|

市场调查报告书

商品编码

1406090

导电有机硅胶-市场占有率分析、产业趋势、统计数据、成长预测 2024-2029Conductive Silicone - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

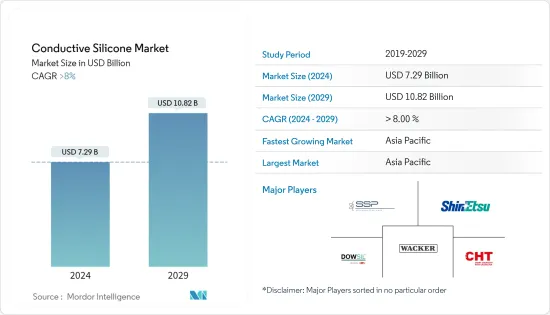

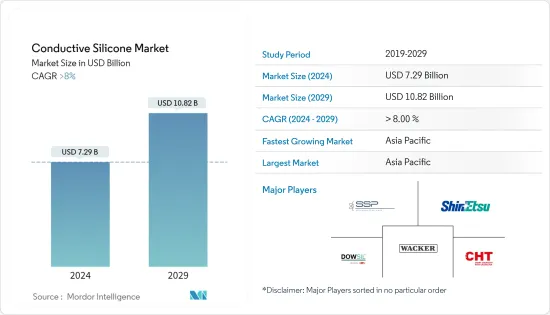

预计2024年导电硅胶市场规模为72.9亿美元,预计2029年将达到108.2亿美元,市场预估及预测期间(2024-2029年)复合年增长率为8%,预计将快速成长。

COVID-19 扰乱了导电有机硅胶供应链,但快速数位化以及远距学习和远距工作的采用导致电子产品需求激增。然而,随着COVID-19病例的减少和业务恢復正常,导电性有机硅胶市场正恢復到疫情前的阶段。

各行业电气设备对导电硅胶的需求不断成长,推动了市场的成长。

另一方面,导电硅胶橡胶所需原材料的高成本预计将抑制预测期内的市场成长。

技术进步,特别是微流体装置等导电硅胶橡胶的进步,正在为市场开闢新的可能性。

由于汽车、电子和通讯行业的需求不断增长,亚太地区在导电有机硅胶市场占据主导地位。

导电硅胶市场趋势

市场区隔主导市场

- 导热硅胶市场以导热材料为主。导电硅胶的高导热性使其成为多种应用的理想材料。

- 热界面材料的需求不断增加,因为它们越来越多地用于将微处理器、LED 阵列和其他发热组件黏合到散热器上,以提供热传递途径。

- 电子系统的小型化和不断增加的电流密度正在推高动作温度,从而推动用于散热的高性能硅胶TIM(热界面材料)的发展。因此,在预测期内,导电硅胶的需求可能会增加。

- 热感界面材料主要用于填充热源(如CPU和GPU)与散热器之间的微观间隙,改善从热源到散热器的热传递,从而防止热源过热和内部系统损坏. 是可以预防的。 TIM 主要用于电脑、笔记型电脑、主机和其他电子设备(路由器、电源、放大器等)。

- 苹果、戴尔、三星、小米等许多公司正在全球扩大智慧型手机和笔记型电脑的销售,这对散热膏和垫片等热感界面材料的消耗产生了直接影响。

- 根据印度品牌股权基金会(IBEF)统计,上一年(2022年)印度通讯市场线下零售金额成长36%,2023年国内通讯市场将维持稳定的金额主导成长。那。

- 随着政府推动Start-Ups生态系统进入热界面材料和系统市场,热界面材料市场规模将会扩大。自2018年以来,包括Thermulon、Rovilus、U-MAP在内的多家公司纷纷进入该市场,创新和拓展热界面材料领域。

- 此外,由于其作为电子元件的抗静电封装被覆剂的作用,以及作为黏剂、密封剂和电线涂料的广泛用途,电子/电气领域预计将成为数量增长最快的应用领域和电缆。将会完成。

- 包括硅胶橡胶在内的导热硅胶橡胶材料越来越多地应用于感测器、印刷基板、电子线路基板等电子元件中,并有望提供良好的效果。这是由于其具有适当的流动性、加工性和高热稳定性等优点。

- 电子设备小型化的趋势强调了保护这些组件免受电磁干扰 (EMI) 和静电耗散 (ESD) 影响的重要性。用于 ESD 和 EMI 保护的导电硅胶橡胶的使用不断增加,预计将在整个预测期内产生积极影响。

- 中国、印度和越南等亚太国家的消费性电子产品成长强劲,预计将在预测期内推动该地区导电硅胶的消费。

亚太地区主导市场

- 亚太地区是导电硅胶最大且成长最快的市场。电子、汽车和发电行业的使用不断增加,推动了亚太地区对导电硅胶的需求。

- 中国、印度、日本、印尼和越南等亚太国家对发电工程的投资不断增加,进一步推动了导电有机硅胶市场的发展。

- 抗静电包装也变得越来越重要,导电硅胶在电子设备中的使用预计将迅速增加,以防止充电过程中的灰尘并保持电气和电子设备的功能和寿命。亚洲是最大的电气和电子设备生产国,包括中国、日本、印度和东南亚国协。

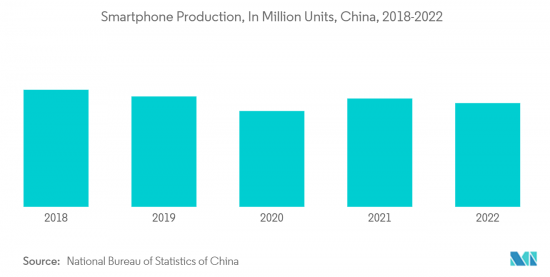

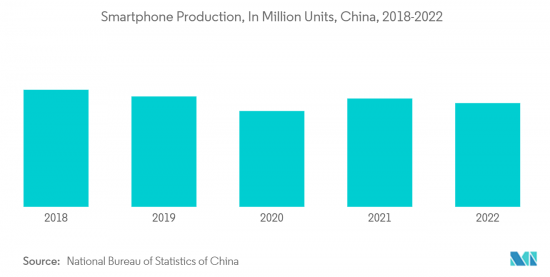

- 中国是导电硅胶的重要消费国,导电有机硅用于各种行动电话组件,如小键盘、EMI屏蔽和温度控管解决方案。中国是全球最大的行动电话製造国之一,2022年产量将占全球产量的30%以上。根据Gizchina Media报道,2023年1月至8月,中国智慧型手机产量为6.79亿支。

- 电瓶采用硅胶保护,避免短路等电气危险。此外,高熔点硅胶非常适合需要高温的应用。此外,硅胶耐腐蚀、耐高温,是製造锂离子电池的理想材料。

- 导热硅胶具有高导热率,使其成为汽车行业各种应用的理想材料。亚洲地区汽车产量占全球一半以上,其中中国、日本、印度、韩国和泰国贡献主要。

- 其用途正在扩大到封装、灌封化合物、保形涂料、紧固、黏合和印刷等应用,预计将推动导电硅胶市场的发展。

- 因此,预计此类市场趋势将在预测期内推动该地区导电有机硅胶市场的需求。

导电硅胶产业概况

导电硅胶市场较为分散。主要公司(排名不分先后)包括 Wacker Chemie AG、DOWSIL(DOW Corning)、 工业、Specialty Silicone Products, Inc 和 ACC Silicones(CHT 集团)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 消费性电子领域对散热的需求日益增加

- 汽车产业需求增加

- 硅胶橡胶需求增加

- 抑制因素

- 与替代产品的竞争

- 原料高成本

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模)

- 产品类别

- 合成橡胶

- 树脂

- 凝胶

- 其他产品类型(糊剂、间隙填充剂、黏剂、润滑脂)

- 目的

- 黏剂和密封剂

- 热界面材料

- 封装和灌封化合物

- 保形涂层

- 其他应用(生物医学和光催化)

- 最终用户产业

- 车

- 建筑学

- 发电

- 电力/电子

- 其他最终用户产业(工业机械和消费品)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Avantor, Inc.

- CHT Germany GmbH

- Dow

- Elkem ASA

- Evonik Industries AG

- Ferroglobe

- LegenDay

- Momentive

- Parker Hannifin Corporation

- Reiss Manufacturing, Inc.

- Shin-Etsu Chemical Co., Ltd

- Soliani Emc srl

- Specialty Silicone Products, Inc.

- Wacker Chemie AG

第七章 市场机会及未来趋势

- 导电硅胶在医疗设备的应用研究与开发

- 硅胶橡胶技术进步的成长

The Conductive Silicone Market size is estimated at USD 7.29 billion in 2024, and is expected to reach USD 10.82 billion by 2029, growing at a CAGR of greater than 8% during the forecast period (2024-2029).

COVID-19 disrupted the conductive silicone supply chain, yet demand for electronics surged due to rapid digitization and the adoption of distance learning and remote work. However, the conductive silicone market is recovering to its pre-pandemic stage as COVID-19 cases declined and businesses returned to normal.

Increasing demand for conductive silicone from electrical devices in various industries fuels market growth.

On the flip side, the high cost of raw material required for conductive silicon rubber is anticipated to restrain the market's growth over the forecast period.

Advancements in technology, particularly in conductive silicone rubber, such as microfluidic devices, are opening up new possibilities within the market.

The Asia-Pacific region dominates the conductive silicone market, owing to rising demand from the automotive and electronics & telecommunications industry.

Conductive Silicone Market Trends

Thermal Interface Materials Segment to Dominate the Market

- The thermal interface materials segment is the dominating segment, offering adhesion to an extensive range of substrates. The high thermal conductivity of conductive silicones makes it an ideal material for various applications.

- Thermal interface material is witnessing increased demand due to their increasing application in bonding microprocessors, LED arrays, and other heat-generating components to heat sinks, ensuring an organized path for heat transfer.

- Increasing small electronic systems and rising current densities have resulted in higher operating temperatures, thereby driving the development of high-performance silicone-based TIM (Thermal Interface Materials) for heat dissipation. Thus, it will likely cause the demand for conductive silicone over the forecast period.

- Thermal Interface Materials are majorly used to fill the microscopic gaps between the heat source (such as a CPU or GPU) and the heat sink to improve the transfer of heat from the heat source to the heat sink, which can help to prevent the heat source from overheating and damaging the internals of a system. TIM is majorly used in computers, laptops, consoles, and other electronic devices (such as routers, power supplies, and amplifiers).

- The electronics segment is one of the major driving segments for the growth of the conductive silicone market, in which many companies like Apple, Dell, Samsung, and Xiaomi are expanding their smartphone and laptop sales across the globe, directly impacting the consumption of thermal interface materials like heat dissipating pastes and pads.

- According to the India Brand Equity Foundation (IBEF), the Indian telecom market experienced a 36% increase in value in offline retail during the previous year (2022) and is anticipated to maintain stable, value-driven growth in the domestic telecom market for the year 2023.

- The thermal interface materials market size rises with governments promoting start-up ecosystems as they enter the thermal interface materials and systems market. Since 2018, many companies have entered this market to innovate and expand the thermal interface materials segment, such as Thermulon, Rovilus, and U-MAP Co.,ltd.

- In addition, the electronics & electrical segment is expected to be the fastest growing application segment in terms of volume owing to their widespread application as adhesives, sealants, and in coatings of wires & cables, along with acting as an anti-static packaging agent for electronic components.

- The heightened utilization of thermally conductive silicone rubber materials, including fluoro silicone rubber, in electronic components like sensors and printed and electronic circuit boards is expected to bring positive outcomes. This is attributed to their advantages of adequate flow, processing capabilities, and elevated thermal stability.

- The increasing trend toward miniaturization in electronic devices has underscored the importance of shielding these components from electromagnetic interference (EMI) and electrostatic dissipation (ESD). As the use of conductive silicone rubber for ESD and EMI protection continues to rise, it is expected to have a positive impact throughout the forecast period.

- Asia-Pacific countries like China, India, and Vietnam have been registering strong growth in consumer electronics, which is expected to drive the consumption of conductive silicone in the region over the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region stands to be the largest and fastest-growing market for conductive silicone. Factors such as rising utilization in electronics, automotive, and power generation industries have been driving the conductive silicone requirements in Asia-Pacific.

- Asia-Pacific countries like China, India, Japan, Indonesia, and Vietnam are witnessing increasing investment in power generation projects, further providing thrust to the conductive silicone market.

- Increased significance of anti-static packaging for dust control during electric charge and sustaining functionality and longevity of the electrical and electronic devices is anticipated to surge utilization of conductive silicone in electronics. Asia is the largest producer of electrical & electronic devices, with countries like China, Japan, India, And ASEAN Countries.

- China is a significant consumer of conductive silicone, used in various mobile phone components, such as keypads, EMI shielding, and thermal management solutions. China is one of the world's largest mobile manufacturing countries, accounting for over 30% of global production in 2022. As per Gizchina Media, the country manufactured 679 million smartphones from January 2023 to August 2023.

- The battery is shielded by silicone against short circuits and other electrical dangers. Additionally, with a high melting point, silicone is perfect for applications requiring high temperatures. In addition, silicone resists corrosion and can sustain high temperatures, making it an ideal material for producing lithium-ion batteries.

- Thermal interface materials dominate the application segment, as they offer adhesion to an extensive range of substrates, and the high thermal conductivity of conductive silicones makes them an ideal material for various applications in the automotive industry. Asian region accounts for more than half of the production of automobiles globally, with significant contributions from China, Japan, India, South Korea, and Thailand.

- Growing utilization in applications such as encapsulants & potting compounds, conformal coatings, fastening, bonding, and printing is expected to thrust the conductive silicone market.

- Hence, all such market trends are expected to drive the demand for the conductive silicone market in the region during the forecast period.

Conductive Silicone Industry Overview

The conductive silicone market is fragmented in nature. The major players (not in any particular order) include Wacker Chemie AG, DOWSIL (DOW Corning), Shin-Etsu Chemical Co., Ltd, Specialty Silicone Products, Inc., and ACC Silicones (CHT Group), among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Consumption from Consumer Electronics Segment for Heat Dissipation

- 4.1.2 Growing Demand from Automotive Industry

- 4.1.3 Rising Demand for Silicon Rubber

- 4.2 Restraints

- 4.2.1 Competition from Substitutes

- 4.2.2 High Cost of Raw Material

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size In Value)

- 5.1 Product Type

- 5.1.1 Elastomers

- 5.1.2 Resins

- 5.1.3 Gels

- 5.1.4 Other Product Types (Pastes, Gap Fillers, Adhesives, and Greases)

- 5.2 Applications

- 5.2.1 Adhesives and Sealants

- 5.2.2 Thermal Interface Material

- 5.2.3 Encapsulant and Potting Compound

- 5.2.4 Conformal Coating

- 5.2.5 Other Applications (Biomedical and Photocatalysis)

- 5.3 End-user Industry

- 5.3.1 Automotive

- 5.3.2 Construction

- 5.3.3 Power Generation

- 5.3.4 Electrical and Electronics

- 5.3.5 Other End-user Industries (Industrial Machinery and Consumer Goods)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Avantor, Inc.

- 6.4.2 CHT Germany GmbH

- 6.4.3 Dow

- 6.4.4 Elkem ASA

- 6.4.5 Evonik Industries AG

- 6.4.6 Ferroglobe

- 6.4.7 LegenDay

- 6.4.8 Momentive

- 6.4.9 Parker Hannifin Corporation

- 6.4.10 Reiss Manufacturing, Inc.

- 6.4.11 Shin-Etsu Chemical Co., Ltd

- 6.4.12 Soliani Emc s.r.l.

- 6.4.13 Specialty Silicone Products, Inc.

- 6.4.14 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Reasearch and Development on Use of Conductive Silicone in Medical Device

- 7.2 Growth in Technological Advancements in Silicon Rubber