|

市场调查报告书

商品编码

1406065

包装涂料添加剂:市场占有率分析、产业趋势与统计、2024-2029 年成长预测Packaging Coating Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

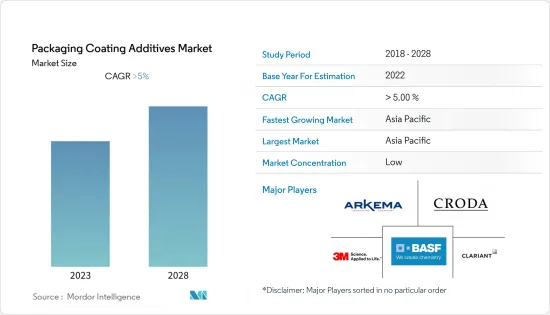

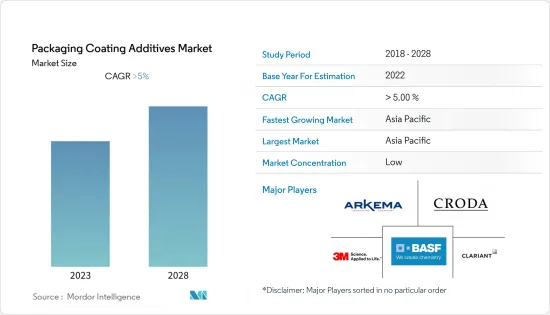

包装涂料添加剂市场规模预计2024年为8.2亿美元,预计2029年将达到10.1亿美元,预测期内(2024-2029年)复合年增长率为5,预计增长超过% 。

COVID-19大流行扰乱了包装涂料添加剂市场,由于全球供应链中断和政府法规,导致销售、生产和分销减少。然而,随着许多经济体恢復正常,市场似乎正在向大流行前的阶段发展。

工业包装需求的不断增长以及食品和饮料包装应用中对防雾和抗菌添加剂的需求不断增长预计将推动市场成长。

另一方面,政府对塑胶使用的严格政策和原材料价格的波动阻碍了市场的成长。

新兴国家和已开发国家对柔性涂料添加剂的需求不断增长以及电子商务趋势预计将为市场成长提供充足的机会。

亚太地区主导全球市场,中国、印度和日本等国家的消费量庞大。

包装涂料添加剂市场趋势

食品和饮料包装领域的需求增加。

- 包装材料容易有摩擦、化学稳定性等问题。为了提高包装涂层材料的性能,添加添加剂以提高 pH 稳定性、消除表面摩擦并在包装食品中诱导抗菌性能。

- 由于消费者可支配消费量的增加和忙碌的生活方式,全球食品和加工食品的消费正在增加,这刺激了对包装被覆剂的需求,因此包装涂料添加剂市场将扩大。

- 包装和食品销售的增加食品有助于增加对包装涂料添加剂的需求,因为它们有助于防止食品腐败和洩漏并延长包装食品的使用寿命。

- 此外,使用防雾包装涂料添加剂有助于增加包装食品的销售量,因为它可以保持包装涂料的透明度和透视性,使食品对顾客可见。

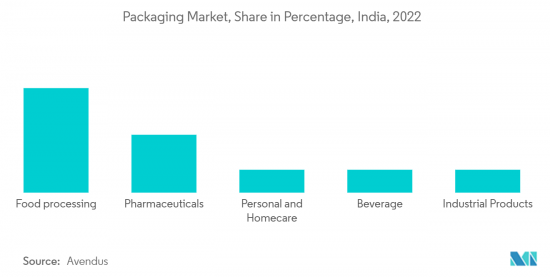

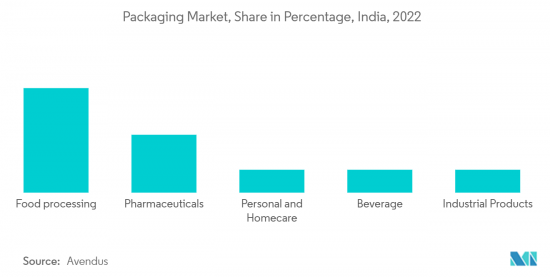

- 据印度投资局称,印度快速成长的食品加工业预计到2025-2026年产值将达到5,350亿美元,正在推动印度食品和饮料包装行业的显着增长,预计到2029年产值将达到5,350亿美元预计将达860 亿美元,年增率为14.8%。这种增长推动了对包装黏剂和涂层黏剂,它们是食品包装的重要组成部分。

- 消费者习惯的变化正在推动美国饮料产业的显着成长。根据PMMI的饮料报告,预计2018年至2028年北美饮料产业将成长4.5%。北美的大部分饮料销售都是由美国卖家实现的。

- 由于上述因素,包装涂料添加剂市场预计在预测期内将快速成长。

亚太地区主导市场

- 预计亚太地区在预测期内将主导包装涂料添加剂市场。随着中国和印度等国家中阶收入的显着增加以及对包装食品的需求增加,该地区对包装涂料添加剂的需求正在增加。

- 电子商务的成长预计将为该地区的包装涂料行业以及包装涂料添加剂市场提供利润丰厚的机会。尤其是食品和饮料包装领域正在经历快速成长。

- 中国在电子商务市场中占有最大份额,占电子商务总销售额的30%以上。

- 对永续性的日益重视正在推动折迭纸盒製造商推出创新的包装解决方案,特别是在乳製品行业。 2022年3月,SIG India推出了不使用铝的无菌纸盒,以满足印度对纸盒乳製品日益增长的需求。

- 作为迈向永续包装的重要一步,ITC Limited 的 Yippee!该品牌于 2023 年 2 月被废弃,YiPPee!将它们转变为环保的生活方式产品,例如笔记型电脑内胆包、托特包和文具袋。

- 上述因素加上政府的支持正在推动包装涂料添加剂市场的成长。

包装涂料添加剂产业概况

包装涂料添加剂市场本质上高度分散。主要企业(排名不分先后)包括 Croda International Plc、 BASF SE、Arkema、3M 和 CLARIANT。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 食品和饮料包装的需求不断扩大

- 工业包装需求增加

- 其他司机

- 抑制因素

- 关于塑胶使用的严格政府政策

- 原物料价格波动

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模)

- 剂型

- 水性的

- 溶剂型

- 粉底

- 功能性

- 滑

- 抗静电

- 防雾

- 抗菌的

- 防塞

- 目的

- 食品和饮料

- 工业的

- 卫生保健

- 消费品

- 其他用途(营养补充)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- Ampacet Corporation

- Arkema

- BASF SE

- BYK Group(ALTANA)

- CLARIANT

- Croda International Plc

- DAIKIN INDUSTRIES, Ltd.

- DIC CORPORATION

- Evonik Industries AG

- Lonza

- PCC Group

- Solvay

第七章 市场机会及未来趋势

- 对柔性涂料添加剂的需求不断增长

- 电子商务的扩张趋势

The Packaging Coating Additives Market size is estimated at USD 0.82 billion in 2024, and is expected to reach USD 1.01 billion by 2029, growing at a CAGR of greater than 5% during the forecast period (2024-2029).

The COVID-19 pandemic disrupted the packaging coating additives market, causing declines in sales, production, and distribution due to global supply chain disruptions and government restrictions. However, the market is seemingly growing towards its pre-pandemic stages as many economies are returning to normalcy.

Increasing demand in industrial packaging and growing demand for anti-fog and anti-microbial additives in food and beverage packaging applications are expected to fuel the market growth.

On the flip side, strict government policies regarding the use of plastics and fluctuation in raw material prices are hindering the growth of the market.

Rising demand for flexible coating additives and growing trends for e-commerce in developing as well as developed countries are expected to offer ample opportunities for the growth of the market.

Asia-Pacific dominated the global market's most significant enormous consumption from countries such as China, India, and Japan.

Packaging Coating Additives Market Trends

Increasing Demand from Food and Beverages Packaging Segment.

- Packaging Materials are prone to problems such as friction and chemical stability. To improve the performance of packaging coating materials, additives are added, which increase the pH stability, make the surface frictionless, and induce anti-microbial properties to the packaged food items.

- Packaged and processed foods consumption is increasing globally owing to increasing disposable income and the hectic lifestyle of consumers, which will help stimulate the demand for packaging coatings, thus enhancing the market for packaging coating additives.

- Increasing sales of packaged and processed foods will help in increasing the demand for packaging coating additives as they help in preventing food spoiling & leakage and also help in increasing the serviceable life of packaged food items.

- Furthermore, the use of antifog packaging coating additive helps to increase the sales of packaged food items as antifog additives helps to maintain the clarity and transparency of packaged coatings, thus making food items visible to the customer.

- According to Invest India, India's burgeoning food processing sector, with an anticipated output of USD 535 billion by 2025-2026, is driving significant growth in the Indian food and beverage packaging industry, which is projected to reach USD 86 billion in 2029, fueled by an annual growth rate of 14.8%. This growth fuels the demand for packaging and coating adhesives, essential food packaging components.

- Due to the changing consumer habits, the beverage industry in the United States has noticed substantial growth. According to PMMI's Beverage Report, the North American beverage industry is expected to grow by 4.5% from 2018 to 2028. Sellers achieve the major portion of the beverage sales in North America in the United States.

- Owing to the aforementioned factors, the packaging coating additives market is expected to grow rapidly during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the market for packaging coating additives during the forecast period. In countries like China and India, due to the significant rise in the income of the middle-class population and the increasing demand for packaged foods, the need for packaging coating additives has been increasing in the region.

- Growth in e-commerce is expected to provide lucrative opportunities for the packaging coatings industry and, consequently, for the packaging coating additives market in the region. The food and beverage packaging segment is the fastest-growing among them.

- China holds the largest share in the e-commerce market, accounting for more than 30% of the total e-commerce sales.

- The growing emphasis on sustainability prompts folding carton manufacturers to introduce innovative packaging solutions, particularly in the dairy segment. In March 2022, SIG India launched an aluminum-free folding carton aseptic packaging to cater to the rising demand for carton-packaged milk products in India.

- In a significant step towards sustainable packaging, ITC Limited's Yippee! The brand introduced "Terra By YiPPee!" in February 2023, a waste upcycling initiative that transforms discarded YiPPee! Wrappers into eco-friendly lifestyle products, including laptop sleeves, totes, and stationery pouches.

- The above factors, coupled with government support, have fueled the growth of the packaging coating additives market.

Packaging Coating Additives Industry Overview

The packaging coating additives market is highly fragmented in nature. The major players (not in any particular order) include Croda International Plc, BASF SE, Arkema, 3M, and CLARIANT, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand in Food & Beverages Packaging

- 4.1.2 Increasing Demand in Industrial Packaging

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Strict Government Policies Regarding the Use of Plastics

- 4.2.2 Fluctuation in Raw Material Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size In Value)

- 5.1 Formulation

- 5.1.1 Water-based

- 5.1.2 Solvent-based

- 5.1.3 Powder-based

- 5.2 Function

- 5.2.1 Slip

- 5.2.2 Anti-static

- 5.2.3 Anti-fog

- 5.2.4 Antimicrobial

- 5.2.5 Anti-block

- 5.3 Application

- 5.3.1 Food and Beverage

- 5.3.2 Industrial

- 5.3.3 Healthcare

- 5.3.4 Consumer Goods

- 5.3.5 Other Applications (Nutraceuticals)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Ampacet Corporation

- 6.4.3 Arkema

- 6.4.4 BASF SE

- 6.4.5 BYK Group (ALTANA)

- 6.4.6 CLARIANT

- 6.4.7 Croda International Plc

- 6.4.8 DAIKIN INDUSTRIES, Ltd.

- 6.4.9 DIC CORPORATION

- 6.4.10 Evonik Industries AG

- 6.4.11 Lonza

- 6.4.12 PCC Group

- 6.4.13 Solvay

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand For Flexible Coating additives

- 7.2 Growing Trend for E-commerce