|

市场调查报告书

商品编码

1405681

Microgreens:市场占有率分析、产业趋势/统计、成长预测,2024-2029Microgreens - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

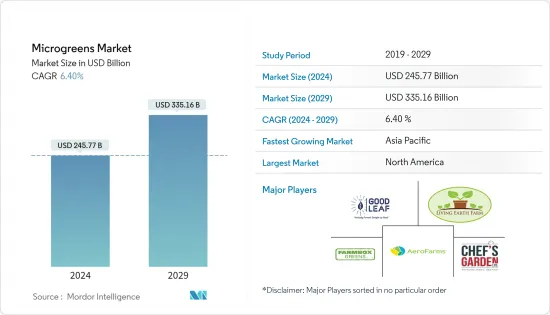

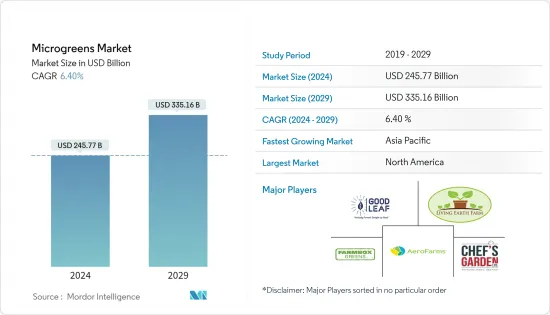

微型蔬菜市场规模预计到 2024 年为 2,457.7 亿美元,预计到 2029 年将达到 3,351.6 亿美元,在预测期内(2024-2029 年)复合年增长率为 6.40%。

主要亮点

- 微型蔬菜是小而柔软的可食用蔬菜。由于它们具有浓郁的香气,并且有多种颜色和质地,因此通常用于改善各种菜餚的颜色、质地和风味,包括麵食、比萨、煎蛋捲和沙拉。食用微型蔬菜对健康的好处包括帮助控制体重、避免慢性疾病、增强免疫力和改善心理健康。

- 虽然微型蔬菜市场是由希望增强风味和为盘子增添色彩的厨师推动的,但还有另一个利基行业推动了这一领域的新增长:化妆品。这些微型蔬菜被加工成油和洗髮精和护肤品等消费品的成分。除了许多其他微量元素外,微型蔬菜还含有大量维生素 A 和 B,这使它们成为对个人护理产品製造商非常有吸引力的成分。从长远来看,这预计将增加对微型蔬菜的需求。

- 西兰花、生菜、芝麻菜和罗勒是一些重要的微型蔬菜,在不同地区采用水耕和垂直农业方法种植。 2021年,北美占据最大的市场占有率。美国在该地区贡献最大份额,其次是加拿大和墨西哥。

微绿色市场趋势

室内农业的采用率增加

随着人口成长增加对粮食的需求并减少生产性土地,农民开始转向室内农业等高科技生产方法。同时,人们变得更加註重健康并开始食用营养丰富的用餐,从而导致了室内农业的引入。消费者不仅在家中实践室内种植,还在各大温室中大规模实践。因此,微型蔬菜市场预计在未来几年将会成长。根据情报平台 Artemis 的一项研究,近 16% 的室内种植者参与微绿色生产。

除这些因素外,人们对农业机械化的接受度不断提高,对水耕、气耕和鱼菜共生等高科技农业技术的了解不断增加,预计将推动微型绿色产业的扩张。随着世界各地的消费者转向更健康的饮食,需求不断增加,预计未来几年微型绿色食品的产量将会增加。由于越来越多地采用这种保护性种植,市场成长缓慢。

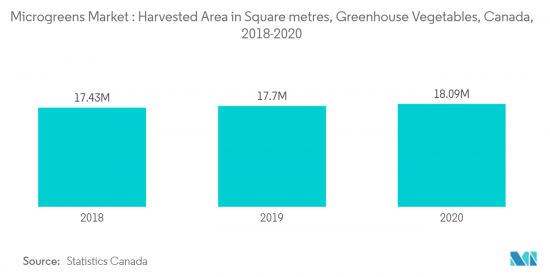

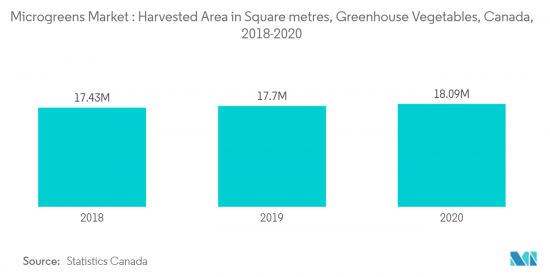

此外,加拿大温室蔬菜(包括微型蔬菜)的产量正在稳步增长,并且预计在不久的将来将持续数十年的成长趋势。温室技术的成功正在推动微型蔬菜市场的发展。因此,随着需求的成长,收益也稳定,支撑着市场的成长。

北美是微型蔬菜最大的市场之一

2021年,北美在微型绿色产业中占据最大份额。对健康益处和均衡饮食的认识不断提高,导致该地区的人们在饮食中加入有机食品,包括绿叶蔬菜沙拉和微型蔬菜,这正在扩大微型蔬菜市场。我是。透过加强室内和垂直农业方法,美国种植者现在能够大规模生产微型蔬菜。例如,根据资讯平台Agrilyst的数据,美国温室的分布因地区而异,但温室中微型蔬菜产量最高的是南部和东北部,2020年分别占71%和59%。此外,水耕为加州农民带来最高的收益。因此,种植了最适合这种耕作方法的作物,例如西兰花、生菜和沙拉蔬菜。

许多零售商向美国当地餐厅和农民提供「经过认证的自然生长」微绿种子,这些种子可以水耕或垂直种植。由于照明需要电力,加拿大农民依靠室内种植而不是温室种植来种植微型蔬菜。在室内种植可以消除室外种植的许多病虫害问题。因此,有机农民正在进入这个市场,因为厨师使用它们来增强风味或作为色彩缤纷的装饰的需求不断增加。

微绿产业概况

微型蔬菜市场分散,与许多大型企业竞争激烈。微型蔬菜市场的主要企业包括 Farmbox Greens LLC、The Chef's Garden Inc.、Aerofarms LLC、Living Earth Farms、Good Leaf Farms、Jiangsu Skyplant Greenhouse Technology 和 Shanghai Dehuan Industry。主要企业正在采取新产品发布和扩大策略,以促进全球微型绿色市场的成长。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究场所

- 市场定义和研究范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场抑制因素

- 价值链分析

第五章市场区隔

- 类型

- 绿色花椰菜

- 生菜 菊苣

- 芝麻菜

- 罗勒

- 茴香

- 红萝卜

- 向日葵

- 萝卜

- 绿豌豆

- 其他的

- 农业

- 室内农业

- 垂直农业

- 商业温室

- 其他的

- 生长培养基

- 泥炭藓

- 土壤

- 椰子核

- 卫生纸

- 其他的

- 配销通路

- 大型超市/超级市场

- 餐厅

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 荷兰

- 西班牙

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 新加坡

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 智利

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 阿尔及利亚

- 沙乌地阿拉伯

- 埃及

- 南非

- 其他中东/非洲

- 北美洲

第六章竞争形势

- 最采用的策略

- 市场占有率分析

- 公司简介

- AeroFarms LLC

- Goodleaf Farms

- Living Earth Farm

- Farm Box Greens

- Jiangsu Skyplant Greenhouse Technology Co. Ltd

- Shanghai Dehuan Industry Co. Ltd

- Chef's Garden Inc.

- Madar Farms

- Metro Microgreens

- Gotham Greens

- Greenbelt Microgreens

第七章 市场机会及未来趋势

The Microgreens Market size is estimated at USD 245.77 billion in 2024, and is expected to reach USD 335.16 billion by 2029, growing at a CAGR of 6.40% during the forecast period (2024-2029).

Key Highlights

- Microgreens are soft, tiny vegetable greens that are available for consumption. They are usually used to improve the color, texture, or flavor of various cuisines such as pasta, pizza, omelets, and salads due to their powerful aromatic flavor and range of colors and textures. The health benefits associated with the consumption of microgreens are they help manage weight, avoid chronic medical conditions, boost immunity, and improve mental health.

- The microgreens market is driven by chefs that use them as flavor enhancements and as colorful garnishes on their plates, but there is another niche industry that pushes new growth within this segment, cosmetics. These micro greens are processed into oils and ingredients for consumer items like shampoo and skincare products. Microgreens contain a lot of vitamins A and B in addition to many other micro-elements, making them very attractive ingredients for personal care product manufacturers. Over the long term, this is expected to boost the demand for microgreens.

- Broccoli, lettuce, arugula, and basil are some of the important microgreens grown across various regions through hydroponics and vertical farming. North America accounted for the largest market share in 2021. The United States is a major contributor to the share of the region, followed by Canada and Mexico.

Microgreens Market Trends

Rise in Adoption of Indoor Farming

The growing population has led to increased food demand which made farmers turn towards high-tech production methods like indoor farming because of the decrease in productive land. Along with this, the growing health consciousness has led people to consume a diet full of nutrients, which has led to the adoption of indoor farming practices. Consumers not only practice indoor farming at home, but it is also largely being cultivated in major greenhouses. Thus, the market for microgreens is anticipated to grow in the years to come. According to a survey by Artemis, an intelligence platform, almost 16% of growers in indoor cultivation are involved in microgreens production.

In addition to these factors, the increased acceptance of agricultural mechanization and increased knowledge of high-tech farming techniques like hydroponics, aeroponics, and aquaponics are anticipated to promote the expansion of the microgreens industry. With consumers across the world turning toward healthy diets, the demand is increasing, and the production of microgreens is anticipated to increase in the coming years. This rising adoption of protected cultivation has led the market to grow moderately.

Furthermore, in Canada, there has been a steady increase in greenhouse vegetable production, including microgreens, and it is anticipated that the multi-decade trend of growth will continue in the near future. The success of greenhouse technology is boosting the microgreens market. Thus, the revenue has stabilized with the growth in demand, which, in turn, has aided in the market growth.

North America is One of the Largest Markets for Microgreens

North America accounted for the largest share of the microgreens industry in 2021. The rise in the awareness of health benefits and balanced diets has made people in this region include green vegetable salads and organic-based food items including microgreens in their diets which is increasing the market for microgreens. With the help of enhanced indoor and vertical farming practices, US growers have been able to produce microgreens on a large scale. For instance, According to Agrilyst, an intelligence platform, the distribution of greenhouses in the United States in various areas varied, but the production of microgreens in greenhouses was most prevalent in the South and Northeast regions, accounting for 71% and 59%, respectively in 2020. Moreover, hydroponic farming generates the highest revenue for Californian farmers. Therefore, crops such as broccoli, lettuce, and salad vegetables are grown, which are best suited for this farming technique.

Many retailers are providing "Certified Naturally Grown" microgreen seeds to local restaurants and farmers in the United States, which can be grown hydroponically and through vertical farming in the country. Canadian farmers rely on indoor farming than greenhouse farming for growing microgreens because of the electricity needed for lighting. Growing indoors eliminates many of the pest and disease problems of outdoor production. Thus, organic farmers are tapping into this market due to the increased demand from chefs that use them as flavor enhancements and colorful garnishes.

Microgreens Industry Overview

The microgreens market is fragmented and highly competitive due to the presence of many major players. The key players in the microgreens market contributing to the market include Farmbox Greens LLC, The Chef's Garden Inc., Aerofarms LLC, Living Earth Farms, Good Leaf Farms, Jiangsu Skyplant Greenhouse Technology Co. Ltd, and Shanghai Dehuan Industry Co. Ltd. The major players are adopting new product launches and expansion strategies for global growth in the microgreens market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Market Definition and Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Value Chain Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Broccoli

- 5.1.2 Lettuce and Chicory

- 5.1.3 Arugula

- 5.1.4 Basil

- 5.1.5 Fennel

- 5.1.6 Carrots

- 5.1.7 Sunflower

- 5.1.8 Radish

- 5.1.9 Peas

- 5.1.10 Other Types

- 5.2 Farming

- 5.2.1 Indoor Farming

- 5.2.2 Vertical Farming

- 5.2.3 Commercial Greenhouses

- 5.2.4 Other Farming

- 5.3 Growth Medium

- 5.3.1 Peat Moss

- 5.3.2 Soil

- 5.3.3 Coconut Coir

- 5.3.4 Tissue Paper

- 5.3.5 Other Growth Mediums

- 5.4 Distribution Channel

- 5.4.1 Hypermarkets/Supermarkets

- 5.4.2 Restaurants

- 5.4.3 Other Distribution Channels

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Netherlands

- 5.5.2.2 Spain

- 5.5.2.3 Germany

- 5.5.2.4 France

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Singapore

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Chile

- 5.5.4.3 Argentina

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East & Africa

- 5.5.5.1 Algeria

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Egypt

- 5.5.5.4 South Africa

- 5.5.5.5 Rest of Middle East & Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 AeroFarms LLC

- 6.3.2 Goodleaf Farms

- 6.3.3 Living Earth Farm

- 6.3.4 Farm Box Greens

- 6.3.5 Jiangsu Skyplant Greenhouse Technology Co. Ltd

- 6.3.6 Shanghai Dehuan Industry Co. Ltd

- 6.3.7 Chef's Garden Inc.

- 6.3.8 Madar Farms

- 6.3.9 Metro Microgreens

- 6.3.10 Gotham Greens

- 6.3.11 Greenbelt Microgreens