|

市场调查报告书

商品编码

1851890

凉感布料:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Cooling Fabrics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

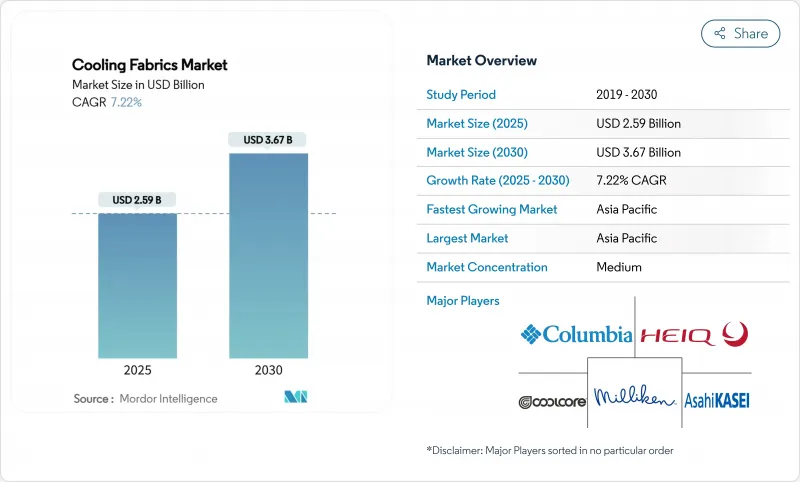

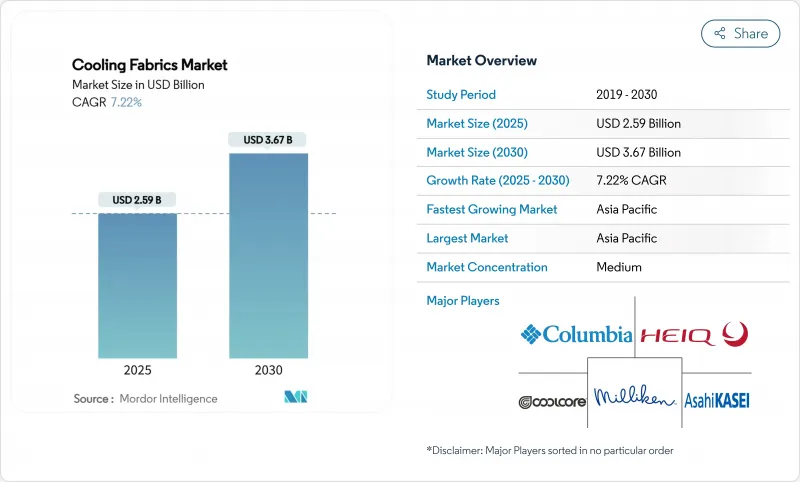

预计到 2025 年,凉感布料市场规模将达到 25.9 亿美元,到 2030 年将达到 36.7 亿美元,在预测期(2025-2030 年)内复合年增长率为 7.22%。

受日益加剧的城市热岛效应、运动和户外生活方式的流行以及材料科学的快速发展等因素的推动,凉感布料市场预计将持续扩张。合成吸湿排汗纤维、被动释放「超织物」和再生纱线的创新正在拓展产品功能,而永续性则加速了天然纤维的应用。製造商正从可进行涂层和混合整理而不影响其完整性的编织结构中获得规模优势,而军方采购则刺激了高级产品在民用领域的普及。新兴经济体的价格敏感度和洗涤后性能下降仍然是不利因素,但各种应用领域的普及仍然能够克服这些限制。

全球凉感布料市场趋势与洞察

运动和休閒领域合成吸湿排汗和发热纤维的快速成长

休閒休閒服和高性能运动服的基本需求。各大品牌纷纷采用 COOLMAX EcoMade、brrr° 等类似纱线,这些纱线注入了相变材料和微矿物,即使在大量出汗的情况下也能持续散热。全球市场参与企业积极投身健身和户外休閒,而合成纤维凭藉其可重复的吸湿排汗、弹性和机械耐久性,继续占据主导地位。技术纺织品的进步推动合成纱线在全球纺织品需求中占比超过 19%,增强了规模经济效益,从而支撑了凉感布料市场的发展。奈米混合填充材提高了导热性,使人造合成纤维的性能超越了许多天然纤维。同时,回收聚对苯二甲酸乙二醇酯 (PET) 的使用稳定了成本,同时满足了日益严格的环境设计法规要求。

户外和运动服饰品牌的全球扩张

跨国户外品牌正将其独特的降温平台从野外探险领域拓展至日常都会服饰。哥伦比亚运动服饰公司的 Omni-Heat Infinity 和 Omni- 帘子技术就是这类跨界融合的典范。降温材料能够承受比周边农村地区高出 8.9°C 的城市温度,从而扩大了潜在市场需求。品牌利用亚太地区的製造群缩短了研发週期,降低了单位成本,并将高端降温产品带入了主流消费者的视野。结合 3D 列印结构和空气动力学面板的迭代式产品发布,标誌着精英运动领域的经验正被应用于休閒服饰,进一步扩大了凉感布料市场。跨半球的技术转移也进一步加速了全球普及的应用。

高冷却性纺织品生产成本高

被动式发光层需要二氧化钛奈米颗粒、聚合物薄膜和奈米银线,因此与普通服饰相比,其材料成本更高。专用涂层生产线需要资本投入,而严格的品管通讯协定则增加了劳动密集度。製程优化已将溢价降低至近10%,但低收入地区仍面临高昂的价格,限制了产量。供应商必须改善连续辊涂製程并拓宽原料选择范围,才能达到大众市场的价格分布。儘管目前生产规模有所缩减,但随着国防、专业运动和工业防护装备(PPE)等高端类别吸收成本并允许研发费用摊销,最终这种趋势应该会惠及价值型市场。

细分市场分析

合成纱线能够实现均匀的吸湿排汗和大规模拉伸,预计到2024年将占据凉感布料市场61.19%的份额。凭藉众多专利降温技术,合成纱线仍是大规模生产运动服饰的成本效益之选。随着监管机构和消费者对生物降解性的日益重视,天然纤维的复合年增长率将达到8.15%。目前,经奈米钻石或几丁聚醣微孔处理的棉花可实现2-3°C的降温效果,而闭合迴路铜氨纤维纱线则将植物来源材料与工业可回收性结合。混纺结构结合了再生纤维素和微矿物合成纤维,以平衡触感和性能。因此,投资者正在资助轧棉厂的升级改造和酵素预处理,以提高天然纤维的质量,这预示着天然纤维将在凉感布料市场中广泛使用。

混纺纱线的进步表明,永续性目标和性能指标并非不可兼得。 Bemberg Cupro 实现了超过 99% 的溶剂回收率,同时又不影响散热性能,充分展现了循环利用的概念。初步试验表明,再生棉在耐热性方面优于原生棉。随着时尚集团宣布基于科学的碳排放目标,采购将转向这些低影响选项,将环保偏好转化为可衡量的需求。未来预测显示,天然纤维冷却系列产品将获得更大的市场份额,而合成纤维仍将是注重吸湿排汗、快干和弹性的服装的核心材料。

到2024年,梭织布料将占总收入的40.66%,复合年增长率(CAGR)为8.37%。这是因为梭织布料紧密控制的织造结构为奈米颗粒涂层、反光膜和相变印刷浆料提供了尺寸稳定的基材。目前织造厂的运作能已处于高位,最大限度地降低了增加冷却设备所需的成本。针织布料凭藉其舒适的弹性和透气性,在运动服领域占据了稳固的地位,但其环状结构需要更慢的机器运转,并且可能会使多层涂层的製备变得复杂。不织布布在一次性医疗和过滤领域的重要性日益凸显,在这些领域,触感悬垂性并非首要考虑因素。

水喷织布机能够织造更细的丹尼织物,同时也能节省能源。多相织造技术可以调整孔隙几何形状,并有助于水蒸气的传输。同时,针织机正采用数位化控制和更精细的针距,以减少表面平整度的差异。将静电纺丝膜层迭在针织或梭织织物上,可以形成一层超薄的辐射层,从而创造出结合了两种结构优势的混合层压材料。由于成本和多功能性优势,梭织织物预计将继续保持在凉感布料市场的领先地位,但由于消费者对拉伸的需求不断增长,针织织物的市场份额预计将保持稳定,而不是下降。

区域分析

到2024年,亚太地区将占全球销售额的31.30%,到2030年将以7.86%的复合年增长率成长。这主要得益于中国在技术纺织品出口方面的规模优势以及其在被动辐射研究领域的领先地位,该技术可使服装温度降低摄氏5度。政府补贴支持超织物试点工厂的建设,而越南、印尼和印度的下游服装製造商则将这些纺织品整合到具有成本竞争力的裁剪缝纫生产线中。日本的材料科学生态系统正在改进用于紫外线反射的聚合物混合物,而韩国的电子产业则致力于研发可将体温资料传输到行动装置的智慧纺织品覆层。不断壮大的中产阶级人口面临着潮湿的夏季,也推动了零售需求的成长。

北美受益于国防合约和户外休閒文化。美国航空系统计画加速了供应商的学习进程,并检验了耐用凉感布料的有效性。总部位于奥勒冈州和科罗拉多的户外品牌每年夏季都会推出新品系列,稳步赢得消费者的青睐。加拿大极端的温差促成了多季节迭穿概念的兴起——一面凉爽,另一面保暖——从而延长了产品的使用寿命。墨西哥作为近岸缝纫基地的角色日益凸显,为品牌在全球物流中断的情况下提供了更大的灵活性。

欧洲的发展轨迹与环境政策息息相关。欧盟的生态设计法规优先考虑纺织品,鼓励价值链可追溯性和回收。德国的Outlast等纺织厂正在使用美国太空总署(NASA)发明的相变材料(PCM)加工技术生产获得生态认证的衬里,而义大利的纺纱企业则在推广对再生纱线进行低影响染色。英国研究理事会正在资助一个专注于奈米结构发光薄膜的大学-产业联盟。该地区不断上涨的能源成本正在推动被动式个人降温设备的需求,儘管其价格昂贵,但仍促进了其在国内的普及。

南美洲和中东/非洲地区蕴藏着新的商机,加上快速的都市化和强烈的太阳辐射,使得这些地区受益匪浅。巴西运动服饰市场的蓬勃发展正推动相变聚酯纤维的在地采购,而海湾国家则正在测试用于在正午45摄氏度高温下辛勤工作的建筑工人的降温工作服。儘管基础设施匮乏和可支配收入有限制约了短期销售成长,但持续的气候暖化预示着长期成长的趋势。为了克服关税和物流的障碍,全球供应商正在探索与当地合作伙伴建立合资企业和技术许可机制,从而使凉感布料市场实现更广泛的地理分布。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 运动和休閒对吸湿排汗合成布料的需求激增

- 户外和运动服饰品牌的全球扩张

- 一种突破性的被动辐射“超织物”,用于缓解城市热岛效应

- 为沙漠作战采购抗高温军服。

- 永续性要求加速了再生冷却纤维的采用

- 市场限制

- 高冷却纤维的生产成本高

- 反覆洗涤导致性能劣化

- 高反射率发光织物的染色局限性

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 依纤维类型

- 自然的

- 合成

- 按织物结构

- 织物

- 针织

- 不织布

- 透过使用

- 运动服

- 防护衣

- 服饰

- 其他用途(医疗/保健纺织品等)

- 按最终用户行业划分

- 消费者

- 工业和製造业

- 国防与安全

- 卫生保健

- 汽车与运输

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚国协

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Ahlstrom

- Asahi Kasei Advance Corporation

- Balavigna Mills Pvt. Ltd.

- brrr°

- Cocona Labs

- Columbia Sportswear Company

- Coolcore

- Elevate Textiles, Inc.

- Everest Textile Co., Ltd.

- FORMOSA TAFFETA CO., LTD.

- HeiQ Materials AG

- LunaMicro AB

- Milliken & Company

- NAN YA PLASTICS CORPORATION

- NILIT

- Outlast Technologies GmbH

第七章 市场机会与未来展望

The Cooling Fabrics Market size is estimated at USD 2.59 Billion in 2025, and is expected to reach USD 3.67 Billion by 2030, at a CAGR of 7.22% during the forecast period (2025-2030).

Heightened urban heat island effects, widespread athletic and outdoor lifestyles, and rapid material-science breakthroughs position the cooling fabrics market for sustained expansion. Synthetic moisture-wicking fibers, passive radiative "metafabrics," and recycled yarn innovations are widening product capabilities while sustainability mandates accelerate natural-fiber adoption. Manufacturers gain scale advantages from woven constructions that accept coatings and hybrid finishes without compromising integrity, and military procurement is stimulating premium product diffusion into civilian segments. Price sensitivity in emerging economies and performance fade after laundering remain headwinds, yet diversified application uptake continues to outweigh these constraints.

Global Cooling Fabrics Market Trends and Insights

Surge in Synthetic Moisture-wicking Fibers for Sports and Athleisure

Athleisure and performance sportswear now treat dynamic cooling as a baseline expectation. Brands integrate COOLMAX EcoMade, brrr° and comparable yarns that embed phase-change materials or micro-minerals, providing continuous heat draw-down even under heavy perspiration . Market penetration benefits from global participation in fitness and outdoor recreation, and synthetic fibers retain dominance because they deliver repeatable moisture transport, stretch and mechanical durability. Technical-textile advances lift synthetic yarns' share of global fiber demand above 19%, reinforcing scale economies that underpin the cooling fabrics market. With nanohybrid fillers improving thermal conductivity, engineered synthetics outperform many natural alternatives. In parallel, recycled Polyethylene Terephthalate (PET) streams keep cost bases stable while satisfying tightening eco-design rules.

Expansion of Outdoor and Performance Apparel Brands Globally

Multinational outdoor labels channel proprietary cooling platforms into both back-country and everyday urban lines. Columbia Sportswear's Omni-Heat Infinity and Omni-Shade technologies exemplify such crossover. Heat-mitigating fabrics combat city temperatures that can sit 8.9°C higher than surrounding rural zones, broadening addressable demand. As brands leverage Asia-Pacific manufacturing clusters, they shorten development cycles and lower per-unit costs, making premium cooling attainable for mainstream consumers. Iterative launches that combine 3D-printed structures with aerodynamic panels demonstrate a migration of elite-sport learnings to lifestyle garments, thus enlarging the cooling fabrics market. Technology transfer across hemispheres further accelerates global uptake.

High Production Cost of Advanced Cooling Textiles

Passive-radiative layers call for titanium dioxide nanoparticles, polymer membranes and silver nanowires that elevate bill-of-materials costs relative to commodity apparel. Specialized coating lines introduce capital outlays, while stringent quality-control protocols add labor intensity. Although process optimization has trimmed the premium to almost 10%, sticker shock persists in lower-income regions, slowing volume. Suppliers must refine continuous-roll deposition and broaden raw-material options to reach mass-price points. Scaling pauses notwithstanding, premium categories such as defense, professional sports and industrial Personal Protective Equipment (PPE) absorb the cost, allowing research and development (R&D) amortization that should eventually spill into value segments.

Other drivers and restraints analyzed in the detailed report include:

- Breakthrough Passive Radiative "Metafabrics" for Urban Heat Mitigation

- Military Procurement of Heat-stress Uniforms for Desert Operations

- Performance Degradation After Repeated Laundering Cycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Synthetic yarns retained 61.19% of cooling fabrics market share in 2024 by delivering uniform moisture transport and stretch at scale. They underpin many patented cooling chemistries that remain cost-optimal for high-volume sportswear. Natural fibers, though, are on an 8.15% CAGR path as regulators and consumers prize biodegradability. Cotton modified with nanodiamonds or chitosan micro-porosity now attains 2-3°C temperature drops, while closed-loop cupro yarns marry plant-based feedstocks with industrial recyclability. Blended constructions pair regenerated cellulose with micro-mineral synthetics, balancing feel and function. Investors therefore finance gin upgrades and enzymatic pre-treatments that elevate natural fiber quality, pointing to broader acceptance within the cooling fabrics market.

Hybrid yarn advances demonstrate that sustainability targets and performance metrics need not be mutually exclusive. Bemberg cupro showcases solvent recovery rates exceeding 99%, illustrating circularity without sacrificing heat-dissipation capacity. Recycled cotton streams also outperform virgin cotton on thermal resistance in pilot trials. As fashion groups publish science-based carbon goals, procurement pivots toward these lower-impact options, translating eco-preference into measurable demand. Over the forecast horizon, natural-fiber cooling lines will likely take incremental share, though synthetics will remain central to rapid-wicking and stretch-critical apparel tiers.

Woven fabrics supplied 40.66% of 2024 revenue and are growing at an 8.37% CAGR because their tightly-controlled interlacings provide dimensionally stable substrates for nanoparticle coatings, reflective films and phase-change print pastes. Weaving plants already operate at high throughput, minimizing incremental cost to add cooling capability. Knits retain strong footholds in activewear thanks to comfort stretch and breathability, yet their looped structure demands slower machinery and can complicate multilayer coatings. Non-wovens gain relevance in disposable medical or filtration niches where tactile drape is secondary.

Process innovation continues to lift woven productivity, with water-jet looms delivering finer deniers while conserving energy. Multi-phase weaves adjust pore geometry, aiding moisture vapor transport. At the same time, knitting equipment adopts digital control and finer gauges, narrowing the gap in surface regularity. Electrospun membranes layered onto knits or wovens add ultra-thin emissive skins, creating hybrid laminates that fuse each construction's strengths. Cost and versatility advantages suggest woven textiles will retain top billing in the cooling fabrics market, but rising consumer appetite for stretch will keep knitted shares steady rather than declining.

The Cooling Fabrics Market Report is Segmented by Fiber Type (Natural and Synthetic), Fabric Construction (Woven, Knitted, and Non-Woven), Application (Sportswear, Protective Wear, and More), End-User Industry (Consumer, Industrial and Manufacturing, Healthcare, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 31.30% of global revenue in 2024 and is moving at a 7.86% CAGR through 2030, anchored by China's scale in technical-textile exports and its leadership in passive-radiative research that delivers 5°C garment cooling. Government grants support pilot plants for metafabric yardage, while downstream apparel makers in Vietnam, Indonesia, and India integrate these textiles into cost-competitive cut-and-sew lines. Japan's material-science ecosystem refines polymer blends for Ultraviolet (UV) reflection, and South Korea's electronics sector pursues smart-textile overlays that feed body-temperature data to mobile devices. Rising middle-class populations confronting humid summers amplify retail pull.

North America benefits from defense contracts and an outdoor recreation culture. US Naval Air Systems programs accelerate supplier learning curves and validate ruggedized cooling fabrics. Outdoor labels headquartered in Oregon and Colorado roll new collections each summer, driving steady consumer uptake. Canada's severe temperature swings prompt multi-season layering concepts that embed cooling on one face and insulation on the other, stretching product utility. Mexico expands role as a near-shore sewing destination, giving brands flexibility amid global logistics disruptions.

Europe's trajectory intertwines with environmental policy. The European Union (EU) Ecodesign regulation prioritizes textiles, compelling value-chain traceability and recyclate usage. German mills like Outlast adapt NASA-born Phase Change Material (PCM) treatments into eco-certified linings, while Italian spinners push low-impact dyeing of recycled yarns. The United Kingdom (UK) research councils fund university-industry consortia focused on nanostructured emissive films. Higher energy costs in the region reinforce demand for passive personal cooling, stimulating domestic uptake despite premium pricing.

South America and the Middle East & Africa present emerging opportunities tied to rapid urbanization and intense solar exposure. Brazil's athletic-wear boom spurs local sourcing of phase-change infused polyester, and Gulf states test cooling uniforms for construction crews working in 45°C midday heat. Infrastructure gaps and limited disposable income temper near-term volumes, yet sustained climate warming suggests long-run growth. Global suppliers eye joint ventures and technology-licensing to local partners to overcome tariff and logistics hurdles, ensuring the cooling fabrics market achieves broader geographic balance.

- Ahlstrom

- Asahi Kasei Advance Corporation

- Balavigna Mills Pvt. Ltd.

- brrr°

- Cocona Labs

- Columbia Sportswear Company

- Coolcore

- Elevate Textiles, Inc.

- Everest Textile Co., Ltd.

- FORMOSA TAFFETA CO., LTD.

- HeiQ Materials AG

- LunaMicro AB

- Milliken & Company

- NAN YA PLASTICS CORPORATION

- NILIT

- Outlast Technologies GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Synthetic Moisture-wicking Fibers for Sports and Athleisure

- 4.2.2 Expansion of Outdoor and Performance Apparel Brands Globally

- 4.2.3 Breakthrough Passive Radiative "Metafabrics" for Urban Heat Mitigation

- 4.2.4 Military Procurement of Heat-stress Uniforms for Desert Operations

- 4.2.5 Sustainability Mandates Accelerating Recycled Cooling Fibers Adoption

- 4.3 Market Restraints

- 4.3.1 High Production Cost of Advanced Cooling Textiles

- 4.3.2 Performance Degradation After Repeated Laundering Cycles

- 4.3.3 Dye-uptake Limitations on High-reflectance Radiative Fabrics

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Fiber Type

- 5.1.1 Natural

- 5.1.2 Synthetic

- 5.2 By Fabric Construction

- 5.2.1 Woven

- 5.2.2 Knitted

- 5.2.3 Non-woven

- 5.3 By Application

- 5.3.1 Sportswear

- 5.3.2 Protective Wear

- 5.3.3 Apparels

- 5.3.4 Other Applications (Medical and Healthcare Textiles, etc.)

- 5.4 By End-user Industry

- 5.4.1 Consumer

- 5.4.2 Industrial and Manufacturing

- 5.4.3 Defense and Security

- 5.4.4 Healthcare

- 5.4.5 Automotive and Transportation

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 NORDIC Countries

- 5.5.3.8 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Ahlstrom

- 6.4.2 Asahi Kasei Advance Corporation

- 6.4.3 Balavigna Mills Pvt. Ltd.

- 6.4.4 brrr°

- 6.4.5 Cocona Labs

- 6.4.6 Columbia Sportswear Company

- 6.4.7 Coolcore

- 6.4.8 Elevate Textiles, Inc.

- 6.4.9 Everest Textile Co., Ltd.

- 6.4.10 FORMOSA TAFFETA CO., LTD.

- 6.4.11 HeiQ Materials AG

- 6.4.12 LunaMicro AB

- 6.4.13 Milliken & Company

- 6.4.14 NAN YA PLASTICS CORPORATION

- 6.4.15 NILIT

- 6.4.16 Outlast Technologies GmbH

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Cooling Fabric with Chalk-based Coating