|

市场调查报告书

商品编码

1405719

消磁系统:市场占有率分析、产业趋势/统计、成长预测,2024-2029Degaussing Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

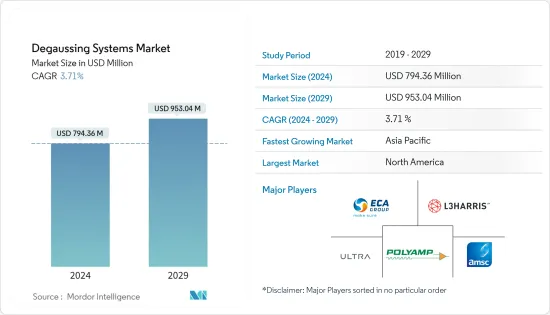

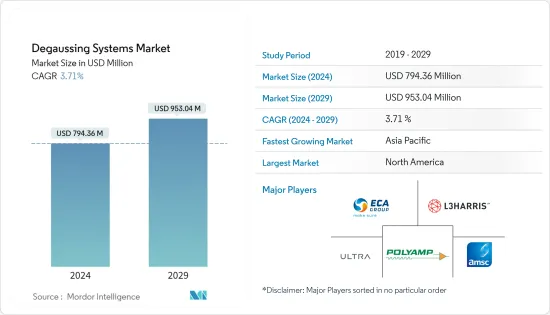

消磁系统市场规模预计到2024年为7.9436亿美元,预计到2029年将达到9.5304亿美元,在预测期内(2024-2029年)复合年增长率为3.71%。

为了防止船舶的磁讯号触发水雷和鱼雷,需要采取有效的对策来控制船舶的磁讯号。世界各地海军舰艇数量的不断增加推动了抑制这种磁讯号的需求,从而产生了对海军舰艇上新型消磁系统的需求。使用超导性等新材料开发先进的退磁系统预计将减轻船舶的重量和退磁设备的能源消耗,从而推动未来几年退磁系统市场的成长。然而,高昂的安装和维修成本以及纤维复合材料在军舰上的使用可能会阻碍未来的市场成长。

消磁系统市场趋势

护卫舰细分市场预计将占据最高市场占有率

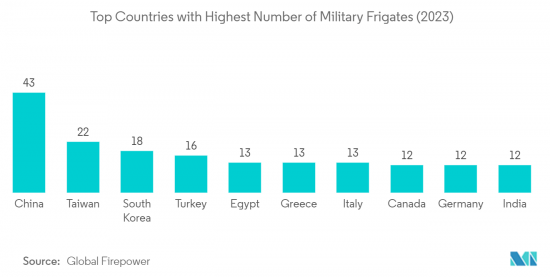

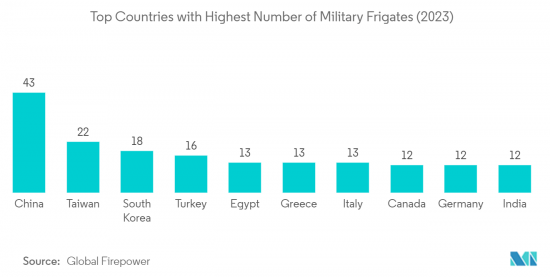

护卫舰的高杀伤力和低探测能力是世界各国海军越来越多采购护卫舰的主要原因。对护卫舰的需求是由国家更新计画推动的,该计画旨在用具有反舰、反潜和防空能力的现代探测和武器系统取代目前老化的战舰舰队。

未来几年,各国海军预计将随着老化而更新其护卫舰舰队。例如,2022年初,台湾海军拨款13.7亿美元预算升级6艘康定级(拉法叶)护卫舰。在预测期内,大部分护卫舰采购计画在欧洲进行。 2022 年 11 月,英国国防部 (MoD) 授予 BAE Systems plc 一份价值 44 亿美元的合同,为格拉斯哥英国海军建造 5 艘城市级 26 护卫舰。因此,所研究市场的护卫舰部分预计将在预测期内稳定成长。

预计亚太地区在预测期内将快速成长

随着海上边界纠纷加剧,亚太地区国家不断增加军费开支。澳洲、印度、中国和印尼等国正在投资建立具有先进能力的海军舰队现代化。作为这些计划的一部分,预计各国将在预测期内开发、建造和采购新的海军舰艇。例如,2022年12月,印度海军接收了-75型卡尔巴里级计划中的第五艘潜舰「瓦吉尔号」。该潜艇由孟买马扎贡码头造船有限公司(MDL)与海军集团合作建造。同时,中国正在透过建造现代化水面战舰、扩大航空母舰和后勤力量来扩大其海军影响力。到2025年,解放军海军舰艇数量预计将从340艘增加到400艘。这种海军现代化是为了在南海紧张局势中加强国家的能力。同样,其他东南亚国家目前正在增强其海军能力,预计这将推动消磁系统市场的成长。

消磁系统行业概况

消磁系统市场是半整合的。消磁系统市场的主要参与者包括 L3Harris Technologies Inc.、ECA Group、Ultra、Polyamp AB 和 American Superconductor Corporation。 L3Harris Technologies Inc. 为德国海军、泰国海军、韩国海军、西班牙海军、土耳其海军、葡萄牙海军、印度海军等提供各种设计和配置的消磁系统。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场抑制因素

- 波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 船型

- 航空母舰

- 驱逐舰

- 护卫舰

- 护卫舰

- 潜水艇

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 拉丁美洲

- 巴西

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 埃及

- 其他中东/非洲

- 北美洲

第六章竞争形势

- 供应商市场占有率

- 公司简介

- L3Harris Technologies Inc.

- Larsen & Toubro Limited

- ECA Group

- IFEN SpA

- Ultra

- Polyamp AB

- American Superconductor Corporatio

- Dayatech Merin Sdn Bhd

- DA Group

- Wartsila Corporation

第七章 市场机会及未来趋势

The Degaussing Systems Market size is estimated at USD 794.36 million in 2024, and is expected to reach USD 953.04 million by 2029, growing at a CAGR of 3.71% during the forecast period (2024-2029).

There is a need for effective measures for magnetic signature control of the naval vessels for protection against sea mines and torpedoes, which ships' magnetic signatures can trigger. This requirement for suppressing a magnetic signature, fueled by a growing naval vessel fleet across the world, is generating demand for new degaussing systems onboard naval vessels. The development of advanced degaussing systems with new materials, like superconductors, which reduce the weight of the vessel and energy consumption of the degaussing equipment, is anticipated to propel the growth of the degaussing systems market in the future. However, the high cost of installation and retrofit and the use of fiber composite materials in warships can hinder the growth of the market in the future.

Degaussing Systems Market Trends

The Frigates Segment is expected to hold the highest market share

The high lethality and low detection capabilities of the frigates are the major reasons for navies around the world to increasingly procure frigates. The replacement programs in various countries to replace the current aging fleet of combat ships with modern detection and weapon systems equipped with frigates that have anti-ship, anti-submarine, and air-defense capabilities are propelling the demand for frigates.

In the coming years, there are several orders of frigates that are anticipated to be replaced and upgraded due to their aging fleet in various navies. For instance, at the beginning of 2022, the Taiwan Navy allocated a budget of USD 1.37 billion to upgrade its 6 Kang Ding-class (La Fayette) frigates. During the forecast period, the majority of frigate procurement is planned in Europe. In November 2022, the UK Ministry of Defence (MoD) awarded a USD 4.4 billion contract to BAE Systems plc to manufacture the five City Class Type 26 frigates for the Royal Navy in Glasgow. Thus, the frigates segment of the market studied is anticipated to witness steady growth during the forecast period.

Asia-Pacific Region Expected to Witness Rapid Growth During the Forecast Period

The escalated maritime border tensions between the countries of the region have led to an increase in their military spending. Countries like Australia, India, China, and Indonesia are investing in the modernization of their naval fleet with advanced capabilities. As a part of these plans, the countries are expected to develop, build, and procure new naval vessels during the forecast period. For instance, in December 2022, the Indian Navy took delivery of the INS Vagir, the fifth submarine under the Project-75 Kalvari class submarines. The submarine was constructed at Mazagon Dock Shipbuilders Limited (MDL) Mumbai in collaboration with the Naval Group. China, on the other hand, is building modern surface combatants and expanding its aircraft carrier and logistics force to grow its naval influence. By 2025, the People's Liberation Army Navy is expected to grow to 400 hulls, up from its fleet of 340. This modernization of the naval fleet is to strengthen the country's capabilities amid the South China Sea tensions. Similarly, the other Southeast Asian countries are also currently enhancing their naval capabilities, which is expected to propel the growth of the degaussing equipment market.

Degaussing Systems Industry Overview

The degaussing systems market is semi-consolidated, and the prominent players in the degaussing systems market are L3Harris Technologies Inc., ECA Group, Ultra, Polyamp AB, and American Superconductor Corporation. L3Harris Technologies Inc. provides various designs and configurations of degaussing systems to the German Navy, Thai Navy, Korean Navy, Spanish Navy, Turkish Navy, Portuguese Navy, and Indian Navy, among others. With a competitive market scenario, companies are investing in the development of new degaussing methods that will replace the existing and conventional degaussing systems. For instance, to capture new market opportunities, American Superconductor Corporation was the first to introduce high-temperature superconductor (HTS) degaussing cable. These HTS cables are proven to reduce 20% of the weight of cables, 40% of installation costs, and utilize lower operating voltages. With the introduction of such products into the market, the companies can strengthen their expansion plans with strong cash flows in the future.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Vessel Type

- 5.1.1 Aircraft Carriers

- 5.1.2 Destroyers

- 5.1.3 Frigates

- 5.1.4 Corvettes

- 5.1.5 Submarines

- 5.1.6 Other Vessel Types

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.4.1 Brazil

- 5.2.4.2 Rest of Latin America

- 5.2.5 Middle East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Egypt

- 5.2.5.4 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 L3Harris Technologies Inc.

- 6.2.2 Larsen & Toubro Limited

- 6.2.3 ECA Group

- 6.2.4 IFEN S.p.A.

- 6.2.5 Ultra

- 6.2.6 Polyamp AB

- 6.2.7 American Superconductor Corporatio

- 6.2.8 Dayatech Merin Sdn Bhd

- 6.2.9 DA Group

- 6.2.10 Wartsila Corporation