|

市场调查报告书

商品编码

1406088

聚苯:市场占有率分析、产业趋势与统计、2024年至2029年成长预测Polyphenylene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

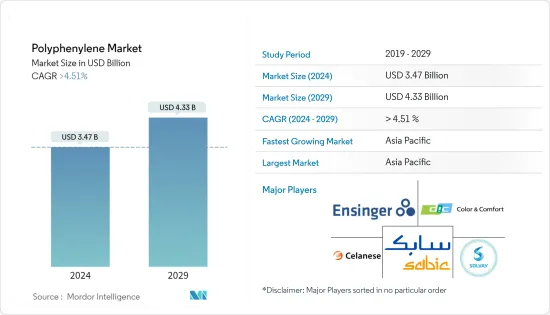

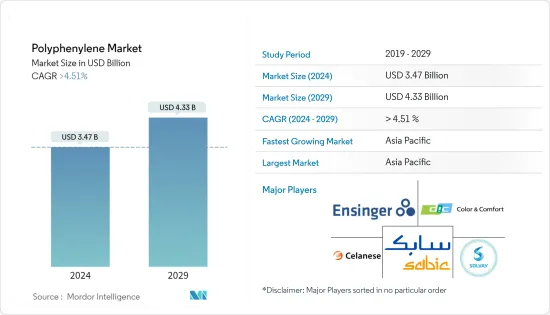

预计2024年聚苯市场规模为34.7亿美元,预计2029年将达到43.3亿美元,在预测期内(2024-2029年)复合年增长率将超过4.51%。

聚苯市场受到 COVID-19 大流行的负面影响,生产和运输放缓,迫使电气、电子和运输等行业因遏制措施和经济中断而放缓生产。目前市场正从疫情中恢復。预计2022年市场将达到疫情前水准并持续稳定成长。

电气和电子行业中聚苯的使用量不断增加以及混合电动车的需求不断增长是推动所研究市场成长的因素。

另一方面,与其他传统材料相比,替代品的可用性和聚苯的高成本是限制市场成长的主要因素。

此外,聚苯在 5G 电路基板中的新兴应用是预计将为研究市场带来利润丰厚机会的关键因素。

亚太地区预计将主导市场,其中中国、日本、韩国和印度占最大的消费量。

聚苯市场趋势

汽车和交通领域的需求增加

- 聚苯被加工成聚苯硫醚(PPS)、聚苯醚(PPO)、聚苯醚(PPE)等衍生物。聚苯撑衍生物是需要较高温度稳定性的电动车零件的首选。

- 近年来,PPS已取代金属、芳香族尼龙、酚醛聚合物、块状成型模塑等应用于多种工程汽车零件。

- 聚苯撑衍生物已成为暴露于高温的汽车零件的理想选择。这些可以提供高强度,同时重量轻。它们用于汽车部件,如电连接器、点火系统、照明系统、燃油系统、混合动力汽车逆变器部件和活塞。

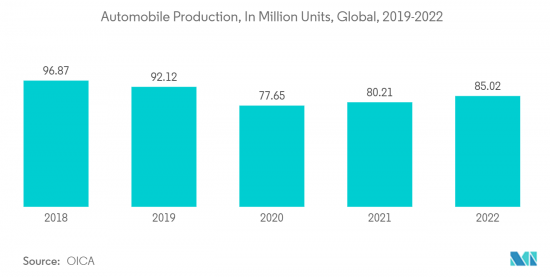

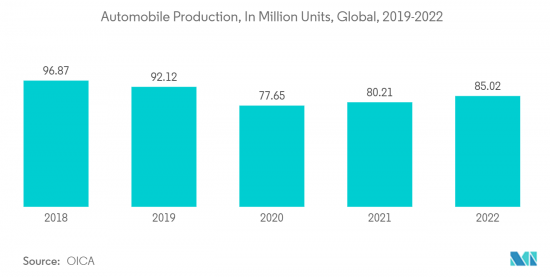

- 根据OICA(国际汽车构造组织)预测,2022年全球汽车产量将达8,502万辆,较2021年成长6%。

- 中国是世界上最大的汽车製造国。该国的汽车行业正在不断改进其产品,并且由于对环境问题的日益关注,正在重点生产在确保燃油效率的同时最大限度地减少排放的产品。

- 根据OICA统计,2022年全国汽车产量达2,702.1万辆,汽车销量达2,686.4万辆,与前一年同期比较增长3.4%及2.1%。

- 此外,全球电动车市场正在显着扩张,这有利于所研究的市场。例如,2022年,全球将售出约1,050万辆纯电动车(BEV)和插电式混合动力电动车(PHEV),较前一年的677万辆成长55%。

- 上述因素预计将显着增加汽车和交通运输领域对聚苯的需求,并推动市场区隔成长。

亚太地区主导市场

- 聚苯最大的市场是亚太地区。在中国、日本、韩国和印度等国家,由于汽车和交通、电气和电子等产业的成长,对聚苯的需求不断增加。

- 在亚太地区,各国政府正在采取有利于电动车采用和扩大电动车製造基础设施的优惠政策。预计这将在预测期内对该地区的电动车市场产生重大推动作用。

- 中国政府的政策发展包括限制对新内燃机火车头製造厂的投资,以及提案到 2025 年收紧轻型小客车的平均燃油经济性。

- 亚洲国家生活水准的提高也导致大众对电动和混合动力汽车使用意识的提高。

- 亚太地区也是全球领先的电气和电子设备生产国,其中包括中国、日本、韩国和马来西亚等国家。印度也正在成为亚洲电子产品的製造地。这样一个成熟的产业预计将吸引该地区对聚苯及其衍生物的需求。

- 因此,电气和电子行业使用量的增加和应用范围的扩大预计将推动市场成长。在电子领域,中国製造商正在建立海外生产基地,拓展国际市场。

- 例如,2023年3月,TCL透过在越南、马来西亚、墨西哥和印度设立海外工厂生产电视机、模组和太阳能电池,扩大了在国际市场的影响力。此外,我们也与巴西当地企业合作,共同开发生产设施、供应链和研发基础设施。

- 此外,根据电子与资讯科技部的数据,2022 财年印度消费性电子产品(电视、配件、音讯)产值将超过 7,450 亿印度卢比(94.6 亿美元)。这支持了市场成长。

- 此外,根据日本电子情报技术产业协会(JEITA)的数据,2022年日本电子产业国内产值预计为111,243亿日元(851.9亿美元),与前一年同期比较增长2% .正在显示。

- 因此,上述最终用户需求的增加预计将推动亚太地区的成长。

聚苯产业概况

聚苯市场分为多个部分。研究市场的主要企业包括(排名不分先后)SABIC、Ensinger、Celanese Corporation、DIC CORPORATION、Solvay 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 扩大在电气和电子产业的应用

- 混合动力电动车的需求增加

- 其他司机

- 抑制因素

- 替代品的可得性

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模)

- 类型

- 聚苯硫醚

- 聚苯醚

- 聚苯醚

- 最终用户产业

- 电力/电子

- 汽车/交通

- 其他最终用户产业(例如涂料)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 墨西哥

- 加拿大

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业采取的策略

- 公司简介

- Biesterfeld AG

- Celanese Corporation

- Chevron Phillips Chemical Company LLC

- DIC Corporation

- Emco Industrial Plastics

- Ensinger

- KUREHA CORPORATION

- LG Chem

- Mitsubishi Chemical Group of companies

- Nagase America LLC

- RTP Company

- SABIC

- Solvay

- Sumitomo Bakelite Co., Ltd.

- TORAY INDUSTRIES, INC.

- Tosoh Europe BV

第七章 市场机会及未来趋势

- 5G电路基板应用

- 其他机会

The Polyphenylene Market size is estimated at USD 3.47 billion in 2024, and is expected to reach USD 4.33 billion by 2029, growing at a CAGR of greater than 4.51% during the forecast period (2024-2029).

The polyphenylene market was negatively impacted by the COVID-19 pandemic as there was a slowdown in production and mobility, wherein industries such as electrical and electronics, transportation, and others were forced to delay their production due to containment measures and economic disruptions. Currently, the market has recovered from the pandemic. The market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

The growing usage of polyphenylene in the electrical and electronics industry and increasing demand for hybrid electric vehicles are the factors driving the growth of the studied market.

On the flip side, the availability of substitutes and the high cost associated with polyphenylene over other conventional materials are key factors limiting the growth of the market studied.

Moreover, the emerging applications of polyphenylene in 5G circuit board is a key factor expected to act as a lucrative opportunity for the studied market.

Asia-Pacific is expected to dominate the market, with the largest consumption from China, Japan, South Korea, and India.

Polyphenylene Market Trends

Increasing Demand from Automotive and Transportation Segment

- Polyphenylene is processed into its derivatives, like polyphenylene sulfide (PPS), polyphenylene oxide (PPO), and polyphenylene ether (PPE). Polyphenylene derivatives are preferred in electric auto parts that require higher temperature stability.

- In recent years, PPS successfully replaced metal, aromatic nylons, phenolic polymers, and bulk molding compounds in various engineered vehicle components.

- Polyphenylene derivatives become the ideal choice for automotive parts exposed to high temperatures. These can provide high strength while being light in weight. These are used in vehicle components, like electrical connectors, ignition systems, lighting systems, fuel systems, hybrid vehicle inverter components, and pistons.

- According to the Organisation Internationale des Constructeurs d'Automobiles(OICA), 85.02 million vehicles were produced across the globe in 2022, witnessing a growth rate of 6% compared to 2021, thereby enhancing the demand for polyphenylene derivatives, which are employed for various automotive parts.

- China is the largest manufacturer of automobiles in the world. The country's automotive sector has been shaping up for product evolution, with the country focusing on manufacturing products to ensure fuel economy while minimizing emissions, owing to the growing environmental concerns.

- According to OICA, automobile production and sales in the country reached 27.021 million and 26.864 million, respectively, in 2022, up 3.4% and 2.1% from the previous year.

- Further, the global electric vehicle market is expanding significantly which is benefitting the market studied. For instance, in 2022, around 10.5 million units of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) were sold across the globe, witnessing a growth rate of 55% compared to 6.77 million units sold in the previous year.

- All factors above are likely to significantly enhance the demand for polyphenylene in the automotive and transportation segment, and thus will propel the growth of the market studied.

Asia-Pacific to Dominate the Market

- Asia-Pacific represents the largest market for polyphenylene. In countries like China, Japan, South Korea, and India, the demand for polyphenylene has been increasing due to growing industries like automotive and transportation and electrical and electronics.

- In the Asia-Pacific region, the governments have adopted favorable policies toward the adoption of electric vehicles and the expansion of manufacturing infrastructure for electric vehicles. This, in turn, is anticipated to provide a huge impetus to the electric vehicle market in the region during the forecast period.

- The Chinese government policy developments include the restriction of investments in new ICE-vehicle manufacturing plants and a proposal to tighten the average fuel economy of its light-duty passenger vehicle fleet by 2025.

- Increasing standards of living in Asian countries have also led to increased awareness among the people of the use of electric and hybrid vehicles.

- The Asia-Pacific region is also the dominant producer of electrical and electronics across the world, with countries such as China, Japan, South Korea, and Malaysia contributing toward it. India is also emerging as a manufacturing hub for electronic products in Asia. This established industry is expected to attract demand for polyphenylene and its derivatives from the region.

- Thus, the increasing usage and widening arena of application in the electrical and electronics industry is expected to drive market growth. In the electronics segment, Chinese manufacturers are setting up overseas production bases in order to expand in the international markets.

- For instance, In March 2023, TCL broadened its presence in international markets by establishing factories abroad, producing televisions, modules, and photovoltaic cells in Vietnam, Malaysia, Mexico, and India. In addition, it has formed partnerships with local companies in Brazil to collaboratively develop production facilities, supply chains, and an R&D infrastructure.

- Further, according to the Ministry of Electronics and Information Technology, the production value of consumer electronics (TV, accessories, and audio) across India was above INR 745 billion (USD 9.46 billion) in fiscal year 2022. Thus supporting the growth of the market.

- Moreover, as per the Japan Electronics and Information Technology Industries Association (JEITA), the domestic production by the Japanese electronics industry was estimated at JPY 11,124.3 billion (USD 85.19 billion) in 2022, witnessing a growth rate of 2% compared to the previous year.

- Thus, rising demand from the end-user mentioned above industries is expected to drive growth in the Asia-Pacific region.

Polyphenylene Industry Overview

The polyphenylene market is partially fragmented in nature. The major players in the studied market (not in any particular order) include SABIC, Ensinger, Celanese Corporation, DIC CORPORATION, and Solvay, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Usage in Electrical and Electronics Industry

- 4.1.2 Increasing Demand from Hybrid Electric Vehicles

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Substitute

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Polyphenylene Sulfide

- 5.1.2 Polyphenylene Oxide

- 5.1.3 Polyphenylene Ether

- 5.2 End-user Industry

- 5.2.1 Electrical and Electronics

- 5.2.2 Automotive and Transportation

- 5.2.3 Other End-user Industries (Coatings, Etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Mexico

- 5.3.2.3 Canada

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Biesterfeld AG

- 6.4.2 Celanese Corporation

- 6.4.3 Chevron Phillips Chemical Company LLC

- 6.4.4 DIC Corporation

- 6.4.5 Emco Industrial Plastics

- 6.4.6 Ensinger

- 6.4.7 KUREHA CORPORATION

- 6.4.8 LG Chem

- 6.4.9 Mitsubishi Chemical Group of companies

- 6.4.10 Nagase America LLC

- 6.4.11 RTP Company

- 6.4.12 SABIC

- 6.4.13 Solvay

- 6.4.14 Sumitomo Bakelite Co., Ltd.

- 6.4.15 TORAY INDUSTRIES, INC.

- 6.4.16 Tosoh Europe B.V.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Applications in 5G Circuit Board

- 7.2 Other Opportunities