|

市场调查报告书

商品编码

1406063

热塑性淀粉 (TPS) -市场占有率分析、产业趋势与统计、2024-2029 年成长预测Thermoplastic Starch (TPS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

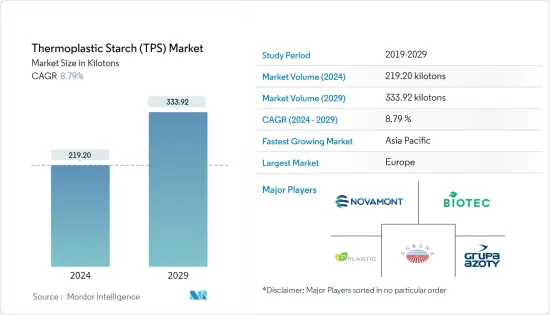

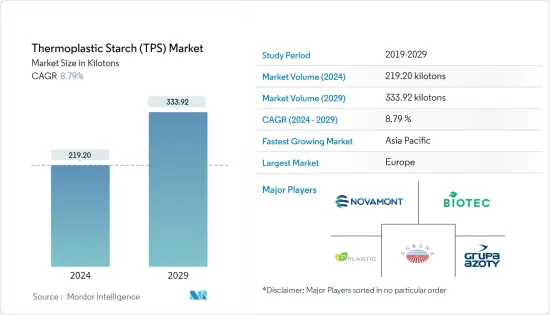

热塑性淀粉市场规模预计到2024年为219.20千吨,预计到2029年将达到333.92千吨,在预测期内(2024-2029年)复合年增长率为8.79%。

COVID-19大流行对2020年的市场产生了负面影响。同时,生产活动暂时停止,热塑性淀粉作为原料的使用量减少,对市场产生了影响。然而,随着监管的放鬆,市场近年来开始加速发展。

主要亮点

- 包装产业需求的增加以及政府扩大生质塑胶使用的有利政策可能会推动市场扩张。

- 相反,与 TPS 相关的多种技术限制可能会阻碍市场成长。

- 在预测期内,改善热塑性淀粉性能的技术进步和创新可能成为所研究市场的机会。

- 欧洲是全球热塑性淀粉市场的关键地区,而亚太地区则是研究市场成长最快的地区。

热塑性淀粉(TPS)市场趋势

包装薄膜需求增加

- 热塑性淀粉薄膜的使用代表了对自然资源的明确利用,从而减少了环境污染。热塑性淀粉薄膜具有生物分解性、成本低、易于加工、可再生优点。淀粉膜被用作一种有前途的商业保鲜膜,可以延长食品的保质期。

- 热塑性淀粉(TPS)是一种淀粉衍生物,被广泛认为是包装行业中替代合成聚合物的最合适材料。

- 与传统的石油基塑胶相比,水解玉米粉薄膜作为永续包装材料的应用具有多种优势,例如生物分解性、再生性和减少对环境的影响。

- 许多公司正在转向永续包装材料。例如,总部位于美国的全球食材解决方案公司 Ingredion 提供 Crisp Film,一种高直链淀粉、白色至灰白色玉米粉。本产品具有优异的成膜性能,在用于包裹油炸食品时可起到保护屏障的作用。

- 据美国农业部(USDA)称,农业研究服务处(ARS)的科学家们开发出了一种基于淀粉的薄膜(被覆剂),它能够使纸张和其他材料更加防水和生物分解性。这种薄膜产品广泛用于食品包装和塑胶袋等领域,减少了堵塞垃圾掩埋垃圾掩埋场的合成产品的数量。

- 2022年8月,印度普通塑胶包装产品环保产品製造商LaFabrica Craft Pvt Ltd宣布推出完全生物分解性的洗髮精和由天然生物聚合物製成的洗髮精,我们开发了小袋和酸辣酱包。香袋的材质由玉米、木薯淀粉、海藻、酪蛋白等有机物质製成。同样在 2022 年 8 月,澳洲生医材料公司 Great Wrap 宣布开发出一种可堆肥生质塑胶,以取代由废弃马铃薯製成的 Clinfilm。

- 因此,所有这些因素预计都会影响预测期内调查市场的需求。

亚太地区是一个快速成长的地区

- 在亚太地区,由于生活方式的改变、可支配收入的增加、工作成年人数量的增加以及对速食的食品不断增长。消费者更喜欢已调理食品,因为烹饪时间显着减少。此外,已调理食品新鲜、包装精美且耐用,支持了市场的需求。

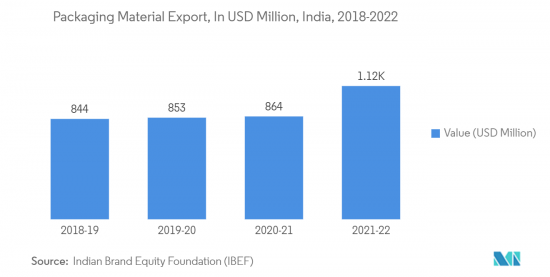

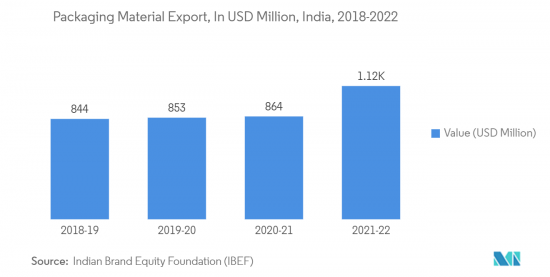

- 由于人均收入上升和电商巨头崛起等因素,中国已成为全球最大的包装材料消费国。 Interpak预计,2023年中国食品包装类包装总量将达到4,470亿件,显示包装产业对热塑性淀粉的需求不断增加。

- 在印度,食品加工是包装的最大消费者,占 45%,其次是药品和个人保健产品。这些最终用户部门不断增长的需求创造了巨大的扩张潜力。食品和饮料业约占印度 GDP 的 3%,是该国最大的雇主,拥有超过 730 万名员工。所有这些因素都表明所研究的市场前景广阔。

- 在日本,每人每年大约使用300至400个塑胶袋,即整个日本超过400亿个塑胶购物袋。因此,随着日本对传统塑胶购物袋的监管更加严格,预计在预测期内对基于 TPS 的产品的需求将会增加。

- 随着许多日本消费者将更高比例的预算分配给食品,投资者和国际品牌有很多机会进入包装市场并引入新的地产地销食品包装偏好。我是。因此,TPS市场在日本包装市场中拥有未来的机会。

- 中国3D列印产业是全球最具活力、成长最快的产业之一。它是仅次于美国的全球第二大市场。中国拥有约310家3D列印新兴企业,包括专注于设计和开发智慧型穿戴装置的HeyGears,以及利用3D列印技术设计和製造矫正器的上海正雅牙科科技。该公司基于其专有的「隐形治疗技术」开发了一种隐形3D列印正畸装置,作为传统钢丝正畸的替代品。

- 目前,印度只有少数3D列印中心,但医疗保健和医疗技术公司正在进入该领域。随着製造商数量的增加,成本也会降低。治疗的广泛使用和需求也将降低人均价格,进一步降低成本。因此,它将对所研究的市场产生影响。

- 日本高龄化,对客製化医疗设备和植入的需求不断增加。 3D列印技术可用于快速、低成本地製造这些设备。此外,日本拥有充满活力的创新产业,3D列印技术可以为时尚、艺术和设计领域生产客製化且独特的产品。

- 因此,在预测期内,亚太地区各最终用户产业对热塑性淀粉的需求预计将增加。

热塑性淀粉 (TPS) 产业概述

热塑性淀粉(TPS)市场正在整合,几家大型企业占了相当大的份额。主要企业(排名不分先后)包括 Novamont SPA、BIOTEC、 KURARAY CO. LTD.(Plantic) 和 AGRANA Beteiligungs AG。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 包装产业需求增加

- 政府利多政策促进生质塑胶发展

- 抑制因素

- 与TPS相关的多项技术限制

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模)

- 製造类型

- 挤出成型

- 射出成型

- 目的

- 包包

- 电影

- 3D列印

- 其他用途(一次性餐具(刀叉餐具)等)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 北欧国家

- 欧洲其他地区

- 世界其他地区

- 南美洲

- 中东/非洲

- 亚太地区

第六章竞争形势

- 合併、收购、合资、合伙和协议

- 市场排名分析

- 主要企业策略

- 公司简介

- Agrana Beteiligungs-AG

- Biome Bioplastics Limited

- Biotec Biologische Naturverpackungen Gmbh & Co. KG

- Biologiq Inc.

- Cardia Bioplastics

- Great Wrap

- Grupa Azoty

- Kuraray Co. Ltd(PLANTIC)

- Novamont SPA

- Rodenburg Biopolymers

第七章 市场机会及未来趋势

- 增强热塑性淀粉性能的技术进步与创新

The Thermoplastic Starch Market size is estimated at 219.20 kilotons in 2024, and is expected to reach 333.92 kilotons by 2029, growing at a CAGR of 8.79% during the forecast period (2024-2029).

The COVID-19 pandemic had a negative impact on the market in 2020. During that time, manufacturing activities were temporarily halted, reducing the usage of thermoplastic starch as a component and thereby impacting the market. However, with the ease of the restrictions, the market started to gather pace over the past couple of years.

Key Highlights

- The increasing demand from the packaging industry and favorable government policies regarding the increased usage of bio-plastics are likely to fuel the market expansion.

- On the contrary, multiple technical constraints associated with TPS will likely hinder the market's growth.

- The technological advancements and innovation to enhance the properties of thermoplastic starch is likely to act as an opportunity in the forecast period for the market studied.

- Europe is the leading region in the global thermoplastic starch market, whereas Asia-Pacific is the fastest-growing region in the market studied.

Thermoplastic Starch (TPS) Market Trends

Increasing Demand from the Packaging Films

- The use of thermoplastic starch films displays a lucid use of natural resources, thereby reducing environmental pollution. Thermoplastic starch films present many advantages, such as biodegradability, low cost, ease of processing, and renewability. The starch films are being used as a promising kind of commercial preservation film for extending the shelf of food.

- Thermoplastic starch (TPS) is a starch derivative and is widely accepted as the most suitable material that can be used in place of synthetic polymers in the packaging industry.

- The application of hydrolyzed corn starch films as a sustainable packaging material grants several advantages, such as biodegradability, reusability, and reduced environmental impact compared to traditional petroleum-based plastics.

- Many companies are shifting towards sustainable packaging materials. For instance, Ingredion, a United States-based global ingredients solutions company, offers CRISP FILM, a high amylose, white to off-white colored corn starch. The products offer good film-forming characteristics and act as a protective barrier when used as a coating for fried foods.

- According to the United States Department of Agriculture, USDA, scientists from the Agricultural Research Service (ARS) developed starch-based film, or coating, with the ability to make paper and other materials more water-resistant and biodegradable. The film product is widely used in food packaging, plastic bags, and other products, reducing the amount of synthetic products clogging landfills.

- In August 2022, LaFabrica Craft Pvt Ltd, an India-based company involved in the production of eco-friendly products for common plastic packaging items, developed a fully biodegradable shampoo sachets and chutney packets using a natural biopolymer. The sachet material has been derived from organic substances such as corn, tapioca starch, seaweed, and casein. Also in August 2022, Great Wrap, an Australian-based biomaterials company, announced the creation of a compostable bioplastic alternative to clingfilm made from waste potatoes.

- Therefore, all these factors are expected to impact the demand for the market studied during the forecast period.

The Asia-Pacific Region is the Fastest Growing Region

- In Asia-Pacific, the demand for packaged food is growing, owing to lifestyle changes, the growing disposable income, the increasing number of working professionals, and the growing preference for fast food. Consumers prefer ready-to-consume foods because they have considerably less time to cook. In addition, ready-to-consume foods are fresh and have attractive and sturdy packaging, supporting the demand for the market studied.

- China is the world's largest consumer of packaging materials globally owing to factors such as growing per capita income and rising e-commerce giants. According to Interpak, in China, total packaging in the foodstuff packaging category is expected to reach 447 billion units in 2023, indicating an increased demand for thermoplastic starch from the packaging industry.

- In India, food processing is the largest consumer of packaging at 45%, followed by pharmaceuticals and personal care products. Increasing demand from these end-user segments is creating a massive potential for expansion. The food and beverages industry accounts for about 3% of India's GDP and is the single largest employer in the country, with more than 7.3 million workforces. All such factors showcase a promising outlook for the market studied.

- In Japan, every person in the country uses around 300-400 plastic bags annually, or more than 40 billion for the entire nation. Thus, the increasing regulations on traditional plastic bags in the country are expected to propel the demand for TPS-based products during the forecast period.

- As the increasing number of Japanese consumers allocate a higher budget percentage for food, various opportunities await investors and international brands to enter the packaging market and introduce new food packaging preferences for local consumption. Thus, the TPS market holds future opportunities in the Japanese packaging market.

- The Chinese 3D printing industry is one of the world's most dynamic and rapidly growing. It is the second-largest market in the world, after the United States. There are about 310 3D printing startups in China, including HeyGears, focusing on designing and developing intelligent wearable equipment; Shanghai Smartee Denti-Technology Co. Ltd uses 3D printing technology for designing and producing orthodontics. The company developed invisible 3D printed braces based on its proprietary "Invisible treatment technology" as a replacement for traditional wire braces.

- There are a few 3D printing centers in India right now, but several healthcare and medical tech companies have entered this segment. The cost will also be reduced if there are more manufacturers. The per capita price also decreases if there is widespread use and demand for treatment; moreover, it costs less. This results in an impact on the market studied.

- Japan has an aging population, which is driving demand for customized medical devices and implants. 3D printing technology can be used to produce these devices quickly and at a low cost. Moreover, Japan has a vibrant creative industry, and 3D printing technology can produce customized and unique products for the fashion, art, and design sectors.

- Therefore, the demand for thermoplastic starch from various end-user industries is expected to increase during the forecast period in Asia-Pacific.

Thermoplastic Starch (TPS) Industry Overview

The thermoplastic starch (TPS) market is consolidated, with a few major players dominating a significant portion. Some major companies (not in any particular order) include Novamont SPA, BIOTEC, Kuraray Co. Ltd (Plantic), and AGRANA Beteiligungs AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Packaging Industry

- 4.1.2 Favorable Government Policies Promoting Bio-plastics

- 4.2 Restraints

- 4.2.1 Multiple Technical Constrains Associated With TPS

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Manufacturing Type

- 5.1.1 Extrusion Molding

- 5.1.2 Injection Molding

- 5.2 Application

- 5.2.1 Bags

- 5.2.2 Films

- 5.2.3 3D Print

- 5.2.4 Other Applications (Disposable Tableware (cutlery) and Others)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 NORDIC Countries

- 5.3.3.6 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Agrana Beteiligungs-AG

- 6.4.2 Biome Bioplastics Limited

- 6.4.3 Biotec Biologische Naturverpackungen Gmbh & Co. KG

- 6.4.4 Biologiq Inc.

- 6.4.5 Cardia Bioplastics

- 6.4.6 Great Wrap

- 6.4.7 Grupa Azoty

- 6.4.8 Kuraray Co. Ltd (PLANTIC)

- 6.4.9 Novamont SPA

- 6.4.10 Rodenburg Biopolymers

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements and Innovation to Enhance the Properties of Thermoplastic Starch