|

市场调查报告书

商品编码

1406084

抗菌添加剂:市场占有率分析、产业趋势/统计、成长预测,2024-2029Antimicrobial Additive - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

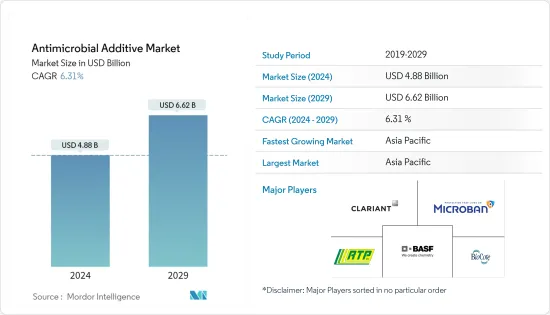

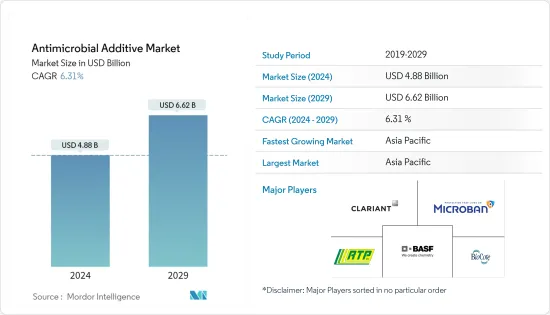

抗菌添加剂市场规模预计到 2024 年为 48.8 亿美元,预计到 2029 年将达到 66.2 亿美元,在预测期内(2024-2029 年)复合年增长率为 6.31%。

抗菌添加剂可在产品的整个使用寿命中抑制微生物的生长,从而提高产品的使用寿命和卫生水平,并付加最终产品的价值。这些添加剂在製造过程中被注入产品中。塑胶和医疗领域产品应用的扩大正在推动市场成长。

然而,安全处置问题以及这些添加剂对生态系统的有害影响可能会阻碍所调查市场的扩张。此外,COVID-19 爆发造成的不利环境也可能阻碍市场成长。

使用抗真菌保护剂来保护柔性聚氯乙烯等进步可能会在未来五年为抗菌添加剂市场提供机会。

亚太地区在塑胶和医疗领域抗菌添加剂的消费量不断增加,在全球市场中占据主导地位。

抗菌添加剂市场趋势

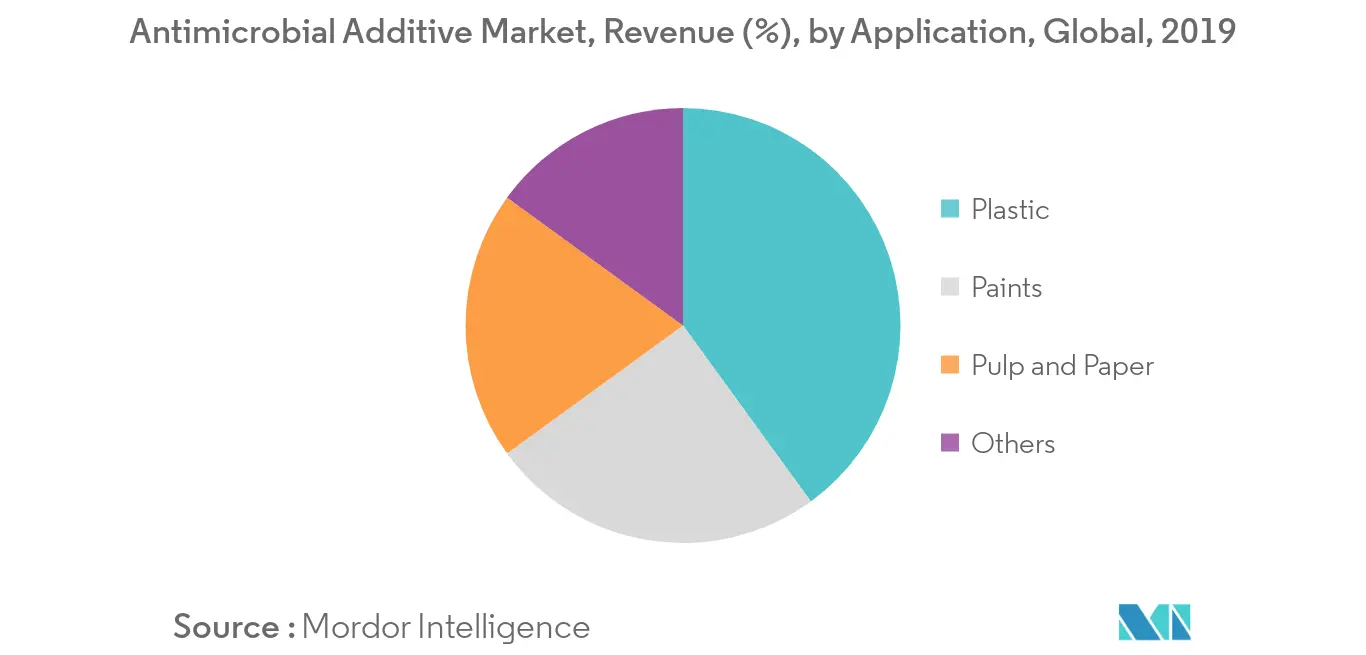

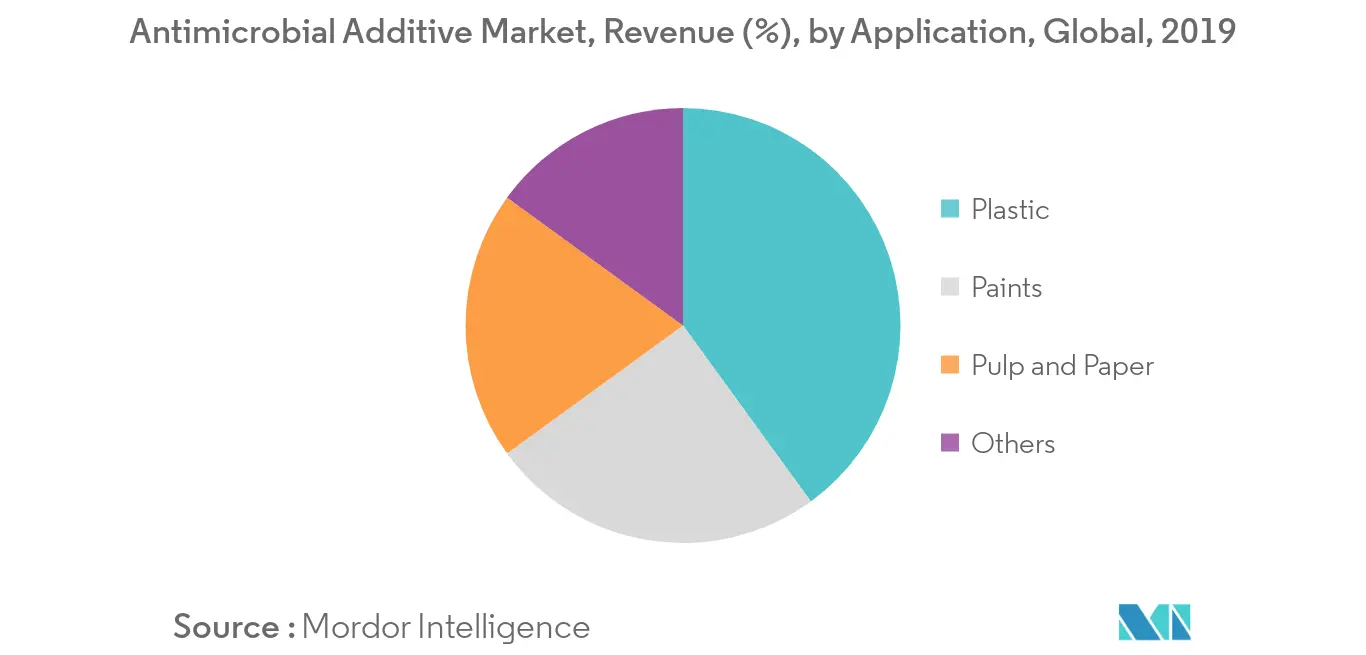

塑胶领域主导市场

- 由于包装、汽车和建筑等各种最终用户行业对塑胶的大量消耗,塑胶领域将主导市场。

- 塑胶是细菌和霉菌等微生物的滋生地。因此,在塑胶的製造过程中加入抗菌添加剂,以提供对各种微生物的抵抗力,并提供塑胶产品的长期耐用性。

- 塑胶广泛应用于皂液器、食品容器、外科产品、呼吸设备等,在预测期内增加了抗菌添加剂的需求。

- 中国、印度等亚太国家在食品饮料和医疗产业抗菌添加剂的使用方面录得强劲增长,预计将在预测期内推动市场发展。

亚太地区主导市场

- 亚太地区是抗菌添加剂的最大市场。食品饮料和医疗行业的广泛应用等因素预计将推动市场成长。

- 抗菌添加剂的有益特性,例如抑制暴露于紫外线、不卫生环境和潮湿的材料上的细菌、藻类和真菌生长,预计将推动市场成长。

- 在医疗家具和医疗设备中加入抗菌添加剂是最大限度降低医疗环境中细菌侵袭风险的一步。

- 纺织品、油漆、聚合物和涂料等广泛应用对无机添加剂的需求不断增长,预计将在预测期内推动市场成长。

- 在食品和饮料最终用途领域,抗菌添加剂正在被广泛使用,食品和饮料行业的货架、地板材料、食品加工设备、製冰机、储存容器、饮水机、水化系统等中都持续使用抗菌添加剂。对该药物的需求预计将会增加。

- 因此,所有这些市场趋势预计将在预测期内推动该地区抗菌添加剂市场的需求。

抗菌添加剂产业概况

全球抗菌添加剂市场较为分散,只有少数大型企业和许多小型公司。主要公司包括BASF SE、BioCote Limited、RTP Company、Clariant 和 Microban。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 食品包装领域的成长

- 扩大抗菌添加剂在塑胶应用中的使用

- 抑制因素

- 抗菌添加剂的毒性

- 由于 COVID-19 的爆发,情况不利

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 类型

- 有机的

- 无机的

- 目的

- 塑胶

- 画

- 纸浆/纸

- 其他的

- 最终用户产业

- 建造

- 车

- 医疗保健

- 食品与饮品

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率/排名分析

- 主要企业策略

- 公司简介

- BASF SE

- BioCote Limited

- Clariant

- LyondellBasell Industries Holdings BV

- Milliken Chemical

- Momentive

- NanoBioMatters

- PolyOne

- RTP Company

- SANITIZED AG

- The DOW Chemical Company

第七章 市场机会及未来趋势

The Antimicrobial Additive Market size is estimated at USD 4.88 billion in 2024, and is expected to reach USD 6.62 billion by 2029, growing at a CAGR of 6.31% during the forecast period (2024-2029).

Antimicrobial additives restrain the growth of microorganisms throughout the useful life of the product, enhance product life & hygiene, and provide value addition to an end product. These additives are infused into a product during the manufacturing process. The growing product application in plastic and healthcare segment has been driving the market growth.

However, the issue of safe disposal and harmful effects of these additives on the eco-system are likely to hinder the expansion of the studied market. Moreover, unfavorable conditions arising due to the COVID-19 outbreak is also likely to hamper market growth.

The advancements such as the use of antifungal protection to preserve flexible polyvinyl chloride are likely to deliver opportunities for the antimicrobial additive market over the next five years.

Asia-Pacific region dominates the market across the world with the escalating consumption of antimicrobial additive in plastic and healthcare sector.

Antimicrobial Additives Market Trends

Plastic Segment to Dominate the Market

- Plastic segment stands to be the dominating segment owing to the extensive consumption of plastic in various end-user industries like packaging, automotive and construction amongst others.

- Plastic is susceptible to microbial growth including bacteria and mold. Therefore antimicrobial additives are incorporated during the production process of plastics and offer resistance against various microbes, thus, resulting in the long-term durability of plastic products.

- Plastics are extensively utilized in soap dispensers, food containers, surgical products, and breathing devices, etc. which augment the demand for antimicrobial additive in the forecast period.

- Asia-Pacific countries like China, India, etc have been registering strong growth in the utilization of antimicrobial additive in food and beverage and healthcare industry, which is expected to drive the market over the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region stands to be the largest market for antimicrobial additive. Factors, such as extensive application in food and beverage and healthcare industry are expected to propel the market growth.

- Beneficial attributes of antimicrobial additives like inhibition of bacterial, algal, and fungal growth for those materials exposed to ultraviolet radiation, unsanitary conditions and moisture are likely to drive the market growth.

- Incorporation of antimicrobial additives in healthcare furnishings and medical equipment is a step toward minimizing the risk of bacteria attack in the healthcare environment.

- Rising demand for inorganic additives in a wide range of applications, including textiles, paints, polymers, and coatings is anticipated to propel the market growth during the forecast period.

- The food and beverage end-use segment is expected to increase the demand of antimicrobial additive owing to continuous utilization of additives in shelving, flooring, and food processing equipment, ice making machines, storage containers, water coolers, and water hydration systems in the food and beverage industry.

- Hence, all such market trends are expected to drive the demand for antimicrobial additive market in the region during the forecast period.

Antimicrobial Additives Industry Overview

The global antimicrobial additive market is fragmented with the presence of a few large-sized players and a large number of small players operating. Some of the major companies are BASF SE, BioCote Limited, RTP Company, Clariant and Microban amongst others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Food Packaging Segment

- 4.1.2 Growing Use of Antimicrobial Additive in Plastic Application

- 4.2 Restraints

- 4.2.1 Toxic Nature of Antimicrobial Additive

- 4.2.2 Unfavorable Conditions Arising Due to COVID-19 Outbreak

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Organic

- 5.1.2 Inorganic

- 5.2 Application

- 5.2.1 Plastic

- 5.2.2 Paints

- 5.2.3 Pulp and Paper

- 5.2.4 Others

- 5.3 End-user Industry

- 5.3.1 Construction

- 5.3.2 Automotive

- 5.3.3 Healthcare

- 5.3.4 Food and Beverage

- 5.3.5 Others

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 BioCote Limited

- 6.4.3 Clariant

- 6.4.4 LyondellBasell Industries Holdings B.V.

- 6.4.5 Milliken Chemical

- 6.4.6 Momentive

- 6.4.7 NanoBioMatters

- 6.4.8 PolyOne

- 6.4.9 RTP Company

- 6.4.10 SANITIZED AG

- 6.4.11 The DOW Chemical Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancement in Antifungal Additive for PVC

- 7.2 Other Opportunities