|

市场调查报告书

商品编码

1405695

OTA 测试:市场占有率分析、产业趋势与统计、成长预测,2024-2029OTA Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

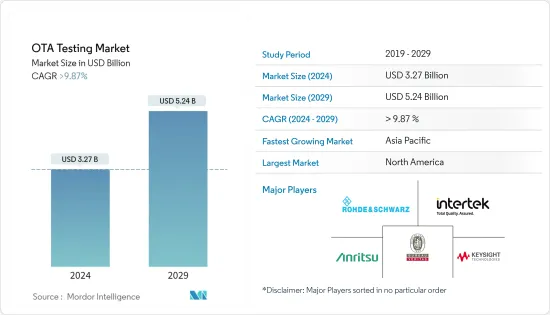

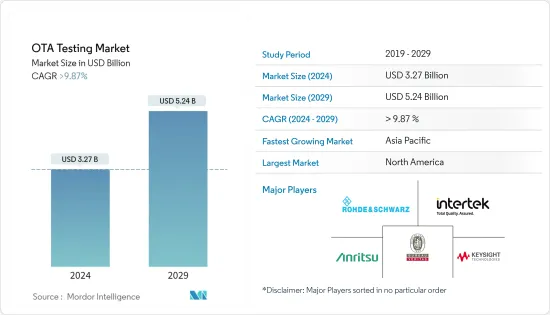

预计 2024 年 OTA 测试市场规模为 32.7 亿美元,2029 年预计将达到 52.4 亿美元,在预测期内(2024-2029 年)复合年增长率将超过 9.87%。

物联网(IoT)技术和智慧型设备的使用日益增多推动了市场成长。此外,越来越多的智慧城市计划和倡议预计将有助于市场开拓。

主要亮点

- 由于多用户麦克风 (MIMO) 无线电的采用越来越多,OTA 测试对于评估多路径对 RF 效能的影响至关重要。执行射频性能测试时必须考虑天线,因为它们是整合概念的组成部分。这不仅需要射频传播模型仿真,还需要 OTA 量测。大多数产业相关人员都专注于设计最佳化,以了解和评估天线图、定向和增益等基本特性。因此,测量空中天线产生的射频的 OTA 技术逐渐被采用。

- 由于大多数OEM专注于为自动驾驶汽车添加 OTA 功能,OTA 测试预计将快速成长。该平台在商业化之前在受控条件下测试汽车、行动装置和类似设计等产品的单一或多用途天线的功能和可靠性。随着越来越多的车辆实现自动驾驶和连网,预计这将推动市场收益大幅成长。

- 无线 (OTA) 测试最常用于测量设备的 MIMO 射频 (MHz) 和天线 RF 性能。 OTA 测试对于评估和认证无线设备(无论是移动还是固定定位)的可靠性和 RF 性能至关重要。 5G NR (5G) 的典范转移增加了设备开发、检验和商业化中对 5G OTA 测试的需求。 5G OTA(空中)测试已成为 5G基地台(BPS) 和 UEE 测试的标准,尤其是毫米波。

- 针对无线电波的高效传输和接收而最佳化的天线技术可在毫米波频率的 5G 系统中实现高保真通讯。然而,这种复杂性增加了考试的挑战。内建天线与TRx电路整合。然而,内建天线很小,天线电路和 TRx 之间的侦测很困难。晶片组的复杂性推动了对更好的天线系统和前端的需求,以进行无线测量 (OTA) 和产品开发。

- 然而,在预测期内,天线阵列的高成本、部署问题和检测设备预计将在一定程度上抑制 OTA 市场的成长。汽车产业是受 COVID-19 影响最严重的产业之一。 COVID-19上半年,製造业销售量下降,但下半年汽车销售大幅成长,对调查市场产生了负面影响。

OTA测试市场趋势

通讯和消费性设备领域预计将显着成长

- 有些物联网设备的射频天线效能非常差,导致使用者体验较差。物联网设备在尺寸、形状和材质上与传统设备不同,并且在不同的环境中运作。因此,物联网设备的OTA测试提出了挑战。 CTIA(蜂窝电信和互联网协会)成立了物联网工作小组,并宣布了针对 LTE-M 设备的 OTA调查方法。

- 鑑于物联网 (IoT) 产业的快速成长、OTA 测量的重要性以及标准化的现状,GSMA 正在製定物联网设备的 OTA 测试规范。该规范包括测试设定、测试方法、测试程序和效能要求。智慧小工具可以透过云端接收韧体更新。韧体更新处理器、硬体周边设备以及在其上运行的应用程式。这些更新预计将是市场领先的。

- 使用OTA(Over-The-Top)方法来测试5G组件和无线设备而不是传统的有线方法对于检验5G技术和设备的性能至关重要。 5G 测试面临的挑战很复杂,但世界各地的工程师已经在创建新的测试工具和方法,例如 OTA,这对于使 5G 无处不在至关重要。

- 2022 年 1 月,沃达丰更新了 OTA 测试的 CETECOM 认证。 CETECOM 现在能够进行符合沃达丰终端规范的空中射频性能 V5.1 测试。 OTA 测试用于检验无线电设备、天线和其他组件的性能和可靠性。此外,Verizon、AT&T 和 Sprint 等主要无线服务供应商要求其供应商首先检验其无线设备是否能在多种条件下无缝运作。

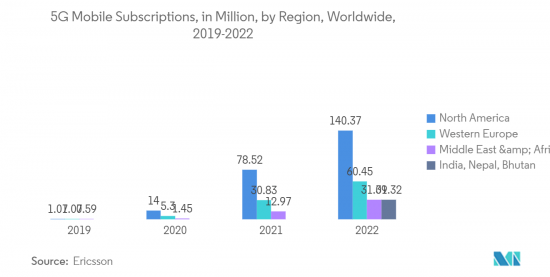

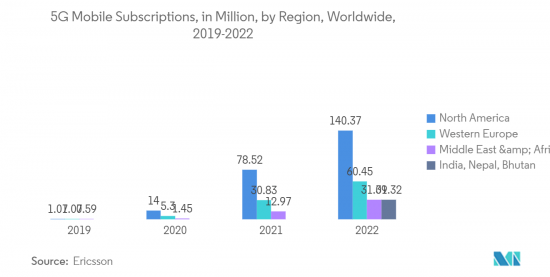

- 爱立信预计,2019年至2027年,全球5G用户数预计将快速成长,从超过1,200万增加到超过40亿。订阅数量最多的地区预计将是东北亚、东南亚、印度、尼泊尔和不丹。此外,全球智慧城市的数量正在迅速增加,智慧和无线连接设备的数量也在显着增加。预计这将推动所有无线设备对 OTA 测试服务的需求,以满足行业标准并促进接收器和天线的性能评估。

北美地区预计将实现显着成长

- 由于智慧城市的兴起、下一代无线技术开发研究活动的增加,以及通讯业、航太业更多地采用 5G 技术,北美地区预计将在预测期内获得可观的收益。和国防工业。这是预料之中的。此外,对自动驾驶汽车的需求不断增长以及自动驾驶汽车产量的增加正在推动市场收益的成长。

- 定期 OTA 测试使製造商能够在缺陷成为严重问题之前检测并纠正缺陷。这有助于降低生产成本、加快上市时间并提高车辆品质。巨大的汽车产量可能是所研究市场的驱动力。例如,根据工业合作与发展办公室 (OICA) 的数据,美国汽车工业去年生产了 917 万辆汽车。

- 根据爱立信移动报告,预计到2024年5G合约将占北美移动合约的55%。根据GSMA关于全球移动经济状况的报告,继美国四大通讯业者推出5G之后,北美地区预计将在未来几年成为5G部署的「领导者」。该组织预测,到 2025 年,北美大陆 48% 的连接将是 5G 网络,仅次于亚洲的 50%。

- 两家公司正在共同努力,更好地为客户服务。例如,Eurofins(Eurofins 全球实验室网路的一部分)宣布,现在可以在其圣克拉拉实验室设施提供 FR1、FR2 和 FR1 的 OTA(无线)预测试。对于 FR2,Eurofins 使用 5G FR2 毫米波 (mmWave) 测试室。对于 FR2 OTA(5G 毫米波)预测试,Eurofins 将使用欧洲通讯标准协会 (ETS) 紧凑型天线测试范围 (CTAR) AmS-5705 暗室,这是 5G 毫米波的卓越解决方案。

- 2022 年 10 月,由 Visual AI 提供支援的下一代测试自动化平台 Applitools 将正式与领先的 GSI、SI 和 VAR 启动合作伙伴计划,其中包括 Accenture、Apexon、Cap Gemini、EPAM、Infosys、Tech Mahindra 和 TTC。 。 Applitools 的使命是建立必要的基础设施并了解我们的合作伙伴最需要什么。这包括培训和认证途径、根据合作伙伴的进入市场方法量身定制的官方进入市场路线、合作伙伴资源中心等等。

OTA测试产业概况

由于国内和国际市场上存在多个参与者,OTA 测试市场已变得半固体。为了保持市场竞争力,主要企业正在采取产品创新、策略联盟和併购等策略来扩大产品系列併扩大地域覆盖范围。该市场的主要企业包括 Intertek Group PLC、Bureau Veritas SA、Anritsu Corporation 和 Keysight Technologies。

2023年1月,Aurora Labs和NTT DATA宣布在汽车产业建立全球策略联盟,并开始在製造和物流领域开展合作计划。 AI技术与5G的智慧型整合实现了可扩展、敏捷的OTA软体升级,具有高扩充性,并从头到尾提高了安全性,包括5G传输层。

2022 年 12 月,Elektrobit 和 Airbiquity 宣布交付整合 OTA(空中下载)解决方案,预计将为行动产业提供安全可靠的下一代 OTA 服务。该解决方案将Elektrobit的汽车OTA更新软体产品与Airbiquity的多ECU OTA软体管理平台整合在一起,使OEM能够更轻鬆地为其车队购买并建立端到端OTA系统。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 不断成长的物联网市场

- 快速发展的 5G 技术

- 市场挑战

- 检测设备尺寸不断增大且高成本

第 6 章 技术概览

- 测试参数:天线测试、总辐射功率(TRP)、总各向同性灵敏度(TIS)等(EIRP、EIS等)

- 相关标准(CTIA、3GPP等)

第七章市场区隔

- 依技术

- 5G

- LTE

- UMTS

- 其他技术(CDMA、GSM)

- 按申请

- 汽车和交通

- 工业的

- 航太/国防

- 通讯和消费性设备

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第八章竞争形势

- 公司简介

- Intertek Group PLC

- Bureau Veritas SA

- Anritsu Corporation

- Keysight Technologies

- Rohde & Schwarz GmbH & Co. KG

- Eurofins Scientific

- UL LLC

- MVG(Microwave Vision Group)

- SGS SA

- CETECOM GmbH(RWTV GmbH)

- BluFlux LLC

- Element Materials Technology

第九章投资分析

第10章市场的未来

The OTA Testing Market size is estimated at USD 3.27 billion in 2024, and is expected to reach USD 5.24 billion by 2029, growing at a CAGR of greater than 9.87% during the forecast period (2024-2029).

The market growth is driven by increased usage of Internet of Things (IoT) technologies and smart devices. Furthermore, increasing smart city projects and efforts are likely to contribute to market revenue development.

Key Highlights

- OTA testing is essential for assessing the multipath impact on RF performance due to the increasing adoption of Multi-User Microphone (MIMO) radios. As the antennas are essential to the integrated concept, RF performance tests must be conducted with the antenna in mind. To achieve this, OTA measurement is necessary, as well as the simulation of the RF propagation model. Most industry players are focusing on optimizing their designs to understand and evaluate essential properties such as antenna diagrams, Directivity, and Gain. Consequently, they are gradually adopting OTA methods to measure the radio frequency produced by an antenna while in the air.

- OTA testing is expected to grow rapidly because most OEMs are focused on adding OTA capabilities to autonomous vehicles. Platforms test single or multi-purpose antenna functionality and dependability on products such as automobiles, mobile devices, and similar designs under controlled conditions before commercialization. This is expected to drive significant market revenue growth as more and more vehicles become autonomous and connected.

- Over-the-air (OTA) testing is most commonly used to measure the device's MIMO Radio Frequency (MHz) and antenna RF Performance. The OTA test is essential for assessing and certifying the reliability and RF performance of wireless devices, whether mobile or fixed location. The 5G NR (5G) paradigm shift has increased the need for 5G OTA testing in the development, validation, and commercialization of devices. 5G OTA (over the air) testing has become standard in 5G base stations (BPS) and UEE testing, especially in mmWave.

- Antenna techniques that are optimized for efficient radio frequency wave transmission or reception enable high-fidelity communications for mmWave frequency 5G systems. However, this complexity adds to the testing challenges. The built-in antenna is integrated with the TRx circuitry. However, the built-in antennas are small and difficult to probe between the antenna circuits and the TRx. Due to the complexity of the chipset, there is a growing need for better antenna systems and/or frontends for over-the-air measurement (OTA) and product development.

- However, antenna array and deployment issues, as well as high testing equipment costs, are expected to slow down some growth in the OTA market over the forecast period. The automotive sector was one of the most affected industries by COVID-19. While manufacturing sales decreased in the first half, automotive sales increased significantly in the second half of COVID-19, negatively impacting the studied market.

OTA Testing Market Trends

Telecommunication and Consumer Devices Segment Expected to Witness Significant Growth

- Some IoT devices have very poor RF antenna performance, which leads to a poor user experience. IoT devices are different from traditional devices in terms of size, shape, and material and work in various environments. This poses challenges when it comes to OTA testing IoT devices. CTIA (Cellular Telecommunications & Internet Association) has established an IoT Task Force and published OTA test methodologies for LTE-M devices.

- Due to the rapid growth of the Internet of Things (IoT) industry, the significance of OTA measurement, and the current state of standardization, the GSMA is creating OTA testing specifications for IoT devices. The specifications include test setup, test methodology, test procedure, and performance requirements. A smart gadget is able to receive firmware updates through the cloud. The firmware updates the processor, the hardware peripherals, and the application running on top of it. These updates are expected to lead the market.

- The use of OTA (over-the-top) methods for testing 5G parts and wireless devices, rather than the conventional cabled methods, is primarily necessary to validate the performance of 5G technologies and devices. While the challenges of 5G testing are complex, engineers around the world are already creating new test tools and methods, such as OTA, which are essential for making 5G ubiquitous.

- In January 2022, Vodafone renewed its CETECOM certification for OTA testing. CETECOM can now conduct testing in accordance with the Vodafone Specification for Terminals on Over-the-Air RF Performance V5.1. OTA testing is used to validate the performance and dependability of wireless devices, antennas, and other components. Additionally, major wireless service providers, like Verizon, AT&T, and Sprint, among others, require their suppliers first to verify that the wireless devices can function seamlessly under numerous conditions.

- According to Ericsson, 5G subscriptions are expected to skyrocket globally between 2019 and 2027, rising from over 12 million to over 4 billion. Subscriptions are predicted to be highest in North East Asia, Southeast Asia, India, Nepal, and Bhutan. Moreover, the number of smart cities worldwide has been increasing rapidly, which has been significantly increasing the number of smart and wireless-connected devices. This is anticipated to drive the demand for OTA testing services for all wireless devices to meet industry standards and facilitate the assessment of receiver and antenna performance.

North America Expected to Witness Significant Growth

- North America is expected to generate significant revenue during the forecast period due to an increase in the number of smart cities, increased research activities to develop next-generation wireless technology, and rising adoption of 5G technology in the telecom sector, automotive industry, aerospace industry, and defense industry. Furthermore, rising demand for autonomous vehicles and increased production of self-driving cars are boosting market revenue growth.

- By performing OTA tests regularly, manufacturers can detect and fix defects before they become critical issues. This helps to reduce production costs, speed up time to market, and enhance vehicle quality. The vast automotive production would be the driving force of the studied market. For example, according to the Office for Industry Cooperation and Development (OICA), the U.S. automotive industry produced 9.17 million vehicles last year.

- According to the Ericsson Mobility report, in the North American region, 5G subscriptions are predicted to account for 55% of mobile subscriptions by 2024. According to GSMA's report on the state of the global mobile economy, the North American region is expected to be a "leader" in 5G deployment in the coming years following deployments by the four major U.S. telecoms. The group estimates that, by 2025, 48% of connections on the continent will be on 5G networks, trailing only behind Asia at 50%.

- The companies are working together to better serve their customers. For instance, Eurofins, part of the global network of laboratories known as Eurofins, announced that it is now able to provide FR1, FR2, and FR1 OTA (over-the-air) pre-tests at its lab facility in Santa Clara. For FR2, Eurofins is using the 5G FR2 mmWave (mmWave) test chamber. For FR2 OTA (5G mmWave) pre-tests, Eurofins will use the European Telecommunications Standards Agency's (ETS) AmS-5705 compact antenna test range (CTAR) chamber, an excellent solution for 5G mmWave.

- In October 2022, Applitools, the provider of the next-generation test automation platform powered by Visual AI, announced the formal launch of its Partner Program with leading GSIs, SIs, and VARs such as Accenture, Apexon, Cap Gemini, EPAM, Infosys, Tech Mahindra, TTC, and others. Applitools' mission is to construct the necessary infrastructure and understand what partners require most in order to collaborate on building a scalable business that also satisfies the needs of its combined consumers. This includes training and certification pathways, official routes to market that align with the way its partners go to market, and a Partner Resource Center.

OTA Testing Industry Overview

The OTA testing market is semi-consolidated owing to the presence of several players in the market operating in the domestic and international markets. The market appears to be moderately concentrated, with major players adopting strategies like product innovation, strategic partnerships, and mergers and acquisitions to expand their product portfolio and expand their geographic reach in order to stay competitive in the market. Some of the major players in the market are Intertek Group PLC, Bureau Veritas SA, Anritsu Corporation, and Keysight Technologies, among others.

In January 2023, Aurora Labs and NTT DATA announced a global strategic alliance in the Automobile Industry, starting with collaborative projects in Manufacturing and Logistics. The intelligent integration of AI technology and 5G enables scalable and agile OTA software upgrades with greater scalability and improved security from start to finish, including the 5G transport layer.

In December 2022, Elektrobit and Airbiquity announced the availability of a pre-integrated over-the-air (OTA) solution that was expected to enable the next generation of safe and secure OTA services for the mobility industry. The solution integrated Elektrobit's in-car OTA update software products with Airbiquity's multi-ECU OTA software management platform, allowing OEMs to source and create an end-to-end OTA system for their vehicle fleets more easily.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing IoT Market

- 5.1.2 Rapidly Evolving 5G Technology

- 5.2 Market Challenges

- 5.2.1 Large Size and High Cost of Testing Devices

6 TECHNOLOGY SNAPSHOT

- 6.1 Testing Parameters (Antenna Testing, Total Radiated Power (TRP), Total Isotropic Sensitivity (TIS), Others (EIRP, EIS, etc.))

- 6.2 Relevant Standards (CTIA, 3GPP, etc.)

7 OVER-THE-AIR TESTING MARKET SEGMENTATION

- 7.1 By Technology

- 7.1.1 5G

- 7.1.2 LTE

- 7.1.3 UMTS

- 7.1.4 Other Technologies (CDMA, GSM)

- 7.2 By Application

- 7.2.1 Automotive and Transportation

- 7.2.2 Industrial

- 7.2.3 Aerospace and Defense

- 7.2.4 Telecommunication and Consumer Devices

- 7.2.5 Other Applications

- 7.3 By Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia Pacific

- 7.3.4 Latin America

- 7.3.5 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Intertek Group PLC

- 8.1.2 Bureau Veritas SA

- 8.1.3 Anritsu Corporation

- 8.1.4 Keysight Technologies

- 8.1.5 Rohde & Schwarz GmbH & Co. KG

- 8.1.6 Eurofins Scientific

- 8.1.7 UL LLC

- 8.1.8 MVG (Microwave Vision Group)

- 8.1.9 SGS SA

- 8.1.10 CETECOM GmbH (RWTV GmbH)

- 8.1.11 BluFlux LLC

- 8.1.12 Element Materials Technology