|

市场调查报告书

商品编码

1406041

导电油墨:市场占有率分析、产业趋势与统计、2024-2029 年成长预测Conductive Ink - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

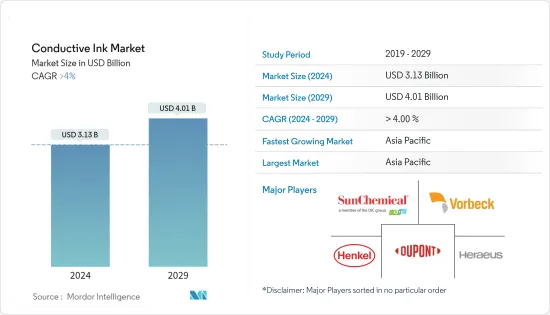

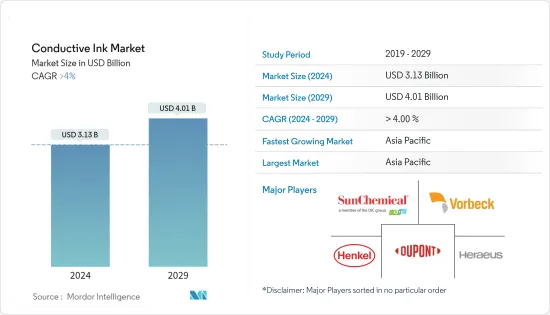

导电油墨市场规模预计2024年为31.3亿美元,预计2029年将达到40.1亿美元,预测期内(2024-2029年)复合年增长率超过4%,预计还会增长。

由于供应链中断和製造工厂关闭,COVID-19 大流行对 2020 年市场产生了负面影响。 COVID-19大流行在短期内扰乱了电子和太阳能产业。然而,市场将在 2021 年和 2022 年復苏,预计在预测期内也会成长。

太阳能电池板安装量的增加和对印刷基板(PCB) 的需求不断增加正在推动市场研究。

另一方面,原物料价格的波动正在阻碍市场研究的成长。

此外,增加对奈米材料和奈米技术的投资可能会提供市场研究机会。

亚太地区在全球整体市场中占据主导地位,其中消费量最高的国家是中国、印度和日本。

导电油墨市场趋势

太阳能电池领域的需求不断扩大

- 导电油墨由于具有高导电率、低薄片电阻、对氧化铟锡和氧化镉锡有良好的黏合、良好的印刷解析度和较低的固化温度而广泛应用于太阳能电池板。

- 此外,为了与传统电网电力系统竞争,光电产业面临降低原料成本和提高生产效率的巨大压力。在这种情况下,使用导电油墨是业界可行的解决方案。

- 在全球范围内,光伏(PV)行业正在稳步增长,其中中国在当前和未来新增产能方面领先全球光伏市场。

- 在可再生能源中,太阳能和风能是世界上成长最快的。这两种再生能源来源占可再生能源发电的三分之二。

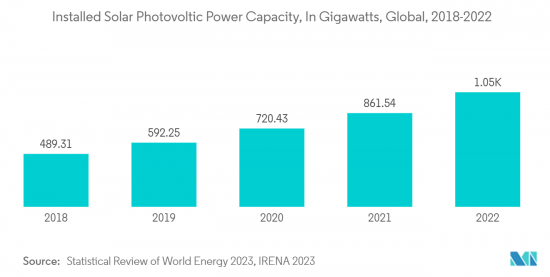

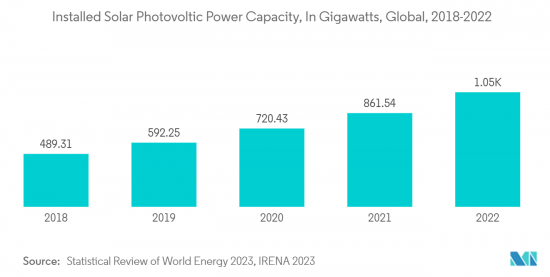

- 根据《2023年世界能源统计年鑑》,2022年全球太阳能发电装置容量为1,053.12吉瓦,较2021年的861.54吉瓦成长22.2%。

- 根据国际能源总署(IEA)预测,2022年太阳能发电量将增加创纪录的270兆瓦时(TWh),达到近1,300太瓦时,比去年增长约26%。 2022年可再生能源发电成长超过风力发电。

- 总体而言,所有这些因素预计将在未来几年推动光伏应用导电油墨市场的发展。

亚太地区主导市场

- 亚太地区已成为全球市场上导电油墨的主要消费国,其中包括中国、印度和日本等国家。

- 中国在亚太和全球市场的太阳能发电量成长中处于领先地位。预计未来几年新增产能大部分将来自中国、印度和其他亚太国家。

- 随着对柔性印刷电子产品的需求不断增加,导电油墨越来越多地用于印刷基板(PCB)、感测器和天线的生产。

- 台湾是PCB产业的领先国家。根据台北印刷电路协会(TPCA)统计,印刷电路基板产业一度以33.9%的市场占有率领先全球。 2022年,台湾印刷基板产量达到约6.25亿平方英尺。

- 如果台湾政府建立全球先进印刷基板製造中心,并追求印刷基板材料供应的自主权,台湾或许能保持技术领先三到五年。

- 此外,中国几乎主导了全球电子生产市场的整个价值链,并且还在大力投资寻找快速发展电子产品小型化的新途径。

- 根据中国电力委员会预计,截至2022年,中国太阳能发电装置容量将超过390吉瓦。过去十年,中国在太阳能发电容量建设方面取得了重大进展,累积容量从2012年的仅为4.2吉瓦增加到2022年的392.6吉瓦。

- 此外,为了在印度实现绿色革命,印度政府制定了2030年部署500吉瓦可再生能源的雄心勃勃的目标,其中包括部署280吉瓦太阳能。

- 总体而言,这些因素预计将在未来几年推动亚太地区导电油墨市场的发展。

导电油墨产业概况

全球导电油墨市场部分整合,少数领导企业在全球市场占有重要地位。市场上营运的主要企业(排名不分先后)包括 Sun Chemical、Vorbeck Materials、DuPont、Henkel AG &Co.KGaA 和 Heraeus Holding。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 增加太阳能板安装

- 印刷基板需求增加

- 其他司机

- 抑制因素

- 原物料价格波动

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模)

- 类型

- 银基

- 铜底座

- 石墨烯型

- 奈米碳管

- 电介质

- 导电聚合物

- 其他类型(金/铂基等)

- 目的

- 太阳能

- 无线射频识别 (RFID)

- 感应器

- 触控萤幕和显示器

- 基板

- 其他应用(数位印刷、航太等)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Ad-Nano Technologies Private Limited

- Applied Ink Solutions c/o Kayaku Advanced Materials Inc.

- Celanese Corporation

- Creative Materials Inc.

- Daicel Corporation

- DuPont

- Henkel AG & Co. KGaA

- Heraeus Holding

- InkTec Co. Ltd

- Johnson Matthey

- Poly-ink

- Sun Chemical

- Parker Chromerics

- NovaCentrix

- Vorbeck Materials

第七章 市场机会及未来趋势

- 加大奈米材料投资

- 其他机会

The Conductive Ink Market size is estimated at USD 3.13 billion in 2024, and is expected to reach USD 4.01 billion by 2029, growing at a CAGR of greater than 4% during the forecast period (2024-2029).

The COVID-19 pandemic negatively affected the market in 2020 due to disruptions in the supply chain and the closure of manufacturing facilities. The electronics and solar industry was hampered in the short term due to the COVID-19 pandemic. However, the market recovered in 2021 and 2022 and is expected to grow over the forecast period.

The growing installation of solar panels and the increasing demand for printed circuit boards (PCBs) have been driving the market study.

On the flip side, the fluctuating raw material prices have been hindering the growth of the market studied.

Further, the increasing investment in nanomaterials and nanotechnology is likely to provide the opportunity for market study.

The Asia-Pacific region dominated the market across the world, with the largest consumption coming from countries such as China, India, and Japan.

Conductive Ink Market Trends

Growing Demand from Photovoltaic Segment

- Conductive ink, owing to its high conductivity, low sheet resistivity, excellent adhesion to indium tin oxide and cadmium tin oxide, superior printing resolution, and low curing temperature, has been widely used in solar cell panels.

- Moreover, the solar (photovoltaic) industry has been facing significant pressures to both reduce raw materials costs and increase production efficiency in order to compete with traditional grid power systems. In such a scenario, the usage of conductive inks acts as a viable solution for the industry.

- Globally, the photovoltaic (PV) industry has been increasing at a steady pace, with China leading the global PV market in terms of capacity additions through the current and future years.

- Among all the renewable energy sources, solar PV and wind energy accounted for the fastest growth across the world. Both renewable energy sources contribute two-thirds of the renewable energy generation annually.

- According to the Statistical Review of World Energy 2023, the world's installed photovoltaic power capacity stood at 1053.12 gigawatts, registering an increase of 22.2% in 2022 as compared to 861.54 gigawatts in 2021.

- According to the International Energy Agency, solar PV generation increased by a record 270 terawatt hours (TWh) in 2022, up around 26% from last year and reaching almost 1 300 TWh. It has surpassed wind energy in terms of generation growth of all the renewable technologies in 2022.

- Overall, all such factors are expected to drive the market for conductive ink in photovoltaic applications through the years to come.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region, owing to countries such as China, India, and Japan, has emerged as the leading consumer of conductive inks in the global market.

- China leads the photovoltaic capacity additions in both the Asia-Pacific and the global market. It is expected that most of the capacity addition through the coming years will come from China, India, and other Asia-Pacific countries.

- With the increasing demand for flexible and printed electronics, conductive inks are being increasingly used in the production of printed circuit boards (PCBs), sensors, and antennas.

- Taiwan is a leading country in the PCB industry. According to the Taipei Printed Circuit Association (TPCA), the printed circuit board industry has temporarily led the global market with a 33.9% market share. In 2022, the output volume of printed circuit boards in Taiwan reached about 625 million square feet.

- Taiwan may maintain its technological lead for 3-5 years if the government establishes a global hub for advanced PCB fabrication and pursues autonomy in PCB material supply.

- Additionally, China leads almost the entire value chain of the electronics production market globally and is also significantly investing in finding new ways to rapidly develop the miniaturization of electronics products.

- According to the China Electricity Council, as of 2022, China has an installed solar power capacity of over 390 gigawatts. China has made enormous strides in building its solar power capacity within the past decade, growing cumulative capacity from only 4.2 gigawatts in 2012 to 392.6 gigawatts in 2022.

- Further, to bring in a green revolution in India, the Indian government has set an ambitious target of having 500 GW of installed renewable energy by 2030, which includes the installation of 280 GW of solar power, which in turn will increase the demand for conductive inks in the country.

- Overall, such factors are expected to drive the market for conductive ink in the Asia-Pacific region through the years to come.

Conductive Ink Industry Overview

The global conductive ink market is partially consolidated in nature, with a few major players occupying a significant position in the global market. Some of the major companies (not in any particular order) operating in the market are Sun Chemical, Vorbeck Materials, DuPont, Henkel AG & Co. KGaA, and Heraeus Holding, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Installation of Solar Panels

- 4.1.2 Increasing Demand for Printed Circuit Boards

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Fluctuating Raw Material Prices

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Silver-based

- 5.1.2 Copper-based

- 5.1.3 Graphene-based

- 5.1.4 Carbon Nanotubes

- 5.1.5 Dielectric

- 5.1.6 Conductive Polymers

- 5.1.7 Other Types ( Gold and Platinum Based, etc)

- 5.2 Application

- 5.2.1 Photovoltaics

- 5.2.2 Radio Frequency Identification (RFID)

- 5.2.3 Sensors

- 5.2.4 Touchscreens and Displays

- 5.2.5 Printed Circuit Boards

- 5.2.6 Other Applications (Digital Printing, aerospace, etc)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Ad-Nano Technologies Private Limited

- 6.4.2 Applied Ink Solutions c/o Kayaku Advanced Materials Inc.

- 6.4.3 Celanese Corporation

- 6.4.4 Creative Materials Inc.

- 6.4.5 Daicel Corporation

- 6.4.6 DuPont

- 6.4.7 Henkel AG & Co. KGaA

- 6.4.8 Heraeus Holding

- 6.4.9 InkTec Co. Ltd

- 6.4.10 Johnson Matthey

- 6.4.11 Poly-ink

- 6.4.12 Sun Chemical

- 6.4.13 Parker Chromerics

- 6.4.14 NovaCentrix

- 6.4.15 Vorbeck Materials

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Investment in Nanomaterials

- 7.2 Other Opportunities