 2023, an estimated 78.4 million (25.9%) United States adults aged 18 years or older are projected to have doctor-diagnosed arthritis by 2040. Hence, the growing burden of orthopedic diseases is expected to create the demand for chondroitin sulfate, thereby boosting market growth.

The increasing geriatric population is likely to increase the market growth during the forecast period as this population is highly prone to orthopedic diseases. For instance, according to the 2022 statistics published by the United Nations Population Fund, in Canada, about 19% of the population was aged 65 years and above in 2022. Thus, the growing geriatric population is at a high risk of developing musculoskeletal injuries, which raises the demand for chondroitin sulfate products and propels the market growth.

Also, recent product launches in the veterinary sector focusing on improving bone health in pet animals are likely to contribute to market growth. For instance, in March 2021, Dogsnob, a United States-based premium dog supplement brand, launched Mobility Management Soft Chews, which contain chondroitin sulfate, which is formulated to support mobility, relieve pain, maintain bone strength, and promote heart health for puppies, adults, and senior dogs. The product launches to increase the demand for chondroitin sulfate to manufacture the formulation region are expected to boost the growth of the market during the forecast period.

Therefore, the growing burden of orthopedic diseases, such as osteoporosis and arthritis, and the product launches in the country by prominent players are projected to lead to increased competition among the major players. This competition can lead to improved product offerings, new advancements, and pricing competitiveness.

Chondroitin Sulfate Industry Overview

The chondroitin sulfate market is fragmented in nature due to the presence of several companies operating globally as well as regionally. Some of the key market players are Lesaffre (Gnosis SpA), Merck KGaA(Sigma-Aldrich Inc.), SARIA International GmbH (Bioiberica S.A.U.), and Rochem International Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Osteoarthritis

- 4.2.2 Growing Applications of Chondroitin Sulfate

- 4.3 Market Restraints

- 4.3.1 Adverse Effects of Chondroitin Sulfate

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - in USD million)

- 5.1 By Source

- 5.1.1 Swine

- 5.1.2 Shark

- 5.1.3 Bovine

- 5.1.4 Synthetic

- 5.1.5 Other Sources

- 5.2 By Application

- 5.2.1 Pharmaceuticals

- 5.2.2 Cosmetics

- 5.2.3 Veterinary

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 SARIA International GmbH (Bioiberica S.A.U)

- 6.1.2 Rochem International Inc.

- 6.1.3 Lesaffre (Gnosis SpA)

- 6.1.4 BASIC NUTRITION

- 6.1.5 BeiJing Geyuantianrun Bio-tech Co. Ltd

- 6.1.6 Merck KGaA (Sigma-Aldrich Inc.)

- 6.1.7 Synutra Inc.

- 6.1.8 Summit Nutritionals International

- 6.1.9 Beloor Bayir

- 6.1.10 Chongqing Aoli Biopharmaceutical Co. Ltd

- 6.1.11 TSI Group Ltd