|

市场调查报告书

商品编码

1406080

煞车油:市场占有率分析、产业趋势与统计、2024-2029 年成长预测Brake Fluids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

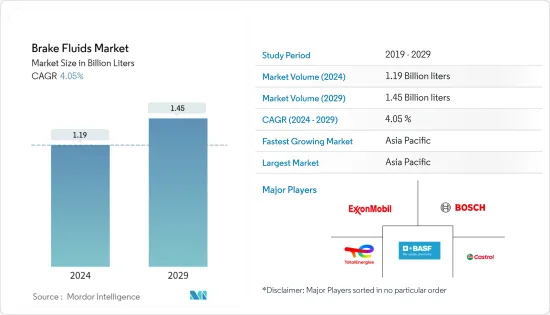

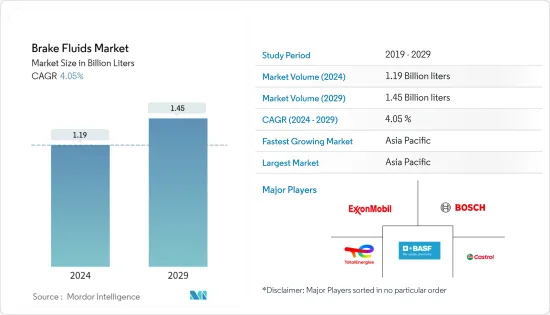

预计2024年煞车油市场规模为11.9亿公升,预计2029年将达到14.5亿公升,在预测期间(2024-2029年)复合年增长率为4.05%。

COVID-19 大流行对煞车油行业造成了沉重打击。全球封锁和政府实施的严格规定摧毁了大多数生产基地。儘管如此,业务自 2021 年以来已经復苏,预计未来几年将大幅成长。

主要亮点

- 推动市场的主要因素是电动车产量的增加以及新兴国家汽车产量的显着成长。

- 另一方面,与煞车油使用相关的严格安全标准阻碍了市场成长。

- 汽车领域的技术开拓预计将为市场研究提供机会。

- 亚太地区是最大的市场,由于中国、印度和日本等国家的消费,预计在预测期内将成为成长最快的市场。

煞车油市场趋势

轻型商用车需求增加

- 煞车油是一种用于所有类型车辆的液压油,包括小客车和轻型商用车。

- 煞车油也用于电动车。近年来,电动车产量的成长受到政府多项零排放和环保汽车措施的推动,以及消费者意识的提高,推动了市场需求。

- 全球许多汽车製造商都在积极投资电动车,包括特斯拉、通用汽车、丰田、BME、日产、福特和福斯。这些投资预计将在未来五到十年内获得回报。

- 2022年前三季全球小客车产量约5,000万辆,较2021年同期成长近9%。然而,根据欧洲汽车工业协会(ACEA)的报告,销量仍较2019年疫情前水准下降约500万辆。

- 根据世界经济论坛 (WEF) 的公告,2022 年上半年全球售出约 430 万辆新电池驱动电动车 (BEV) 和插电式混合动力汽车(PHEV)。此外,纯电动车销量每年成长约75%,插电式混合动力车销量成长37%。此外,2022年前8个月,全球电动车销量突破570万辆大关,插电式电动车市场占有率增至近15%。

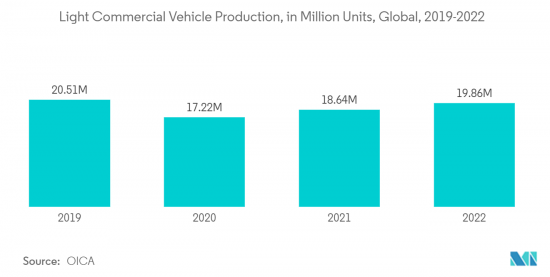

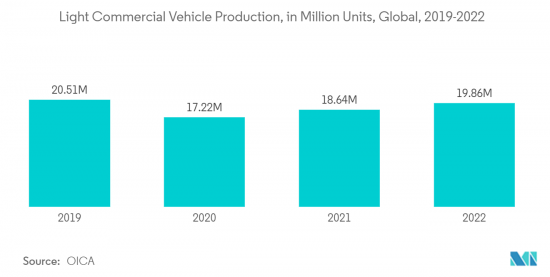

- 国际汽车组织(OICA)公布的资料显示,2022年全球轻型商用车(LCV)产量为19,861,126辆,较2021年成长7%。

- 因此,由于上述因素,煞车油的需求预计在预测期内将增长。

亚太地区主导市场

- 由于中国、印度、日本和韩国等主要汽车生产国的存在,预计亚太地区将占据煞车油市场的最大份额。这些国家正在努力透过加强汽车製造基础和建立高效的供应链来实现更高的盈利。

- 在亚太地区,各国政府正在采取有利于电动车采用和扩大电动车製造基础设施的优惠政策。因此,亚太煞车油市场预计将在预测期内获得显着成长动能。

- 根据中国工业协会统计,中国是全球最大的汽车生产国,预计2022年汽车产量将达到2,700万辆,比去年的2,600万辆成长3.4%。

- 在印度,根据印度汽车工业协会(SIAM)的数据,该国汽车工业在2021-22年(2021年4月至2022年3月)期间将总合生产22,933,230辆汽车。此外,根据印度经济监测中心 (CMIE) 的数据,汽车产量从 2022 年 6 月的 1,69,519 辆增加到 2022 年 7 月的 1,93,629 辆。这些因素可能会增加对煞车油的需求。

- 此外,根据OICA的数据,2022年日本和韩国的汽车总产量将分别为7,835,519辆和3,757,049辆。

- 由于上述因素,亚太地区对煞车油的需求预计将成长。

煞车油产业概况

全球煞车油市场因其性质而部分分散。主要企业(排名不分先后)包括 TotalEnergies、Robert Bosch LLC、CASTROL LIMITED、Exxon Mobil Corporation 和BASF SE。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 电动车产量增加

- 新兴国家汽车产量显着成长

- 其他司机

- 抑制因素

- 与煞车油使用相关的严格安全标准

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模)

- 流体类型

- 石油基

- 非石油基

- 产品类别

- DOT 3

- DOT 4

- DOT 5

- DOT 5.1

- 目的

- 轻型商用车

- 小客车

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 土耳其

- 捷克共和国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 伊朗

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率分析(%)**/排名分析

- 主要企业策略

- 公司简介

- BASF SE

- CASTROL LIMITED

- Chevron Corporation

- China Petrochemical Corporation(SINOPEC)

- Dow

- Exxon Mobil Corporation

- FUCHS

- Hi-Tec Oils Pty Ltd.

- Morris Lubricants

- Motul

- Repsol

- Robert Bosch LLC

- TotalEnergies

- Valvoline

第七章 市场机会及未来趋势

- 汽车领域技术发展

- 其他机会

The Brake Fluids Market size is estimated at 1.19 Billion liters in 2024, and is expected to reach 1.45 Billion liters by 2029, growing at a CAGR of 4.05% during the forecast period (2024-2029).

The COVID-19 pandemic harmed the brake fluids sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business is recovering since 2021 and is expected to rise significantly in the coming years.

Key Highlights

- The major factor driving the market studied is an increase in the production of electric vehicles and remarkable growth in automotive production in emerging economies.

- On the flip side, stringent safety standards associated with using brake fluids are hindering the market's growth.

- The technological development in the automobile sector is expected to act as an opportunity for the market studied.

- The Asia-Pacific region represents the largest market and is expected to be the fastest-growing market over the forecast period, owing to the consumption from countries such as China, India, and Japan.

Brake Fluids Market Trends

Increasing Demand from Light Commercial Vehicles

- Brake fluid is a type of hydraulic fluid used in all kinds of vehicles, such as passenger cars, light commercial vehicles, and others.

- Brake fluids are used in electric vehicles. The recent increase in the production of electric vehicles is driven by the initiatives taken by several governments toward zero-emission and eco-friendly vehicles, as well as growing consumer awareness is boosting the market demand.

- Many global automotive manufacturers, including Tesla, General Motors, Toyota, BME, Nissan, Ford, and Volkswagen, are significantly investing in electric cars. These investments are expected to show results in the next 5-10 years.

- In the first three quarters of 2022, around 50 million passenger cars were manufactured worldwide, which increased by nearly 9% compared to the same quarter in 2021. However, this was still less by around 5 million units from pre-pandemic levels in 2019, according to the European Automobile Manufacturers' Association (ACEA) report.

- As per the World Economic Forum (WEF), nearly 4.3 million new battery-powered EVs (BEVs) and plug-in hybrid electric vehicles (PHEVs) were sold globally in the first half of 2022. Additionally, BEV sales grew by around 75% yearly and PHEVs by 37%. Moreover, global electric car sales crossed the 5.7 million units mark in the first eight months of 2022, and the market share of plug-in electric cars increased to nearly 15%.

- As per data published by the International Organization of Motor Vehicles (OICA), the world production of light commercial vehicles (LCV) in 2022 accounted for 19,860,126 units, which increased by 7% compared to 2021.

- Thus, due to the factors above, the demand for brake fluids is expected to grow during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to account for the largest brake fluid market due to the presence of leading automobile producers such as China, India, Japan, and South Korea. These countries are working hard to strengthen the manufacturing base for vehicles and develop efficient supply chains for greater profitability.

- In the Asia-Pacific region, the governments adopted favorable policies toward adopting electric vehicles and expanding the manufacturing infrastructure of electric vehicles. It, in turn, is anticipated to provide a huge impetus to the brake fluids market in the Asia-Pacific region during the forecast period.

- According to the China Association of Automobile Manufacturers (CAAM), China includes the largest automotive producer in the world, with a total vehicle production of 27 million units in 2022, registering an increase of 3.4% compared to 26 million units produced last year.

- Moreover, in India, during FY 2021-22 (April 2021 to March 2022), according to the Society of Indian Automobile Manufacturers (SIAM), the country's automotive industry produced a total of 22,933,230 units of vehicles in 2022. Further, according to the Centre for Monitoring Indian Economy (CMIE), car production increased to 1,93,629 units in July 2022 from 1,69,519 units in June 2022. Such factors are likely to increase the demand for brake fluids.

- Further, according to OICA, in 2022, the total production of motor vehicles in Japan and South Korea accounted for 7,835,519 units and 3,757,049 units, respectively.

- The demand for brake fluids in Asia Pacific is expected to grow owing to the factors above.

Brake Fluids Industry Overview

The global brake fluids market is partially fragmented in nature. The major players (not in any particular order) include TotalEnergies, Robert Bosch LLC, CASTROL LIMITED, Exxon Mobil Corporation, and BASF SE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increase in the Production of Electric Vehicles

- 4.1.2 Remarkable Growth in Automotive Production in Emerging Economies

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Safety Standard Associated With the Use of Braking Fluids

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Fluid Type

- 5.1.1 Petroleum

- 5.1.2 Non-petroleum

- 5.2 Product Type

- 5.2.1 DOT 3

- 5.2.2 DOT 4

- 5.2.3 DOT 5

- 5.2.4 DOT 5.1

- 5.3 Application

- 5.3.1 Light Commercial Vehicles

- 5.3.2 Passenger Cars

- 5.3.3 Others

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 Turkey

- 5.4.3.7 Czech Republic

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Iran

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 CASTROL LIMITED

- 6.4.3 Chevron Corporation

- 6.4.4 China Petrochemical Corporation (SINOPEC)

- 6.4.5 Dow

- 6.4.6 Exxon Mobil Corporation

- 6.4.7 FUCHS

- 6.4.8 Hi-Tec Oils Pty Ltd.

- 6.4.9 Morris Lubricants

- 6.4.10 Motul

- 6.4.11 Repsol

- 6.4.12 Robert Bosch LLC

- 6.4.13 TotalEnergies

- 6.4.14 Valvoline

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Development in Automobile Sector

- 7.2 Other Opportunities